The Tiger Forex Report 5-6-24

The Tiger Forex Report – Week of 5/6 – /10/2024

The DXY is under pressure, and more downside action this week is likely.

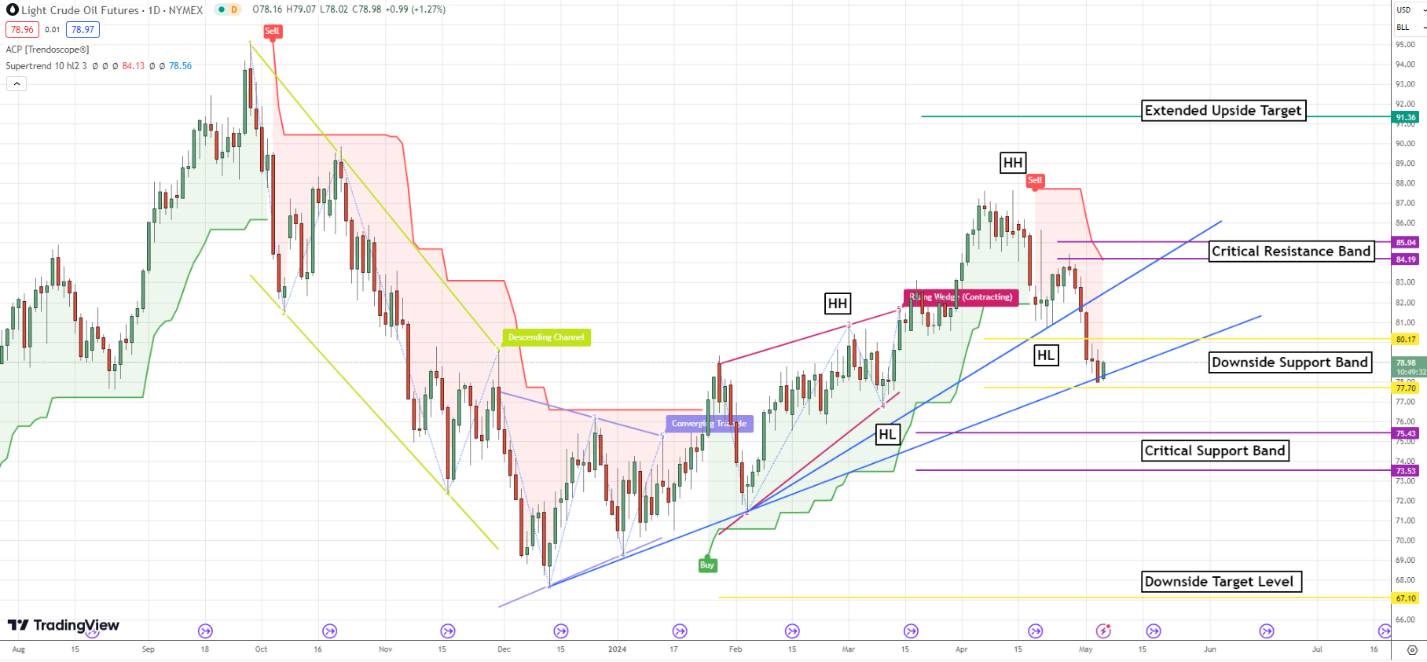

Crude Oil Bears are taking profits, but a bounce is very likely this week.

30yr T-Bonds are in rally mode. This should keep the USD under pressure this week.

EURUSD Weekly Outlook:

The Bulls are in control of the EURUSD. Yields are soft, and the market is taking advantage of this opportunity. A rally to challenge the monthly directional pivot level is the call for the next few sessions. Do not fight a breach of this level. Trading above 1.0834 could get hairy. The critical resistance band is a very viable target under the current technical and fundamental conditions.

The critical support band is the floor for any downside action this week. Yields are soft, and the Bears do not have much to work with. Only a failure from 1.0704 would change the outlook. The downside target #1 would then become the objective. Watch Yields. If they firm up the Bears could regain their edge.

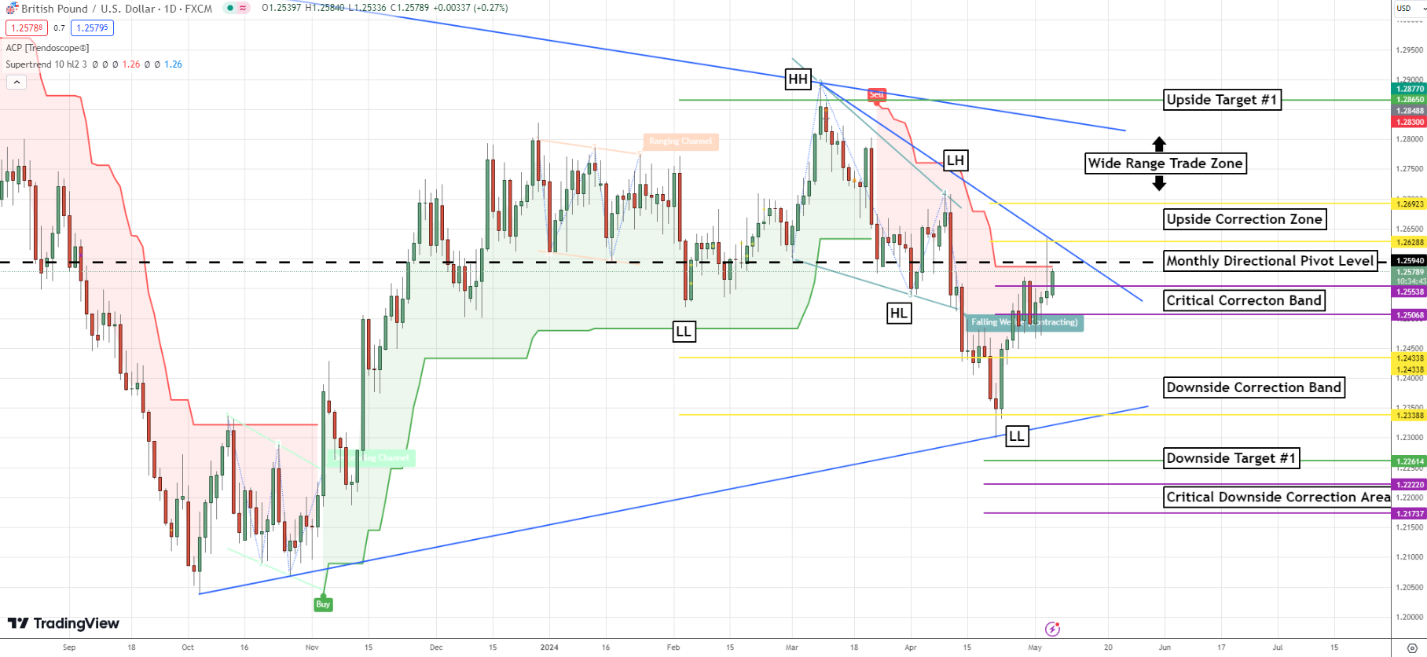

GBPUSD Weekly Outlook:

This market is set to disappoint. The short-term trend is positive, and it most likely will flirt with newer move highs. Just be careful. Pullbacks are very likely as the market tries to press new highs. A rally above 1.2625 would be a good sign that the market is going to make a play for the 0.2692 level.

The critical correction band is most likely going to hold this market up. Only a failure from 1.2506 would reverse the short-term outlook. Trading under here would set the Bears up for a slide that targets the downside correction band.

USDCHF Weekly Outlook:

USDCHF Bears are in control, and the digestion area is the objective. Be cautious. If the Bears hit support, momentum is likely to build. The digestion area is the first stop on a move that has the potential to hit the critical short-term support band.

Trading above 0.9010 keeps this currency in a holding pattern. Only a rally above 0.9149 confirms strength. A rally above here should have the Bulls pressing up against the upside target level in a heartbeat. If the Bulls can pull off a move like that we will have an update later in the week.

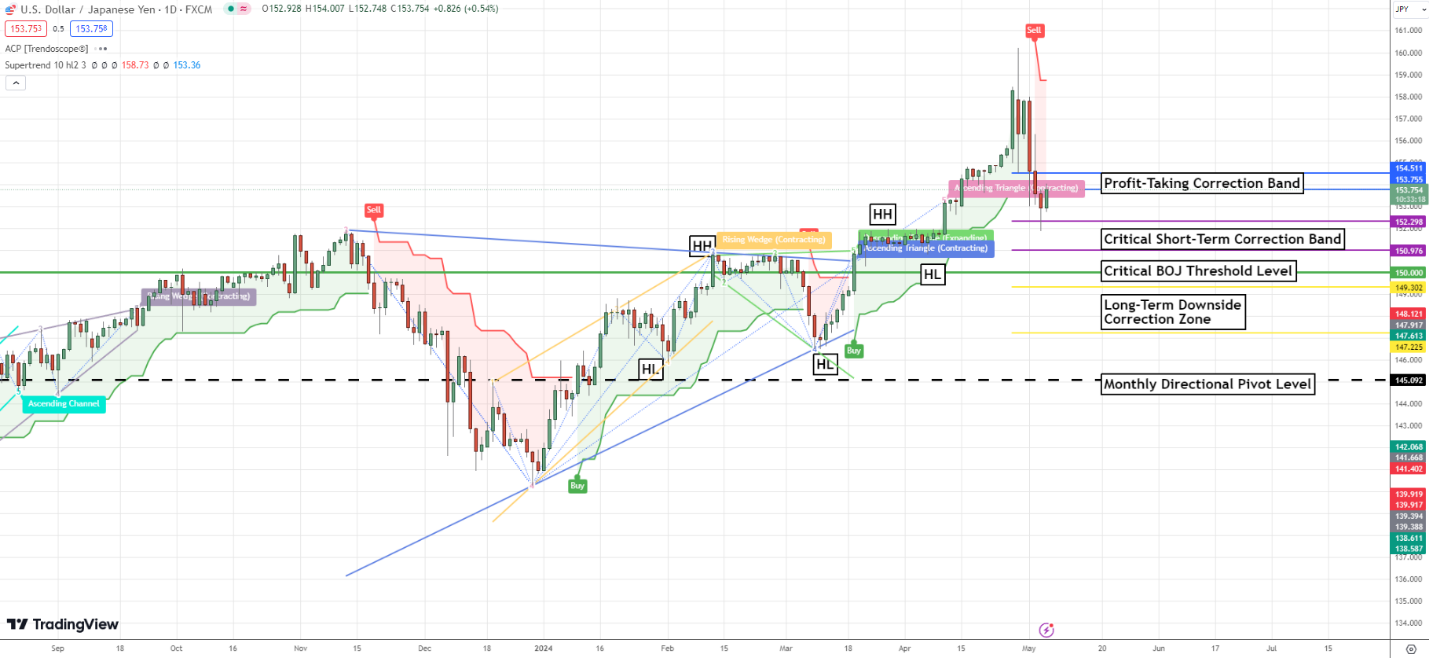

USDJPY Weekly Outlook:

The USDJPY hit the critical short-term correction band. And that should help to prop the market up. There has been extreme volatility in this market over the past week. And it is not likely to stop any time soon. A rally above 154.51 is on the agenda. 159.00 is the Bullish target to aim for.

Yields are soft, and Crude is as well. That could give the Bears an edge this week. A failure from 150.97 would be a sign that the trend is trying to reverse. 150.00 is the first target on a slide that could press new move lows into the long-term downside correction zone.

AUDUSD Weekly Outlook:

The Bulls pressed key resistance last week, and another challenge of resistance is on the agenda for the next few days. If the AUDUSD gets above the 0.6642 level fresh buying is likely to enter the market. Yields are soft, and a blowoff rally is not out of the question. The long-term upside target is the level in the cross hairs. With the current momentum, it is a viable objective to shoot for.

If the AUDUSD falls on support it should not last long this week. This market is in a buy-break forecast. A failure from the 0.6552 level would be a good indication that this currency is putting the trend on pause as the market looks for a new floor. The digestion area is expected to keep this market from falling any further. Yields are soft, and until that changes the Bears do not have much leverage in this currency pair.

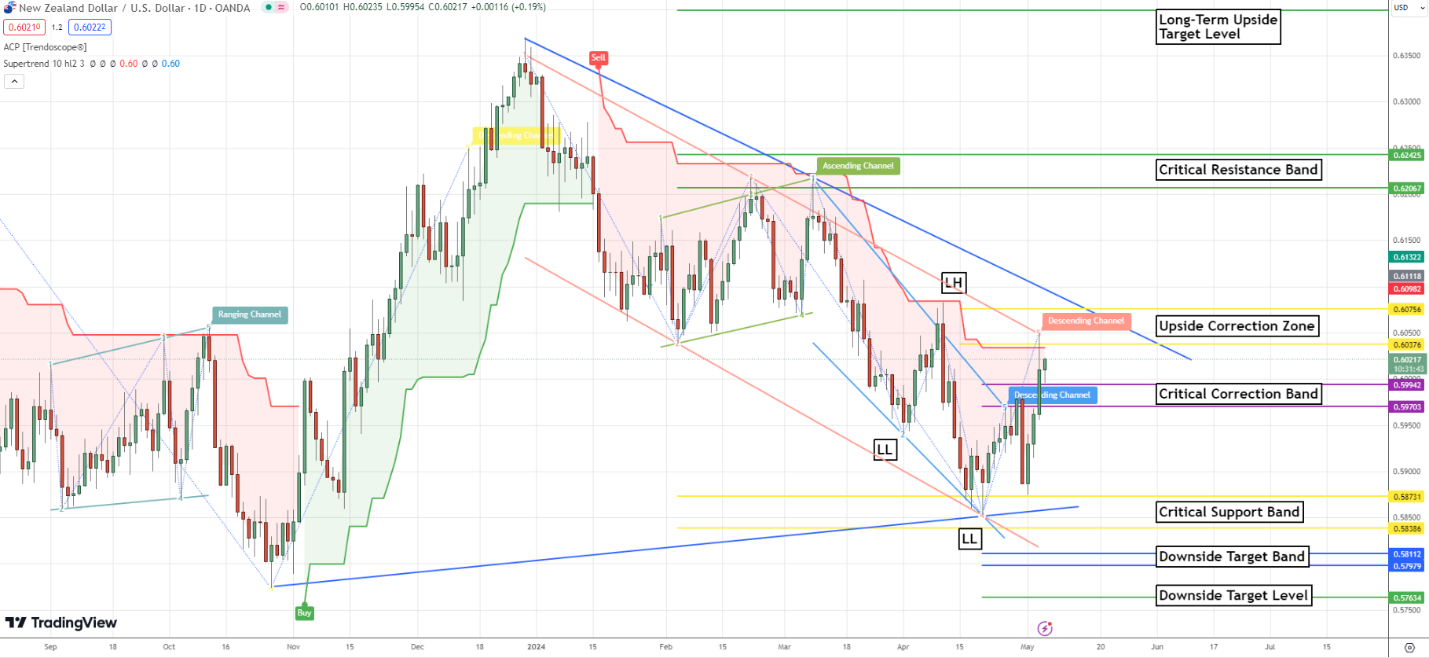

NZDUSD Weekly Outlook:

NZDUSD traders are bouncing off resistance and looking for a reason to sell. It may be tough this week. Yields are soft so the Bulls have an edge. A rally into the upside correction zone is the call. Be careful. If the Bulls breach 0.6075 it could get parabolic. The critical resistance band is a very viable target if the market is going to put the breaks on the current Bearish channel.

The critical support band is the base for a lower trading market this week. If there is a failure from 0.5970 it would be a good indication that momentum has turned. Below 0.5970 it is a free fall to the critical support band. Trading back in this area would be a sign that this currency is setting up for a long-term downtrend.

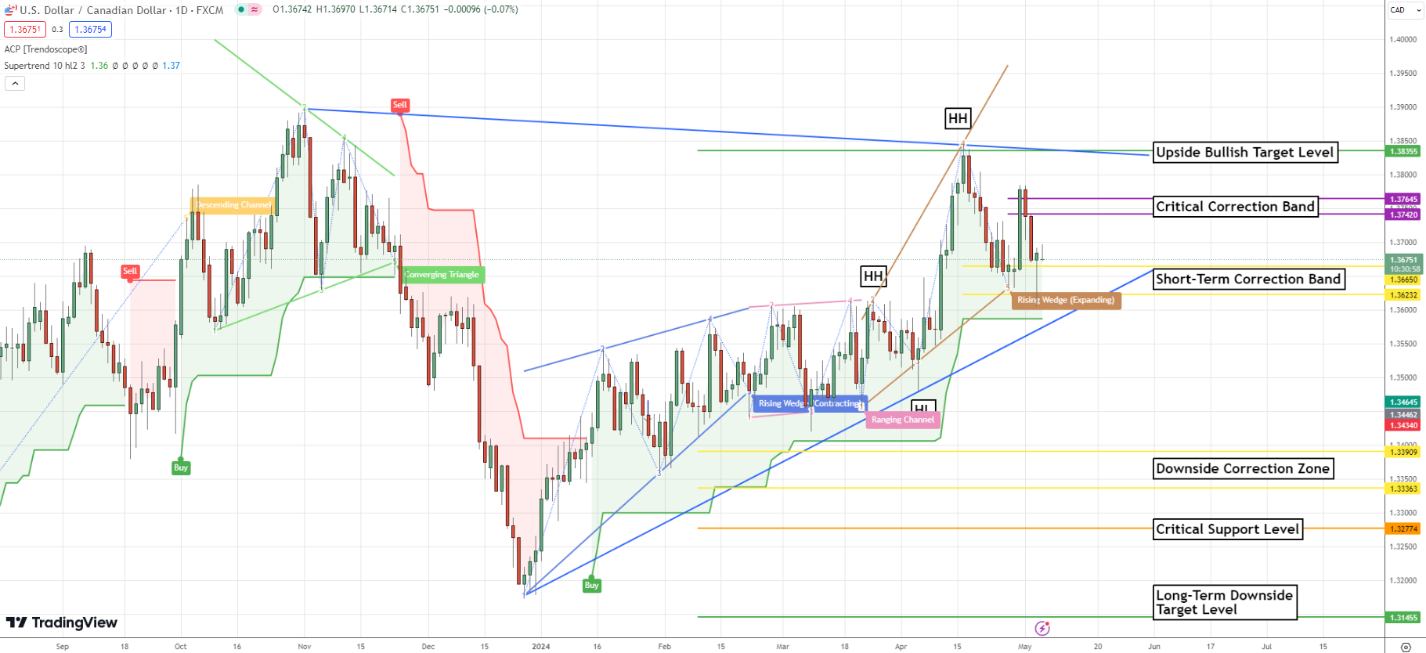

USDCAD Weekly Outlook:

USDCAD fell on strong support last week. And the Bulls are ready for a bounce. A rally into the critical correction band is the call for. This is a key area for the market. If the market gets above 1.3764 it will be a fight. Fresh buying is expected to fuel momentum to the upside-bullish target level.

The short-term correction band is the base for the current trend. If the Bears touch off new lows this week it would be a very negative sign. Trading under 1.3623 rips the rug out from the Bullish trend and sets the USDCAD to hammer support. New lows target the downside correction zone. Yields are soft, and if they remain so this currency should be a Bear for the week ahead.