The Tiger Forex Report 5-13-24

The Tiger Forex Report – Week of 5/13 – 5/17/2024

The DXY is wedging and CPI numbers are going to be popping this week in multiple FX pairs. Expect some inflation trades on the table. Don’t worry about China’s retail sales…their books are cooked.

Crude Oil is pressing the correction. The downside support band may become the range this week.

30yr T-Bond is floating below the upside correction zone extreme. Yields look like they want to soften…but CPI is looming. Get ready for either a dead trade or a wild whipsaw trade.

EURUSD Weekly Outlook:

The biggest component of the DXY may be the worst of the FX pairs to trade this week. Only a close above the monthly directional pivot level would change this outlook. If this should occur the Bulls would be ripe to press this currency all the way up towards the critical resistance band. If Yields soften in a big way the EURUSD Bulls could regain an edge.

The critical support band is the base holding the short-term trend up. A failure from the 1.0704 level would be a negative sign that the Bears are back. That would put the downside target #1 in the crosshairs. Look out below.

GBPUSD Weekly Outlook:

Is the upside correction finished? The GBPUSD is wedging and is ready to spring. Look for a breakout this week. A violation of the monthly directional pivot may reverse the short-term trend as the market pokes its way into the upside correction zone. Do not have any delusions of grandeur all of you Bulls out there. Overall, this currency is in a very large range trade. Only a violation of the upside target #1 would confirm any long-term Bullish trend.

Below 1.2594 the Bears will be trying to drag the market back into the downside correction band. This is all that is expected out of a negative trade this week. Only a big rally in Yields would reverse this outlook and give the Bears a shot at the downside target #1 level.

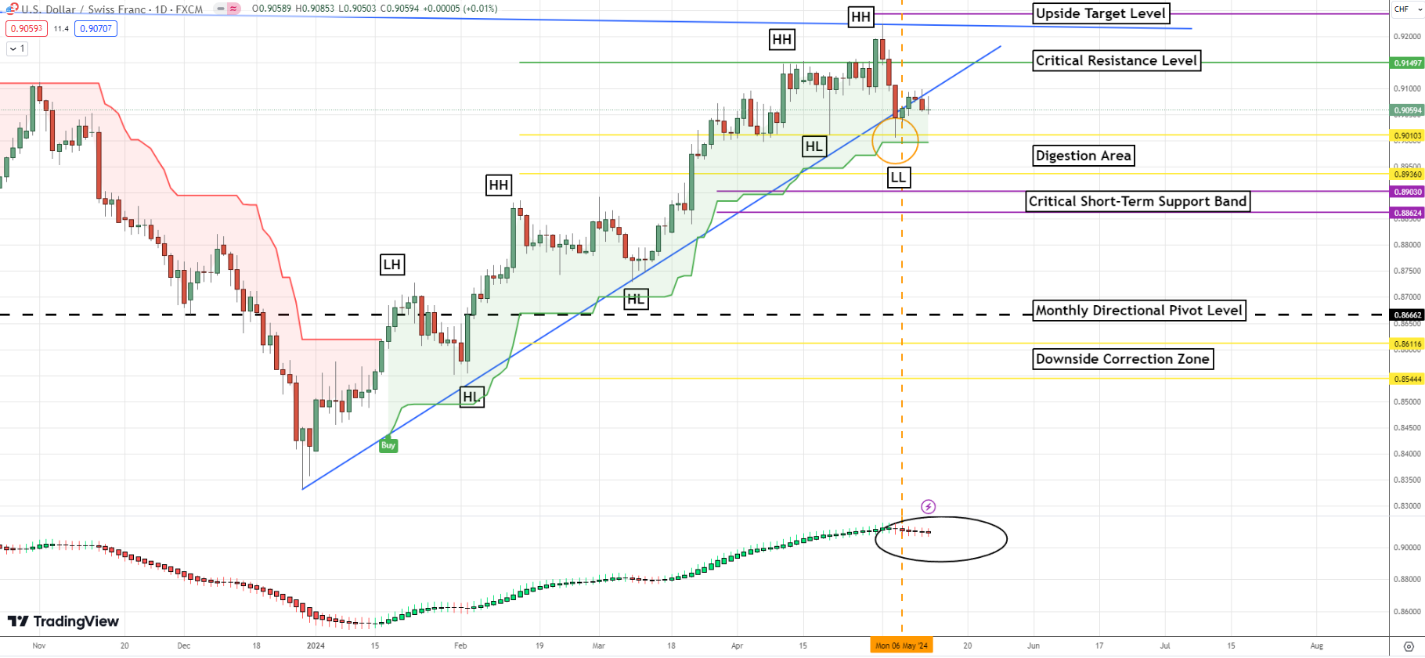

USDCHF Weekly Outlook:

Talk about a snoozer. If there is a currency pair to walk away from, it is this one. The trend remains firm. The digestion area keeps this market afloat, and the critical resistance level puts a cap on rallies. Wait for a breakout. A higher high and lower low are locked in on the daily chart. Indecision is the outlook.

Here is one potential trade to watch out for. If Yields soften in a big way this week, then the Bears may be able to press newer move lows to the critical short-term support band. That is it for the Bears. Watch out swing traders. The USDCHF could be stuck in a funk from 0.9200 down to 0.8862 for the next few months. Get ready for some summertime blues in this FX pair.

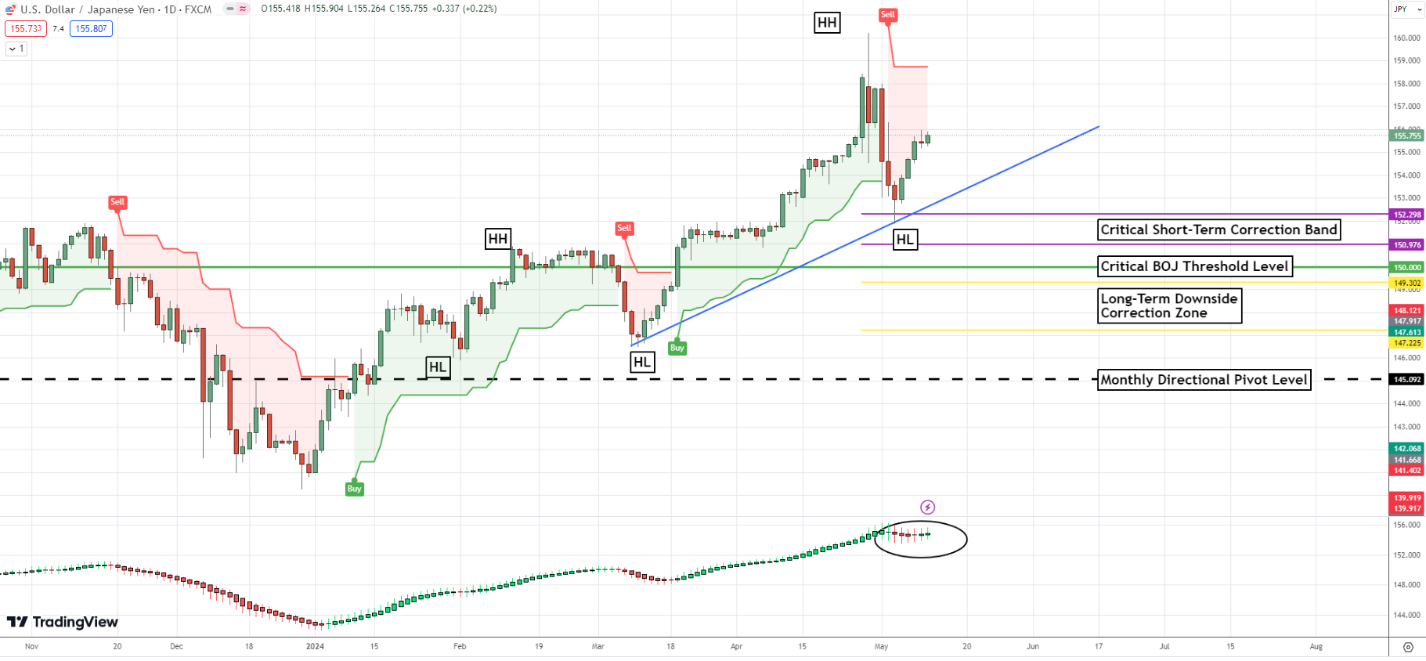

USDJPY Weekly Outlook:

USDJPY traders have been through some crazy volatility over the past few weeks. More is on the menu this week. Even though the market has been in a corrective phase it is likely to be a touch and go trade this week. There is a weak Sell signal that has the Bears trying to get another test of the critical short-term correction band. The BOJ would like it if the market would pull back to this area, but it may not hold up for long. If Crude Oil Bulls come back and Yields firm up the Bulls will most likely reverse direction for this currency.

If the Bulls take control this week it would most likely become another volatile intra-day trade. Should this happen there is a good chance that the market will start grinding higher. Keep your Stops tight. It is unlikely that rallies will hold up over the next week. Big swings are expected. Risk will probably outweigh reward and sitting back and waiting for a solid signal may be the best advice.

AUDUSD Weekly Outlook:

This FX pair is bobbling along the monthly directional pivot level. Be careful trying to force a trade. Be patient, and keep expectations rational. Only a close above the upside breakout level confirms the Bulls resolve to spark a new Bullish wave North. A weak Buy signal sets the stage for an early challenge of resistance this week, and if Yields are soft, it may be reinforced. This would then set the stage for further Bullish action in the weeks ahead.

If the Bears can pull back below 0.6552 the market will be back in a wide range trade for a few sessions. Not much is expected unless the AUDUSD falls into the digestion area. Trading in this zone should not be taken lightly. The Bears will be fighting hard to test the 0.6375 level. Do not fight a slide under here. The downside target band is the extended sell-off objective.

NZDUSD Weekly Outlook:

Could the NZDUSD Bulls press newer move highs? A short-term buy signal has been triggered as the market presses the upside correction zone. Be careful trying to fight this move. A rally above 0.6075 could ignite Stops and fuel a surge higher. The critical resistance band would be a very strong area for the Bulls to reach if a correction gets pressed. Watch Yields to see if Yields soften more this week. If the trend continues in that market, then this currency could unleash a Bullish stampede.

Only a failure from the 0.5970 level would reverse the positive outlook as the Bears regain the trend and drag this currency through the mud again. The critical support band is the first stop on a slide that could press the downside target band. It is not expected to get back to this area this week. However, if Yields catch a strong bid the downside target level could be the next area for new move lows to fall into.

USDCAD Weekly Outlook:

This market is wedging and may disappoint this week. The short-term correction band is the base holding the USDCAD up. Trading above 1.3623 keeps the currency from falling and should have the Bulls ready for a rally into the critical resistance correction band. If a range trade is to remain then the market should not get above here. A breach of 1.3764 would be a positive indication that new move highs are the call. If this occurs the upside bullish target level would become a viable area to shoot for.

Below 1.3623 it could be a free fall. Trading in this area breaks the current uptrend and gives the Bears some room for a correction. Yields are soft, and if the CPI numbers are deflationary the USDCAD could get hammered. The downside correction zone is the target as this grinding Bull pulls back.