Rocket IBM Call Spread 01-21-21

New Trade - IBM Debit Call Spread

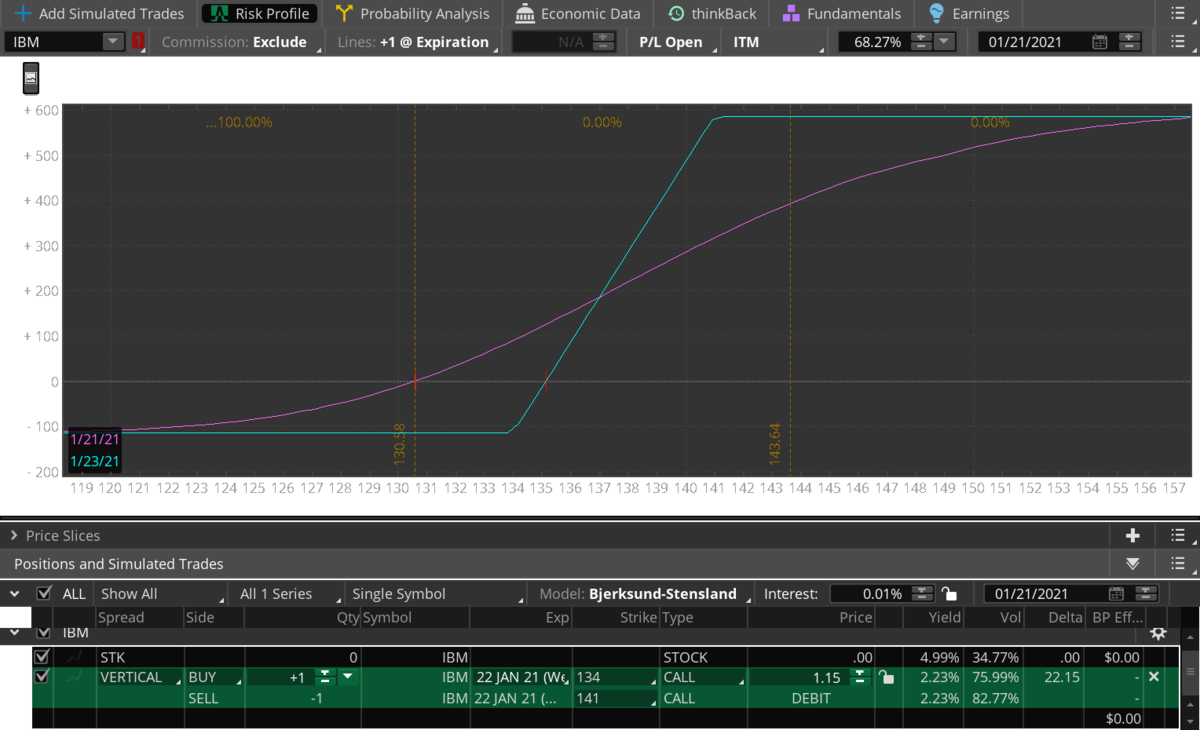

In this trade we are the ones paying the premium looking for a pop to the upside on earnings tonight. IBM is trading at $130.75. Options are pricing in a $5.61 move in either direction with their numbers released after the bell. We are making a bullish trade and we are paying premium.

Both contracts in IBM expire tomorrow Jan 22nd.

Buy a $134 call

Sell a $141 call

This should result in a net debit of about $1.15. Our max risk is $115 per contract if IBM closes anywhere below $134 tomorrow. Our max profit is ($7 - $1.15 = $5.85) $585 per contract if IBM closes above $141. This is a bullish trade that is out-of-the-money and will expire worthless more often that not, so set your risk accordingly.

Both contracts in IBM expire tomorrow Jan 22nd.

Buy a $134 call

Sell a $141 call

This should result in a net debit of about $1.15. Our max risk is $115 per contract if IBM closes anywhere below $134 tomorrow. Our max profit is ($7 - $1.15 = $5.85) $585 per contract if IBM closes above $141. This is a bullish trade that is out-of-the-money and will expire worthless more often that not, so set your risk accordingly.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2021 all rights reserved.