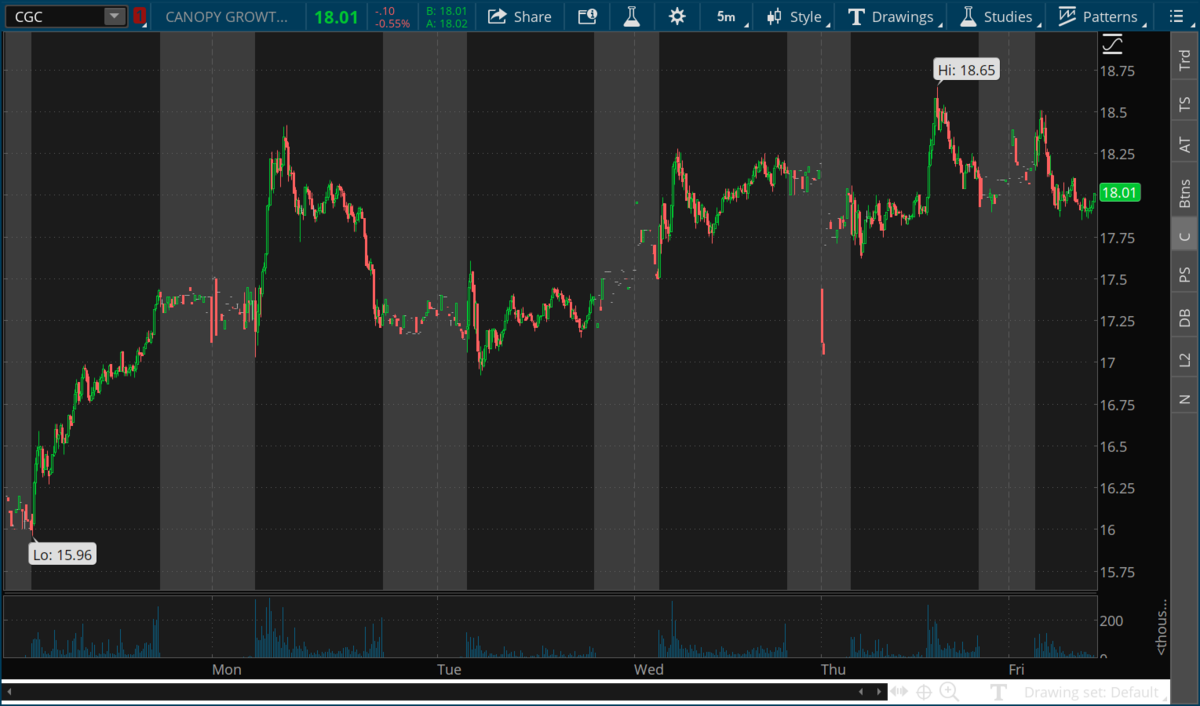

Rocket Equities and Options Friday July 17, 2020

S&P looks tired at these levels

It's hard to imagine the S&P reaching record levels while COVID-19 sets records on a daily basis now with 77,000 new cases recorded yesterday and death totals unfortunately back on the rise nationwide. We saw a dive lower earlier in the morning trading in the S&P and the same thing is possible as we approach afternoon trading, especially on options expiration Friday.

We will wait for next week before initiating any new positions. CGC and UBER our highest on our radar next week for building a position for our long term portfolio. We'll also be looking at shorter term swing trades and potential for some options plays. The full report will be published Monday morning, and I may have updates over the weekend as I'm looking at the markets.

Netflix was priced for perfection last night and disappointed but has held up relatively well and is trading back at prices it just saw earlier this week on Tuesday, and is still about up about 50% for 2020 at this price level.

Current positions:

Long a half-position DIS at $118.63 in our long-term portfolio.

We will wait for next week before initiating any new positions. CGC and UBER our highest on our radar next week for building a position for our long term portfolio. We'll also be looking at shorter term swing trades and potential for some options plays. The full report will be published Monday morning, and I may have updates over the weekend as I'm looking at the markets.

Netflix was priced for perfection last night and disappointed but has held up relatively well and is trading back at prices it just saw earlier this week on Tuesday, and is still about up about 50% for 2020 at this price level.

Current positions:

Long a half-position DIS at $118.63 in our long-term portfolio.

Charts as of 12:30 pm ET