The Tiger Forex 11-13-23

The Tiger Forex Report – Week of 11/13 – 11/17/2023

The DXY is grinding a correction lower, and more testing of support is expected this week.

Crude Oil Bears are slamming newer move lows in a big way. Use the directional pivot level for directional bias in the market this week.

30yr T-Bond Bulls hit the upside correction zone, and set a critical swing high. Use that level to gauge market direction. Trading below Thursday’s High keeps the Bears in control.

EURUSD Weekly Outlook:

EURUSD traders are fighting to press newer move highs. Early in the week it is likely for the Bulls to challenge the 1.0754 level. The USD is expected to fall under pressure for a while, and this could help the market get to the daily directional pivot level. This is a key area. Trading above here extends the Bullish target to the upside target level.

A failure from the downside breakout level is needed to confirm the markets resolve to trade lower. If the market slips below here the EURUSD is likely to be pressing the critical monthly directional pivot level in a heartbeat. 1.0344 is the first target for newer move lows. Use caution fighting a lower trading market back in this area. 1.0194 is the longer-term downside target. Global tensions are not supporting this currency cross. The potential for trading at the Parity level is a very viable end of year scenario.

GBPUSD Weekly Outlook:

Has the GBPUSD finished its correction? Watch the DXY this week. If the Dollar Index falls under pressure, it is very likely that the Bulls will make a play for the critical resistance band. Be careful fighting newer move highs. A rally above 1.2474 could have the market pressing the daily directional pivot level fast. 1.2732 is the extended upside target.

Only a failure from the downside breakout level confirms weakness and return to the overall Bear trend. Do not try and catch a falling knife. Fresh selling pressure is expected to enter the market and pile drive the GBPUSD all the way towards the 1.1739 level. 1.1550 is the longer-term downside trend target.

USDCHF Weekly Outlook:

The USDCHF is wedging and grappling with direction. Key off the downside breakout level. A failure from here confirms the markets intentions to press newer move lows down toward the critical support band. A correction in the DXY is ripe to occur as we head into the holiday market at the end of the month. Should the USD get hit it would help this FX cross continue to press monthly lows towards the 0.8600 level.

Sustained trading above the downside breakout level is likely to spark a Bullish attempt at pressuring resistance. The short-term critical correction band is the key area for upside action. Watch the DXY. If the USD gains strength again the USDCHF will most likely benefit. Trading above 0.9108 would be a good indication that the longer-term Bull trend is trying to get back on course. The upside breakout level is the extended upside target.

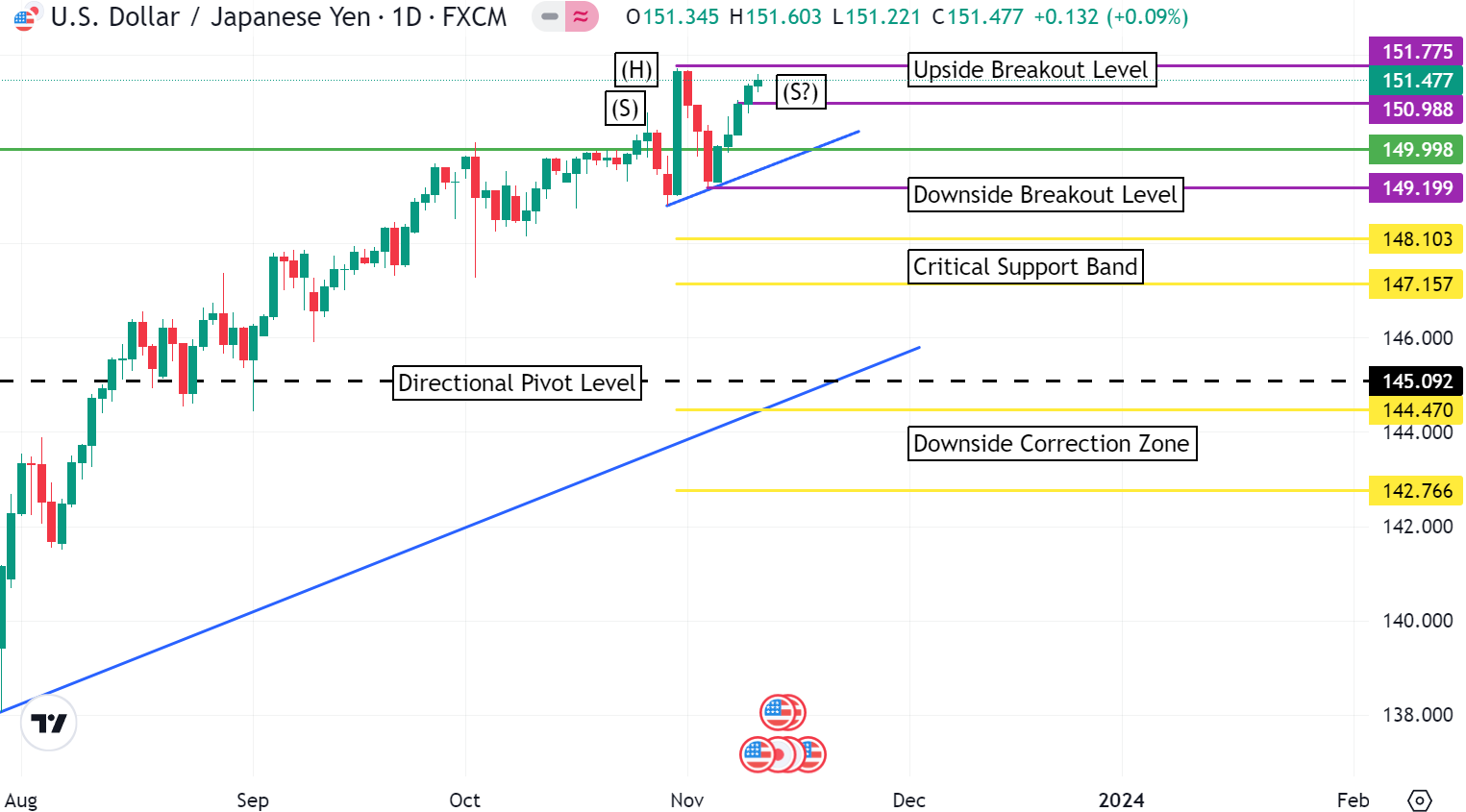

USDJPY Weekly Outlook:

Newer move highs for the USDJPY this week? Or maybe an overdue sell off? There is a potential Head & Shoulders Sell pattern forming. Key off the upside breakout level for the market’s directional bias this week. If the Bulls get above 151.77 fresh buying is likely to press higher move highs up towards the 152.75 level. 154.22 is the longer-term upside target. Keep an eye on DXY. If the USD falls under pressure the Bulls may have a tough time holding new highs.

Between the breakout levels the market will be in limbo digesting the longer-term Bull trend. Only a failure from the downside breakout level confirms a Head & Shoulders Sell pattern. The critical support band is the first stop on a correction that could hit the directional pivot level by Thanksgiving. If the DXY is in corrective mode the USDJPY could pull all the way back into the downside correction zone.

AUDUSD Weekly Outlook:

AUDUSD Bears are trying to drive the market back to the lower end of the recent range trade. Momentum is on the side of the Bears, and the downside breakout level is the objective early this week. Be careful if the market falls below here. Downside momentum is expected to drive the market towards the 0.6160 level. This would be a good profit taking area for any Bears riding the current wave lower. However, be careful buying into newer move lows. If the USD catches a strong bid this FX pair could press the 0.6075-0.6066 support band.

Up to the 0.6525 level the AUDUSD will be in a very tough trade. Only a violation of this level confirms strength to lift the market up towards the upside correction zone. If the market hits this area, it would be a very good profit taking spot. The fundamentals are not looking to well for Australia. Unless the USD really pulls back sharply keep your Stops tight for any Long trades. A close above 0.6657 is needed to confirm any longer-term reversal of the trend.

NZDUSD Weekly Outlook:

The NZDUSD is under serious Bearish pressure. A test of the directional pivot level is the call for early in the week. A failure from here confirms the Bears intentions to press newer move lows in a big way. Watch if Yields rally. If they do it would help add fuel to the Bearish fire. Newer lows have the potential to hit the 0.5610-0.5995 support band. This is a strong area that should hold up. Overall, the trend is a bit stretched, and a digestive consolidation period is likely. Just in time for Thanksgiving.

Sustained trading above the directional pivot level puts the Bears on hold as the Bulls try and get a corrective bounce up into the upside correction zone. The NZDUSD Bulls are likely to have a tough time in this area. If Yields really pull back sharply there is no reason to think that the market can sustain any Bullish trend. Fundamentally this FX pair is a disaster, and long-term expectations are very bleak.

USDCAD Weekly Outlook:

Friday the Bulls set a higher intra day high. The question is, will the long-term trend resume, or press another corrective leg lower? There is a potential Head & Shoulders Sell pattern forming. Trading below the upside breakout level will have the Bears flirting with another run at the critical support band. Should the market fall back to this area it will most likely become a touch and go trade. Do not fight a break under the 1.3572 level. A failure from here should have the Bears looking to extend newer move lows towards the downside breakout level.

Only a rally above the upside breakout level confirms fresh strength that targets the 1.3950 level. It is very likely that fresh buying could enter the market if the USDCAD Bulls cross this hurdle. 1.4075 is the extended upside objective. Watch to see if Yields start to rise again. If this occurs there is a very good chance that the market will be on a mission to make new multi month highs.