Rocket Equities & Options 07-15-21 SPY Options Trade

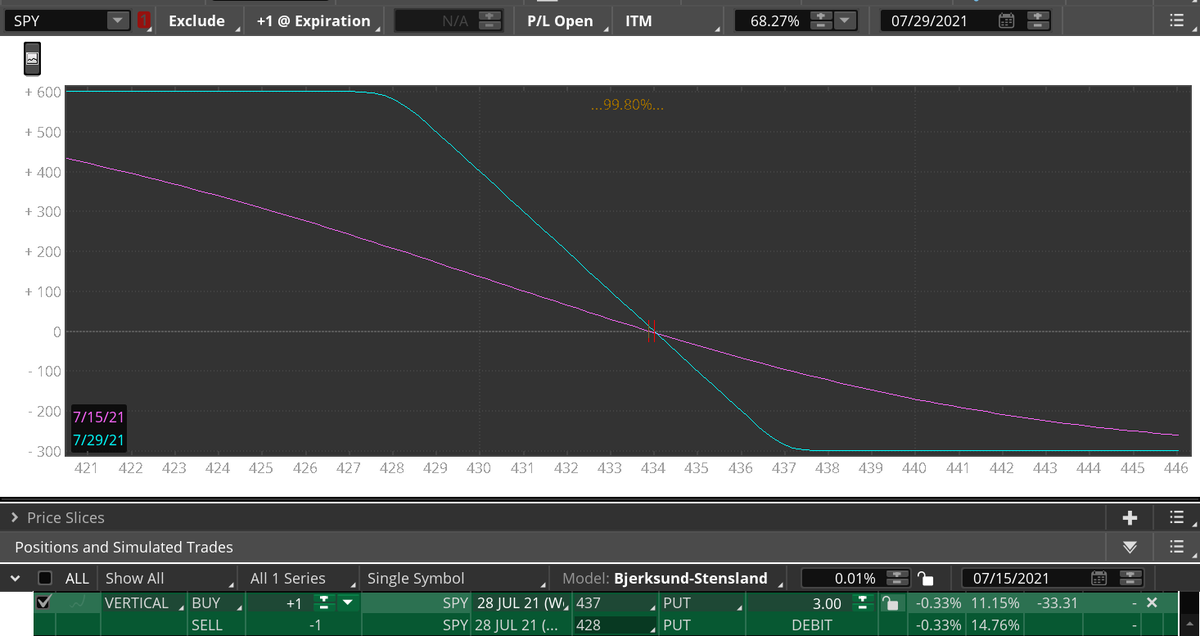

Buying a July 28th SPY $437-$428 Debit Spread

We are buying a SPY put debit spread. This is a bearish option trade for the SPY to pull back to the bottom of it's trading channel.

Both legs expire July 28th (Wednesday options expirations exist for SPY because it is so active and liquid).

Buy the July 28th $437 put.

Sell the July 28th $428 put

This should result in a net debit of about $3.00 for the pair. You may have to pay a bit more or less as the market is volatile, just don't pay above $3.25.

Our max risk is around $300 and our max profit is $600. We are risking about $1 to make $2 in this trade with defined risk, and our breakeven is very close to the current trading price of the SPY. The SPY is trading at $433.80.

MSFT reports earnings next week on July 21st. AAPL and GOOG report earnings the following week on July 27th. FB reports on July 28th. AMZN reports July 29th. Expectations are sky-high as we come into earnings season for the big Tech stocks. All we are looking for is a pull back to the bottom of its uptrend channel.

Both legs expire July 28th (Wednesday options expirations exist for SPY because it is so active and liquid).

Buy the July 28th $437 put.

Sell the July 28th $428 put

This should result in a net debit of about $3.00 for the pair. You may have to pay a bit more or less as the market is volatile, just don't pay above $3.25.

Our max risk is around $300 and our max profit is $600. We are risking about $1 to make $2 in this trade with defined risk, and our breakeven is very close to the current trading price of the SPY. The SPY is trading at $433.80.

MSFT reports earnings next week on July 21st. AAPL and GOOG report earnings the following week on July 27th. FB reports on July 28th. AMZN reports July 29th. Expectations are sky-high as we come into earnings season for the big Tech stocks. All we are looking for is a pull back to the bottom of its uptrend channel.