Rocket - New Equity & Options Trade MCD - 11-06-20

New Trades - Long Term Equity Portfolio - McDonalds

MCD has earnings Monday morning before the bell.

We are going to initiate a half a position in MCD as of this update for our long term equity portfolio - and then we are going to initiate the 2nd half of our position probably sometime next week. We want some exposure to their earnings, yet this is a longer term trade and I prefer to average in the price from today and next week to reduce the variance of the earnings of one 90 day period on our entry price.

MCD looks to trade higher short and long term. They are a well positioned company with a top brand across the world. I also have an option trade for next week in MCD below. Take one or both depending on your risk preference.

MCD is trading at $216.91.

5 year weekly chart:

We are going to initiate a half a position in MCD as of this update for our long term equity portfolio - and then we are going to initiate the 2nd half of our position probably sometime next week. We want some exposure to their earnings, yet this is a longer term trade and I prefer to average in the price from today and next week to reduce the variance of the earnings of one 90 day period on our entry price.

MCD looks to trade higher short and long term. They are a well positioned company with a top brand across the world. I also have an option trade for next week in MCD below. Take one or both depending on your risk preference.

MCD is trading at $216.91.

5 year weekly chart:

MCD Daily Chart - Just bounced off the .382 of its move from late June to its recent highs.

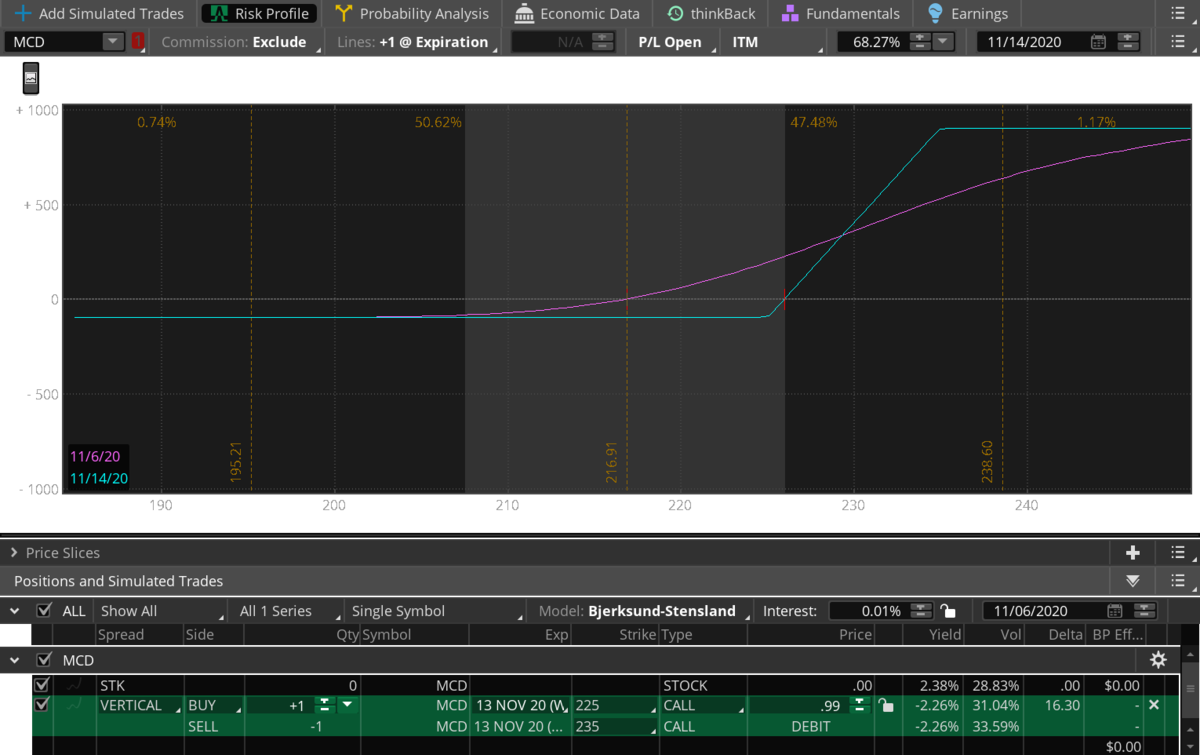

New Options Trade - MCD $225 - $235 Call Spread Expiring November 13th for $1.00

I'm also going to take a flier with a very small position on some good numbers for McDonalds on Monday risking $1 to make $9 on this very out-of-the-money trade.

We may lose on this type of a trade 7 times out of 10 and still have it be very profitable because of the risk vs. reward.

MCD is currently trading at $216.91, and we have value in this trade from $225 - $235 next week for $1.

Buy the Nov 13th $225 call

Sell the Nov 13th $235 call

The result is a $1 debit or $100 per call spread. Our max loss is $100 is MCD closes below $225 next Friday. Our max profit is $900 if MCD closes above $235 next Friday.

We may lose on this type of a trade 7 times out of 10 and still have it be very profitable because of the risk vs. reward.

MCD is currently trading at $216.91, and we have value in this trade from $225 - $235 next week for $1.

Buy the Nov 13th $225 call

Sell the Nov 13th $235 call

The result is a $1 debit or $100 per call spread. Our max loss is $100 is MCD closes below $225 next Friday. Our max profit is $900 if MCD closes above $235 next Friday.

SPY & UBER Update

The SPY is trading slightly down for the session at about $349.95 as of 3 pm EST.

You may get closed out of the SPY put spread by your broker for about $0.25-$0.35.

We got a nice move in Uber this morning on the open, you were probably able to exit the trade anywhere from $0.75-95 for a 50-100% profit from the $0.50 we got in. Uber was even stronger than I imagined early in the day.

You may get closed out of the SPY put spread by your broker for about $0.25-$0.35.

We got a nice move in Uber this morning on the open, you were probably able to exit the trade anywhere from $0.75-95 for a 50-100% profit from the $0.50 we got in. Uber was even stronger than I imagined early in the day.