Rocket Equities & Options - Debit SPY Put Spread 06-01-21

$414 - $412 SPY Debit Put Spread

Markets have started off to the downside with NFP numbers for the month of May due out Friday morning.

We are taking a flier to the downside with a put spread in the SPY. We have 3 days of trading prior to the jobs number on Friday.

Both legs expire Friday June 4th in the SPY. The SPY is trading at $419.78. This is a bearish trade.

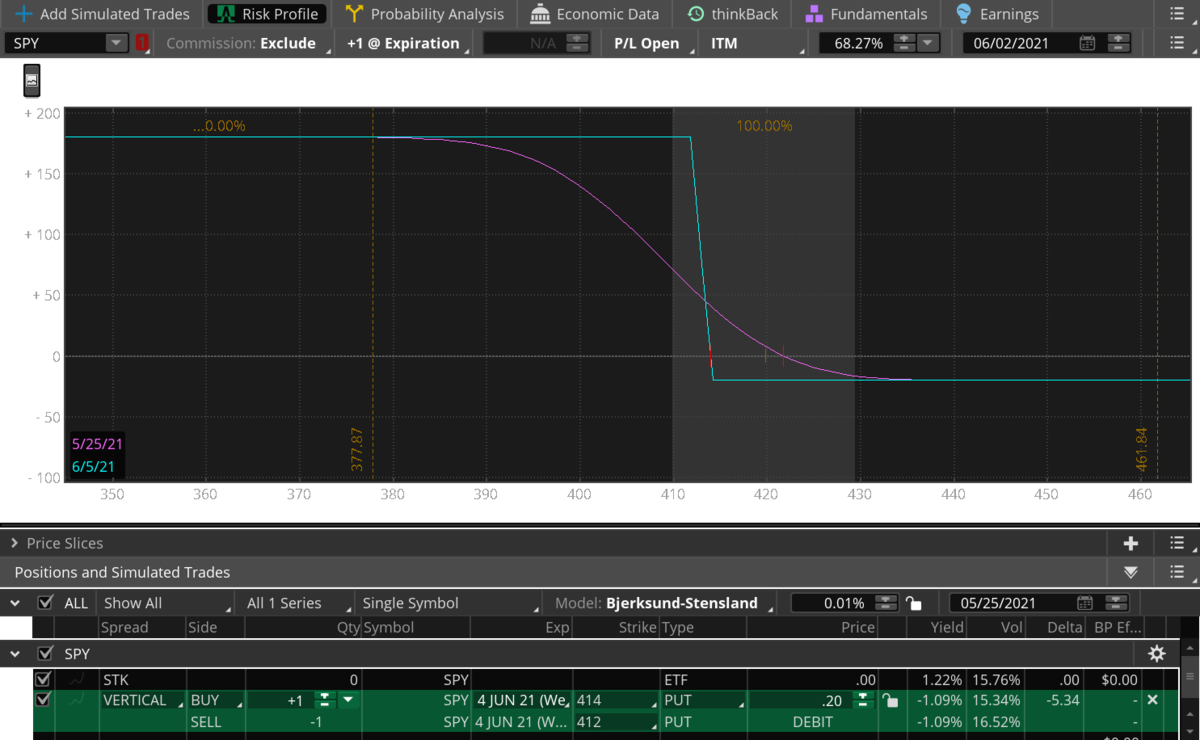

Buy the June 4th $414 SPY Put

Sell the June 4th $412 SPY Put

This will result in a debit of about $0.20 or $20 per contract pair. Don't pay more than $0.25 for this trade, as our max profit is capped by the $2 wide range we've created.

Our max loss is the $20 per contract pair we risk. Our max profit is $180 if the SPY trades below $412 by Friday. This is a low probability trade as it will expire worthless much more often than profitable, so set your risk accordingly.

The S&P is sitting right in the middle of its upward channel line and has been trending higher last week on light volume before the move lower today to start the trading month. Lots of the risk this week coming into the jobs number seems to the downside.

I will have the full report out shortly this afternoon.

We are taking a flier to the downside with a put spread in the SPY. We have 3 days of trading prior to the jobs number on Friday.

Both legs expire Friday June 4th in the SPY. The SPY is trading at $419.78. This is a bearish trade.

Buy the June 4th $414 SPY Put

Sell the June 4th $412 SPY Put

This will result in a debit of about $0.20 or $20 per contract pair. Don't pay more than $0.25 for this trade, as our max profit is capped by the $2 wide range we've created.

Our max loss is the $20 per contract pair we risk. Our max profit is $180 if the SPY trades below $412 by Friday. This is a low probability trade as it will expire worthless much more often than profitable, so set your risk accordingly.

The S&P is sitting right in the middle of its upward channel line and has been trending higher last week on light volume before the move lower today to start the trading month. Lots of the risk this week coming into the jobs number seems to the downside.

I will have the full report out shortly this afternoon.