Rocket Equities and Options Report 12-15-22

Rocket Equities & Options Report

By Tommy O’Brien

December 15, 2022

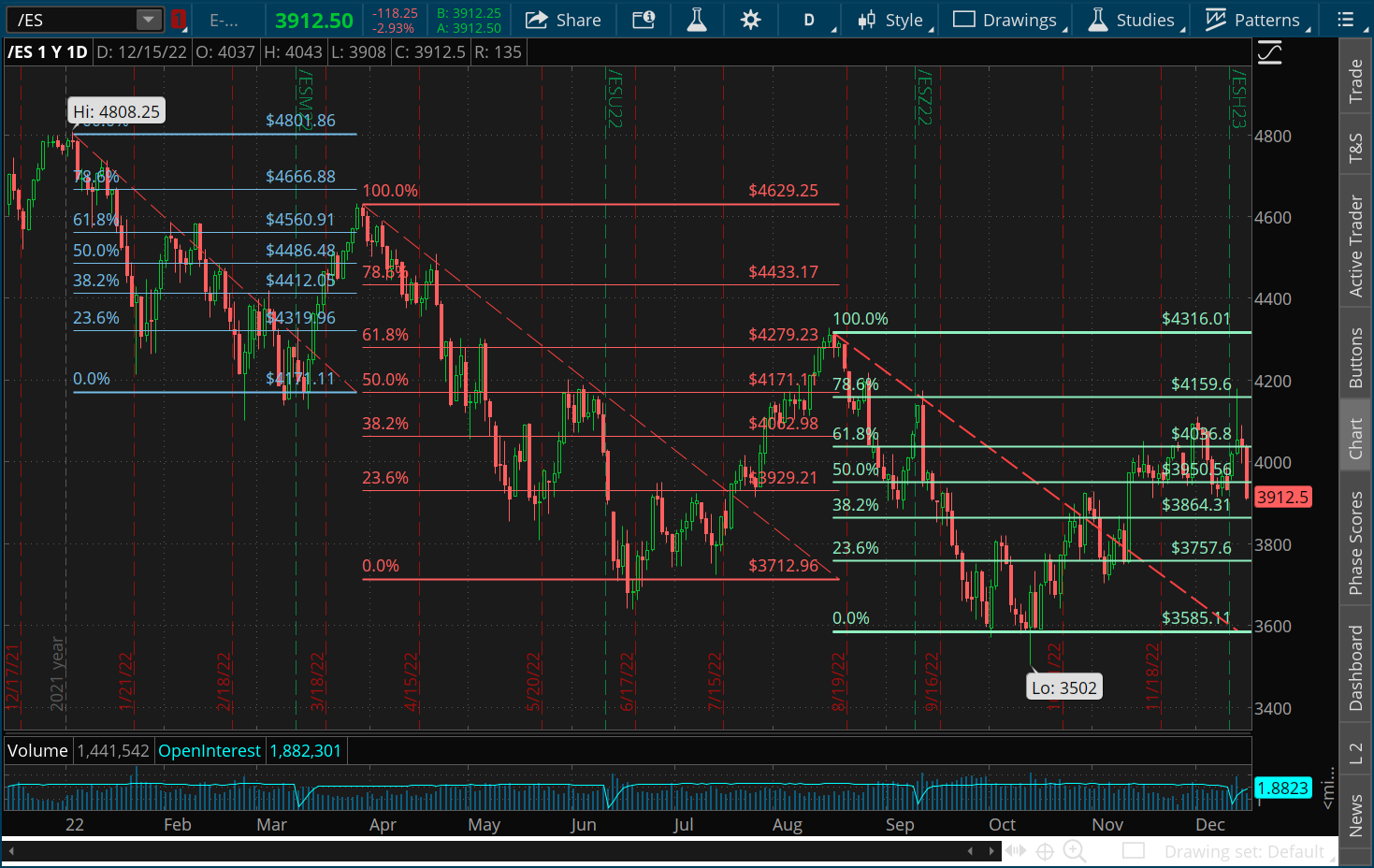

This market looks like it is on its way to 3,200 sometime early to middle of next year. This is the third time this year that tthe market has bounced to about a .618 area before rolling over to a much more dramatic shift to the downside.

Here you see the .618 retracements of each bounce higher within a bear market this year. This time looks to be no different. I would make sure you have some cash free if we do head lower over the next 3-6 months. 3,200 would be a great long term buy.

Even just taking the general area high of 4,150 in the ES futures yesterday (they hit 4,180 on the initial spike), to the 3,912 it is sitting at as I write this letter, this market is now off 5.7% in a few days. Even if you just take the price point of 4,050, where the market was prior to the 130 point acceleration to the upside on the CPI number Tuesday morning, you’ve still given up 3.40% over 2 days.

Be prepared for the very real possibility of dramatically lower prices. Tuesday morning the DOW was trading above $35K and almost near it’s all time high. Weekly jobless claims just came in at 211,000. Things have been very good for a very long time and we all may be in for a surprise to the downside.

This is not all doom and gloom. Longer term, the market will be fine, but this generational battle with inflation has yet to take its complete toll on this market. Stay vigilant, as capital preservation is one of the greatest actions you can take in some markets, and unless you’re prepared for these types of swings to the downside I would be reevaluating where you are positioned as we have some real volatility coming at us for at least the near-term in my opinion.

On a much longer-term basis 3,200 would be a .618 of the entire move higher from the lows of March of 2020 to the recent all-time highs. You can see that we already traded right to about the .328 on the spike low in October. And the 3,200 price point also correlates right to where we were at the start of 2020, giving up all of the gains since that time.

This is a critical area for the 10 -year to see if it can breakout out of this channel, meaning lower rates coming at us.

The Dollar Index is back to a .328 of its longer term up-trend from about $89.50 to the highs of the 114 area.

Gold has bounced right to the .382 area of its recent acceleration lower. This is basically an inverse of what has happened in the Dollar and you can see how perfectly that are inversly correlated. If the Dollar does bounce then look for Gold to trade lower, both at their .382. If the Dollar were to continue to lower prices then that should drive Gold higher as the next stop would be the .618 for each, with Gold nearing $1910 potentially.

The VIX is finally catching a bid from an area that is near support for most of this year from about $20-$22.

There are many ways to approach this market. We are going to look for spots to sell rallies, potentially absorb some volatility to the upside with stocks that are weak, and look to have cash available if we really do get a pull back to 3,200 range. We are following the dollar and gold, along with yields closely, as it will be important to see how they all react as they are at potential inflection points along their trends. I will have another report out this Monday.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies, and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2022 all rights reserved.