Rocket Equities & Options Report 12-27-21

Rocket Equities & Options Report - December 27th, 2021

The market is making new highs today with just 4 more trading days left in the calendar year.

Just today, JP Morgan came out with a note stating "“Conditions for a large selloff are not in place right now given already low investor positioning, record buybacks, limited systematic amplifiers, and positive January seasonals,” the strategists led by Dubravko Lakos-Bujas wrote in a note to clients. “Investor positioning is too bearish -- the market has taken the hawkish central bank and bearish omicron narratives too far.”

Take a moment and think about banks warning investors that they are taking market forces too bearish as the market literally trades at all time highs and looks to close out a year with over 1,000 S&P points gained for 2021 and a 27% return for the year. This is following an 18.4% return in 2020, and a 31.49% return in 2019. Including the -4.38% return in 2018, the market has averaged 15.9% over the last 5 years coming into this year, and we just crushed that with 27% this year, and JP Morgan is telling everyone that they are pricing in too much negative action for a market that just wants higher price.

If the market finishes 2021 up around 27%, which it is right now, then it will have only one negative year since 2008, which was only -4.38% in 2018, and will have averaged about 16.3% returns for the last 13 years and counting since 2008. Even a healthy market has pull backs occasionally, and we will see in 2022 as the Fed begins hiking interest rates if the market can remain as strong as it has been recently.

Expect a quiet market this week, there is no reason for any dramatic moves unless we get some real news of shutdowns because of the spread of the virus, which I don't imagine. The numbers are pretty startling how quickly Omicron is spreading, yet it appears as if cases are more mild, which is a silver lining. 2800+ flights were cancelled during the holidays, so even without shutdowns there will be an impact on parts of this economy while cases are spiking as people just can't show up to work while positive.

Thank you for the opportunity to write this letter. Have a happy and healthy rest of 2021, and be safe as we come into New Years, with so many options for Uber, which we own, and Lyft, and taxis etc, there is no reason to risk everything for one night of driving if you've had one too many drinks. Stay safe for yourself and others on the road and just let someone else drive you, even if you pay surge pricing it's worth it for the one night of the year when you may need that ride and driver most of all.

To a happy and healthy 2022!

Just today, JP Morgan came out with a note stating "“Conditions for a large selloff are not in place right now given already low investor positioning, record buybacks, limited systematic amplifiers, and positive January seasonals,” the strategists led by Dubravko Lakos-Bujas wrote in a note to clients. “Investor positioning is too bearish -- the market has taken the hawkish central bank and bearish omicron narratives too far.”

Take a moment and think about banks warning investors that they are taking market forces too bearish as the market literally trades at all time highs and looks to close out a year with over 1,000 S&P points gained for 2021 and a 27% return for the year. This is following an 18.4% return in 2020, and a 31.49% return in 2019. Including the -4.38% return in 2018, the market has averaged 15.9% over the last 5 years coming into this year, and we just crushed that with 27% this year, and JP Morgan is telling everyone that they are pricing in too much negative action for a market that just wants higher price.

If the market finishes 2021 up around 27%, which it is right now, then it will have only one negative year since 2008, which was only -4.38% in 2018, and will have averaged about 16.3% returns for the last 13 years and counting since 2008. Even a healthy market has pull backs occasionally, and we will see in 2022 as the Fed begins hiking interest rates if the market can remain as strong as it has been recently.

Expect a quiet market this week, there is no reason for any dramatic moves unless we get some real news of shutdowns because of the spread of the virus, which I don't imagine. The numbers are pretty startling how quickly Omicron is spreading, yet it appears as if cases are more mild, which is a silver lining. 2800+ flights were cancelled during the holidays, so even without shutdowns there will be an impact on parts of this economy while cases are spiking as people just can't show up to work while positive.

Thank you for the opportunity to write this letter. Have a happy and healthy rest of 2021, and be safe as we come into New Years, with so many options for Uber, which we own, and Lyft, and taxis etc, there is no reason to risk everything for one night of driving if you've had one too many drinks. Stay safe for yourself and others on the road and just let someone else drive you, even if you pay surge pricing it's worth it for the one night of the year when you may need that ride and driver most of all.

To a happy and healthy 2022!

QQQ Weekly

ES Weekly

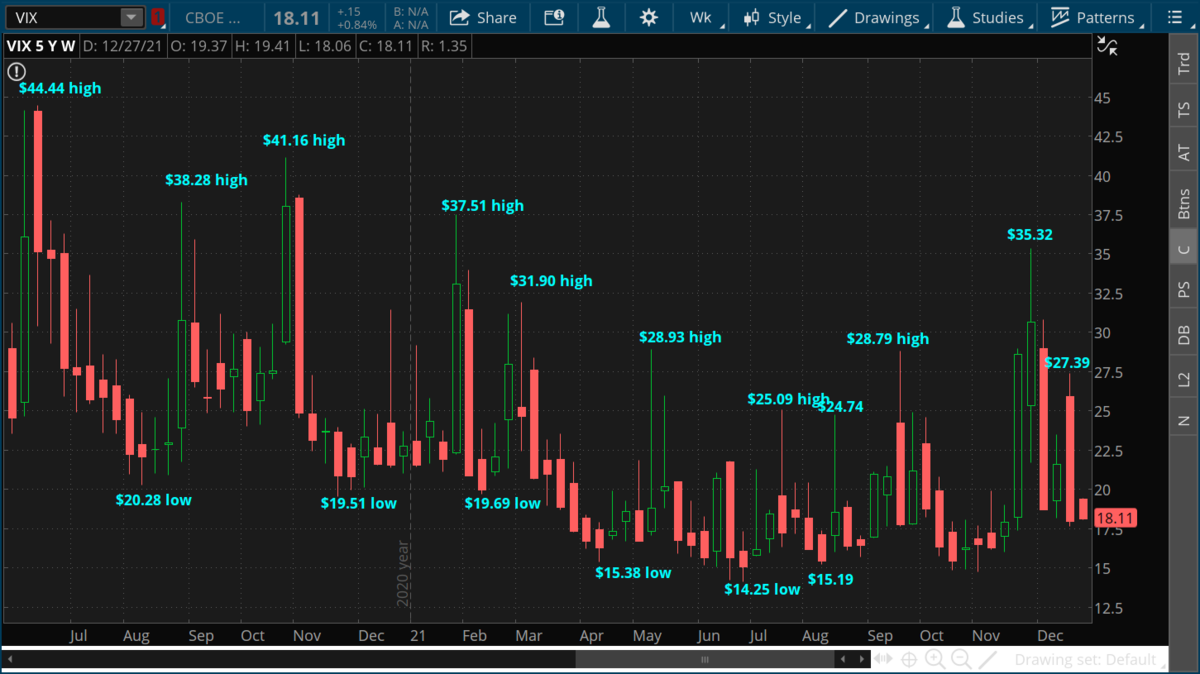

VIX

Gold showing support area at $1,770

10 Year Note Yielding 1.48%

‘Spider-Man: No Way Home’ became the first film since 2019 to break $1 billion at the global box office, a co-production between Sony and Disney. On the flip side of that, you had 'West Side Story' bombing with only $36 million taken in for the 3 weeks it has been open, and it had a $100 million production budget. 'West Side Story', A Steven Spielberg film, is geared towards an obviously older demographic, and you can see how that did not fare as well right now when that portion of society might not be quite as comfortable seeing movies in theaters just yet with Omicron spreading.

Disney traded nicely higher last week, with a low print of $145.08 on Monday and is now trading today above $153. Hopefully the first $1 billion dollar movie in the final week of 2021 is a nice sign of things to come in 2022 as we look to resume a more normal form of life.

Disney traded nicely higher last week, with a low print of $145.08 on Monday and is now trading today above $153. Hopefully the first $1 billion dollar movie in the final week of 2021 is a nice sign of things to come in 2022 as we look to resume a more normal form of life.

Uber also had a nice week last week, and is now almost 25% up from the lows it made of $34.88 just two weeks ago on December 13th. Next stop is $45-$47 where Uber may need to consolidate for a bit before trading up to the $50 range.

WMT has consolidated a bit after trading lower to its support line. Look for WMT to bounce as we come into the new year and challenge the all-time highs area of $153. WMT has a 1.58% dividend yield at this price.

MCD is making new all-time highs yet again today. MCD continues to trade higher with strength and has shown no signs of letting down anytime soon. MCD has a 2.08% dividend.

CRM traded right to the .618 of its last move high and has bounced nicely from there. We want to see some conviction to the upside with volume.

Equity portfolio

Long half position in WMT at $140.91. WMT is trading at $140.02. Stop is $125.31.

We are effectively long CRM at $215.35. CRM is trading at $256.73. Stop is $193.64.

Long half position in DIS at $118.63. Disney is trading at $152.94. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $43.44. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $267.67. Stop is $189.50.

We are effectively long CRM at $215.35. CRM is trading at $256.73. Stop is $193.64.

Long half position in DIS at $118.63. Disney is trading at $152.94. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $43.44. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $267.67. Stop is $189.50.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2021 all rights reserved.