Rocket Equities & Options Friday Update 01-15-21

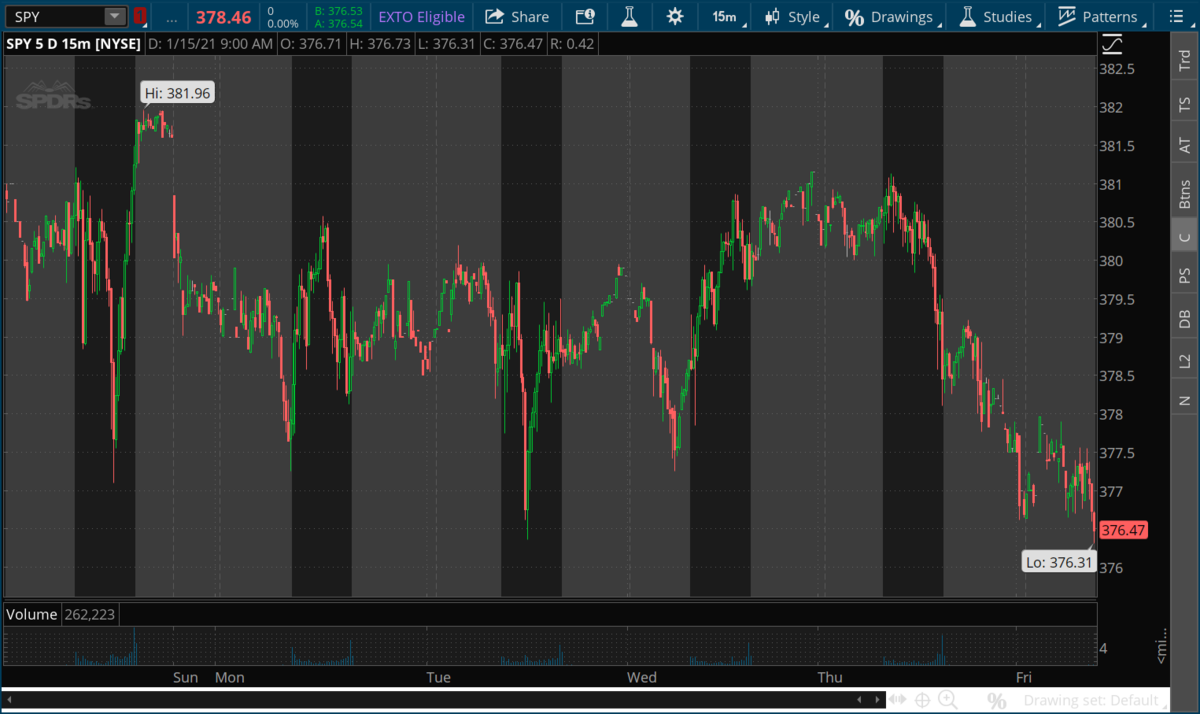

Markets are trading lower ahead of the open. Our SPY and DAL option trades look like they are in good shape to expire worthless today for a max profit.

CRM is trading at $216.20 this morning. We sold a $217.50 put for about $2.15, which will make our effective entry on this stock at $215.35. You can buy CRM on the open if you have not played any of the options plays - we will now hold this in our long term equity portfolio at an entry of $215.35. The stop will be $193.64.

MCD traded lower yesterday. We want to see it hold the lower end of its consolidation, which is the $206 price point.

Stay tuned for updates - I will be sending out a subscriber video today or tomorrow discussing and reviewing our full 2020 trades. And I will be announcing a subscriber webinar in the next few days also.

CRM is trading at $216.20 this morning. We sold a $217.50 put for about $2.15, which will make our effective entry on this stock at $215.35. You can buy CRM on the open if you have not played any of the options plays - we will now hold this in our long term equity portfolio at an entry of $215.35. The stop will be $193.64.

MCD traded lower yesterday. We want to see it hold the lower end of its consolidation, which is the $206 price point.

Stay tuned for updates - I will be sending out a subscriber video today or tomorrow discussing and reviewing our full 2020 trades. And I will be announcing a subscriber webinar in the next few days also.

Options Trades:

$384-$385 SPY Jan 15th Call Credit Spread for $0.27 credit (maximum $27 profit per contract). $0.73 ($73 per contract) risked if SPY closes above $385 today The SPY is trading at $376.47 this morning pre-market.

$40 - $39 DAL Jan 15th Put credit spread for $0.25 credit. We risk $0.75 if DAL closes below $39 today. DAL is up a bit this morning on their earnings. DAL is trading at $41.10 pre-market.

Short Term portfolio:

None active

Long Term portfolio:

Sold a Jan 15th CRM $217.50 Put for about a $2.15 credit - CRM is trading under this price level, if you do not want to get assigned 100 shares of CRM then you can close this position. I am going to assume assignment since CRM has traded below our strike price for a decent portion of the week. We are now effectively long CRM at $215.35. CRM is trading at $216.19. Our stop is $193.64.

Long half position in DIS at $118.63. Disney is trading at $173.30. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $57.20. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $208.55. Stop is $189.50.

$384-$385 SPY Jan 15th Call Credit Spread for $0.27 credit (maximum $27 profit per contract). $0.73 ($73 per contract) risked if SPY closes above $385 today The SPY is trading at $376.47 this morning pre-market.

$40 - $39 DAL Jan 15th Put credit spread for $0.25 credit. We risk $0.75 if DAL closes below $39 today. DAL is up a bit this morning on their earnings. DAL is trading at $41.10 pre-market.

Short Term portfolio:

None active

Long Term portfolio:

Sold a Jan 15th CRM $217.50 Put for about a $2.15 credit - CRM is trading under this price level, if you do not want to get assigned 100 shares of CRM then you can close this position. I am going to assume assignment since CRM has traded below our strike price for a decent portion of the week. We are now effectively long CRM at $215.35. CRM is trading at $216.19. Our stop is $193.64.

Long half position in DIS at $118.63. Disney is trading at $173.30. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $57.20. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $208.55. Stop is $189.50.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2021 all rights reserved.