Mastering Probability End of Day Reports for April 28, 2021

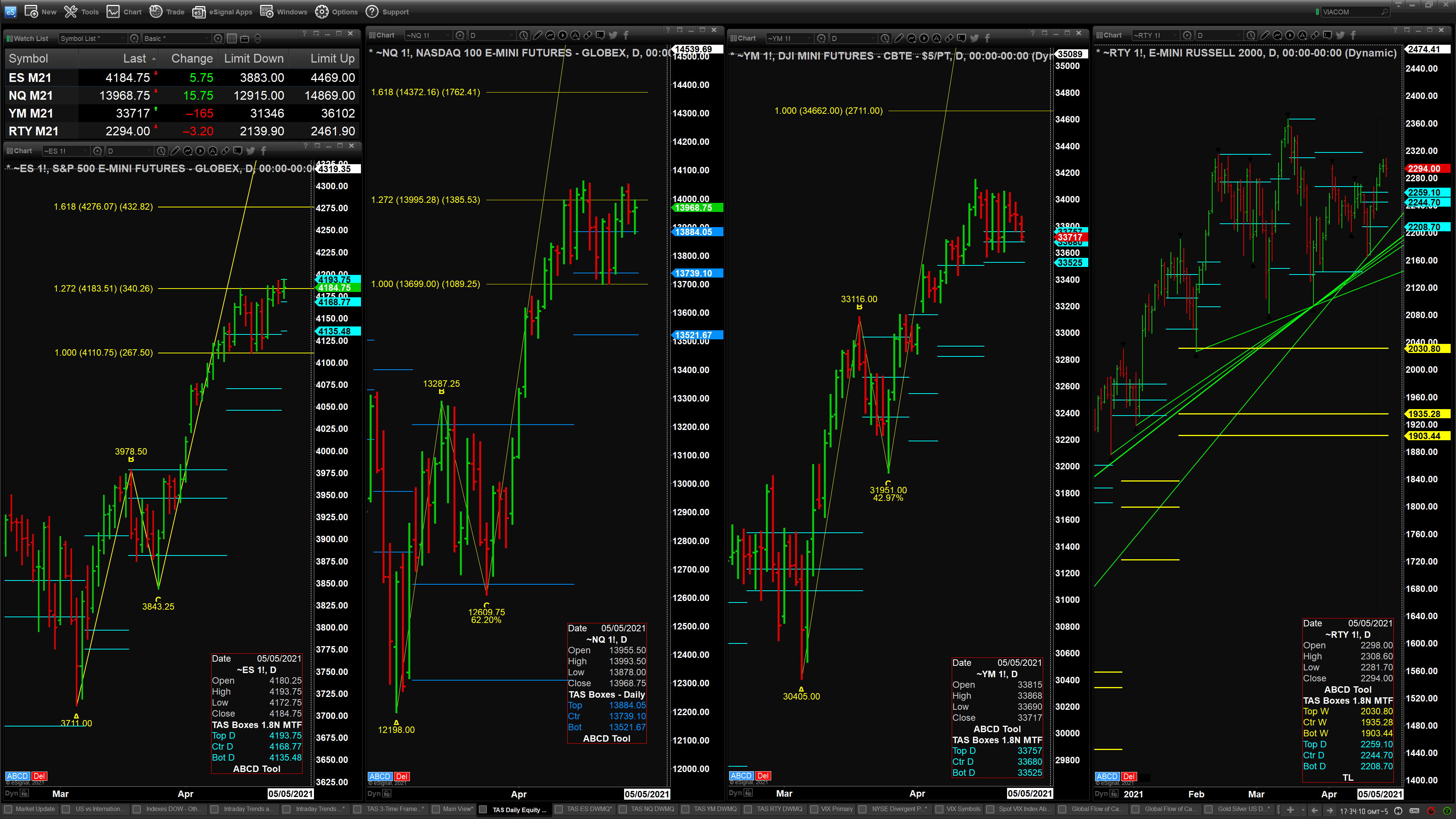

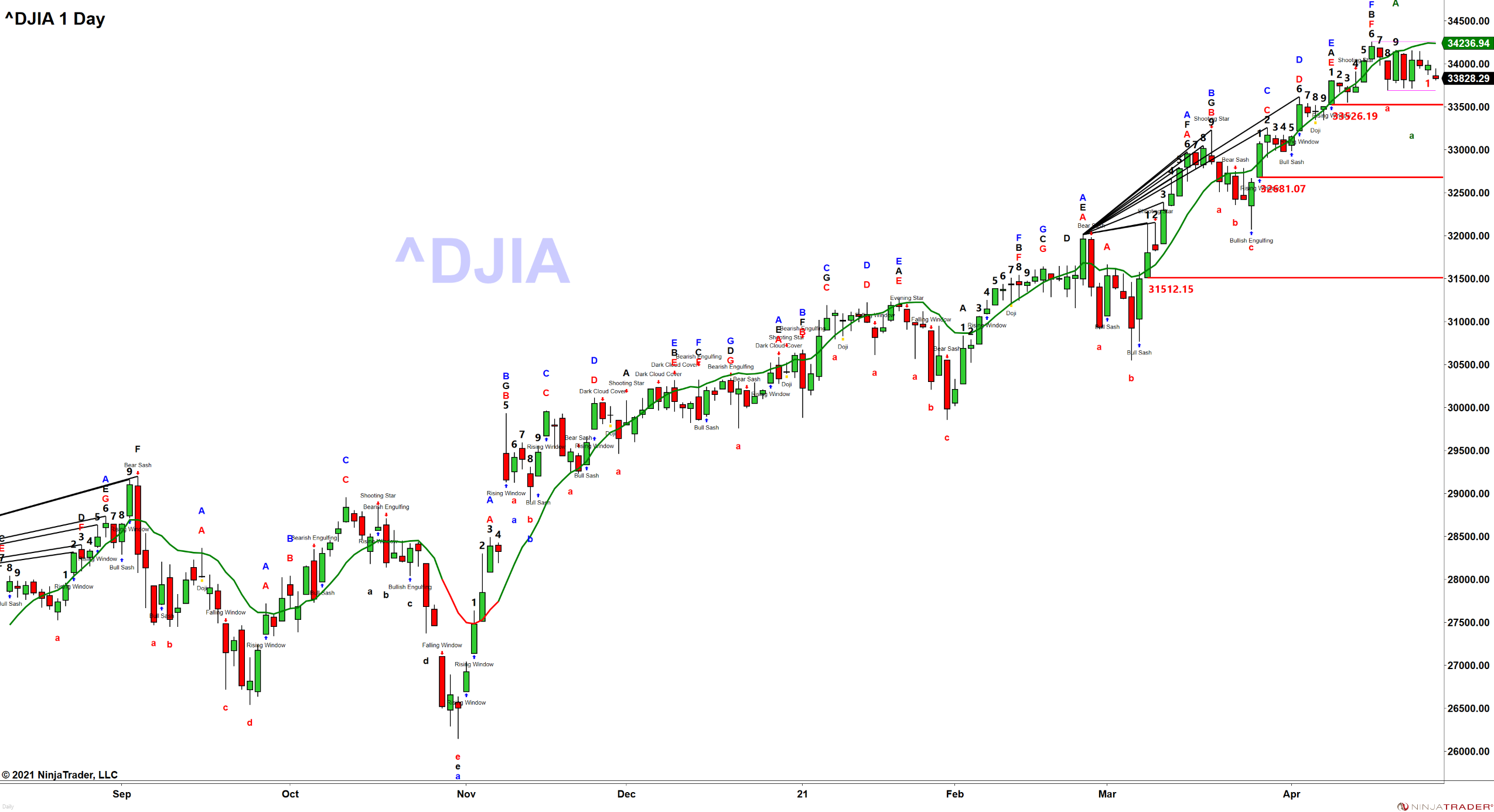

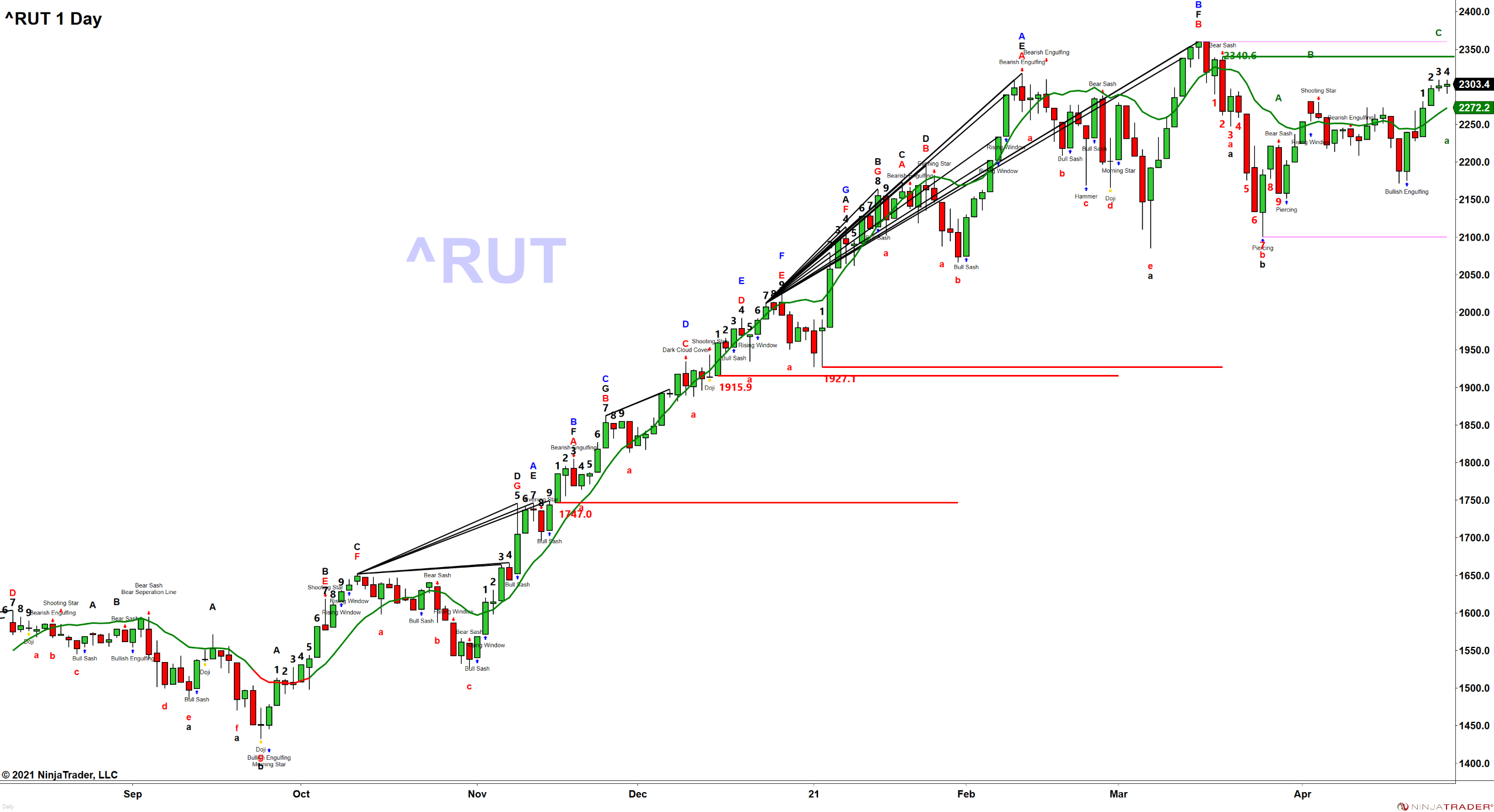

U.S. indices mostly closed lower on the day.

The S&P 500 generated a bearish Shooting Star candle today and price closed below its OUL which confirms a RMI top.

Unfortunately, the ES mini did not confirm a top leaving us to wonder which signal is correct?

The ES is attempting to form a new daily profile. We’ll know in the morning if this takes hold or not, but for now, 4193.75 is resistance and 4135 is support.

Have a great evening!

Current Positions:

|

Positions |

ACTUAL ENTRY |

INITIAL INTRADAY STOP |

ADJUSTED INTRADAY STOP |

TARGET EXIT |

CURRENT NEWSLETTER PRICE |

PER SHARE RISK (STOP LOSS) |

NEWSLETTER PER SHARE PROFIT (LOSS) |

REWARD (LOSS) FACTOR |

|||

|

|

|||||||||||

|

Date |

SYMBOL |

DESCRIPTION |

|

||||||||

|

3/9/2021 |

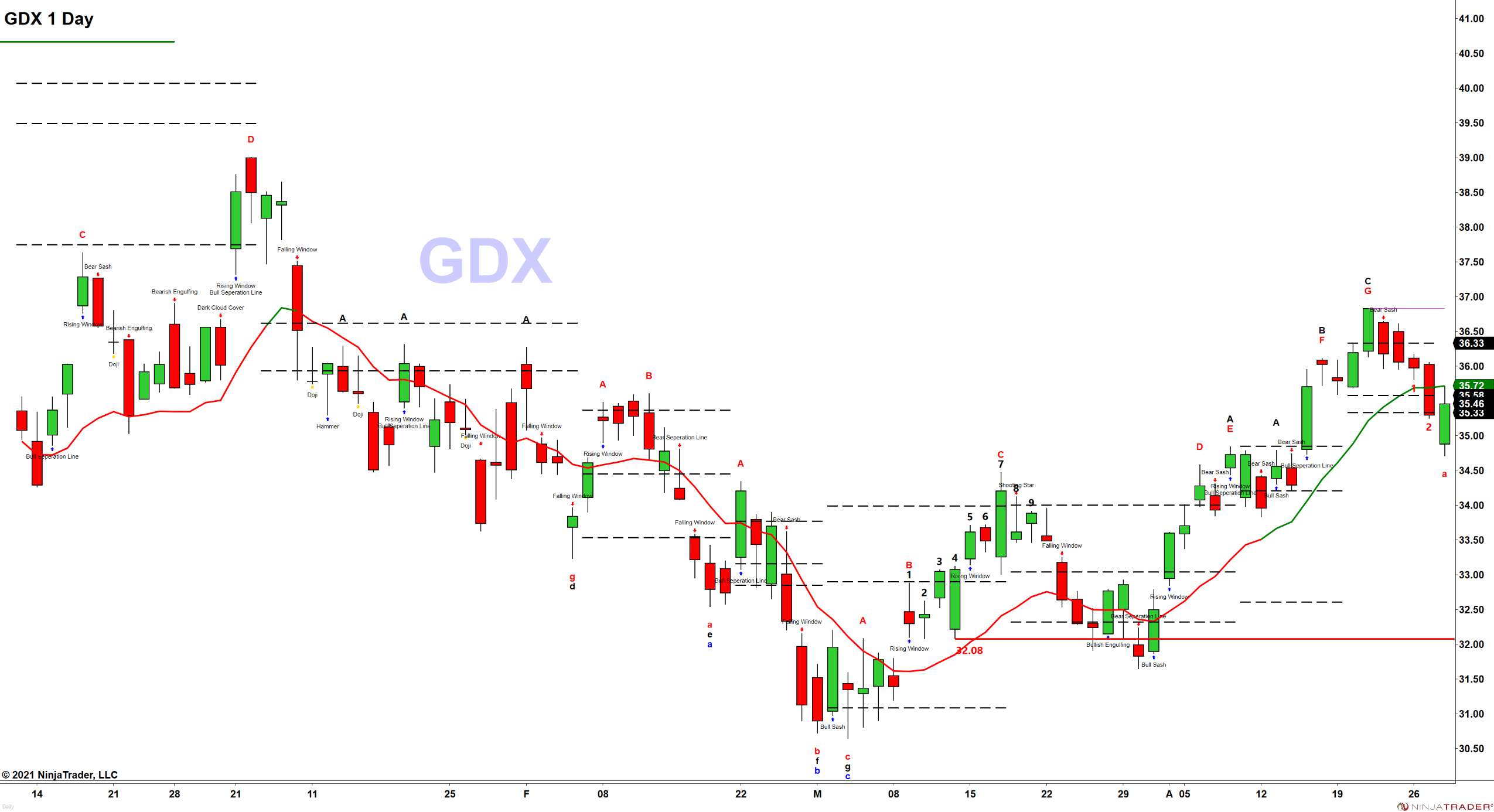

GDX |

LONG Gold Miners - 1X |

32.47 |

30.53 |

34.10 |

40.67 |

35.45 |

$1.94 |

$2.98 |

1.54 |

|

|

3/9/2012 |

NUGT |

LONG Gold Miners - 2X |

54.70 |

48.08 |

59.53 |

90.90 |

64.31 |

$6.62 |

$9.61 |

1.45 |

|

|

3/10/2021 |

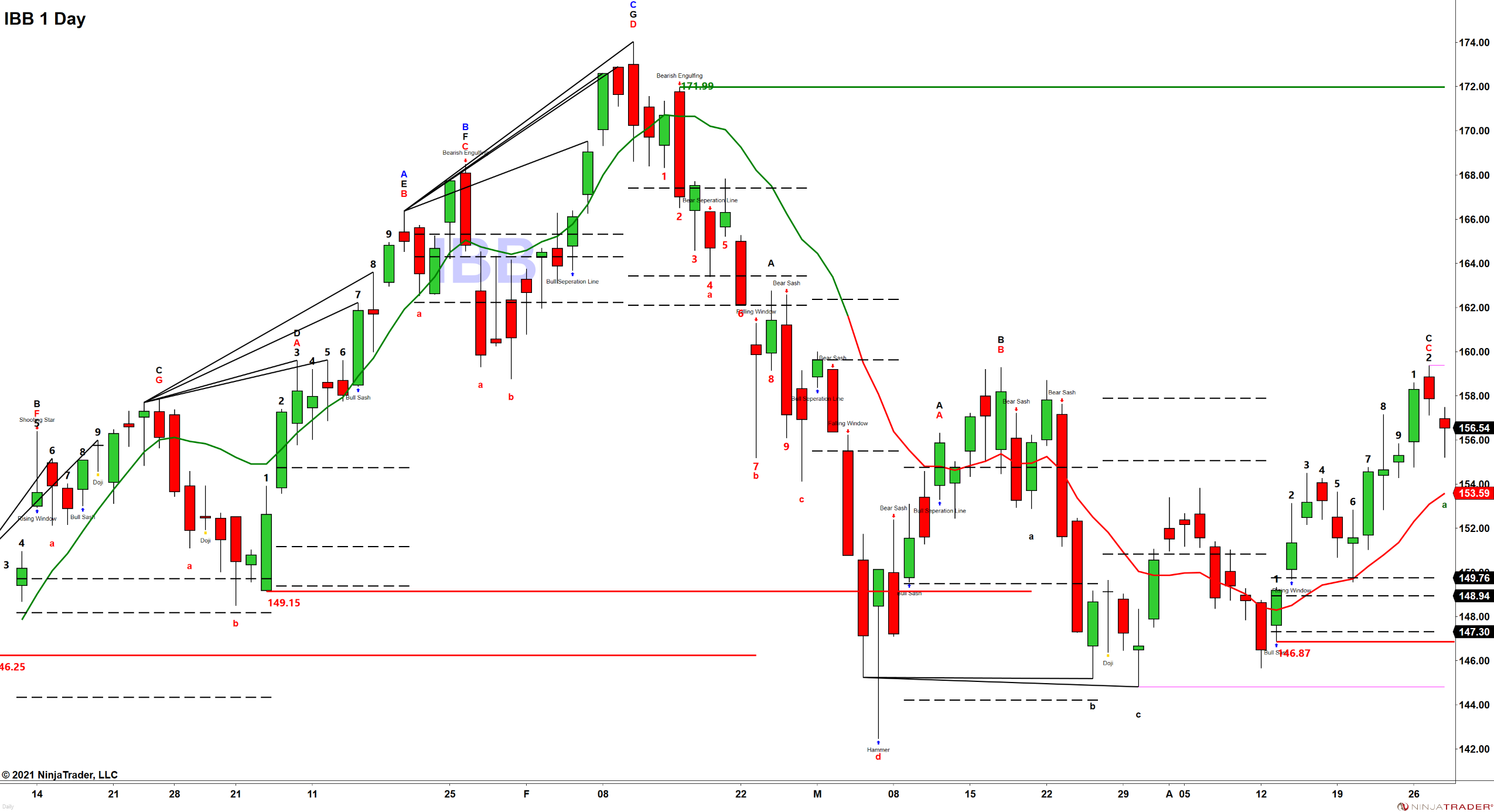

IBB |

LONG NDX Biotech |

153.42 |

143.99 |

153.42 |

171.99 |

156.77 |

$9.43 |

$3.35 |

0.36 |

|

|

3/15/2021 |

EQX |

EQUINOX GOLD |

8.48 |

7.80 |

7.81 |

10.00 |

8.39 |

$0.68 |

($0.09) |

(0.13) |

|

|

3/24/2021 |

TLT |

LONG 20+Yr Bonds |

137.42 |

134.78 |

137.85 |

148.08 |

138.73 |

$2.64 |

$1.31 |

0.50 |

|

|

3/29/2021 |

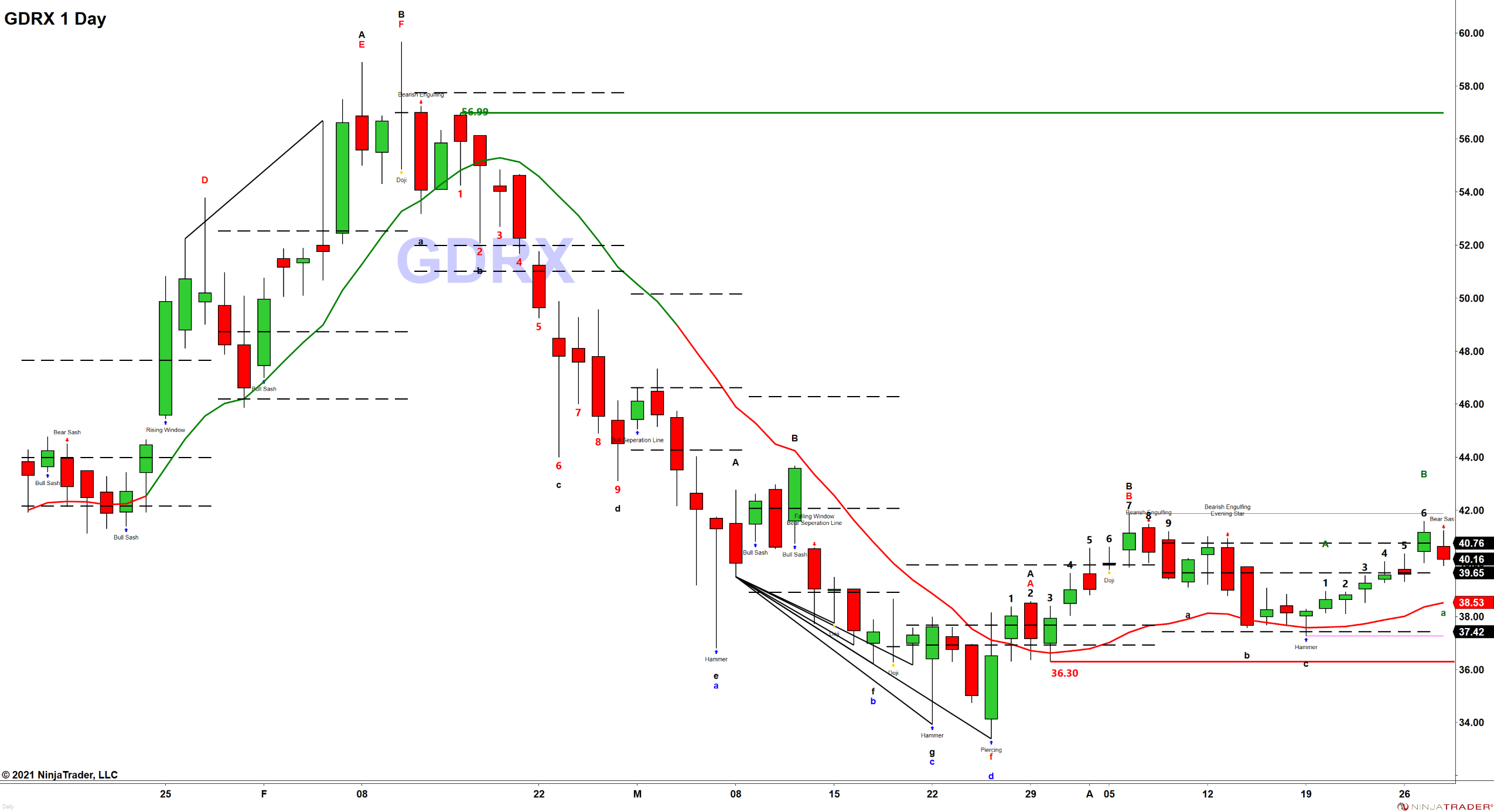

GDRX |

GOODRX HLDGS |

38.51 |

33.19 |

37.17 |

56.99 |

40.15 |

$5.32 |

$1.64 |

0.31 |

|

|

3/29/2021 |

SCCO |

SOUTHERN COPPER |

68.07 |

63.43 |

68.68 |

75.98 |

73.02 |

$4.64 |

$4.95 |

1.07 |

|

|

4/6/2021 |

CANE |

LONG SUGAR |

7.04 |

6.80 |

7.87 |

8.78 |

8.07 |

$0.24 |

$1.03 |

4.29 |

|

|

4/8/2021 |

WEAT |

LONG WHEAT |

6.08 |

5.85 |

6.85 |

7.33 |

6.92 |

$0.23 |

$0.84 |

3.65 |

|

|

4/14/2021 |

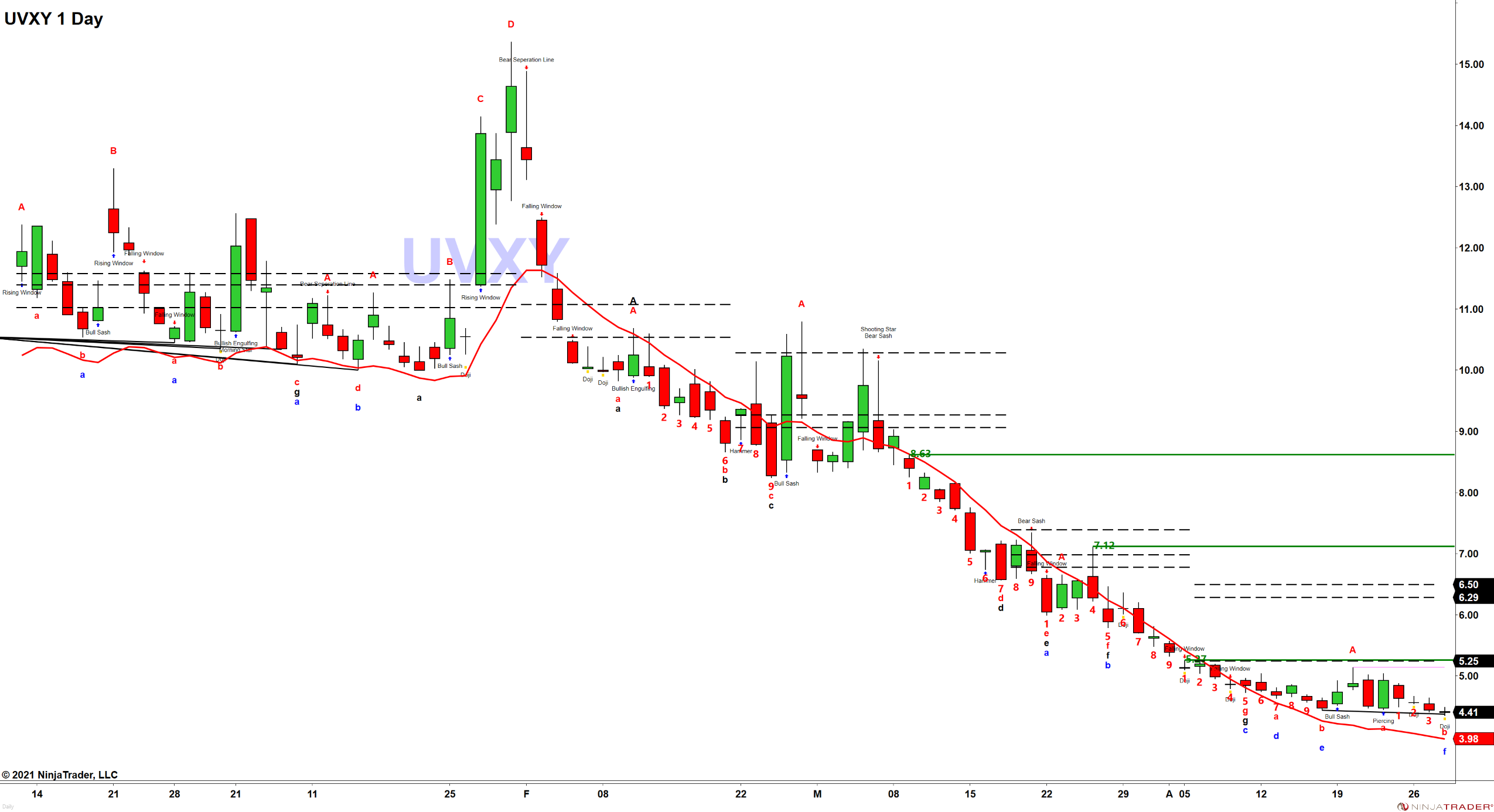

UVXY |

LONG VIX |

4.73 |

4.10 |

|

7.12 |

4.42 |

$0.63 |

($0.31) |

(0.49) |

|

|

4/19/2021 |

ACB |

AURORA CANNABIS |

8.20 |

7.33 |

7.71 |

14.50 |

9.05 |

$0.87 |

$0.85 |

0.97 |

|

|

4/22/2021 |

PRLB |

PROTO LABS |

107.34 |

96.55 |

106.50 |

121.80 |

114.47 |

$10.79 |

$7.13 |

0.66 |

|

We are not making any changes to our current positions.

Have a great evening!

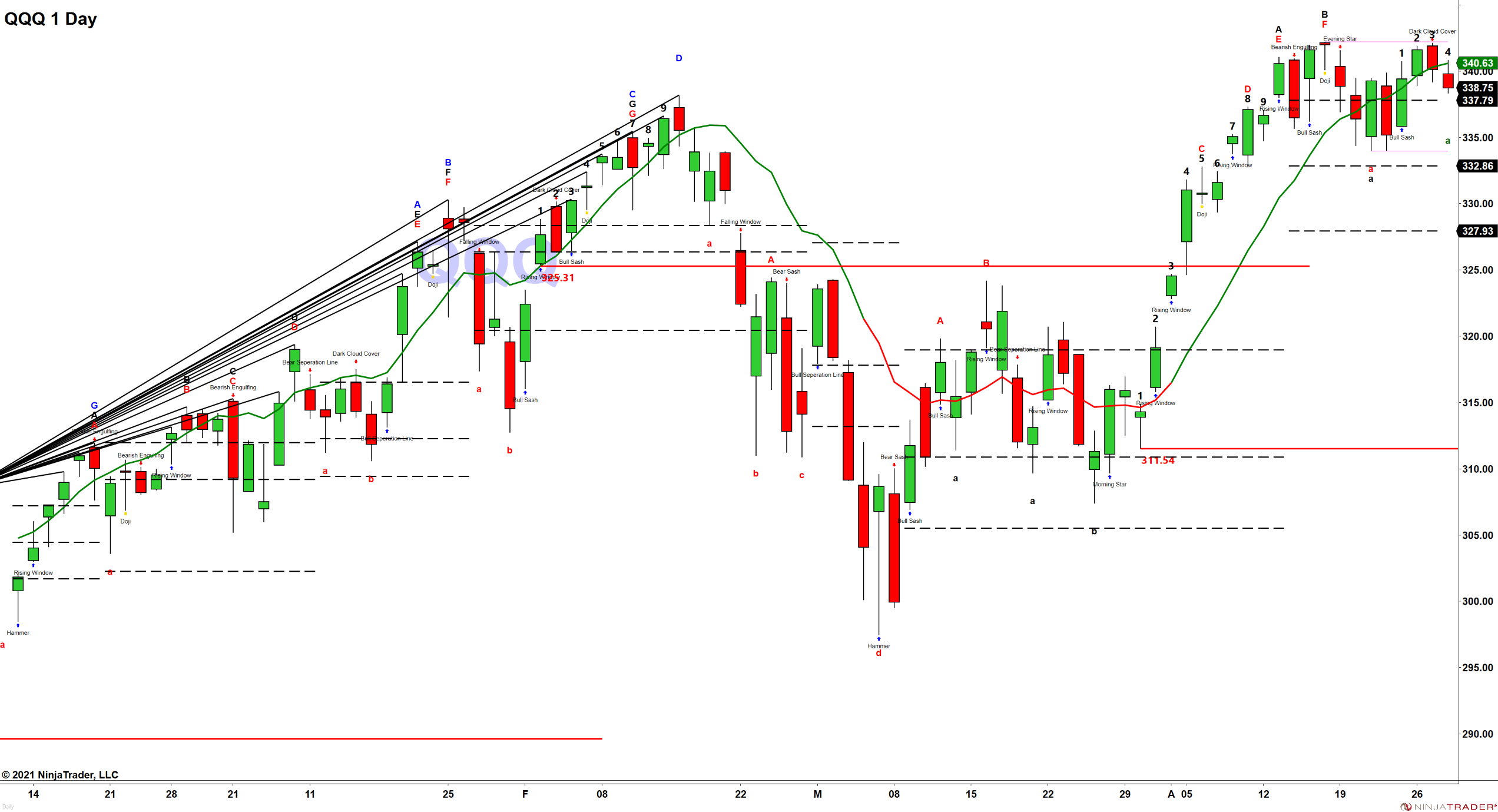

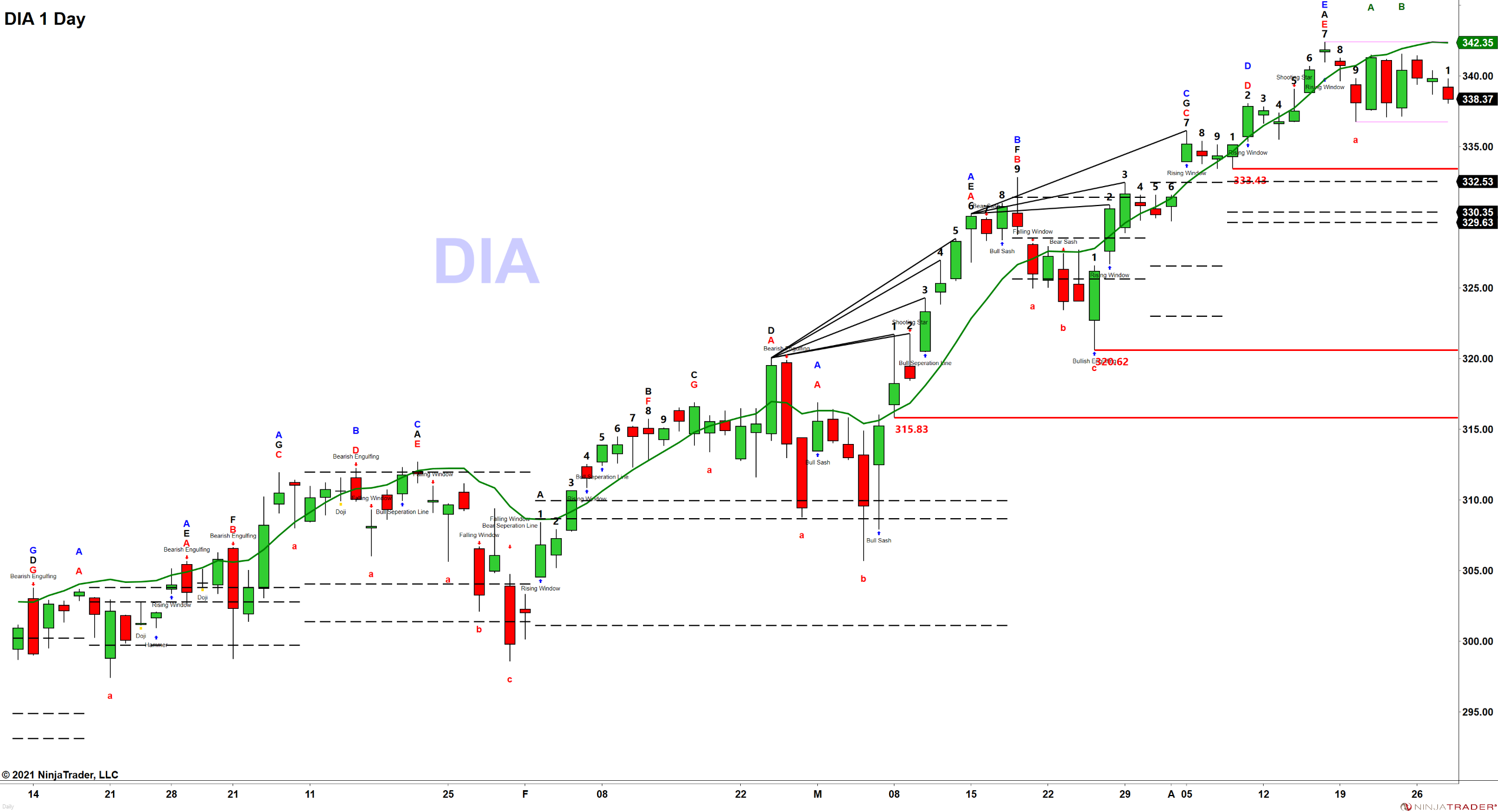

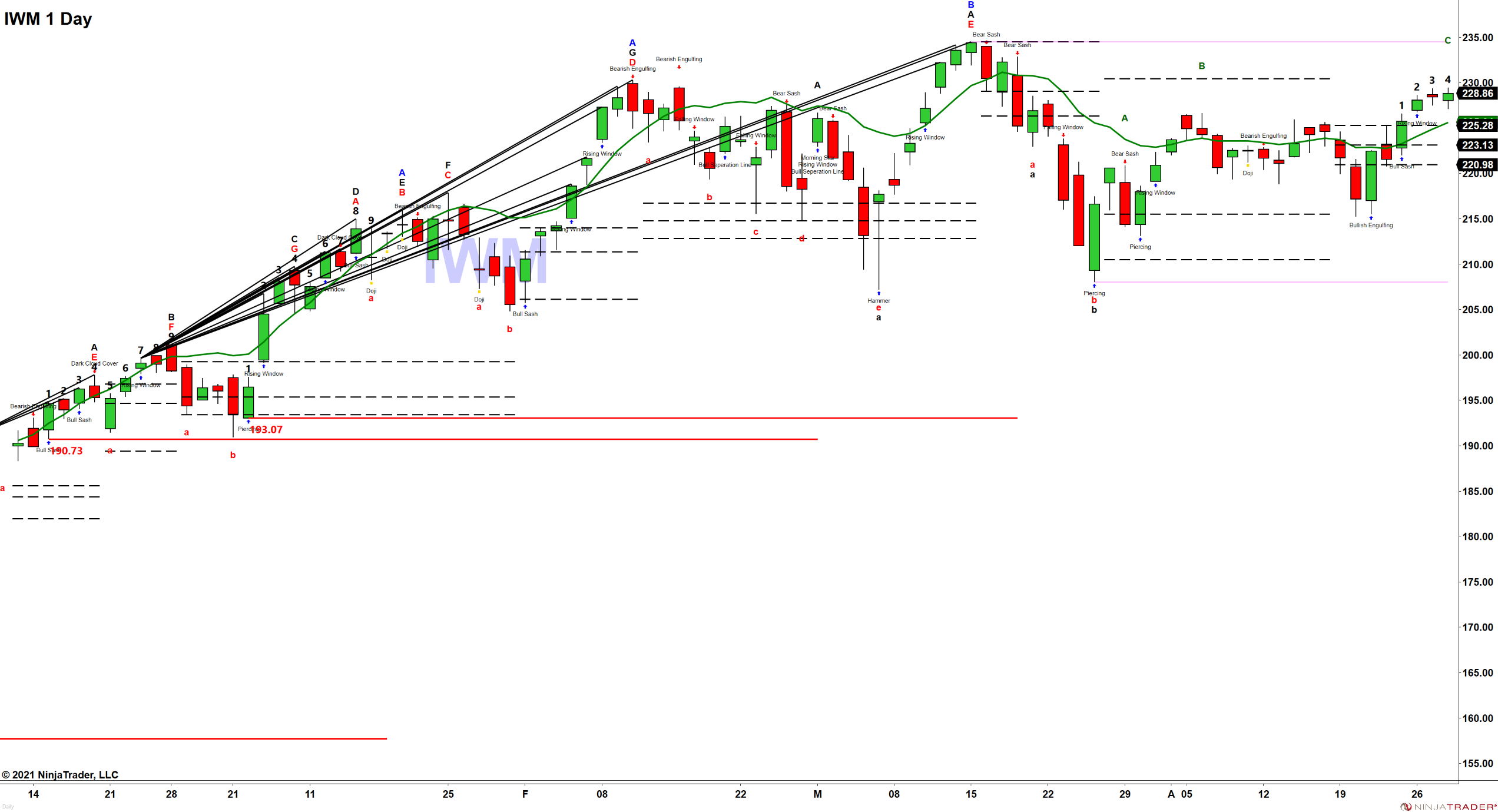

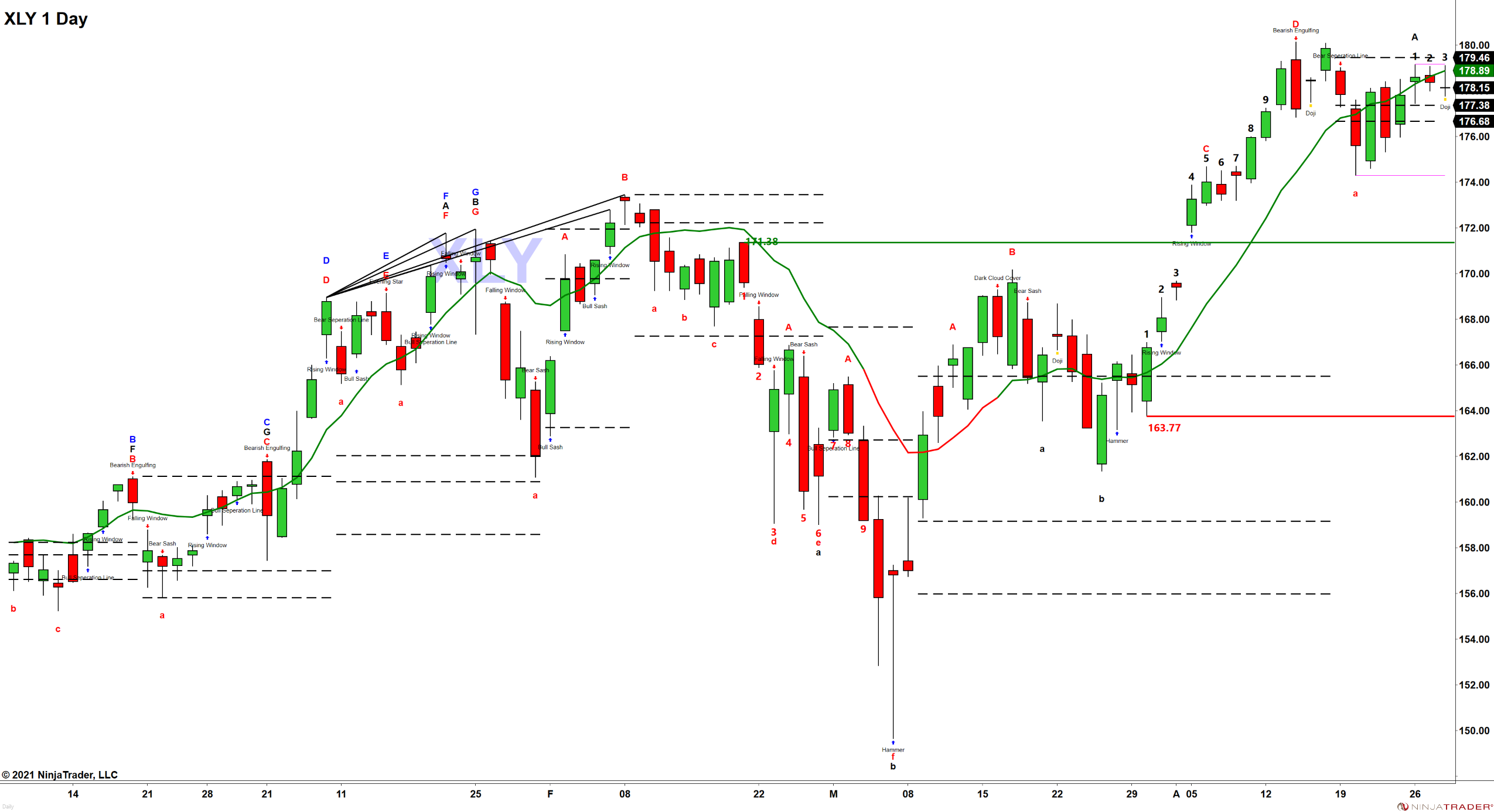

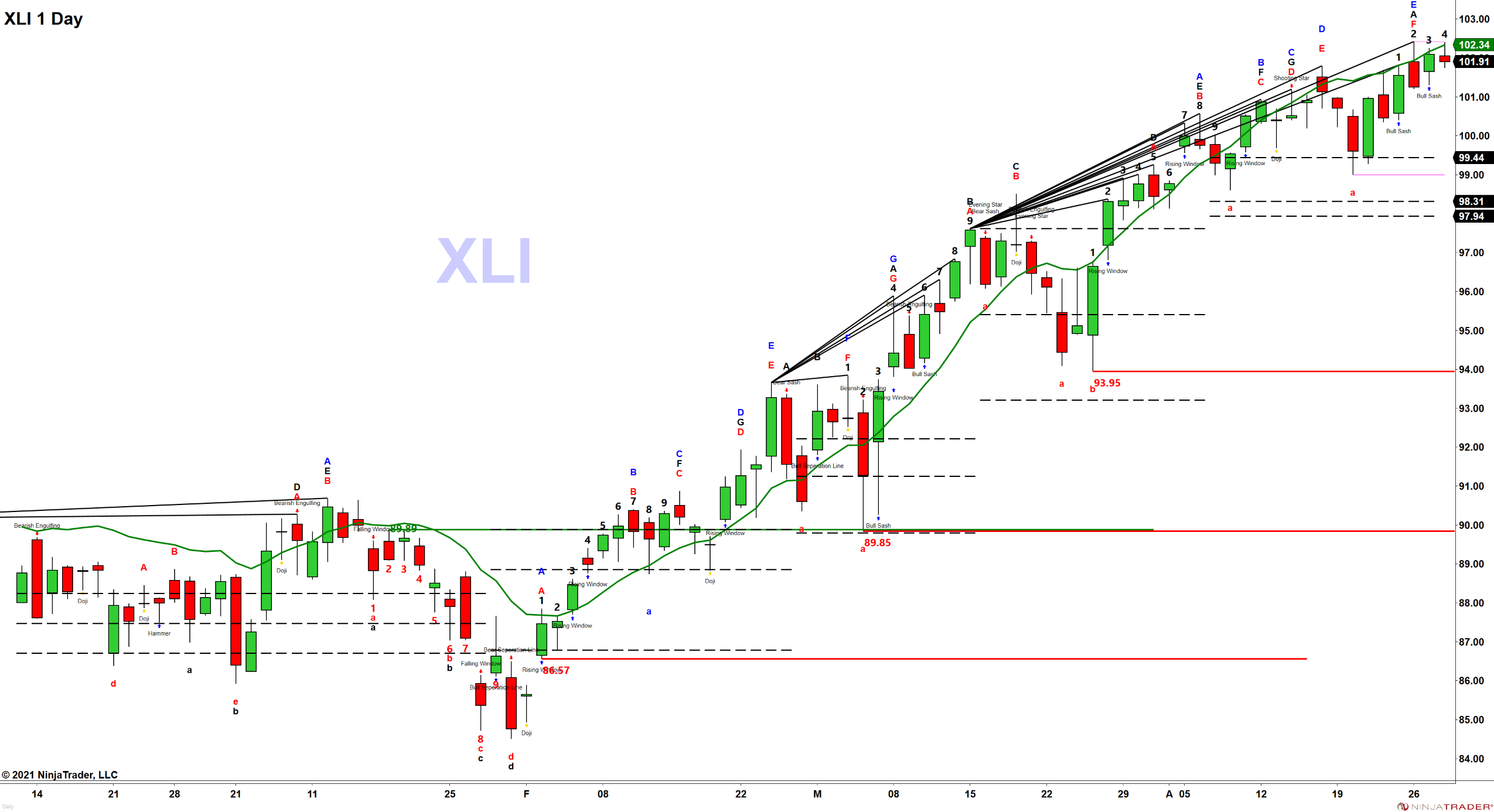

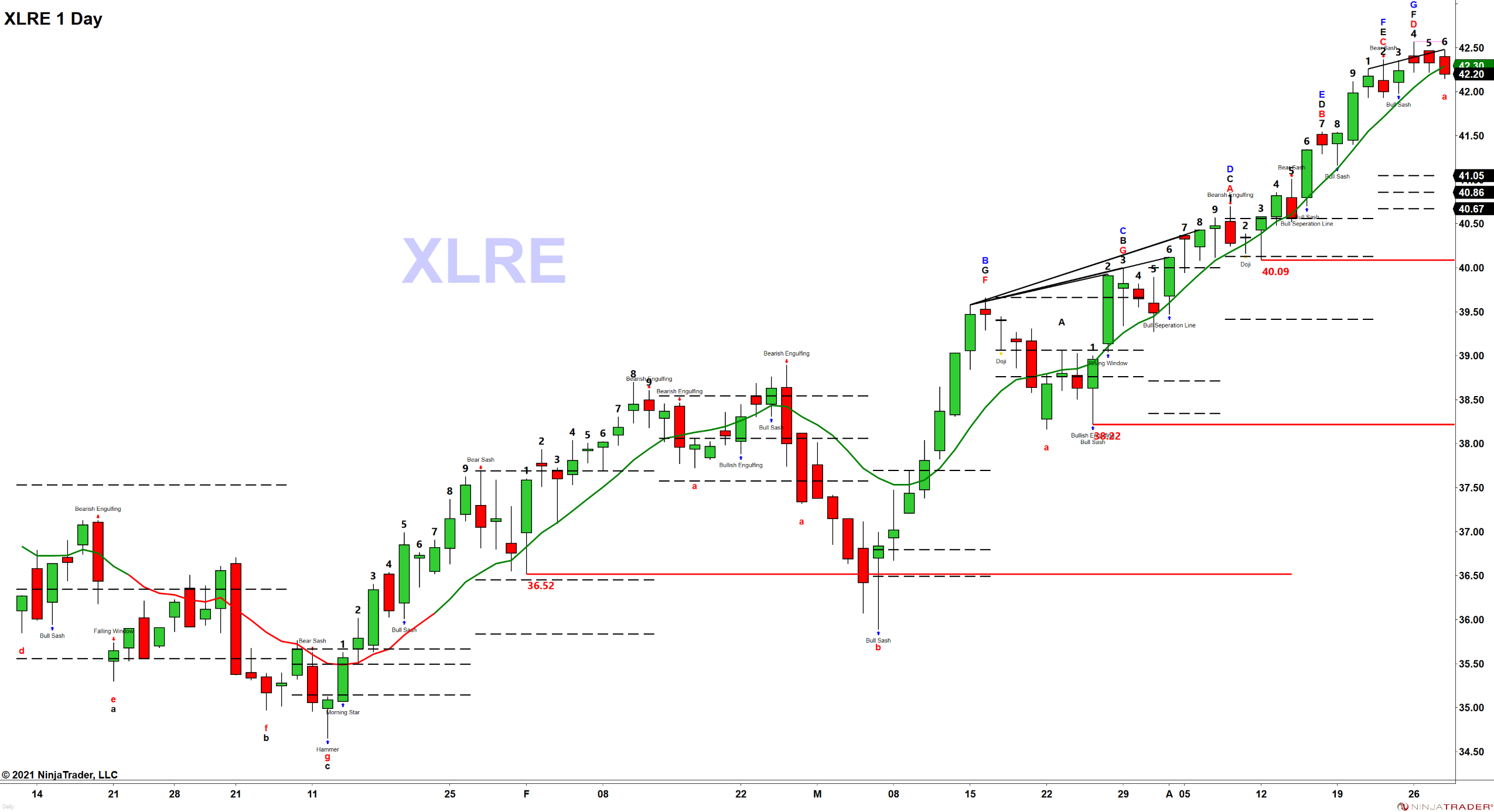

Below are charts as of the close for the cash indices for their daily time frame.

Chart legend for the following charts. The red/green line is the Oscillator Unchanged Line. A green line means that the Price Oscillator (the difference between the 19 & 39-day EMA) is above zero and when the line is red, it means the Price Oscillator is below zero. When price is above a green OUL, it is a bullish condition and when price is below a red OUL, it is a bearish condition. When price is below a green OUL, it suggests a retracement back to support and when price is above a red OUL, it suggests a countertrend rally to resistance. Black numbers are TD Setup counts. A 9 count indicates, and impending trend change may be near. The red and green lines are the Tom Demark Setup Trend lines that define important trend reversal price levels. Charts with shaded patterns are confirmed Gartley Sell patterns.

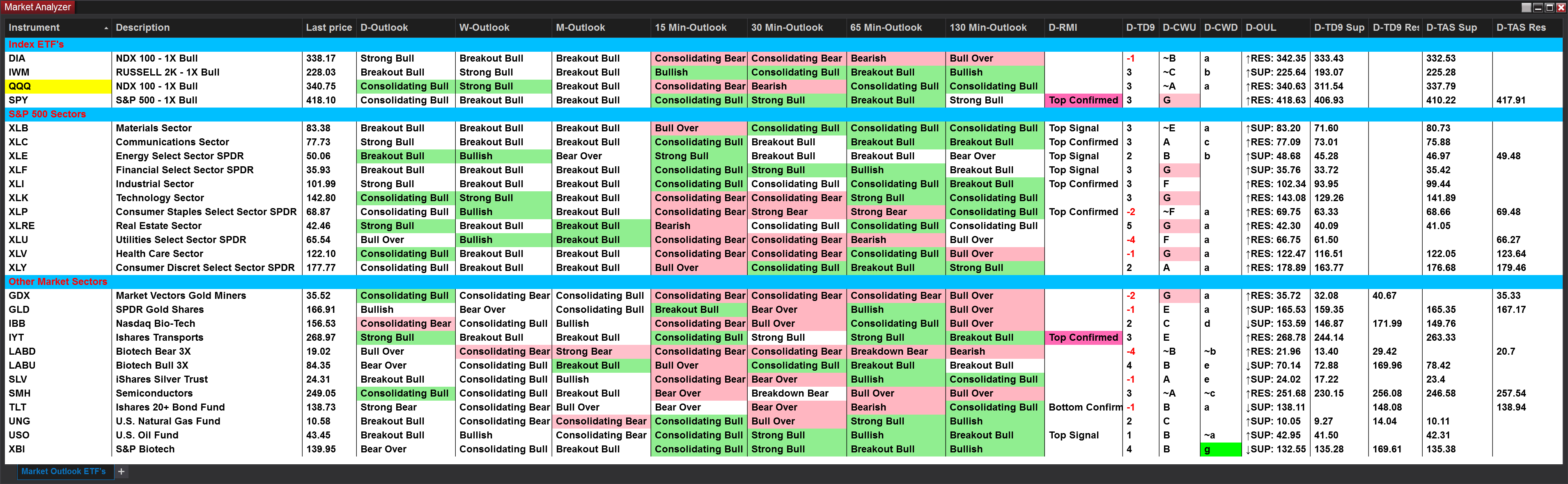

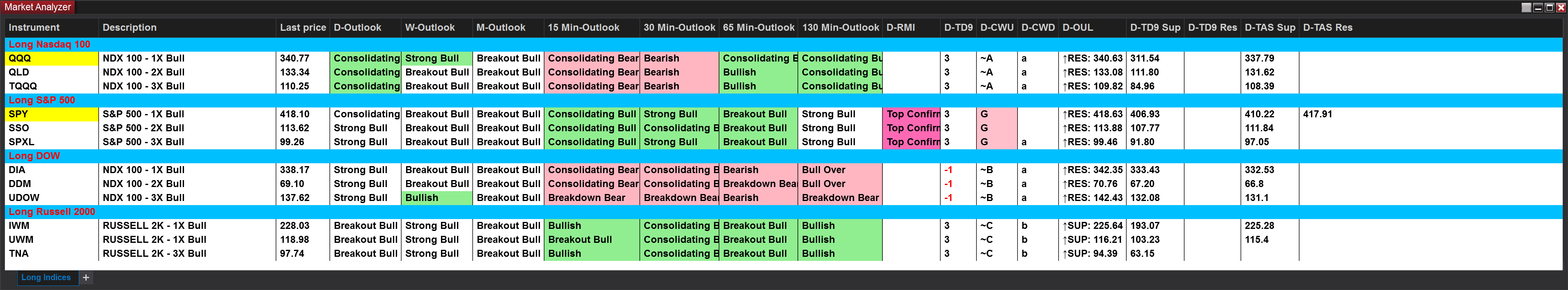

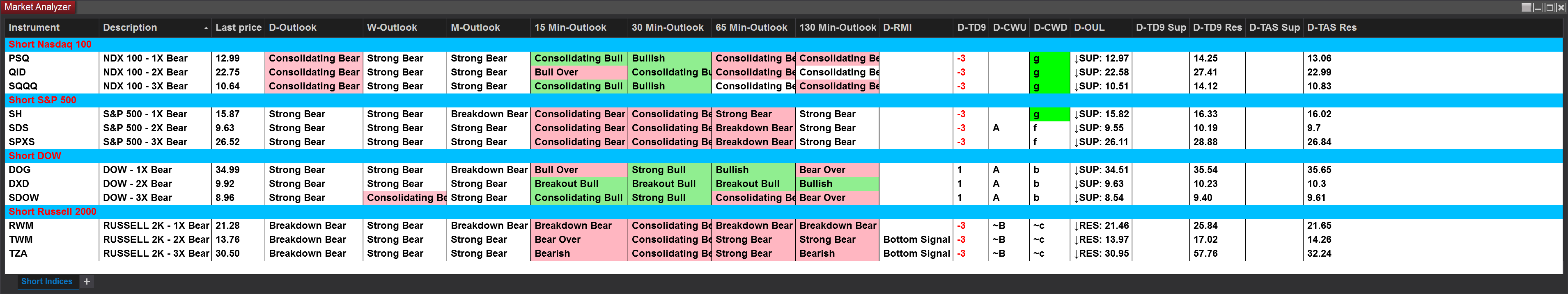

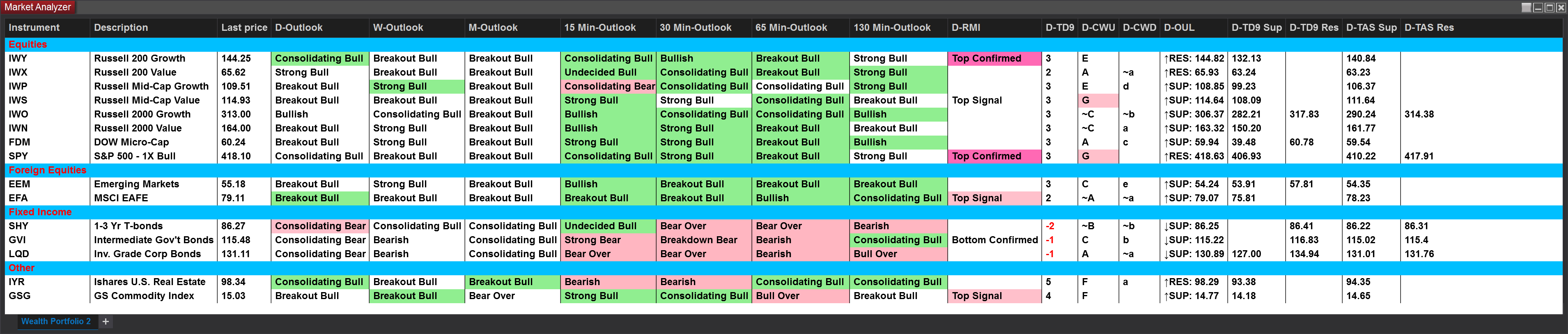

Above are Bob’s signals for index ETF’s, the S&P 500 sectors as well as various other popular ETF’s. (Color highlighted signals reflect a change in the outlook or an RMI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

Above are Bob’s signals for index ETF’s for both long and short positions. (Color highlighted signals reflect a change in the outlook or an RMI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

Below are charts as of today’s close for the index ETF’s and the S&P 500 sectors for their daily time frame.

Chart legend for the following charts. The red/green line is the Oscillator Unchanged Line. A green line means that the Price Oscillator (the difference between the 19 & 39-day EMA) is above zero and when the line is red, it means the Price Oscillator is below zero. When price is above a green OUL, it is a bullish condition and when price is below a red OUL, it is a bearish condition. When price is below a green OUL, it suggests a retracement back to support and when price is above a red OUL, it suggests a countertrend rally to resistance. Black numbers are TD Setup counts. A 9 count indicates, and impending trend change may be near. The red and green lines are the Tom Demark Setup Trend Lines. A red TDST is support and a green TDST is resistance. Black dashed lines are the TAS market profiles, with the top being resistance, the bottom being support and the center being the point of control, the price area where both buyers and sellers believe the sector is fairly valued. Charts with shaded patterns are confirmed Gartley Sell patterns.

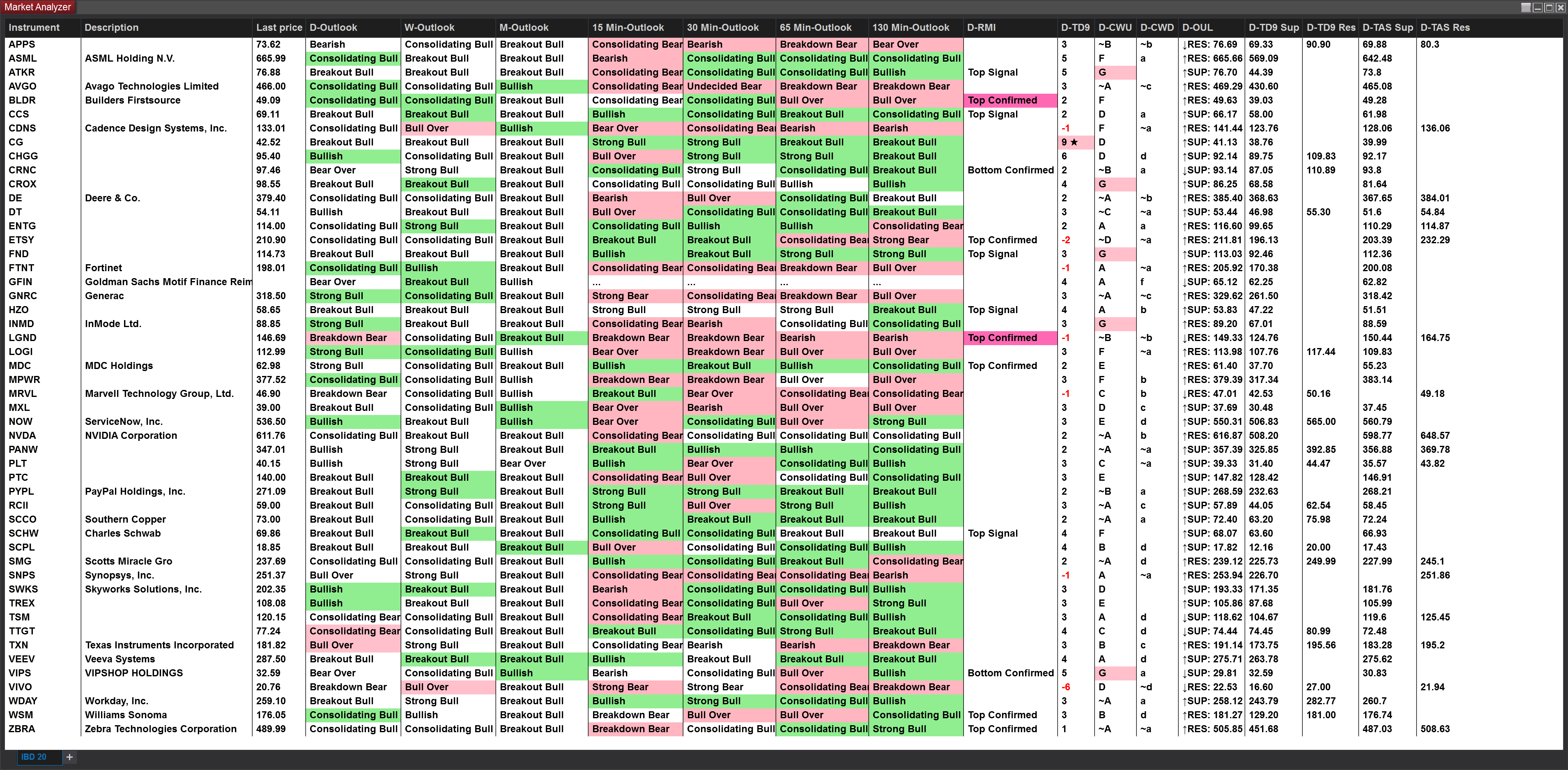

Below are Bob’s ( B ullish o r B earish) “black box signals” for various portfolios and individual stocks.

The required conditions that make up the outlook for each status signal are as follows:

1. Breakout Bull

a. Price Oscillator is above zero

b. Price is trading above the OUL

c.

Price is above the Top of the TAS box

2. Strong Bull

a. Price Oscillator is above zero

b. Price is trading below the OUL

c. Price is above the Top of the TAS box

3. Bullish – Buy TAS & OUL Support

a. Price Oscillator is above zero

b. Price is trading above the OUL

c.

Price is trading within the box

4. Consolidating Bull - Hold

a. Price Oscillator is above zero

b. Price is trading below the OUL

c.

Price is trading within the box

5. Undecided Bull

a. Price Oscillator is above zero

b. Price is trading above the OUL

c.

Price is trading below the bottom of the box

6. Bull Over – Take Profits – Go Short

a. Price Oscillator is above zero

b. Price is trading below the OUL

c.

Price is trading below the bottom of the box

7. Breakdown Bear

a. Price Oscillator is below zero

b. Price is trading below the OUL

c.

Price is below the Bottom of the TAS box

8. Strong Bear

a. Price Oscillator is below zero

b. Price is trading above the OUL

c.

Price is below the Bottom of the TAS box

9. Bearish – Sell TAS & OUL Resistance

a. Price Oscillator is below zero

b. Price is trading below the OUL

c. Price is trading within the box

10. Consolidating Bear - Hold

a. Price Oscillator is below zero

b. Price is trading above the OUL

c.

Price is trading within the box

11. Undecided Bear

a. Price Oscillator is below zero

b. Price is trading below the OUL

c.

Price is trading above the top of the box

12. Bear Over – Take Profits – Go Long

a. Price Oscillator is below zero

b. Price is trading above the OUL

c. Price is trading above the top of the box

Above are Bob’s signals for the typical wealth portfolio which you can use as a guide for your long-term portfolio allocation as of the close. (Color highlighted signals reflect a change in the outlook or an RMI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

Above are Bob’s signals for the suggested TD Ameritrade typical wealth portfolio which you can use as a guide for your long-term portfolio allocation as of the close. (Color highlighted signals reflect a change in the outlook or an MI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

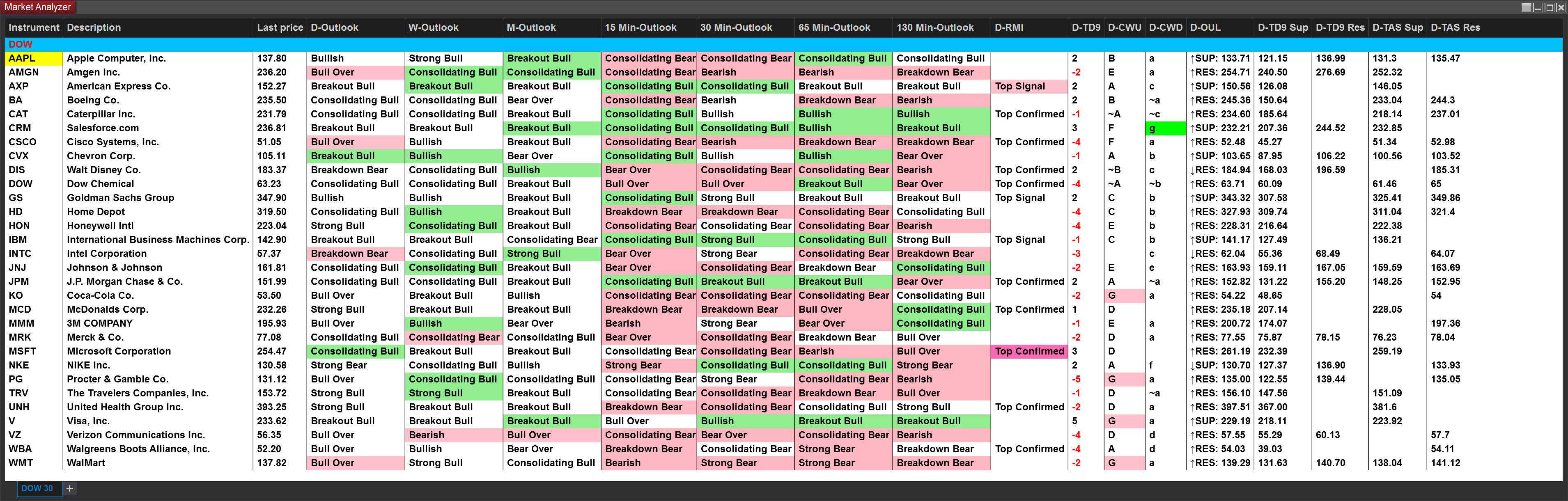

Above are Bob’s signals for the DOW 30 stocks as of the close. (Color highlighted signals reflect a change in the outlook or an RMI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

Above are Bob’s signals for many of the worldwide indices that can make up the portion of your portfolio that you wish to allocate to foreign equities. (Color highlighted signals reflect a change in the outlook or an RMI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

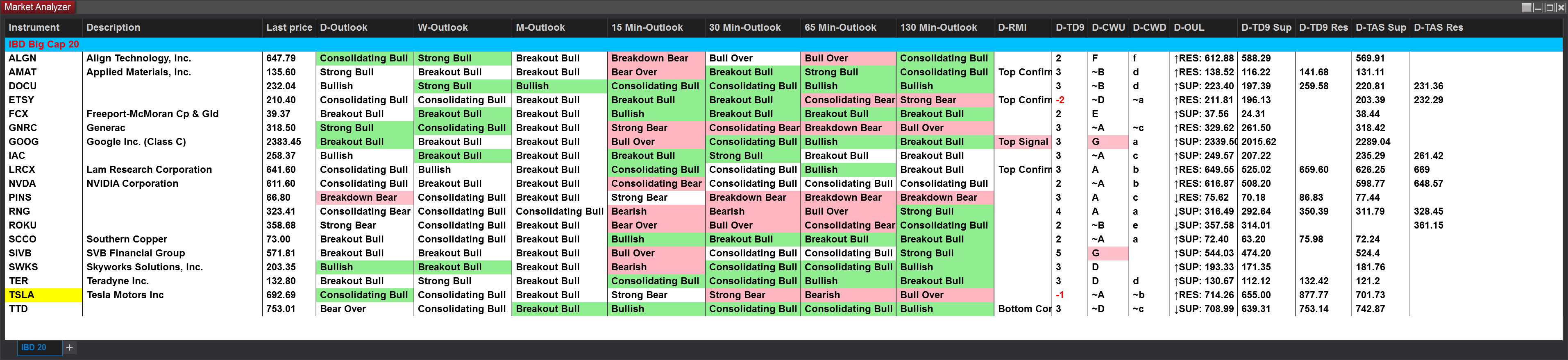

Above are Bob’s signals for the IBD Big Cap 20 stocks. (Color highlighted signals reflect a change in the outlook or an RMI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

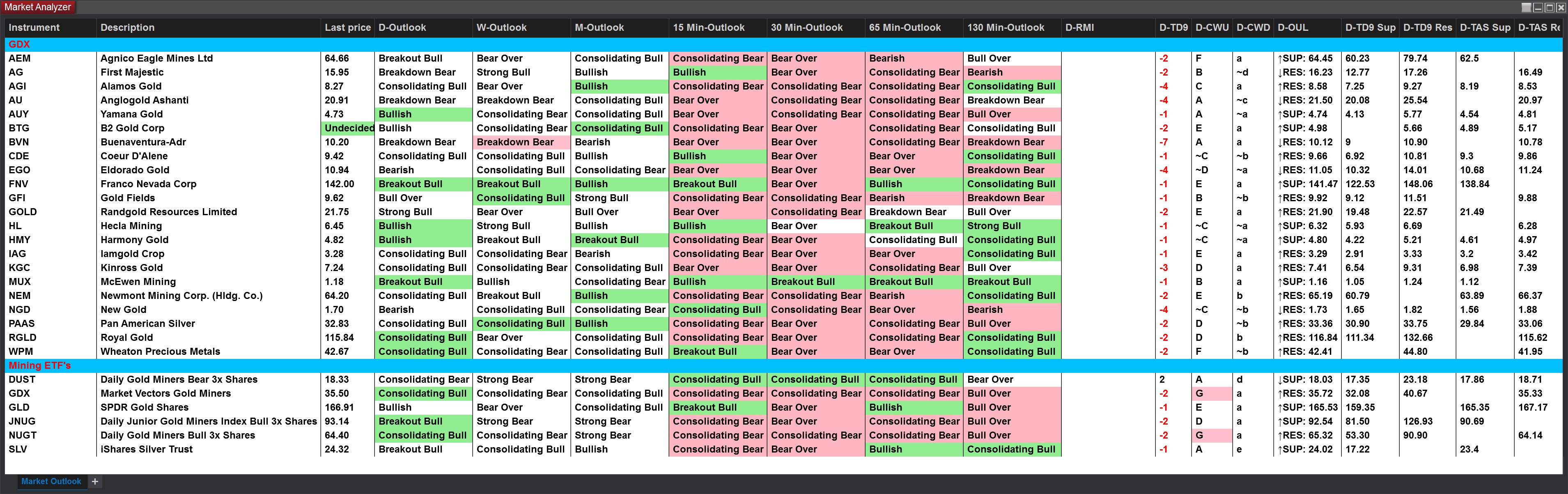

Above are Bob’s signals for most of the components that make up the majority of the Mining sector. (Color highlighted signals reflect a change in the outlook or an RMI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

Above are Bob’s signals for most of the components that make up the majority of the Mining sector. (Color highlighted signals reflect a change in the outlook or an RMI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

Above are Bob’s signals for most of the components that make up the IBD 50. (Color highlighted signals reflect a change in the outlook or an RMI indicator since its previous time frame session. If the time frame has not completed, the signal change which is in real time will not be confirmed until the period has ended).

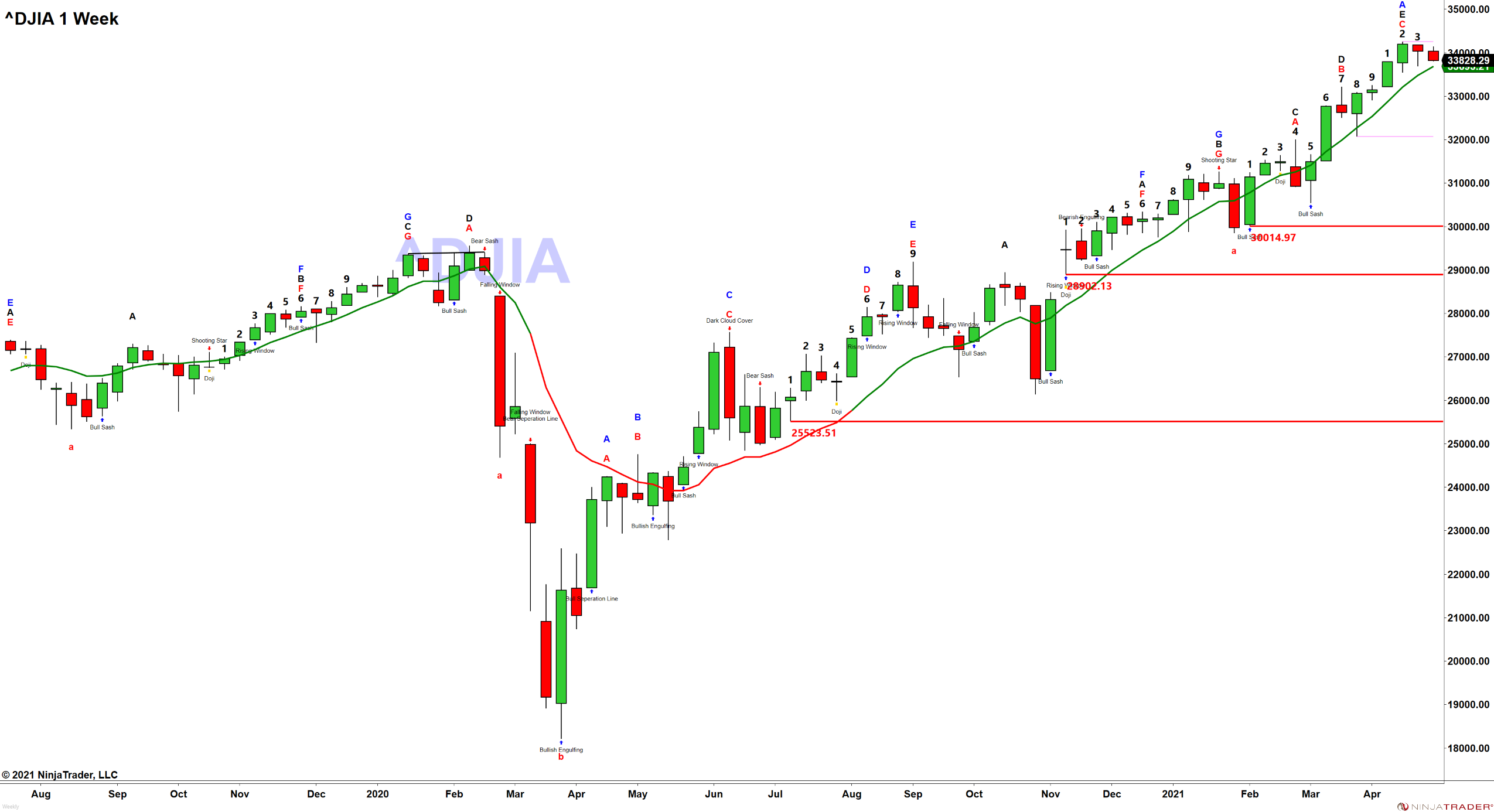

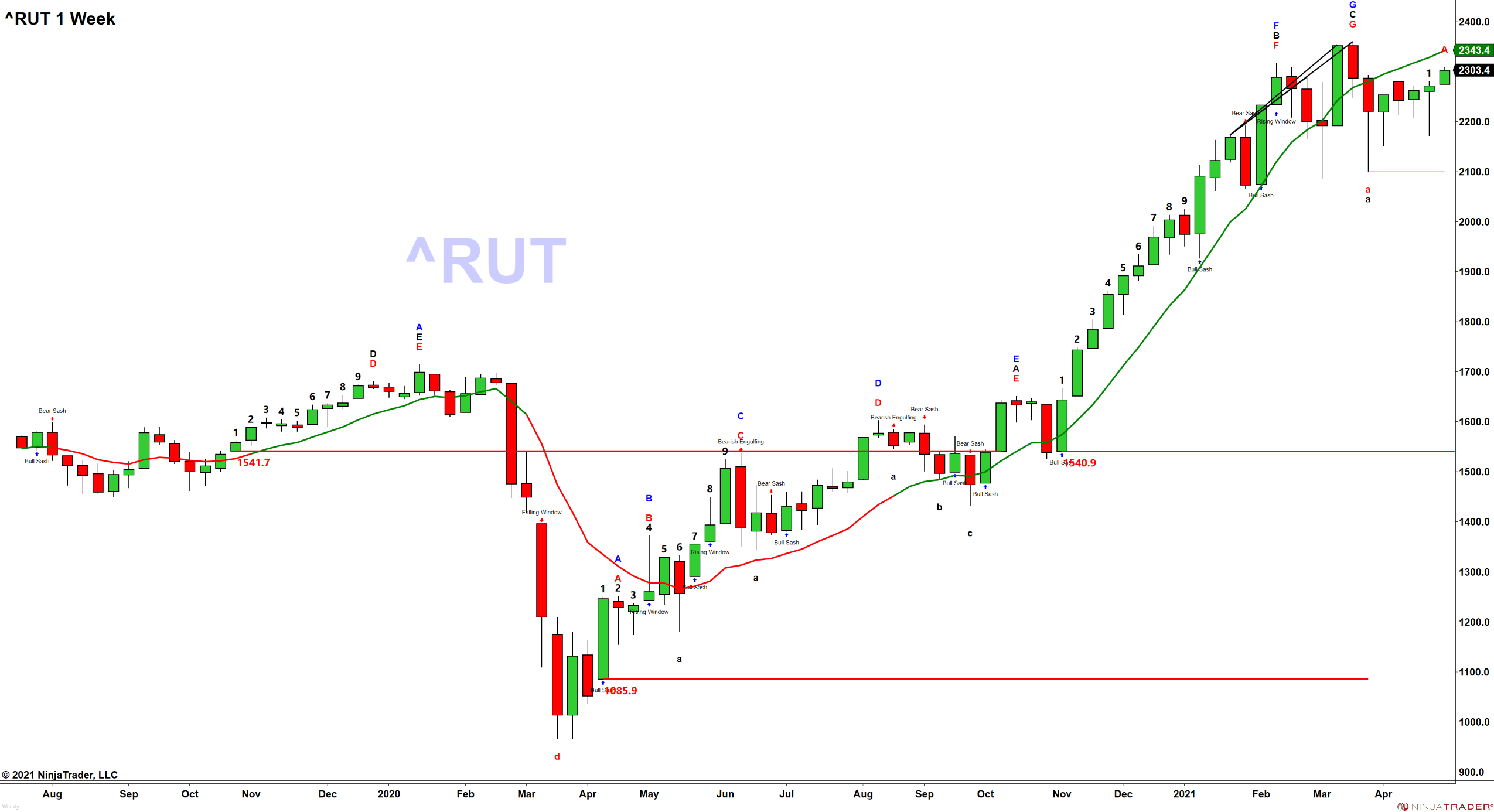

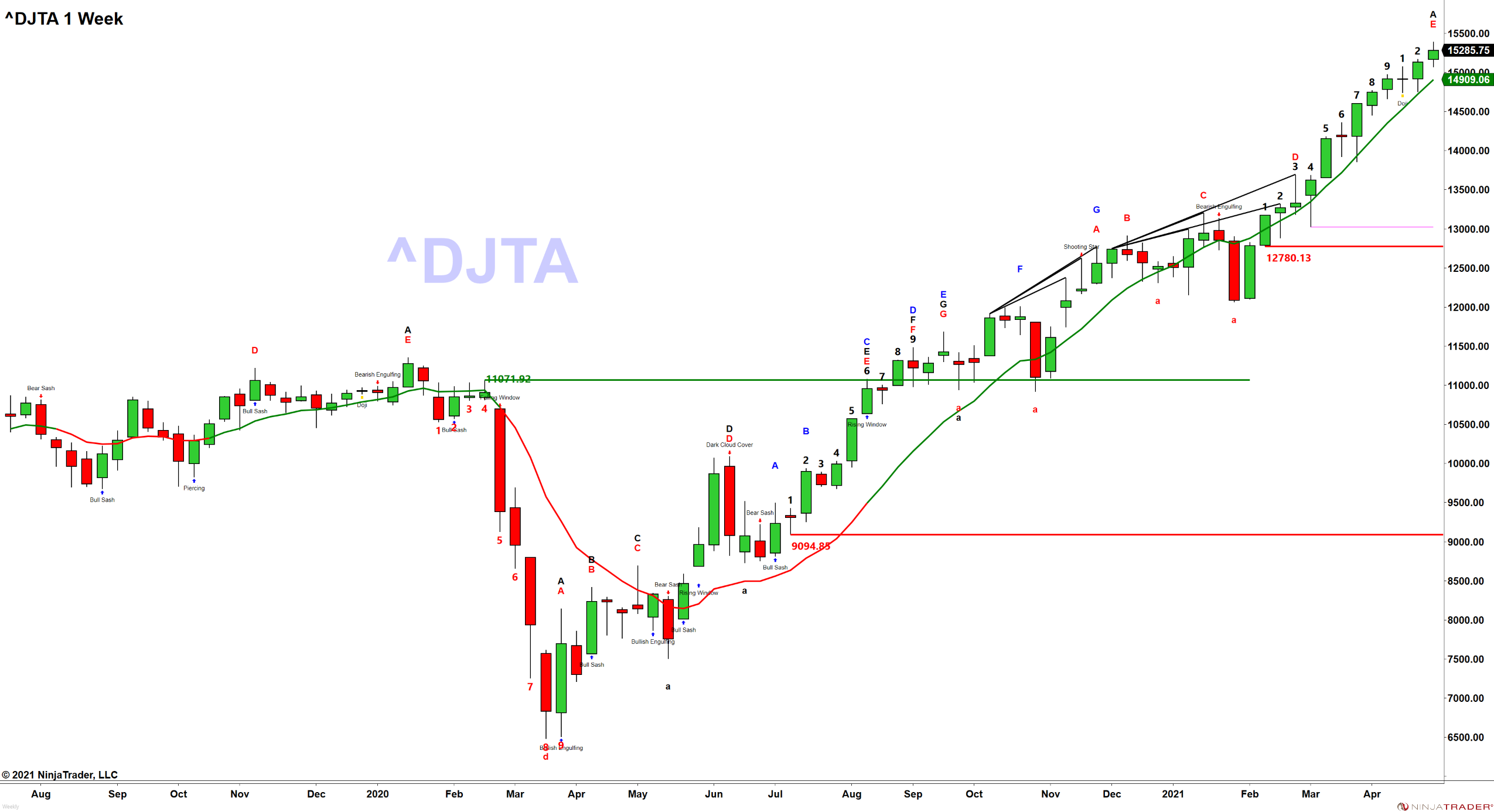

Below are charts as of the close for the cash indices for their weekly time frame.

Chart legend for the following charts. The red/green line is the Oscillator Unchanged Line. A green line means that the Price Oscillator (the difference between the 19 & 39-day EMA) is above zero and when the line is red, it means the Price Oscillator is below zero. When price is above a green OUL, it is a bullish condition and when price is below a red OUL, it is a bearish condition. When price is below a green OUL, it suggests a retracement back to support and when price is above a red OUL, it suggests a countertrend rally to resistance. Black numbers are TD Setup counts. A 9 count indicates, and impending trend change may be near. The red and green lines are the Tom Demark Setup Trend Lines. A red TDST is support and a green TDST is resistance. Black dashed lines are the TAS market profiles, with the top being resistance, the bottom being support and the center being the point of control, the price area where both buyers and sellers believe the sector is fairly valued. Charts with shaded patterns are confirmed Gartley Sell patterns.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies, and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Mastering Probability” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. and/or Steve Rhodes will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2020 all rights reserved.