Rocket Equities & Options SPY Options Debit Put Spread 11-05-20

SPY Debit Put Spread

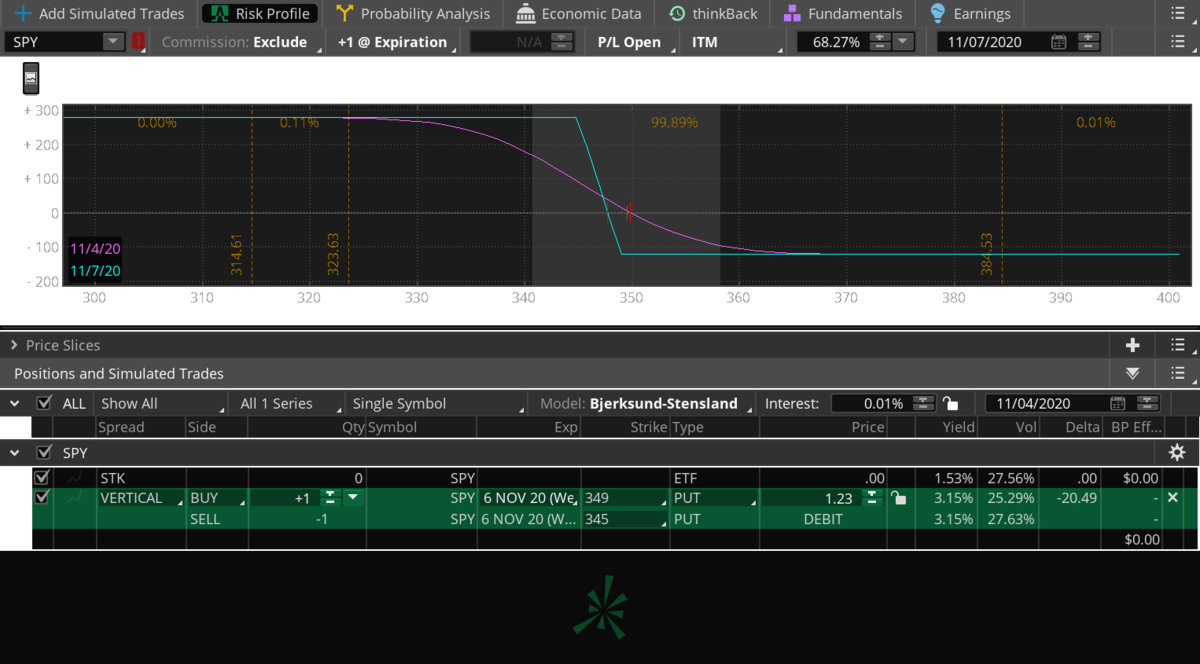

We're going to buy a put spread looking for a pull back in the SPY with defined risk if indices accelerate higher. The SPY is now up 8.4% just from Friday's intra-day low.

Buy the SPY Nov 6th $349 put.

Sell the SPY Nov 6th $345 put.

This should result in a cost (debit) of about $1.25 per contract. Our max risk is the $125. Our max profit is $275 if the SPY closes under $345 by Friday. This position is out-of-the-money right now, so we lose our entire investment if the SPY closes Friday where it currently is. Set your risk accordingly.

Buy the SPY Nov 6th $349 put.

Sell the SPY Nov 6th $345 put.

This should result in a cost (debit) of about $1.25 per contract. Our max risk is the $125. Our max profit is $275 if the SPY closes under $345 by Friday. This position is out-of-the-money right now, so we lose our entire investment if the SPY closes Friday where it currently is. Set your risk accordingly.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Rocket Equities & Options” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2020 all rights reserved.