Rocket Equities & Options - Friday Update 01-22-21

Market Update - January 22, 2021

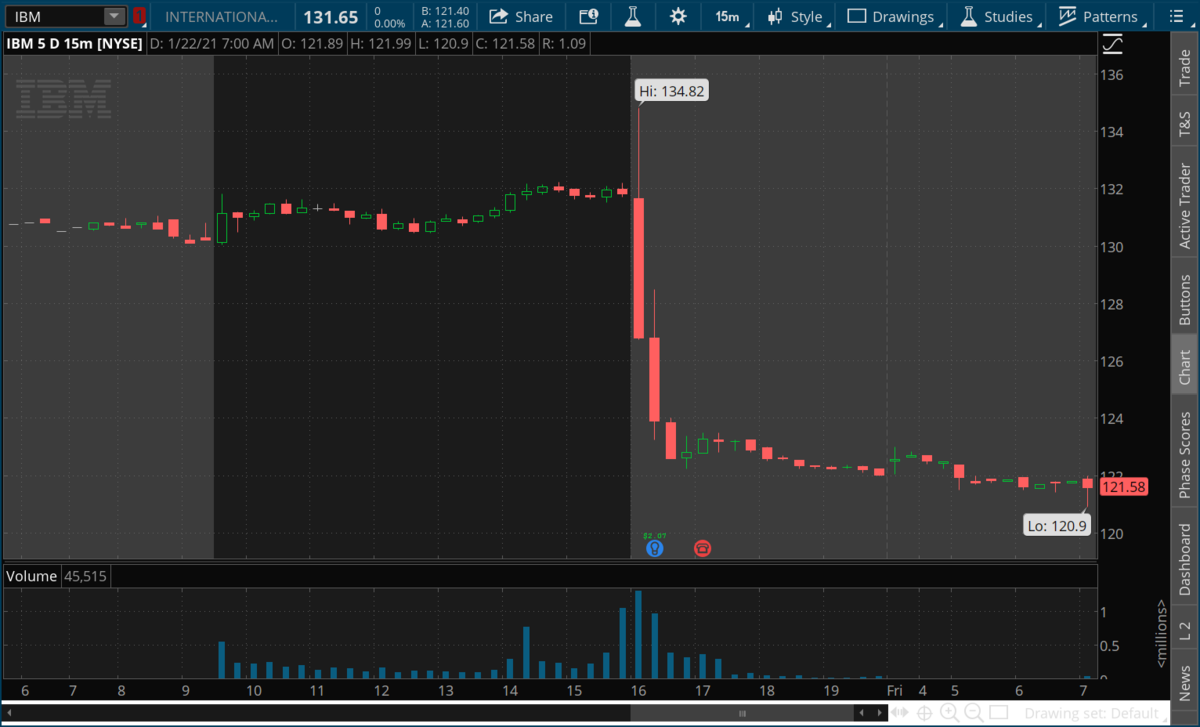

IBM disappointed last night and is trading dramatically lower. There are 2 main elements to the options trades we make around earnings, volatility and price direction. We were long volatility last night with an upward bias. The volatility part of the trade was correct, but the direction was obviously wrong as big blue still has some work to do. IBM announced shrinking revenue for the 4th consecutive quarter, and declined to provide earnings guidance for the full year. IBM is down 10% overnight.

INTC had a volatile overnight session. INTC spiked higher as their earnings were released just prior to the close yesterday, only to give back all of its gains during its conference call. We are holding our INTC credit spread for now and we will see how it trades for the early part of today's session - I will have an update out later today on INTC.

Equity Update:

CRM has had some nice upward action this week following our entry last week. Goldman initiated coverage this morning of CRM with a buy rating and a $315 price target. CRM is trading at $224.50. We are long CRM from an effective price of $215.35.

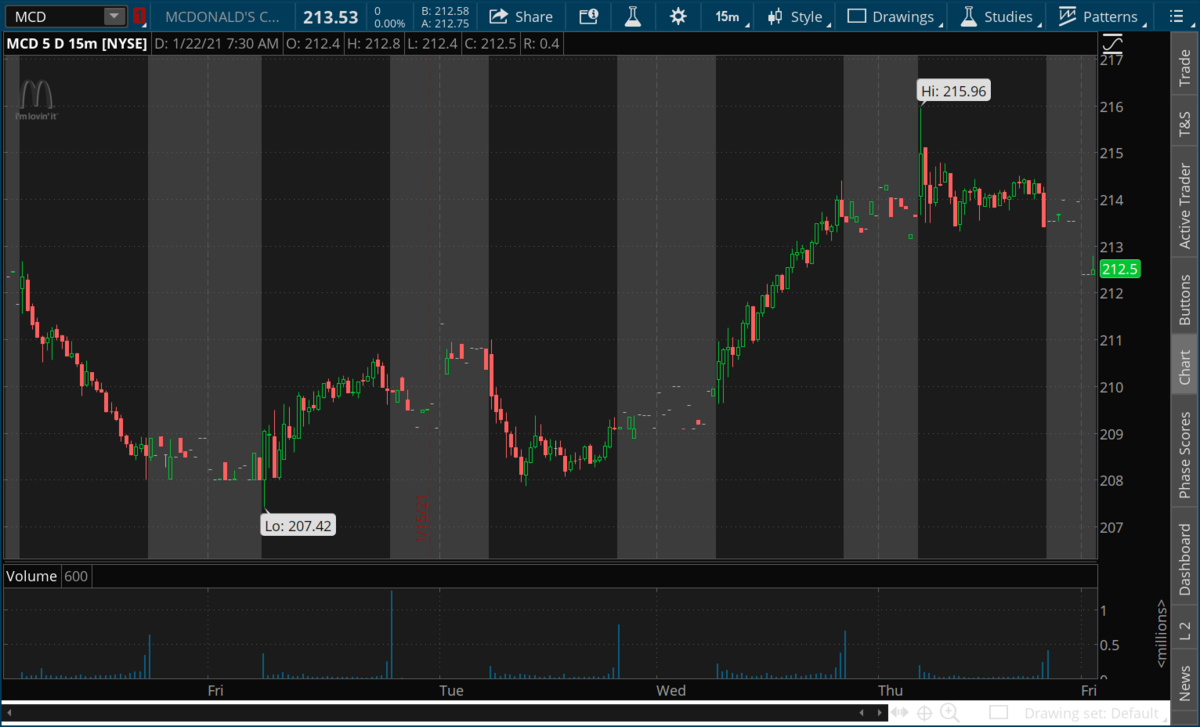

MCD traded nicely higher on Wednesday. MCD still is in a consolidation; we want to see it trade higher with volume as we approach the top of its consolidation.

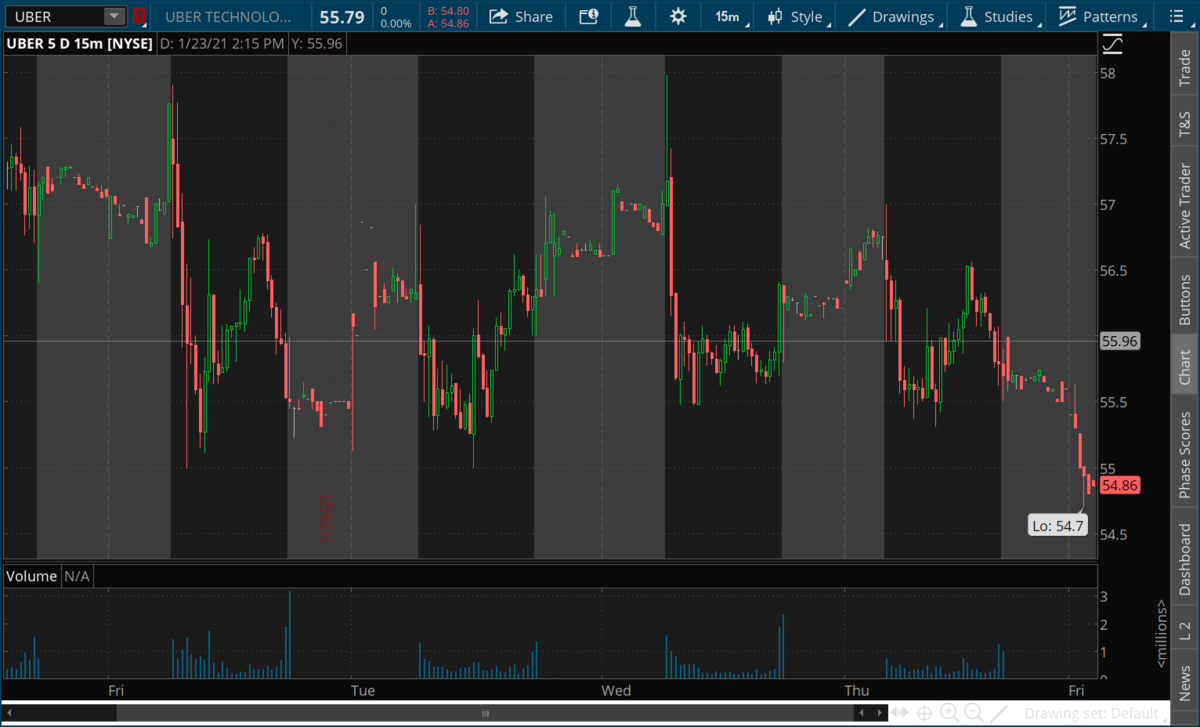

Uber has pulled back to test the top of its prior consolidation on lighter volume.

Disney spiked higher on NFLX earnings earlier this week, and then proceeded to give back most of the gains over the last couple of days. DIS continues to consolidate in its higher range.

Options Trades:

NFLX $525 - $530 credit call spread for $1.25 collected ($3.75 risked). Expires today for a loss. NFLX is trading at $572.

INTC $59 - $60 Credit Call Spread for $0.43 credit ($0.57 risked). This call spread expires at the end of today. We are gonna let things play out today with this trade. INTC is trading at $59.50 as of 7:30 am EST this morning, after trading to a high of $63.95 last night.

IBM $134 - $141 Debit Call Spread for $1.15 debit ($5.85 max profit). IBM disappointed with earnings last night and this trade looks to expire for a loss today.

Short Term portfolio:

None active

Long Term portfolio:

We are effectively long CRM at $215.35. CRM is trading at $224.50. Stop is $193.64.

Long half position in DIS at $118.63. Disney is trading at $173.00. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $54.80. Stop is $26.24.

Long half position in MCD at $216.91. You can buy MCD here if you have not yet. MCD is trading at $212.50. Stop is $189.50.

NFLX $525 - $530 credit call spread for $1.25 collected ($3.75 risked). Expires today for a loss. NFLX is trading at $572.

INTC $59 - $60 Credit Call Spread for $0.43 credit ($0.57 risked). This call spread expires at the end of today. We are gonna let things play out today with this trade. INTC is trading at $59.50 as of 7:30 am EST this morning, after trading to a high of $63.95 last night.

IBM $134 - $141 Debit Call Spread for $1.15 debit ($5.85 max profit). IBM disappointed with earnings last night and this trade looks to expire for a loss today.

Short Term portfolio:

None active

Long Term portfolio:

We are effectively long CRM at $215.35. CRM is trading at $224.50. Stop is $193.64.

Long half position in DIS at $118.63. Disney is trading at $173.00. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $54.80. Stop is $26.24.

Long half position in MCD at $216.91. You can buy MCD here if you have not yet. MCD is trading at $212.50. Stop is $189.50.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2021 all rights reserved.