Morning Market Report - January 15, 2020

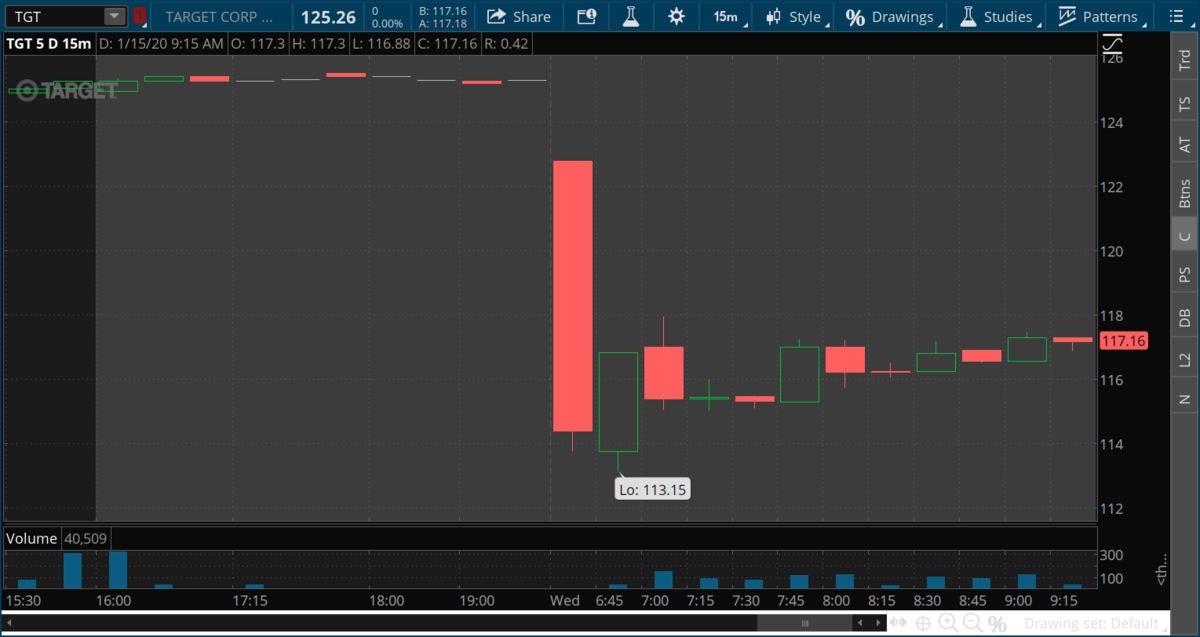

Target shares plunge as holiday sales miss estimates on weakness in toys and electronics

Target said its same-store sales were up just 1.4% during the holidays, compared with growth of 5.7% a year ago.

"The company said that despite missing the mark, it is maintaining a prior outlook for fourth-quarter earnings. It also said the final three months of 2019 remains on track to mark Target’s 11th consecutive quarter of same-store sales gains.

Target said it found strength in apparel and beauty, while lackluster performance in key holiday categories like electronics, toys and parts of its home business offset those gains."

Source: CNBC

"The company said that despite missing the mark, it is maintaining a prior outlook for fourth-quarter earnings. It also said the final three months of 2019 remains on track to mark Target’s 11th consecutive quarter of same-store sales gains.

Target said it found strength in apparel and beauty, while lackluster performance in key holiday categories like electronics, toys and parts of its home business offset those gains."

Source: CNBC

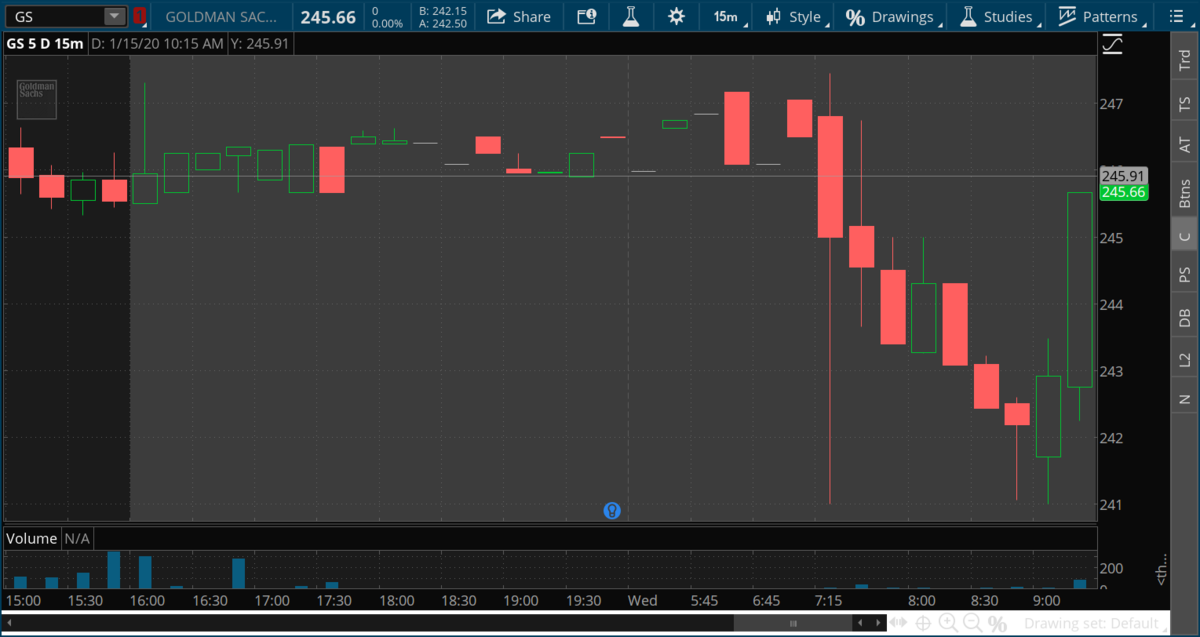

Goldman Sachs tops revenue expectations, but quarterly profit hit by $1.1 billion legal bill

The bank on Wednesday posted quarterly revenue of $9.96 billion, a 23% increase that exceeding the $8.51 billion estimate by more than $1 billion.

But quarterly profit was stung by the litigation charge, driving a 22% decline in earnings to $4.69 per share. Shares of the bank dropped 1.1% in premarket trading.

But quarterly profit was stung by the litigation charge, driving a 22% decline in earnings to $4.69 per share. Shares of the bank dropped 1.1% in premarket trading.

Source: CNBC

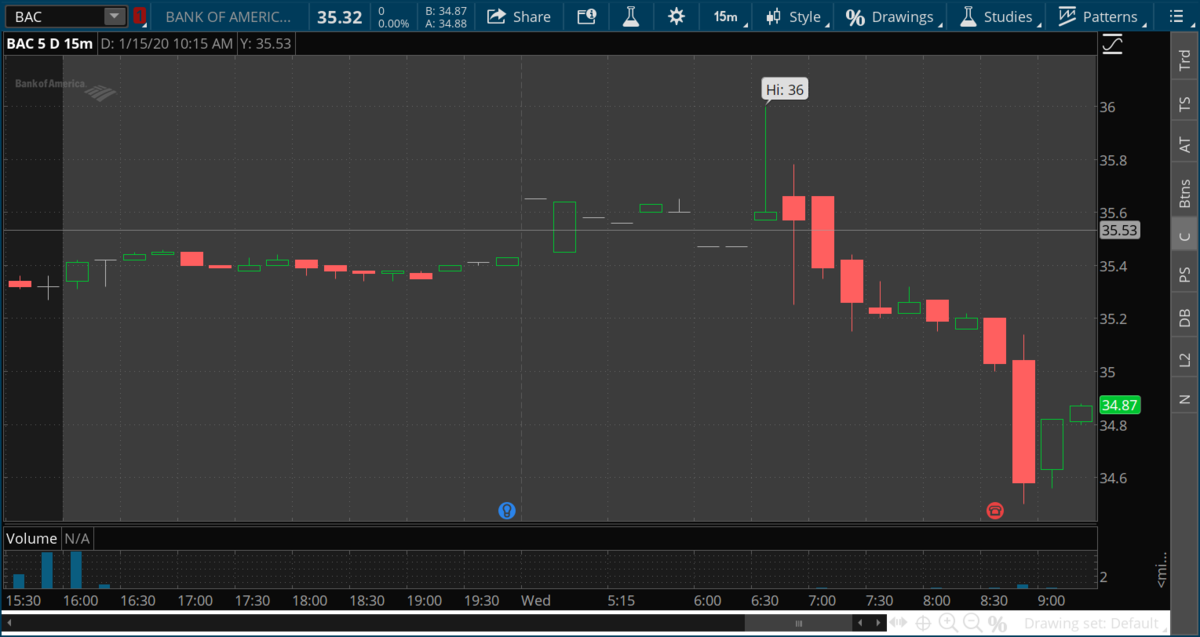

Bank of America beats analysts’ profit estimate on rebound in bond-trading revenue

The bank said fourth-quarter profit was $7 billion, a 4% decline from a year earlier.

But earnings per share were 74 cents, an unexpected 6% increase, helped by a reduction in outstanding shares.

That exceeded the 68 cent estimate of analysts surveyed by Refinitiv. Revenue fell 1% to $22.5 billion, edging out the $22.35 billion estimate.

But earnings per share were 74 cents, an unexpected 6% increase, helped by a reduction in outstanding shares.

That exceeded the 68 cent estimate of analysts surveyed by Refinitiv. Revenue fell 1% to $22.5 billion, edging out the $22.35 billion estimate.

Source: CNBC

Tommy O'Brien's 9 am EST TigerTV Market Update

US producer prices barely rise as services remain subdued

U.S. producer prices edged up in December as a rise in the cost of goods was offset by weakness in services.

The producer price index for final demand ticked up 0.1% last month after being unchanged in November, the Labor Department said.

"The Labor Department said on Wednesday its producer price index for final demand ticked up 0.1% last month after being unchanged in November. In the 12 months through December, the PPI increased 1.3% after gaining 1.1% in November.

The producer price index for final demand ticked up 0.1% last month after being unchanged in November, the Labor Department said.

"The Labor Department said on Wednesday its producer price index for final demand ticked up 0.1% last month after being unchanged in November. In the 12 months through December, the PPI increased 1.3% after gaining 1.1% in November.

For all of 2019, the PPI rose 1.3%. That was the smallest gain since 2015 and followed a 2.6% increase in 2018.

Economists polled by Reuters had forecast the PPI climbing 0.2% in December and advancing 1.3% on a year-on-year basis.

Excluding the volatile food, energy and trade services components, producer prices also nudged up 0.1% in December after being unchanged in November. The so-called core PPI rose 1.5% in the 12 months through December after gaining 1.3% in November. Core PPI increased 1.5% in 2019, also the smallest advance since 2015, after rising 2.8% in 2018."

Source: CNBC

Gold

Oil

VIX Chart

Bonds and Notes