Rocket Equities & Options Friday Update 02-12-21

Disney Surprises with a Profit as Subscriber Numbers Continue to Accelerate Higher

2 of our core equity positions reported earnings this week and they both traded nicely higher. Disney reported last night and surprised with a profit, even while their parks and movie business has been decimated. Uber reported earlier in the week and gave back some of their gains it had priced in following LYFT earnings, yet still is well positioned to finish the week on a positive note.

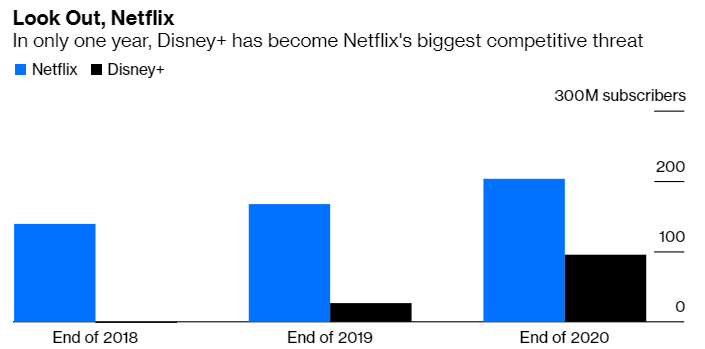

Disney+ now has nearly 95 million subscribers. Disney+ reported 94.9 million subscribers as of January 2nd, the end of its first quarter, up from 73.7 million subscribers at the end of their prior quarter.

CRM continues to trade nicely. You can see how our patience really paid off on this trade, we waited for the full pull back while absorbing premium selling cash secured puts, and we are now up a solid 12% from our entry on January 15th, while the S&P is up about 4.2% over that same time period. And that doesn't count the premiums we absorbed with options prior to our effective entry into the equity on January 15th.

Disney+ now has nearly 95 million subscribers. Disney+ reported 94.9 million subscribers as of January 2nd, the end of its first quarter, up from 73.7 million subscribers at the end of their prior quarter.

CRM continues to trade nicely. You can see how our patience really paid off on this trade, we waited for the full pull back while absorbing premium selling cash secured puts, and we are now up a solid 12% from our entry on January 15th, while the S&P is up about 4.2% over that same time period. And that doesn't count the premiums we absorbed with options prior to our effective entry into the equity on January 15th.

CRM Daily

CRM Hourly

DIS 15-Min

DIS Daily

DIS vs. NFLX - Bloomberg Graphic

Uber 15-min

Uber Daily

WMT Daily

MCD 15-Min

Options Trades:

None

Short Term portfolio:

None active

Long Term portfolio:

Long half position in WMT at $140.91. WMT is trading at $144.02. Stop is $125.31. WMT reports earnings Feb 18th.

We are effectively long CRM at $215.35. CRM is trading at $241.24. Stop is $193.64. CRM reports earnings Feb 25th.

Long half position in DIS at $118.63. Disney is trading at $181.16. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $60.71. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $214.27. Stop is $189.50.

None

Short Term portfolio:

None active

Long Term portfolio:

Long half position in WMT at $140.91. WMT is trading at $144.02. Stop is $125.31. WMT reports earnings Feb 18th.

We are effectively long CRM at $215.35. CRM is trading at $241.24. Stop is $193.64. CRM reports earnings Feb 25th.

Long half position in DIS at $118.63. Disney is trading at $181.16. Stop is $98.45.

Long half position in UBER at $31.50. Uber is trading at $60.71. Stop is $26.24.

Long half position in MCD at $216.91. MCD is trading at $214.27. Stop is $189.50.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2021 all rights reserved.