Rocket - PYPL Put Credit Spread 11-02-20

PYPL Put Credit Spread $180 - $172.50

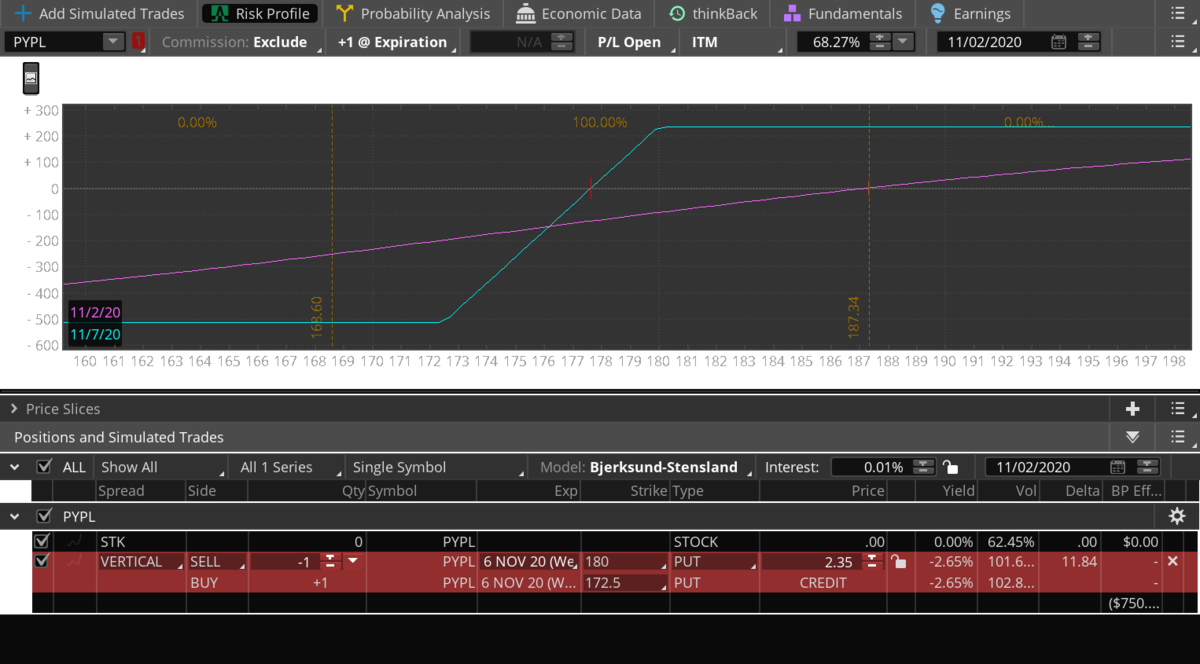

We are initiating a credit spread in PYPL ahead of their earnings after the bell tonight.

We are placing a bullish trade by absorbing the premium in the puts below the market from the $180 to $172.50 price point. PYPL is trading at $187.45. The options market is pricing in a $18.64 move this week, or about 10%.

Sell the Nov 6th $180 put in PYPL

Buy the Nov 6th $172.50 put in PYPL

This will result in a credit of about $2.40.

Our max profit is $235 (the credit we initially receive) if PYPL expires above $180 on Friday. Our max loss is $515 if PYPL expires below $172.50 Friday, which is possible. We can always close this position tomorrow if we don't want to hold it through the election. I like the factor that if it goes against us tonight we can hold through to Friday and possibly get a post election boost.

We are placing a bullish trade by absorbing the premium in the puts below the market from the $180 to $172.50 price point. PYPL is trading at $187.45. The options market is pricing in a $18.64 move this week, or about 10%.

Sell the Nov 6th $180 put in PYPL

Buy the Nov 6th $172.50 put in PYPL

This will result in a credit of about $2.40.

Our max profit is $235 (the credit we initially receive) if PYPL expires above $180 on Friday. Our max loss is $515 if PYPL expires below $172.50 Friday, which is possible. We can always close this position tomorrow if we don't want to hold it through the election. I like the factor that if it goes against us tonight we can hold through to Friday and possibly get a post election boost.