The Tiger Forex Report 9-23-24

The Tiger Forex Report – Week of 9/23 – 9/27/2024

The DXY is riding the lows in the wake of the FED meeting. It is expected to remain under pressure.

Crude Oil Bulls are on the move and ready to poke at resistance some more.

30yr T-Bond Bears are in profit-taking mode. The next few economic releases will have a big influence on the next directional move. Waiting for the numbers.

EURUSD Weekly Outlook:

The EURUSD is flirting with resistance, but the Bears are ripe to initiate a fresh sell-off. That is the call for the week. A break toward the downside correction zone is expected. This is a key area holding the trend intact. If the Bears get a dip below here then the downside breakout level should be in play. 1.0834 is the extended sell-off target.

A close above the upside breakout level is needed to confirm any show of strength. Trading above here targets the 1.1270 and 1.1350 levels. Fundamental woes are weighing on this market, and unless the DXY gets hit hard, the Bulls in the EURUSD will have a tough time maintaining a new trend wave higher.

GBPUSD Weekly Outlook:

The Bulls are trying to keep the upside trend in new move-high mode. The trend is your friend, and this market remains in a buy-dip mode. Sustained trading above the upside breakout level confirms the Bulls' resolve to press on higher. 1.3480 and 1.3550 are the upside trend targets.

If the Bears can spark a pullback, the market will be focused on the downside correction zone. This area is expected to hold. A failure in this area would be a good sign that the GBPUSD will be targeting the downside breakout level. If this level fails, 1.2594 becomes a viable multi-week trend objective.

USDCHF Weekly Outlook:

The Swissie is snaking along and stuck in a range-bound slump. A break below the downside breakout level is needed to spark fresh selling. Trading below here targets the 0.8275 level. Be careful buying into a slide this deep. Long-term trend factors are Bearish for this market. Wait for a valid buy signal.

Bullish momentum is nonexistent right now. A rally into the upside correction zone may occur, but there is not likely to be any follow-through. Only a breach of the upside breakout level would confirm a Bullish correction is ready to press new move highs for a while. Should this unfold, the upside target #1 will be the longer-term trend objective.

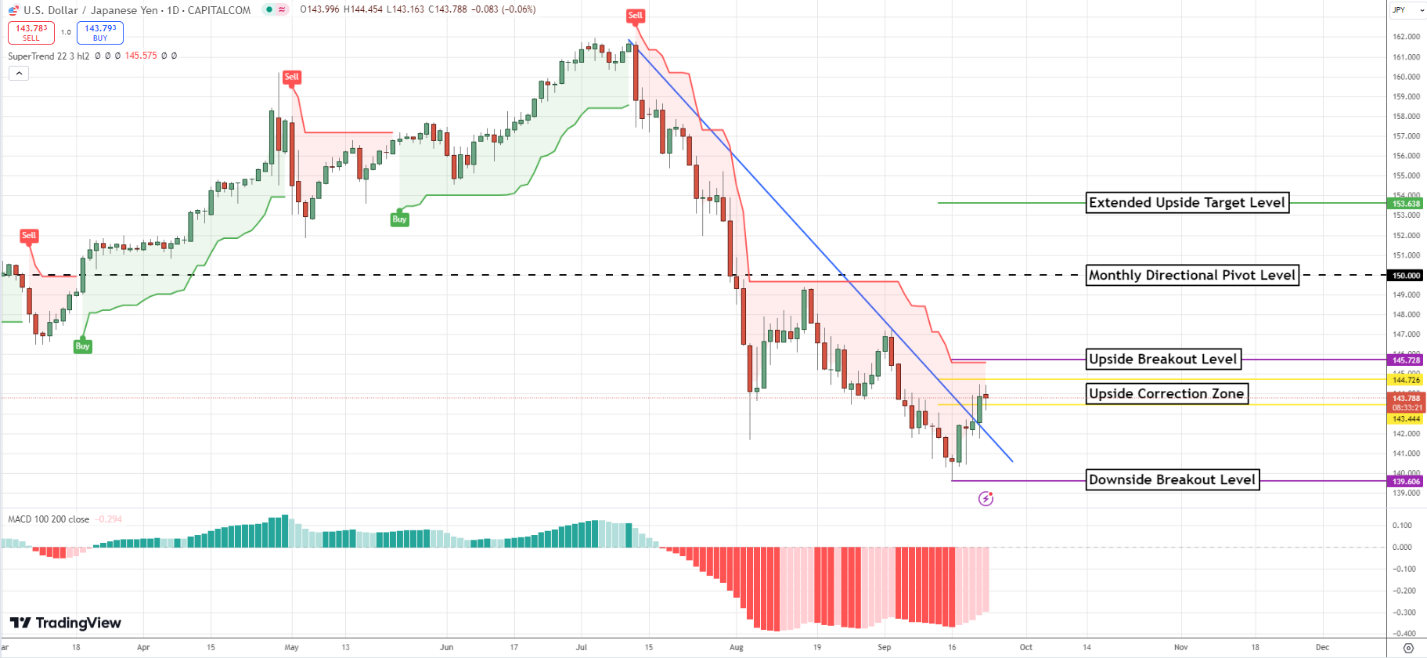

USDJPY Weekly Outlook:

USDJPY Bulls are in a profit-taking rally situation. The upside correction zone is the key hurdle to cross. Trading above here should spark a challenge of the upside breakout level. Use caution fighting a rally in this area. Fresh buying is likely to enter the market and stretch the rally up toward the monthly directional pivot level. This is also the key BOJ price point that they wish to keep this currency below.

A slide under the downside breakout level is needed to confirm that the major trend is back in action. Should this occur, the 138.40 and 137.90 levels will become viable downside trend objectives. With Crude Oil in a Bullish way it is not likely that the market will get much lower than these trend targets.

AUDUSD Weekly Outlook:

AUDUSD Bulls are on the move, and it looks like they will remain a force to contend with. 0.6950 and 0.7025 are the upside targets to shoot for. This is all that is likely out of a rally, and a digestive phase is on the horizon. With the DXY in the dumps, this currency should remain a Bull.

There is not much potential for the downside this week, and a pullback will most likely just be a profit-taking slide. The downside correction zone should hold the market up in the event of a correction. Only a break below this area would confirm that the Bears are gunning for newer move lows. The downside breakout level should then be in play.

NZDUSD Weekly Outlook:

Choppy, choppy, and more choppiness is the call for the NZDUSD. A close above the upside breakout level is required to confirm a fresh leg higher is brewing. Trading above here targets the 0.6400 and 0.6444 levels.

Below the upside breakout level, the market will be leaning on what was the critical resistance band. This area is key. Trading below here confirms a short-term profit-taking slide that targets the downside breakout level. If, the Bears get below here, things could get harry as this FX pair presses new move lows. It is very unlikely that this will occur this week since the DXY is riding the lows.

USDCAD Weekly Outlook:

There is not much of an exciting trade in the USDCAD. Newer move highs were pretty weak in the wake of the FED meeting. Big sideways is the call. In the short-term, the market is poised to test support. If the DXY unwinds to the downside, then this currency has a good chance at making a run for the downside correction band.

Only a rally above last week’s high would confirm the market's resolve to lift the USDCAD higher. This would make the upside breakout level a viable trend objective. However, with the DXY in Bear mode, it would be very unlikely that this market will get much upside action.