Rocket Equities & Options Report June 27, 2022

Monday Report - June 27th, 2022 - Selling a NKE Credit Put Spread $105 - $100 Expires Friday

Markets have started the week off slightly to the upside. The S&P is now almost 8% higher from its lows made only 10 days ago. This is still on pace to be one of the worst starts to the year since 1970. As of Friday's close the S&P 500 is down almost 18%.

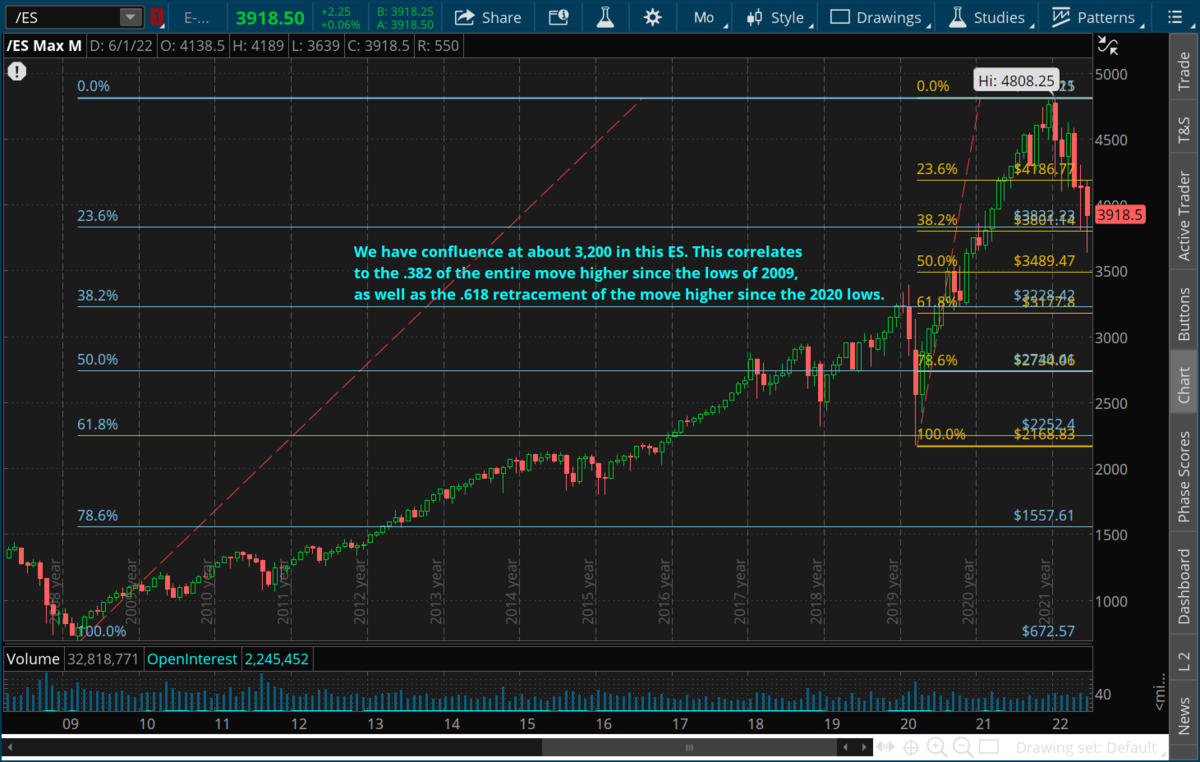

I have included charts for all 3 major indices that show where confluence is. Confluence is when 2 different Fibonacci retracement levels coincide. In this case we have a .382 retracement from the larger move all the way back to the 2008/2009 lows, and the .618 retracement levels from the 2020 lows. In all major indices these areas line up relatively near each other. The NQ came within just 300 points of hitting that price area already. We are at the end of earnings season, with a few notable companies reporting this week, and then we wait for the new quarter to kick off with the banks in the 2nd week of July.

The week should slow down tremendously by Thursday or Friday, with markets closed on Monday for July 4th. We get Core PCE on Wednesday, which the market will be watching closely as it is the Fed's preffered inflation indicator.

Notable earnings this week:

We get Nike (NKE) earnings after the bell tonight. Wednesday, Bed Bath and Beyond reports their numbers. And on Thursday we get Micron (MU), Constellation Brands (STZ), and Walgreen Boots Alliance (WBA) reporting.

Nike reports after the bell today.

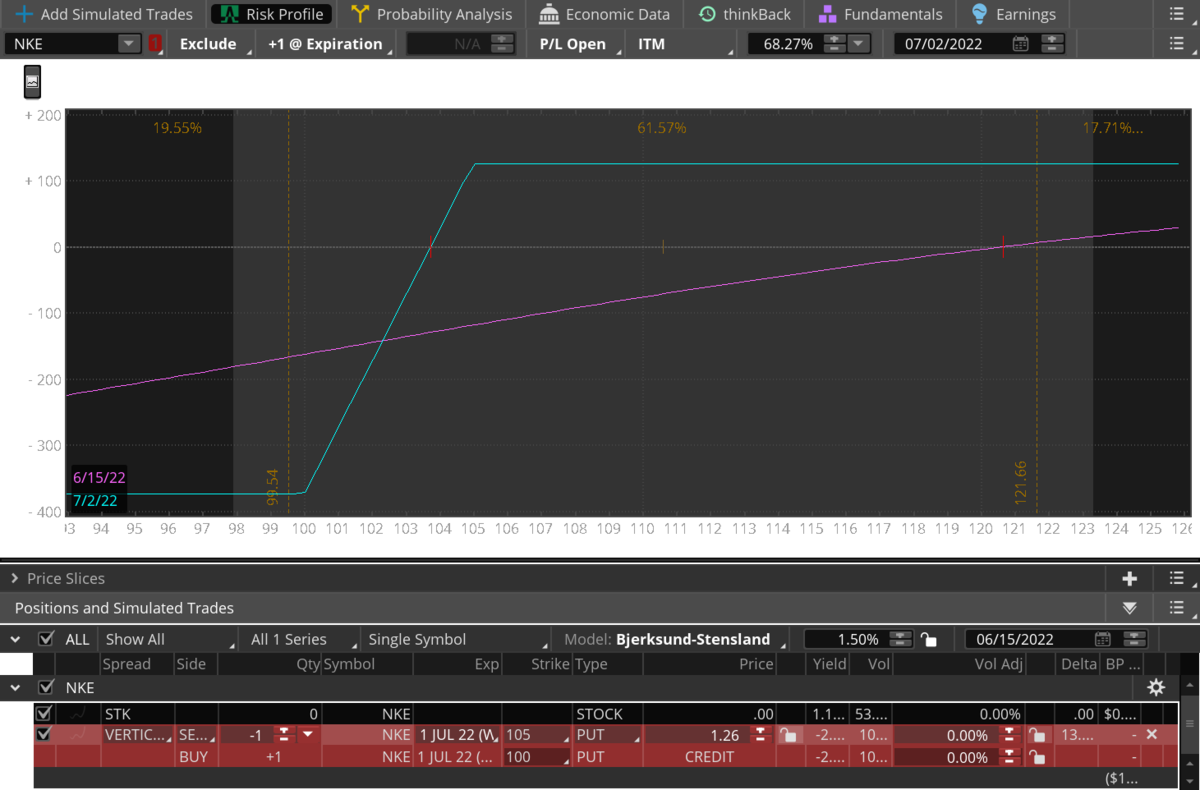

We have a new bullish options trade in Nike today; we are selling a put spread below the market. NKE has pulled back to the .618 of the entire move higher during covid. The $105 area also correlates to its pre-covid highs, which should act as support. We are selling a put spread below the $105 to $100.

Sell the $105 NKE Put Expires July 1st, 2022

Buy the $100 NKE Put Expires July 1st, 2022.

This should result in a net credit of about $1.25 (You may have to practice some price discovery to get executed but don't go too far below $1.25, as it then skews the risk vs. reward of the trade).

Our max profit is the premium we collect when placing this trade, $125 per contract pair. We make our max profit if NKE closes above $105 on Friday. Our max loss is $375 per contract pair, if NKE closes below $100 this week. We will see how it trades on earnings tonight, and possibly move it out tomorrow depending on the action. We are risking $3 for every $1 in potential profit. Even though this is a high probability trade, still keep your risk in check as there is always a chance they miss earnings and we lose 100% of what we put up here.

DIS is trading at $96.23. We bought DIS at $118.63 and got stopped out at $98.45 for a $20.18 or 17.01% loss. Disney has pulled back to its breakout area from May of 2020 on much lighter volume. Disney continues to face many obstacles when it comes to streaming, but they are well positioned for future growth, and the Parks business will be booming for years to come, along with movie theaters, which are back. We got stopped out of our position for this letter, and I can't just advise you to hold, but I still hold some Disney shares and do not plan on selling in the near term with Disney under $100. I will not be covering Disney going forward unless I formally recommend another buy. I like Disney, but the ES is at 4,000 and has a very real risk of trading lower so I would prefer to wait for a potential better entry.

MCD is trading at $247.72. We bought MCD at $216.91. MCD is again coming into an area of resistance near $255. It needs some strength to break through that area to the upside. MCD has a dividend yield of about 2.23% right now at this price level.

Stay tuned for updates!

I have included charts for all 3 major indices that show where confluence is. Confluence is when 2 different Fibonacci retracement levels coincide. In this case we have a .382 retracement from the larger move all the way back to the 2008/2009 lows, and the .618 retracement levels from the 2020 lows. In all major indices these areas line up relatively near each other. The NQ came within just 300 points of hitting that price area already. We are at the end of earnings season, with a few notable companies reporting this week, and then we wait for the new quarter to kick off with the banks in the 2nd week of July.

The week should slow down tremendously by Thursday or Friday, with markets closed on Monday for July 4th. We get Core PCE on Wednesday, which the market will be watching closely as it is the Fed's preffered inflation indicator.

Notable earnings this week:

We get Nike (NKE) earnings after the bell tonight. Wednesday, Bed Bath and Beyond reports their numbers. And on Thursday we get Micron (MU), Constellation Brands (STZ), and Walgreen Boots Alliance (WBA) reporting.

Nike reports after the bell today.

We have a new bullish options trade in Nike today; we are selling a put spread below the market. NKE has pulled back to the .618 of the entire move higher during covid. The $105 area also correlates to its pre-covid highs, which should act as support. We are selling a put spread below the $105 to $100.

Sell the $105 NKE Put Expires July 1st, 2022

Buy the $100 NKE Put Expires July 1st, 2022.

This should result in a net credit of about $1.25 (You may have to practice some price discovery to get executed but don't go too far below $1.25, as it then skews the risk vs. reward of the trade).

Our max profit is the premium we collect when placing this trade, $125 per contract pair. We make our max profit if NKE closes above $105 on Friday. Our max loss is $375 per contract pair, if NKE closes below $100 this week. We will see how it trades on earnings tonight, and possibly move it out tomorrow depending on the action. We are risking $3 for every $1 in potential profit. Even though this is a high probability trade, still keep your risk in check as there is always a chance they miss earnings and we lose 100% of what we put up here.

DIS is trading at $96.23. We bought DIS at $118.63 and got stopped out at $98.45 for a $20.18 or 17.01% loss. Disney has pulled back to its breakout area from May of 2020 on much lighter volume. Disney continues to face many obstacles when it comes to streaming, but they are well positioned for future growth, and the Parks business will be booming for years to come, along with movie theaters, which are back. We got stopped out of our position for this letter, and I can't just advise you to hold, but I still hold some Disney shares and do not plan on selling in the near term with Disney under $100. I will not be covering Disney going forward unless I formally recommend another buy. I like Disney, but the ES is at 4,000 and has a very real risk of trading lower so I would prefer to wait for a potential better entry.

MCD is trading at $247.72. We bought MCD at $216.91. MCD is again coming into an area of resistance near $255. It needs some strength to break through that area to the upside. MCD has a dividend yield of about 2.23% right now at this price level.

Stay tuned for updates!

ES faces heavy resistance to upside at 4,100 to 4,200 range

ES Confluence at 3,200 area

ES recent low is 3,639

NQ Confluence at 10,750 to 10,500 area

NQ already hit recent low of 11,068

YM Confluence at just above 25,000

YM recent low only 29,639

VIX Weekly

10-Year Note Monthly

Breaking below important area of 117.13, which are the lows of 2018

Gold Weekly

Gold continues to consolidate, and has held up relatively well with the overall strength of the dollar.

Crude Daily

CL bounced right off the .382

BTC Monthly

Back to when BTC Futures started trading in December of 2017 - wild it has been that long.

DIS Weekly

MCD Weekly

Options Trades:

Selling a NKE Credit Put Spread $105 - $100 Expires July 1st, 2022 for $1.25.

Equity portfolio:

Long half position in MCD at $216.91. MCD is trading at $248.29. Stop is $189.50.

Long half position in DIS at $118.63 and got stopped out at $98.45 for a $20.18 or 17.01% loss. Disney is trading at $96.52.

Selling a NKE Credit Put Spread $105 - $100 Expires July 1st, 2022 for $1.25.

Equity portfolio:

Long half position in MCD at $216.91. MCD is trading at $248.29. Stop is $189.50.

Long half position in DIS at $118.63 and got stopped out at $98.45 for a $20.18 or 17.01% loss. Disney is trading at $96.52.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2022 all rights reserved.