Rocket Equities & Options Report 03-01-22

Rocket Equities & Options Report - March 1st, 2012

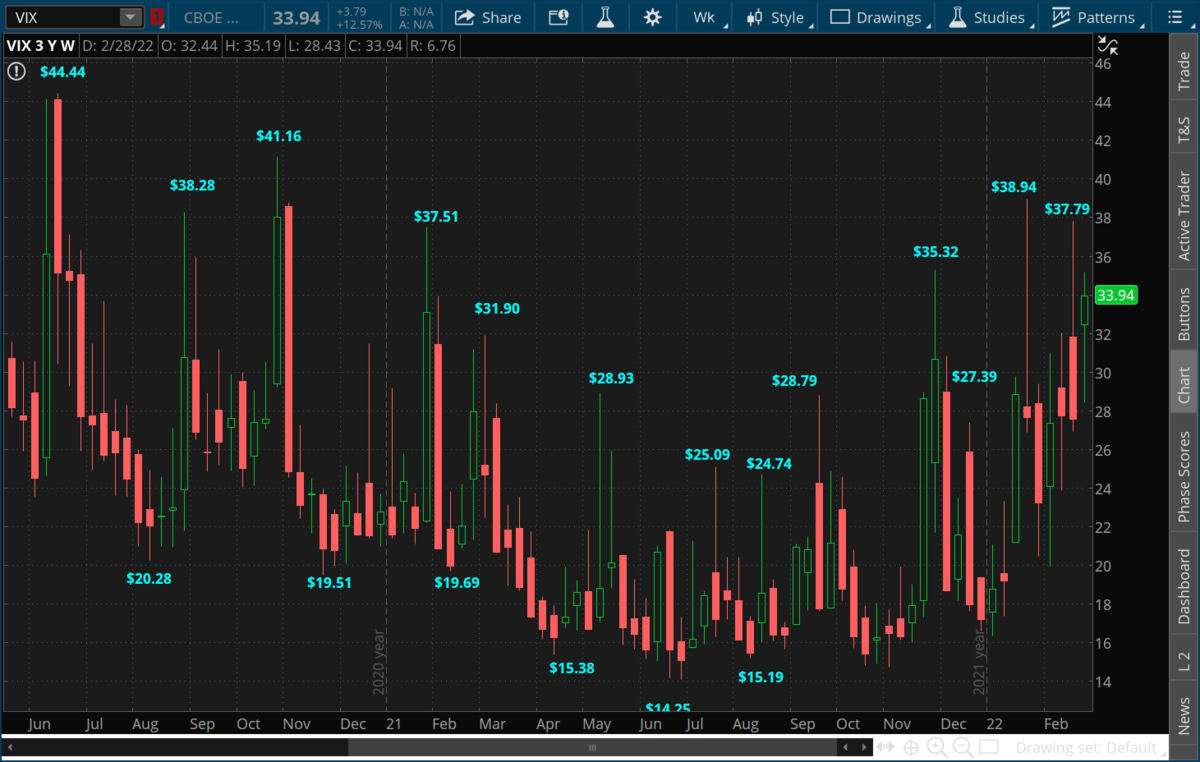

Market volatility persists as the reports from Ukraine continue to look worse and worse as Russia builds a 40 mile convoy and is now attacking civilian buildings in larger cities. Oil is spiked to $106.78 earlier and the 10 year note is near a yield of 1.70% down from 2.00% within the last week, and the VIX sits near 34.

We get Chairman Powell speaking this week, ahead of Non-farm payrolls for February on Friday. CPI for February is out next Thursday, March 10th. And then we get a Fed meeting in 2 weeks.

There is almost an eternity of time that must pass before we reach the next Fed decision on March 16th when you consider how quikcly things are moving right now. It's difficult to imagine where the Ukraine situation is in 2 weeks from now, but there is a distinct chance that things have escalated from where we currently sit, and Putin will be dealing with a severely isolated Russia almost reglardless of where things go from here, so this geopolitical risk will not end quickly. I don't see this giving the Fed too much pause unless markets really get hit another 15%+ from here to the downside, but I do think that the chance for them to surprise with a 50 basis point hike is almost 0% right now. Look to the wage data in Non-farm payrolls, along with CPI data on March 10th, for any clues that could change. It would take something drastic in those numbers to push a 50 basis point move during war with oil prices spiking.

We have a lot of Fed speak this week ahead of Friday's jobs number and some earnings companies still reporting, stay tuned for updates.

We get Chairman Powell speaking this week, ahead of Non-farm payrolls for February on Friday. CPI for February is out next Thursday, March 10th. And then we get a Fed meeting in 2 weeks.

There is almost an eternity of time that must pass before we reach the next Fed decision on March 16th when you consider how quikcly things are moving right now. It's difficult to imagine where the Ukraine situation is in 2 weeks from now, but there is a distinct chance that things have escalated from where we currently sit, and Putin will be dealing with a severely isolated Russia almost reglardless of where things go from here, so this geopolitical risk will not end quickly. I don't see this giving the Fed too much pause unless markets really get hit another 15%+ from here to the downside, but I do think that the chance for them to surprise with a 50 basis point hike is almost 0% right now. Look to the wage data in Non-farm payrolls, along with CPI data on March 10th, for any clues that could change. It would take something drastic in those numbers to push a 50 basis point move during war with oil prices spiking.

We have a lot of Fed speak this week ahead of Friday's jobs number and some earnings companies still reporting, stay tuned for updates.

Crude Oil Daily

Crude Oil Monthly

QQQ Weekly

In last week's report I highlighted the chance of the QQQ to possibly head to $315. It traded to $317.75 last Thursday just missing the exact .382.

ES Weekly

The NQ Futures missed thier .382 by just a couple of points, that same level would bring the S&P near the 3,800 level.

VIX

Gold

Gold on its way to 2020 high of $2,089.

10 Year Note Weekly - Back near 1.70%

Notes with quite the bounce at the .618 level, and bouncing with volume

Disney has pulled back on light volume. Next stop is the $155-$160 area, where it spent some time in early January, and then onto fill the gap left open between the $165 - $175 area.

Uber also traded right back to the exact .618 of the entire move higher, before bouncing all the way up to $42-$44 area following their solid earnings. Uber then slammed lower the following day on CEO remarks that were a bit more cautious. Uber has also pulled back on light volume.

WMT has pulled back on light volume since their earnings a couple of weeks ago. WMT has a 1.65% dividend.

MCD continues to be one of the strongest equities in our portfolio and comes with a 2.26% dividend. MCD has traded back to near a 50% retracement, which also correlates to where it consolidated a bit during 2021.

We got stopped out of CRM on the flash low last Thursday morning at $$184.74. If you didn't sell and you still hold CRM as an investment position then I think you'll be fine in the long run, as it bounced right near the .618 of the recent pull-back, and is a strong cloud company well positioned to grow in the future. I will not be covering this equity going forward but I think it is a strong growht company that should over perform with a 5 year time horizon.

Equity portfolio

Long half position in WMT at $140.91. WMT is trading at $136.09. Stop is $125.31.

Long half position in DIS at $118.63. Disney is trading at $145.34. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $33.93. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $239.81. Stop is $189.50.

We bought CRM at $215.35 and got stopped out at $184.74 for a $30.61 or 14.21% loss . CRM is trading at $210.88. I'm lowering the stop to $189.45. I don't want to get stopped out if we trade to the .618 of the move higher on this pull back before popping higher.

Long half position in DIS at $118.63. Disney is trading at $145.34. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $33.93. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $239.81. Stop is $189.50.

We bought CRM at $215.35 and got stopped out at $184.74 for a $30.61 or 14.21% loss . CRM is trading at $210.88. I'm lowering the stop to $189.45. I don't want to get stopped out if we trade to the .618 of the move higher on this pull back before popping higher.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2022 all rights reserved.