The Tiger Forex Report 06-27-22

The Tiger Forex Report – Week of 6/27 – 7/01/2022

Divergence in multiple Forex crosses last week kept the DXY in a sloppy range trade. Things are setting the stage for a breakout in front of the U.S. 4 th of July weekend holiday.

Key levels to watch for in the DXY…

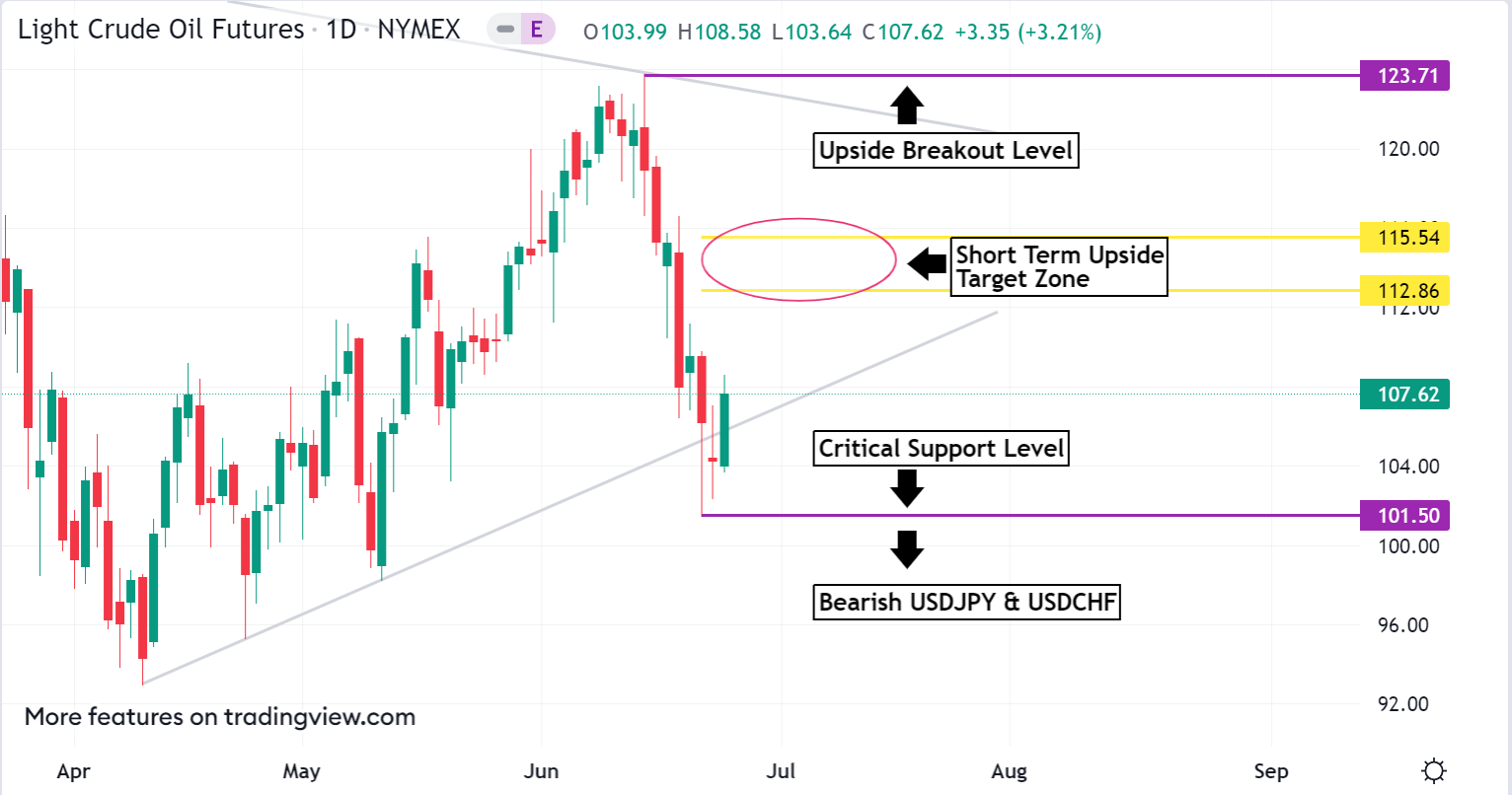

Crude Oil is looking to put a stop to the current downside correction…

30yr T-Bond influences on the USD…

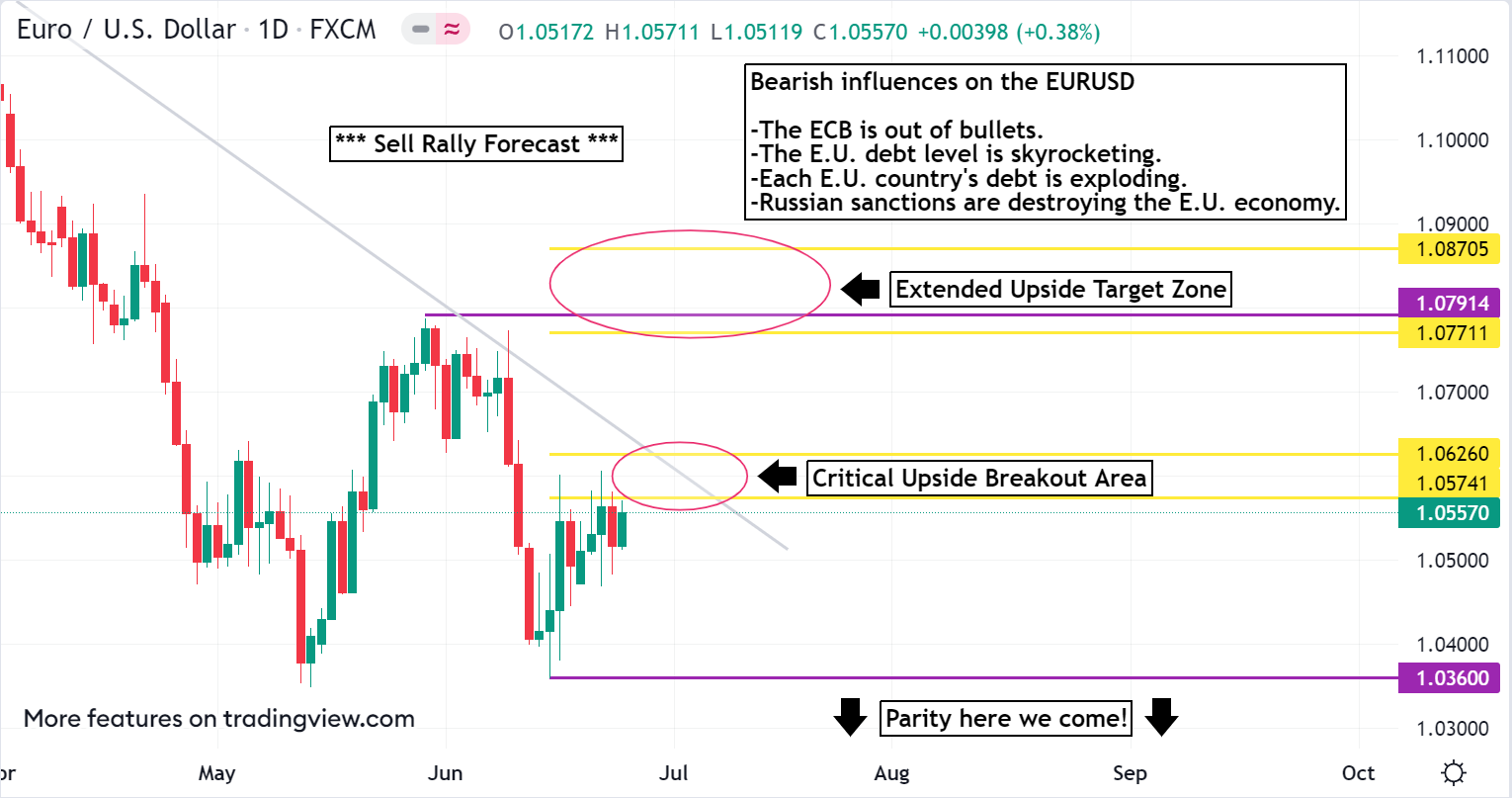

EURUSD Weekly Outlook :

What a grind higher it was for the EURUSD Bulls. This is a corrective rally to sell. The 1.0574 – 1.0626 critical upside breakout area is holding. Only a breach of 1.0626 confirms strength for an extended push towards the 1.0771 level. It is very unlikely that there is enough gas in the tank to get any further than this area. The E.U. is a disaster spiraling out of control economically.

Trading under 1.0574 keeps this cross rate poised for a slide down to search for new lows targeting 1.0360 and beyond. Do not fight any dip below here. The long term trend is a Bear, and it is unlikely the EURUSD can maintain a neutral to higher trade. Parity is likely to be hit by summer’s end.

GBPUSD Weekly Outlook :

Winding its coil tight the GBPUSD is ready to spring. The Buy Signal reached its initial target area. Use caution as this Forex market flirts with an upside breakout. It is unlikely that the market will breach the 1.2413 level. Only a print above here confirms the strength to extend any fresh rally. The 1.2782 – 1.2986 resistance band is the longer-term upside target zone.

Bears need to key off of the DXY. If the USD firms up then the GBPUSD will likely go support hunting. Trading under 1.2298 has this FX pair targeting the 1.1928 level. This is not a break to fade. Any failure of 1.1928 is an indication that USD Bulls are not through slamming the GBPUSD. Look out below. Hitting the 1.1790 area is not out of the question.

USDCHF Weekly Outlook :

USDCHF traders had a bit more trending action than many other pairs last week. Probing new move lows through Friday’s trade. Key support rests around the 0.9525 level. If the Bear trend is going to continue then the volatility has the potential to drive this cross rate towards the 0.9336 – 0.9277 extended downside target zone. However, fundamentals just do not point towards this type of move.

Key off of Friday’s low looking for a bounce back up to the 0.9786 – 0.9847 area. If this market is set for sideways to lower, than this should cap any rally this week. Trading above 0.9847 should not be taken lightly. Upside buying pressure is expected to build in this area. A challenge of 1.0047 is on the menu, and sustained trading above parity if the DXY gets a rally. Watch the 30yr T-Bonds too for USD bias here.

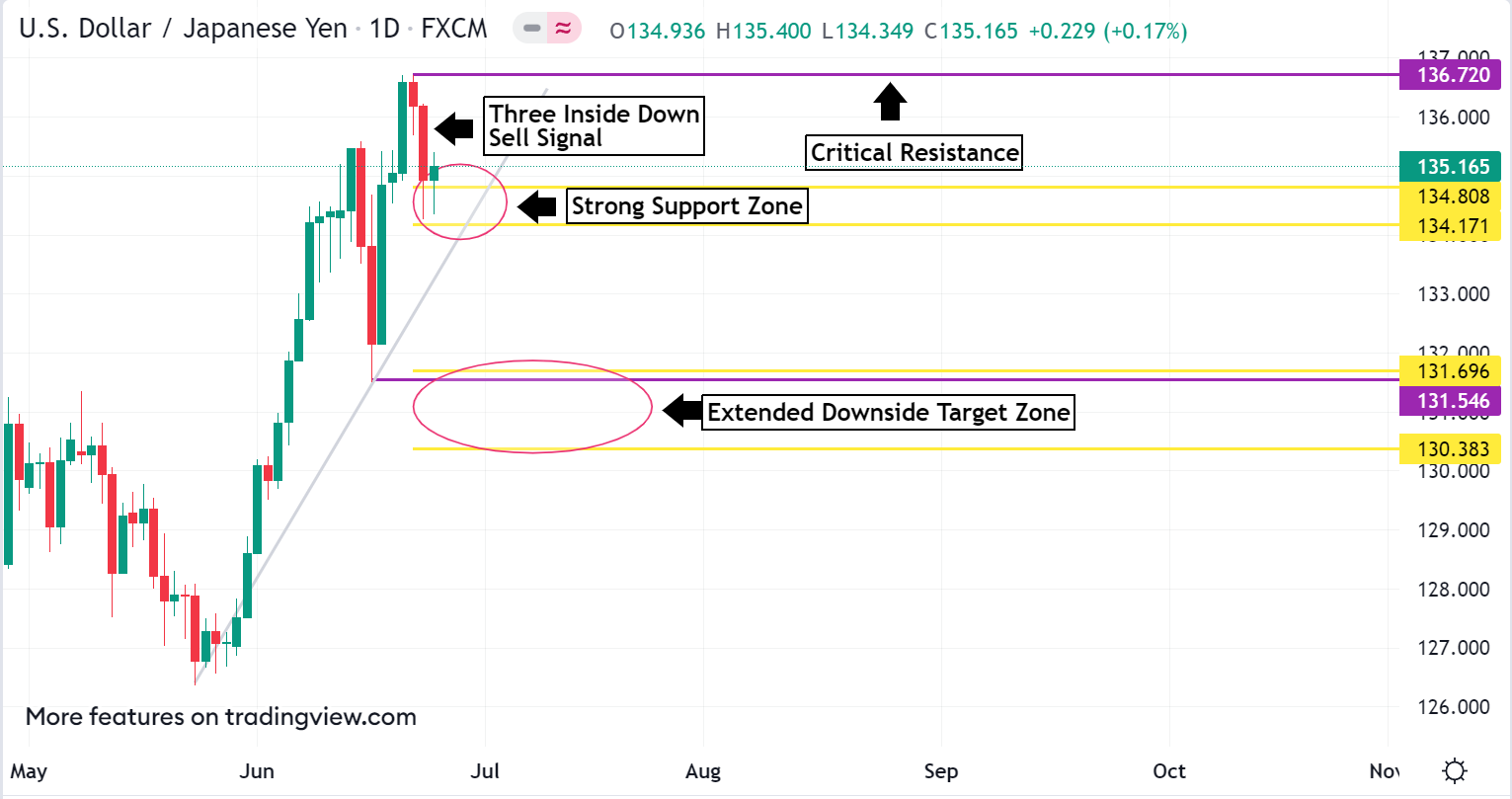

USDJPY Weekly Outlook :

USDJPY touched off a short-term sell signal last week. The initial short term target zone of 134.80 – 134.17 is holding. A sustained trade below 134.17 is needed to confirm weakness. 131.69 – 130.38 is the extended downside target zone. As long as Crude Oil is stable to higher, and the U.S. interest rate markets are on edge the USDJPY is a Bull.

The sell signal is a counter trend signal in a very aggressive Bull market. Trading above 134.17 keeps the Bulls afloat, and a run at resistance is likely. Weak shorts are expected to get blown out and fuel a fresh wave of buying. A rally above 136.72 may set the Bulls up for a nice bonus move. 139.40 is the longer-term upside objective.

AUDUSD Weekly Outlook :

AUDUSD has settled into a rough range trade. Wait for a breakout. Sustained trading above 0.7070 puts the Bears on edge as the Bulls try and make a go of it. The 0.7258 – 0.7350 upside breakout target zone should put a cap on any Bullish strength.

Remember the overall trend is a Bear. Watch out for the 0.6852 support level. It is expected to get dicey as the Bears squeeze weak longs out and drive this Forex pair down towards the 0.6680 level.

NZDUSD Weekly Outlook :

NZDUSD traders are having a tough go of it. The trend is your friend, and it is a sell rally forecast here. Trading under 0.6398 sets the Bears up for a test of 0.6194 this week. It should get volatile in this area. Downward momentum in the long term has the potential to take this market to 0.5830 before a longer-term bounce may occur. Very Bearish fundamental and technical influences for the NZDUSD.

Only above 0.6398 can the Bulls find some extra strength. 0.6579 is the first stop on a move that should run out of steam in the 0.6612 – 0.6714 upside target zone. A big rally in the U.S. interest rates would be the only real unforeseen influence that could propel the NZDUSD to these levels.

USDCAD Weekly Outlook :

Wow! Tight range trade…Big range trade. This market has lost its sense of direction. USDCAD is hovering under critical resistance. Expect an early test of support down to 1.2857. This is the line in the sand if the Bulls have a chance at holding up this pair. Trading under 1.2857 targets the 1.2797 – 1.2732 critical support zone. Back into the heart of a long-term range trade.

The 1.3017 – 1.3079 critical resistance zone is keeping the ceiling in place. A breakout above this area is not very likely. However, if the DXY explodes to higher levels, and the 30yr T-Bond collapses to new lows…. The bulls may be able to finally bet a longer-term rally going. Not likely though.

Disclaimer: Trading in securities such as stocks, options, indexes, currencies, and futures involve risk and should not be undertaken without due diligence and serious independent study. Options, stocks, currencies and futures trading, involve substantial risk. Subscribers may carry out their trading based on what they learn from “Teddy Kekstadt’s Forex Market Analysis” however all risks of potential financial losses are the customer’s responsibility. TFNN, Corp. will be in no way liable for financial losses resulting from trading decisions based on this newsletter. Past performance is no guarantee of future results. Reproduction in whole, or in part, is not permitted without prior written consent. Copyright 2022 all rights reserved.