Rocket - New Options Trade ZM 03-01-21

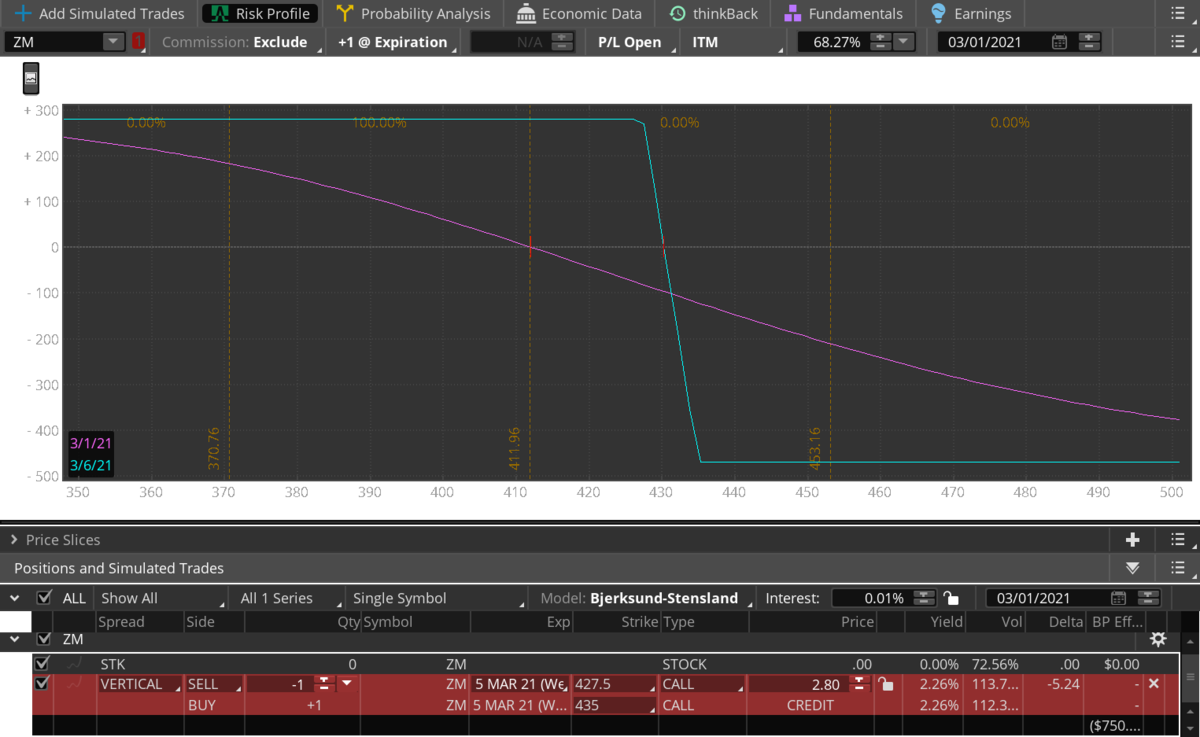

ZM Selling a Credit Call Spread $427.50 - $435.00

Sell a March 5th $427.50 Call

Buy a March 5th $435 call

Collect a credit of at least $2.50 when executing the pair. We are risking a maximum of about $5.00 or $500 per contract pair, and our max profit is the $2.50 or $250 we collect when initiating this trade. We achieve our max profit if ZM stays below $427.50 as of Friday's close. Our max loss is if ZM closes anywhere above $435 as of Friday. You may not get executed as there is a wide bid/ask. Make sure you place this as a limit pair trade.

ZM has earnings tonight and is pricing in almost a $39 move. We will look to collect some of that premium above the market.

ZM is a good stock long term, but short term they face a decelerating growth, and the re-opening of the economy.

I know this is late in the day, and I usually try to give more time to execute trades, but the opportunity presented itself. ZM is up more than 10% already today and I think it will be tough to trade dramatically higher on earnings this week. Keep your risk vs. reward in check as we know this is a volatile market and anything is possible.

Buy a March 5th $435 call

Collect a credit of at least $2.50 when executing the pair. We are risking a maximum of about $5.00 or $500 per contract pair, and our max profit is the $2.50 or $250 we collect when initiating this trade. We achieve our max profit if ZM stays below $427.50 as of Friday's close. Our max loss is if ZM closes anywhere above $435 as of Friday. You may not get executed as there is a wide bid/ask. Make sure you place this as a limit pair trade.

ZM has earnings tonight and is pricing in almost a $39 move. We will look to collect some of that premium above the market.

ZM is a good stock long term, but short term they face a decelerating growth, and the re-opening of the economy.

I know this is late in the day, and I usually try to give more time to execute trades, but the opportunity presented itself. ZM is up more than 10% already today and I think it will be tough to trade dramatically higher on earnings this week. Keep your risk vs. reward in check as we know this is a volatile market and anything is possible.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2021 all rights reserved.