test 05-27-21 2

Sit Rep:

TLT possibly could break lower today and run to 128.

The Fed talks today at 2 ET.

Earnings from some big names on Thursday.

Volume is low. This is not good for any sustained rally. We need volume by Thursday.

Yesterday’s action was plain ugly if you’re a bull.

The only slight positive to the markets is an uptick in put buying in options.

Just waiting now for the Fed at 2 PM. Look for even lighter volume until Powell talks. Watch for updates after.

We bailed on SGMO as it acted poorly but it also saw few shorts and that’s what we needed to push this higher.

Regards,

David White - Path@TFNN.Com

None.

|

Market Volumes Report |

||||||||||

|

Date |

NYSE Volume |

AMEX Volume |

NASD Volume |

Total Volume |

Short Volume |

Dark % |

NYSE $ |

AMEX $ |

NASD $ |

Total Market $ |

|

3/16/2021 |

4,613,084,539 |

2,344,945,486 |

5,493,899,307 |

12,451,929,332 |

2,285,374,648 |

35.0% |

214,729,000,083 |

107,653,251,392 |

249,771,628,461 |

572,153,879,936 |

|

3/15/2021 |

4,900,109,353 |

1,897,787,990 |

5,972,374,835 |

12,770,272,178 |

2,316,548,703 |

35.6% |

222,797,641,772 |

100,585,944,844 |

231,075,639,752 |

554,459,226,368 |

|

3/12/2021 |

4,476,288,569 |

1,897,054,214 |

5,497,218,014 |

11,870,560,797 |

2,102,887,830 |

35.4% |

208,154,394,502 |

101,675,443,565 |

242,622,418,746 |

552,452,256,813 |

|

3/11/2021 |

5,312,889,081 |

1,944,402,505 |

6,008,856,668 |

13,266,148,254 |

2,451,304,513 |

35.9% |

243,363,967,358 |

115,478,687,316 |

263,168,067,129 |

622,010,721,803 |

|

3/10/2021 |

5,847,388,880 |

2,173,033,832 |

6,023,886,746 |

14,044,309,458 |

2,513,441,512 |

33.5% |

263,154,041,747 |

138,324,243,855 |

286,668,849,356 |

688,147,134,958 |

|

3/09/2021 |

5,513,569,492 |

2,384,609,926 |

6,345,568,911 |

14,243,748,329 |

2,470,885,934 |

34.5% |

257,348,072,577 |

144,532,405,396 |

314,863,603,281 |

716,744,081,254 |

|

3/08/2021 |

5,871,710,817 |

2,448,885,509 |

6,010,230,630 |

14,330,826,956 |

2,399,013,820 |

33.0% |

266,317,449,062 |

161,008,441,818 |

304,848,693,934 |

732,174,584,814 |

|

3/05/2021 |

6,851,074,404 |

3,145,378,119 |

7,725,204,408 |

17,721,656,931 |

2,911,705,459 |

32.5% |

292,647,245,792 |

192,543,483,327 |

387,521,447,918 |

872,712,177,037 |

|

3/04/2021 |

7,195,400,364 |

3,510,985,806 |

7,864,385,761 |

18,570,771,931 |

2,917,158,038 |

31.4% |

305,752,196,271 |

219,225,824,750 |

398,765,208,815 |

923,743,229,836 |

|

3/03/2021 |

6,173,668,203 |

2,538,623,418 |

5,529,987,423 |

14,242,279,044 |

2,277,028,005 |

33.2% |

247,796,680,923 |

150,920,819,466 |

288,024,161,512 |

686,741,661,901 |

|

3/02/2021 |

5,536,011,760 |

2,187,185,981 |

4,948,149,416 |

12,671,347,157 |

2,095,439,052 |

33.7% |

238,116,465,394 |

115,921,848,990 |

234,243,682,000 |

588,281,996,384 |

|

3/01/2021 |

5,114,822,248 |

2,226,863,307 |

5,079,530,681 |

12,421,216,236 |

2,124,733,979 |

34.1% |

224,620,439,337 |

134,186,319,032 |

255,441,598,764 |

614,248,357,133 |

|

2/26/2021 |

6,526,073,921 |

3,360,342,264 |

5,906,116,606 |

15,792,532,791 |

2,299,117,984 |

31.6% |

287,822,501,449 |

188,241,748,187 |

337,896,288,753 |

813,960,538,389 |

|

2/25/2021 |

6,547,477,599 |

3,170,863,041 |

6,390,381,118 |

16,108,721,758 |

2,671,703,118 |

32.6% |

281,612,569,284 |

187,526,862,972 |

341,622,868,318 |

810,762,300,574 |

|

2/24/2021 |

6,012,794,754 |

2,228,121,359 |

5,886,234,880 |

14,127,150,993 |

2,380,986,683 |

34.8% |

261,457,583,594 |

113,773,860,413 |

268,739,648,254 |

643,971,092,261 |

|

2/23/2021 |

6,296,616,750 |

2,908,485,769 |

7,516,517,821 |

16,721,620,340 |

2,685,713,295 |

33.7% |

274,833,072,730 |

151,707,258,166 |

351,368,897,206 |

777,909,228,102 |

|

2/22/2021 |

5,917,101,230 |

2,308,215,519 |

6,483,744,979 |

14,709,061,728 |

2,499,023,847 |

35.0% |

244,428,134,200 |

108,919,718,429 |

280,428,048,180 |

633,775,900,809 |

|

2/19/2021 |

4,845,321,801 |

2,089,666,929 |

6,737,822,663 |

13,672,811,393 |

2,437,472,636 |

36.0% |

220,580,459,943 |

104,420,633,125 |

258,368,432,653 |

583,369,525,721 |

|

2/18/2021 |

4,793,651,873 |

2,112,581,406 |

6,499,427,849 |

13,405,661,128 |

2,505,441,699 |

35.5% |

204,527,383,869 |

93,768,234,866 |

230,880,350,423 |

529,175,969,158 |

|

2/17/2021 |

4,730,653,832 |

2,614,356,711 |

7,280,502,142 |

14,625,512,685 |

2,781,033,583 |

35.6% |

208,036,296,397 |

97,018,381,269 |

244,674,806,552 |

549,729,484,218 |

|

2/16/2021 |

5,058,991,205 |

2,519,318,874 |

7,722,109,210 |

15,300,419,289 |

2,928,640,308 |

36.2% |

224,458,499,680 |

97,974,420,090 |

257,450,271,965 |

579,883,191,735 |

|

2/12/2021 |

4,135,067,553 |

2,012,750,786 |

7,416,946,350 |

13,564,764,689 |

2,703,751,609 |

36.8% |

175,368,807,521 |

75,482,844,399 |

216,492,668,833 |

467,344,320,753 |

|

2/11/2021 |

4,590,963,295 |

2,593,041,392 |

10,916,784,654 |

18,100,789,341 |

3,811,658,076 |

37.1% |

192,218,237,242 |

82,874,561,916 |

260,093,673,446 |

535,186,472,604 |

|

2/10/2021 |

4,837,075,626 |

3,286,408,761 |

10,785,937,494 |

18,909,421,881 |

3,946,158,207 |

36.8% |

196,275,160,531 |

77,899,839,403 |

238,173,294,558 |

512,348,294,492 |

|

Date |

NYSE Volume |

AMEX Volume |

NASD Volume |

Total Volume |

Dark Volume |

Dark % |

NYSE $ |

AMEX $ |

NASD $ |

Total Market $ |

This newsletter’s methods purpose is to catch the major moves in the markets, not the smaller fluctuations. Positions put on are with the expectation only of larger moves even if they do not develop. We would rather stop out flat or with small losses than miss big moves that have the possibility of life-changing money. We do not like to make a change in a position until we have a signal that something has profoundly changed. Big money is usually made by sitting on your hands.

Market Direction Is Half the Battle:

25 percent of getting a stock trade right is the market sector. There is also a listing of sectors and how their summation indexes are ranked. You can that lists ETFs here. Short the weak and go long the strong. Another good resource is to look for a contradiction in the advancers and decliners versus the straight sector rankings.

Art of Timing the Trade Charts:

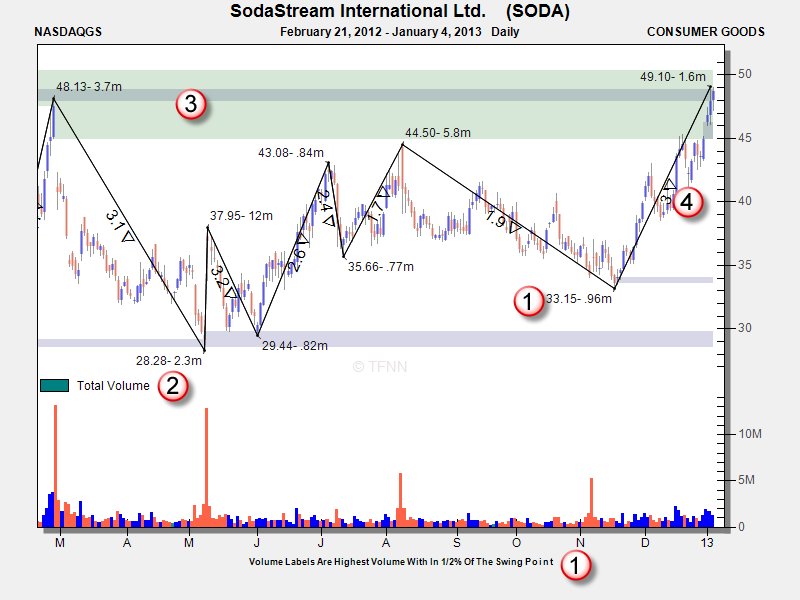

When looking at the charts, if the chart has “Max Volume” label at the bottom that signifies that the highest volume within ½% of the swing point price was used. This tries to capture the maximum energy at the highs. These are the stocks I am following as the ones most likely to give a signal and in some cases ones I am looking at playing. There are some things to know about the charts we show in this newsletter.

Summation Index:

The summation index is an oscillator of 19 and 38 days that shows the mid-term direction with market breadth. Divergence in the number of stocks that are behind the move is what we are looking for.

Broad Indexes:

I spend little time on the Dow and Nasdaq 100 indexes as they are statistically noise. Larger Indexes like the Russel, S&P 500, NYSE, NASDAQ Composite, that have hundreds if not thousands of stocks in them are important.

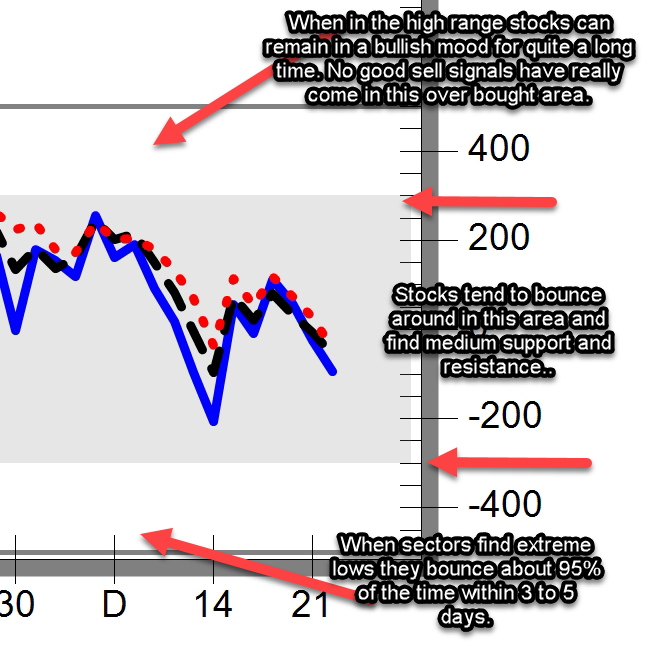

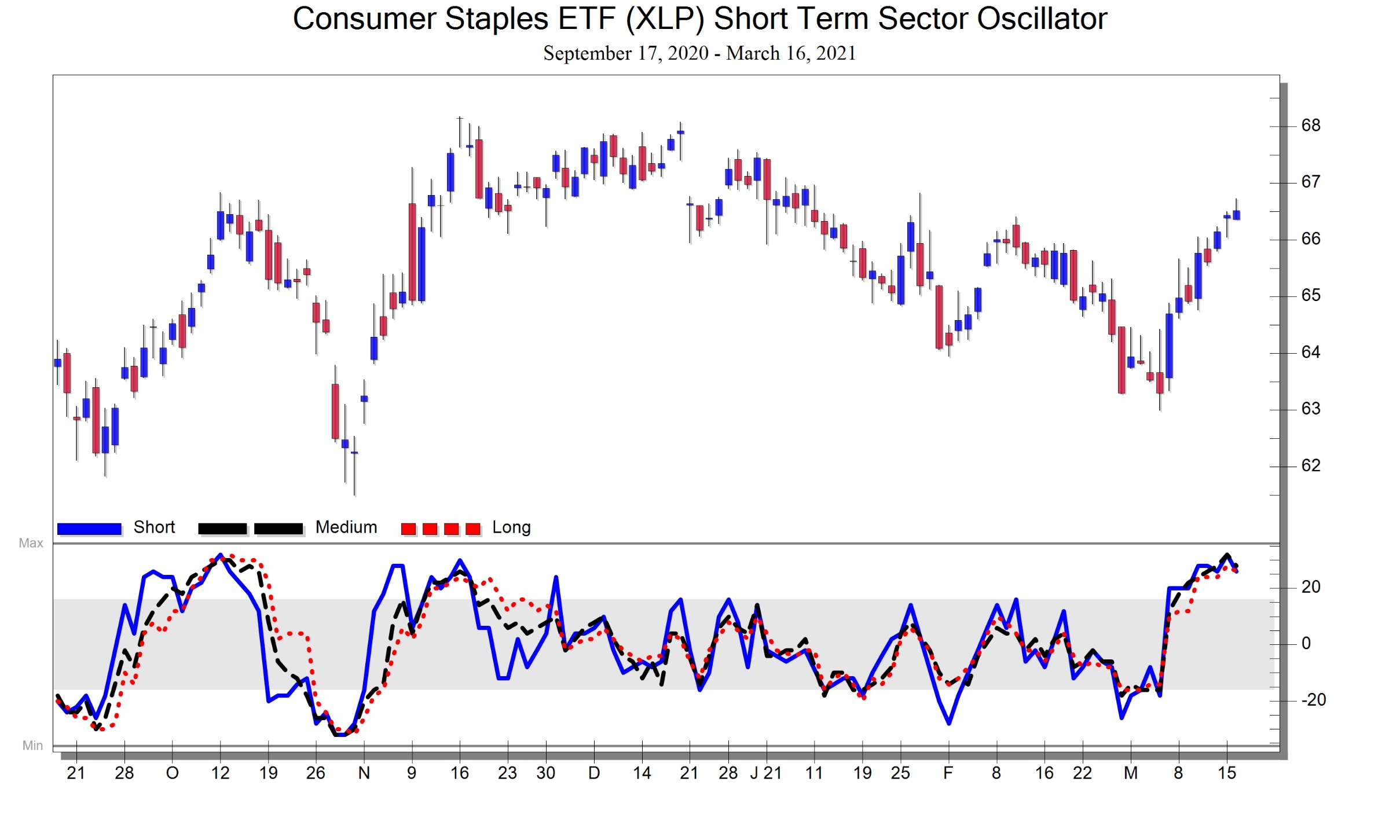

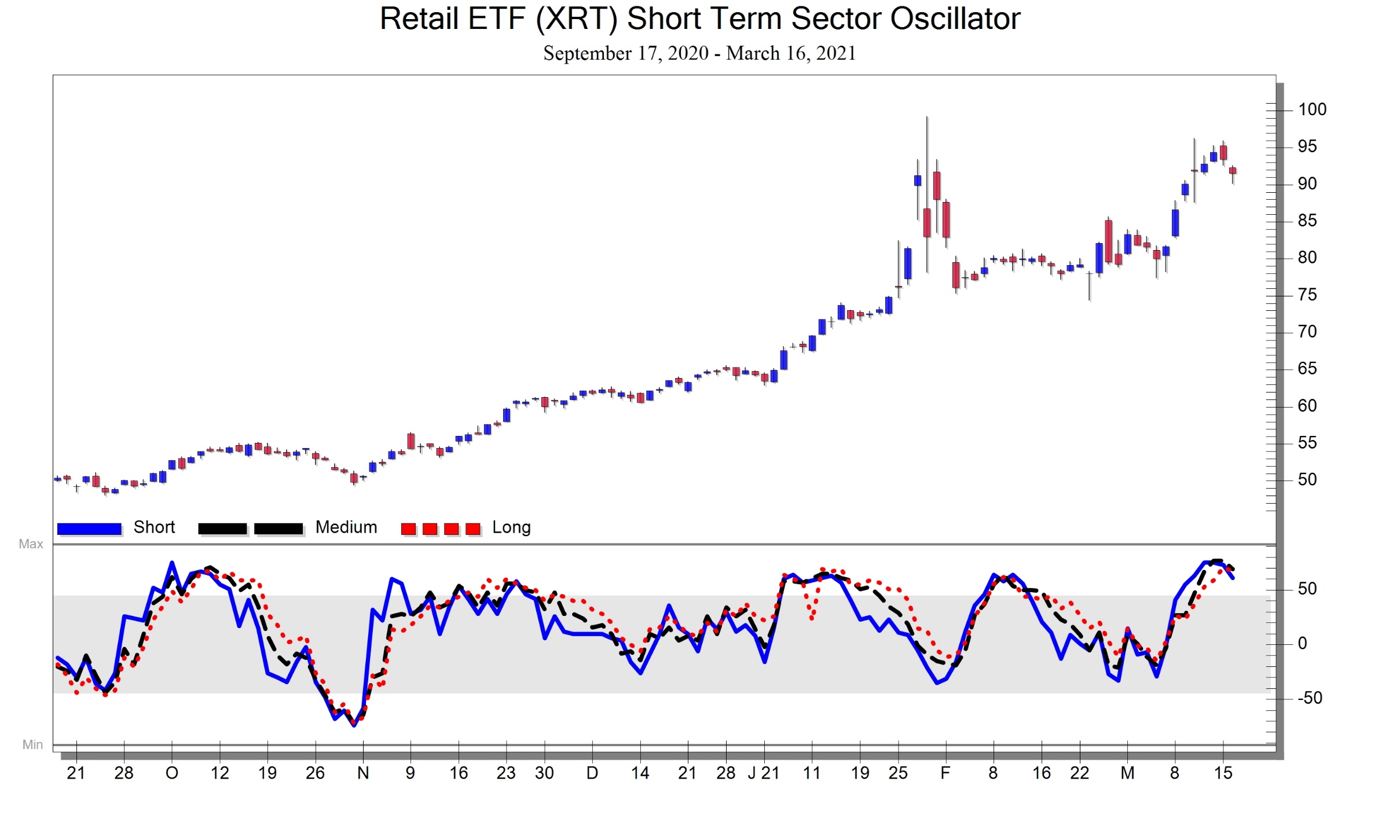

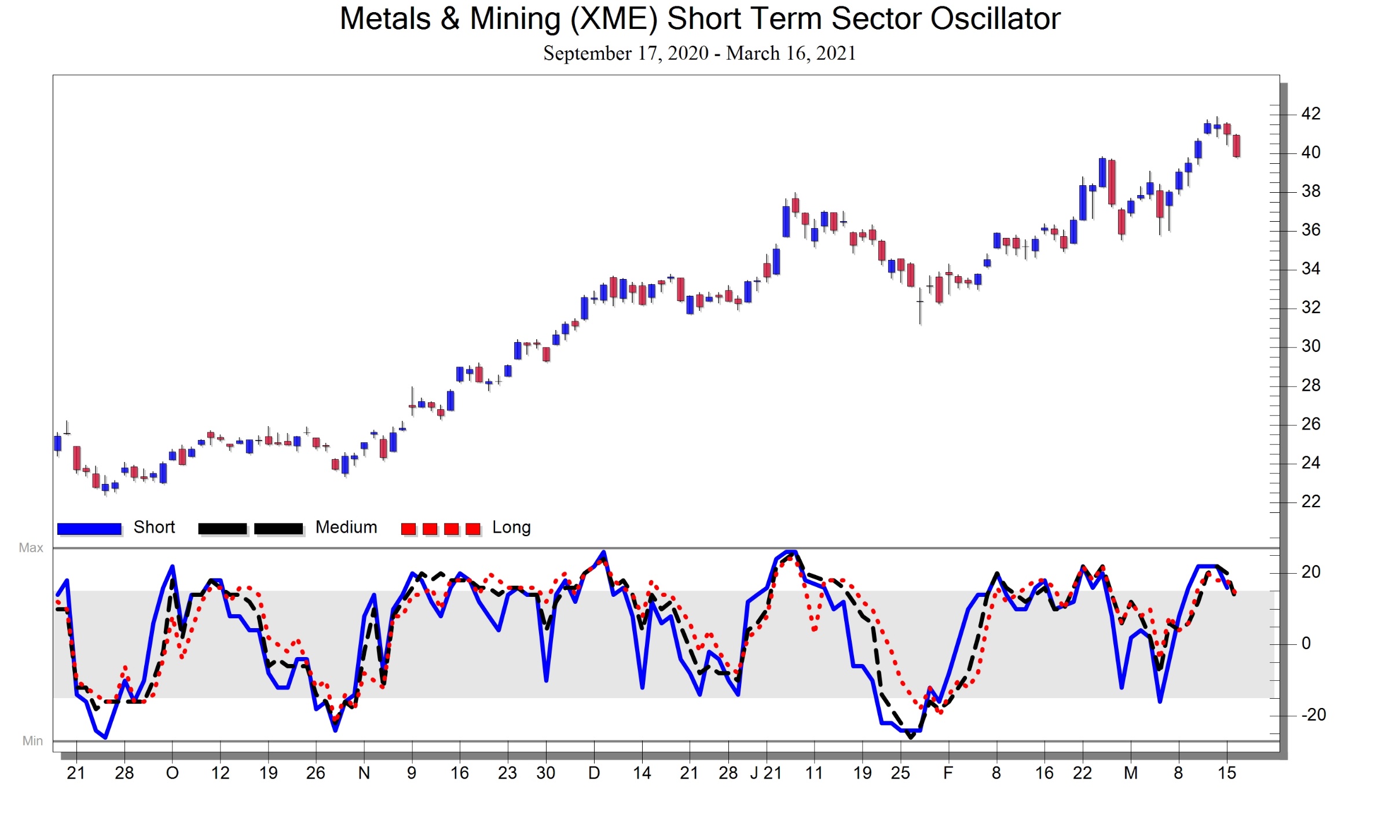

Shorter-Term Sector Oscillator Charts:

The Sector Oscillator Charts show the total stocks above and below the 3 X 3 Displaced Moving Average in the chosen sector. There are longer 7x5 and 25x5 lines too. While I am no big fan of moving averages, short-term oversold conditions show up well when historical extremes are hit on all the stocks in a sector on all those different time scales. In machine learning this is called bagging and ensemble methods. The great thing is that these lead 3 to 5 days at lows. Highs can remain overbought for a much longer time frame in positive markets. We have bought when the blood is in the streets with this indicator and is the best buy the lows signal, I have ever found.

Beliefs:

• In trading stocks, a formula that can mean anything means nothing. If it cannot be tested, I cannot use it.

• The larger the volume and energy differential (PLVI) passed a 40% change, the better the odds are logarithmically.

• Volume with price is the most predictive indicator by an order of magnitude.

• I do not trade for a daily wage and will wait for the odds to favor my play.

• Surprises happen in the direction of most of the stocks, not the indexes.

Reading:

Reminiscences of a Stock Operator

I recommend the books above but don’t completely agree with all their conclusions. For the most part they will help you learn how to think like a trader and question your beliefs. The first book is for understanding probability, the second for history, and the last for psychology. I am going to assume you have already read Timing the Trade and have a basic understanding of how to trade using volumes.

Disclaimer:

Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Path of Least Resistance” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2017 all rights reserved.

Graphics:

Graphics from outside sources have been linked if possible. Click on them to go to the source.

1. The volume labels are the highest volume within ½ % of the swing point. Just because there may have been a higher high the day after a penny higher, I still want to see the most energy at a swing point. The swing point price and volume is shown with an ‘m’ for millions and a ‘b’ for billions.

2. Total Volume label is the volume is averaged per frequency or not. Volume can be labeled for weekly and monthly periods either averaged for the time frame, or as a total amount. In the Past 10 years IBM has had as little as 15 trading days in one month, and as many as 23. When looking for changes in volume you can see how the frequency of trading days can easily skew the absolute volume method of months with more trading days. The same applies for weekly data where there is a range of 2 to 5 days every year in the trading days in a week.

3. Trading gaps as shown in bluish and tannish translucent bars. Gaps are from the previous days close to the open of the next day. As the gaps have been filled with trading ranges between the open and closing price, not the extremes of the day, they are no longer shown. On the right side of the chart, they will continue for five days, even after they have negated, so you can see that it has been recently filled.

4. The Power Law Vector Indicator communicated on the chart as a number and then the nabla ( ∇ ) symbol. This figure is a quick look at the total energy consumed in a move between two swing points. Just like your electric bill, it is the change in price times the time, times the volume. The A/C in your home draws 240 volts and runs a lot in the summer. Your hair dryer runs a few minutes on 120 volts. We are interested in seeing a number that makes it easy to compare the moves of different legs of swings and seeing the bill for each one.

Published by the TFNN Corporation • 300 4th Avenue South Suite 200 - St. Petersburg, FL 33701 • 877.518.9190 • WWW.TFNN.COM • © 2021 • All Rights Reserved