Rocket Equities & Options Report 06-07-21

Monday Report - June 7th, 2021

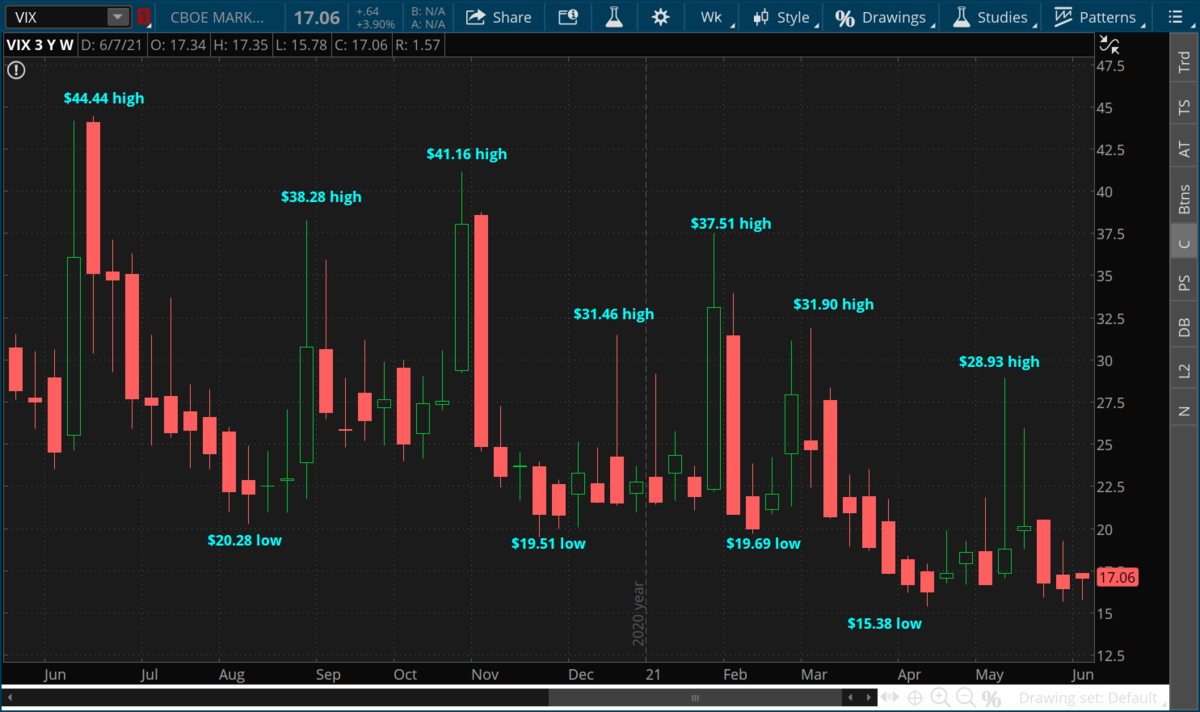

Markets have started the week off slightly to the downside. We are light on earnings for the next couple of weeks as we come into summer trading and the VIX sitting at $17.08. We get CPI data out Thursday and the market will be looking for data regarding any indication of inflation persisting.

DIS is trading at $177.29. We bought DIS at $118.63. Disney has continued to trade nicely to the upside from the .382 of their run from the November lows. Disney may also be forming a small ABC up taking it to the $189 area. The next stop for Disney is $183.40 (the high from Dec 31st, 2020), which acted as support, and may now be an area of resistance as we trade up to that level. Over the next 3-6 months look for Disney to accelerate their openings and the stock should begin to recognize that transition.

CRM is trading at $238.87. We bought CRM at $215.35. CRM traded higher nicely on Friday, and is continuing higher today. We now may need to build some cause to trade through the $240 area.

WMT is trading at $140.79. We bought WMT at $140.91. WMT is pulling back with the market this morning, after continuing to consolidate last week. WMT has been trading between the $140 and $150 area, which correlates to the gap left open from their earnings in February. WMT is building cause to break above this area. WMT also has a dividend yield of 1.55% right now at this price level. WMT continues to look strong and well positioned to benefit from stimulus as the country opens back up.

MCD is trading at $233.42. We bought MCD at $216.91. MCD is in an ABC up formation which will take it up to $255.76. MCD passed its B point the week of April 5th with 14+ million shares traded on a weekly basis vs. 10.5M and 9.5M at its B point back in October of last year. MCD is consolidating near its B point before trading higher. MCD has a dividend yield of about 2.21% right now at this price level.

UBER is trading at $51.00. Uber has bounced nicely from its recent low of $43.17. Uber may be forming a smaller ABC up that could take it up to the $57 area. Uber had pulled back to the .618 from its entire run higher from November of last year. Uber had also pulled back to a .382 of its entire run from the Covid lows from March of 2020. This is a nice area of confluence at about $45, which also correlates to the high from the week of November 2nd. Uber is now running into an area that was support at about $50; we want to see it trade through this area with volume.

CPI data out Thursday, which is the largest piece of economic data out that week and the market will be looking for any clues of inflation.

Stay tuned for updates!

DIS is trading at $177.29. We bought DIS at $118.63. Disney has continued to trade nicely to the upside from the .382 of their run from the November lows. Disney may also be forming a small ABC up taking it to the $189 area. The next stop for Disney is $183.40 (the high from Dec 31st, 2020), which acted as support, and may now be an area of resistance as we trade up to that level. Over the next 3-6 months look for Disney to accelerate their openings and the stock should begin to recognize that transition.

CRM is trading at $238.87. We bought CRM at $215.35. CRM traded higher nicely on Friday, and is continuing higher today. We now may need to build some cause to trade through the $240 area.

WMT is trading at $140.79. We bought WMT at $140.91. WMT is pulling back with the market this morning, after continuing to consolidate last week. WMT has been trading between the $140 and $150 area, which correlates to the gap left open from their earnings in February. WMT is building cause to break above this area. WMT also has a dividend yield of 1.55% right now at this price level. WMT continues to look strong and well positioned to benefit from stimulus as the country opens back up.

MCD is trading at $233.42. We bought MCD at $216.91. MCD is in an ABC up formation which will take it up to $255.76. MCD passed its B point the week of April 5th with 14+ million shares traded on a weekly basis vs. 10.5M and 9.5M at its B point back in October of last year. MCD is consolidating near its B point before trading higher. MCD has a dividend yield of about 2.21% right now at this price level.

UBER is trading at $51.00. Uber has bounced nicely from its recent low of $43.17. Uber may be forming a smaller ABC up that could take it up to the $57 area. Uber had pulled back to the .618 from its entire run higher from November of last year. Uber had also pulled back to a .382 of its entire run from the Covid lows from March of 2020. This is a nice area of confluence at about $45, which also correlates to the high from the week of November 2nd. Uber is now running into an area that was support at about $50; we want to see it trade through this area with volume.

CPI data out Thursday, which is the largest piece of economic data out that week and the market will be looking for any clues of inflation.

Stay tuned for updates!

ES Daily

VIX Weekly

10-Year Note Weekly

DIS Daily

DIS .382 small ABC possibly forming

UBER Weekly

UBER Daily

Uber Daily just back to start of May

Uber is possibly forming a smaller time frame AB = CD, with a .382 pullback from its run higher it had in May, which could take it up to $57.10

WMT Daily

MCD Daily

CRM Daily

Options Trades:

June 4th $414 - $412 SPY Debit Put Spread expired for a loss of $0.20 or 100%.

Short Term portfolio:

None active

Long Term portfolio:

Long half position in WMT at $140.91. WMT is trading at $140.79. Stop is $125.31.

We are effectively long CRM at $215.35. CRM is trading at $238.36. Stop is $193.64.

Long half position in DIS at $118.63. Disney is trading at $177.14. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $50.94. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $233.42. Stop is $189.50.

June 4th $414 - $412 SPY Debit Put Spread expired for a loss of $0.20 or 100%.

Short Term portfolio:

None active

Long Term portfolio:

Long half position in WMT at $140.91. WMT is trading at $140.79. Stop is $125.31.

We are effectively long CRM at $215.35. CRM is trading at $238.36. Stop is $193.64.

Long half position in DIS at $118.63. Disney is trading at $177.14. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $50.94. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $233.42. Stop is $189.50.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2021 all rights reserved.