The Tiger Forex Report 1-23-23

The Tiger Forex Report – Week of 1/23 – 1/27/2023

DXY remains hard pressed, and the Bears are ready to flirt with new move Lows.

Crude Oil is holding firm, and it is probably USD weakness that is keeping the Bulls from making a play for the 87.45 level.

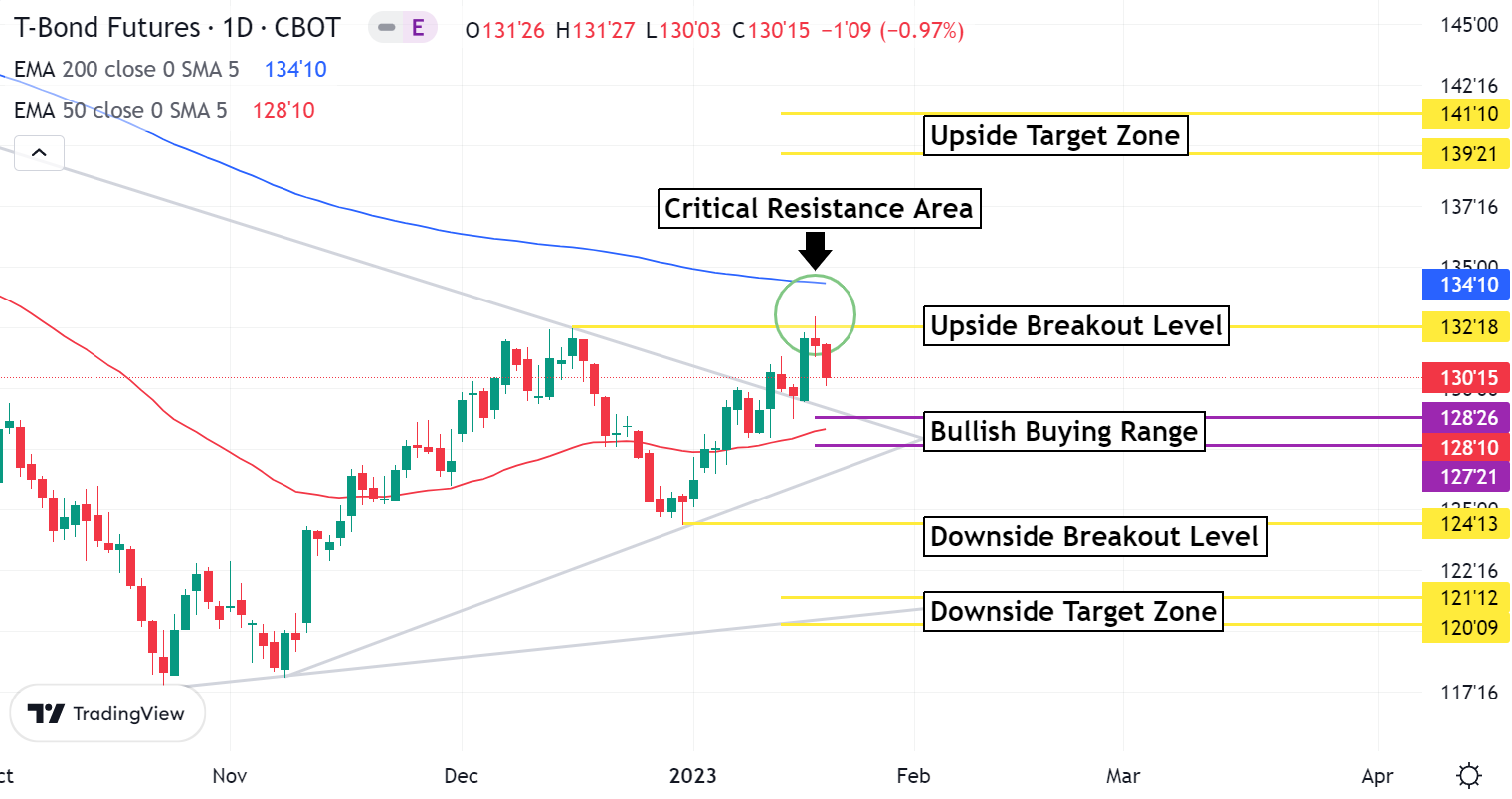

30yr T-Bond could set the tone this week. The market fell off a new move high and looks like a profit taking correction is brewing.

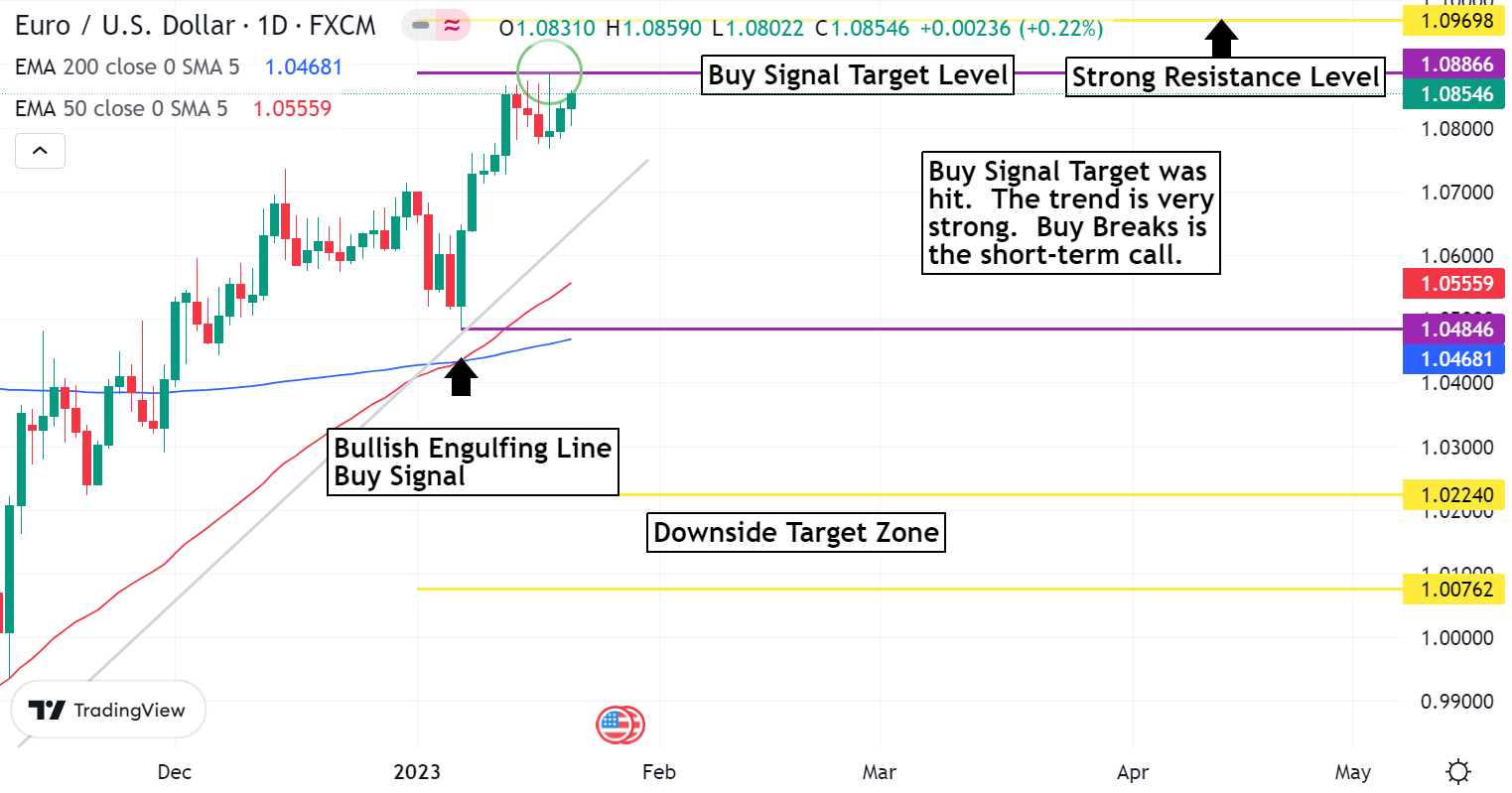

EURUSD Weekly Outlook:

The Bulls are relentless, and more prodding to the upside is likely early in the week. Sustained trading above the 1.0886 Buy signal target is a positive indication that newer move highs are on the agenda. 1.0969 is the objective on a move that has the potential to reach 1.1084 before there is any slowdown in the trend.

Below 1.0886 the EURUSD is set for a neutral trade back towards the 1.0700 area. Watch Yields this week. If the treasuries sell off then it is very possible a nice corrective sell off may unwind here too. 1.0484 is the key support level, and it is unlikely that the Bears have the potential to drag this FX pair back to these levels anytime soon. The clock is ticking down to the next Fed meeting. That means that the market will be very jittery for a few weeks. Can you imagine if the Fed does a half point raise??? That is all that the broad consensus expects out of the next three meetings. We may have a very interesting crossroads situation ahead of us very soon.

GBPUSD Weekly Outlook:

GBPUSD Bulls are holding a steep slope, and the trend is expected to stay firm. A challenge of last weeks high will be the key directional resistance level to be aware of. A breach of 1.2443 this week should spark fresh buying, and a test of the 1.2490 level is not out of the question. This currency cross is in a buy break posture that should not be discounted.

If the market falls under the 1.2352 level, then a corrective slide may develop. It will be rough to maintain any strong slide unless there is a rally in yields. The GBP may be strong, but the USD is the weaker currency in the short-term. Fundamentals are helping to boost the GBP, but will it continue? If the treasuries begin a nice break this week, then the Bears may get a chance to drag the GBPUSD back towards the 1.1843 level. This area is likely to hold, unless the Fed is more Hawkish than the consensus believes. Things should get interesting the next few weeks.

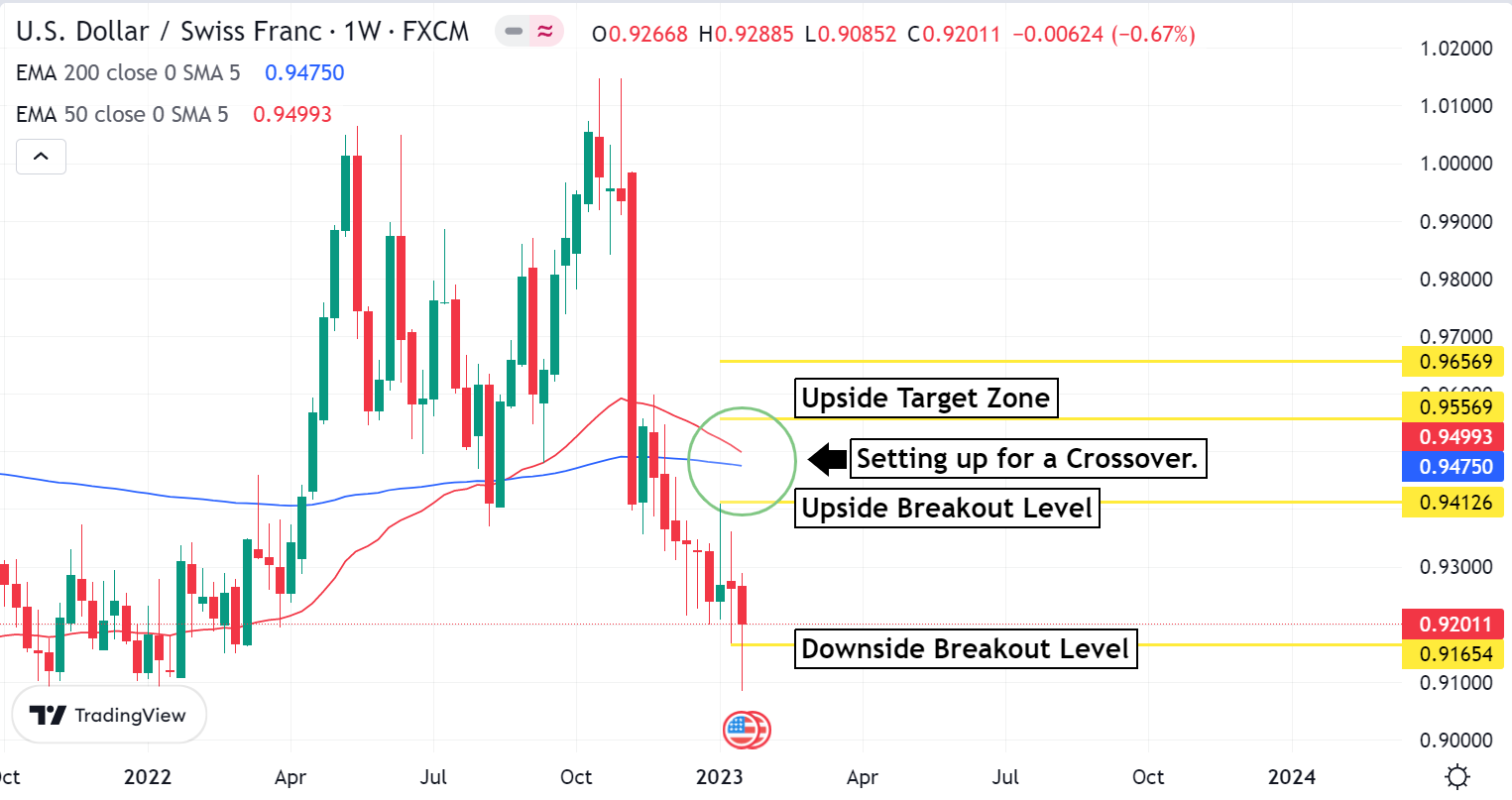

USDCHF Weekly Outlook:

If there is a currency that is Bear it is the USADCHF. Be careful with this one for a while. Technically this market is oversold, and fundamentally it has weakness too. However, the reality is that this is one of the currency pairs that is on its own mission. Use the 0.9165 downside breakout level for direction. Trading below here rips the rug out again for a slide down towards the 0.8955 level.

A sustained trade above 0.9165 will have this currency in a holding pattern up to the 0.9412 upside breakout level. Heavy resistance is expected in this area. It is unlikely that the Bears can hold a rally, but the Fed may give a gift. If the Fed gets more Hawkish, then there is a likelihood of an extended rally that targets the 0.9556-0.9656 upside target zone.

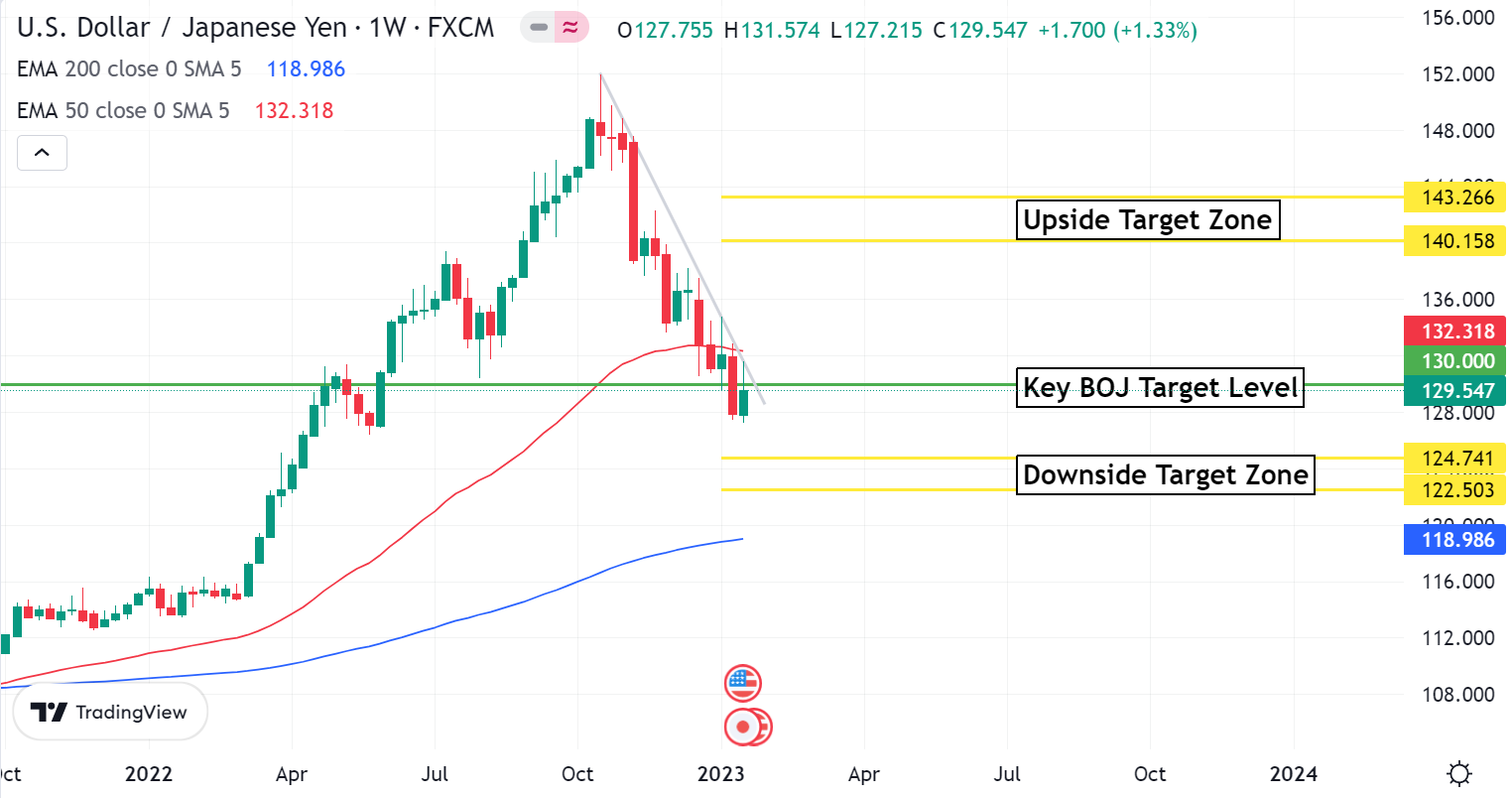

USDJPY Weekly Outlook:

If there was an exciting time to trade the USDJPY it is now. We are on the cusp where the Japanese may start to deviate from the disciplined path that they have been clinging to. The 130.00 level is the pivot to use for directional bias. Below this point the Bears are looking to make a play for the 124.74-122.50 downside target zone. This is all that is likely for newer move trend lows. The BOJ still needs to pass the torch to confirm our bias.

Trading above 130.00 will be very tough. Use caution trying to buy this market. Wait for a valid signal. If Yields rise, and if Crude Oil rallies more, there may be such an opportunity. The 140.15-143.26 upside target zone is all that is in the cards for a “corrective” rally. All bets are off if the USDJPY continues higher from this area. The Fed is always full of surprises, and you should not underestimate that.

AUDUSD Weekly Outlook:

AUDUSD traders are having a bit more trouble with maintaining a bullish posture than other Forex pairs. The long-term trend is still a Bear, and the technical aspects concur. Use last weeks close for directional bias. Above 0.6967 this currency will try and make a play for resistance. 0.7149 is the first key level to rise above. Only a rally above here would confirm long-term strength for a move up into the 0.7261-0.7358 upside target zone.

Trading under 0.6967 should have the AUDUSD retesting lower price levels. A print under 0.6883 would be just the signal to confirm long-term weakness in the market. The 0.6631 downside breakout level then becomes the next objective. Do not take this area likely. Trading under this level would be a significant indication that this currency is back on the long-term Bear trend.

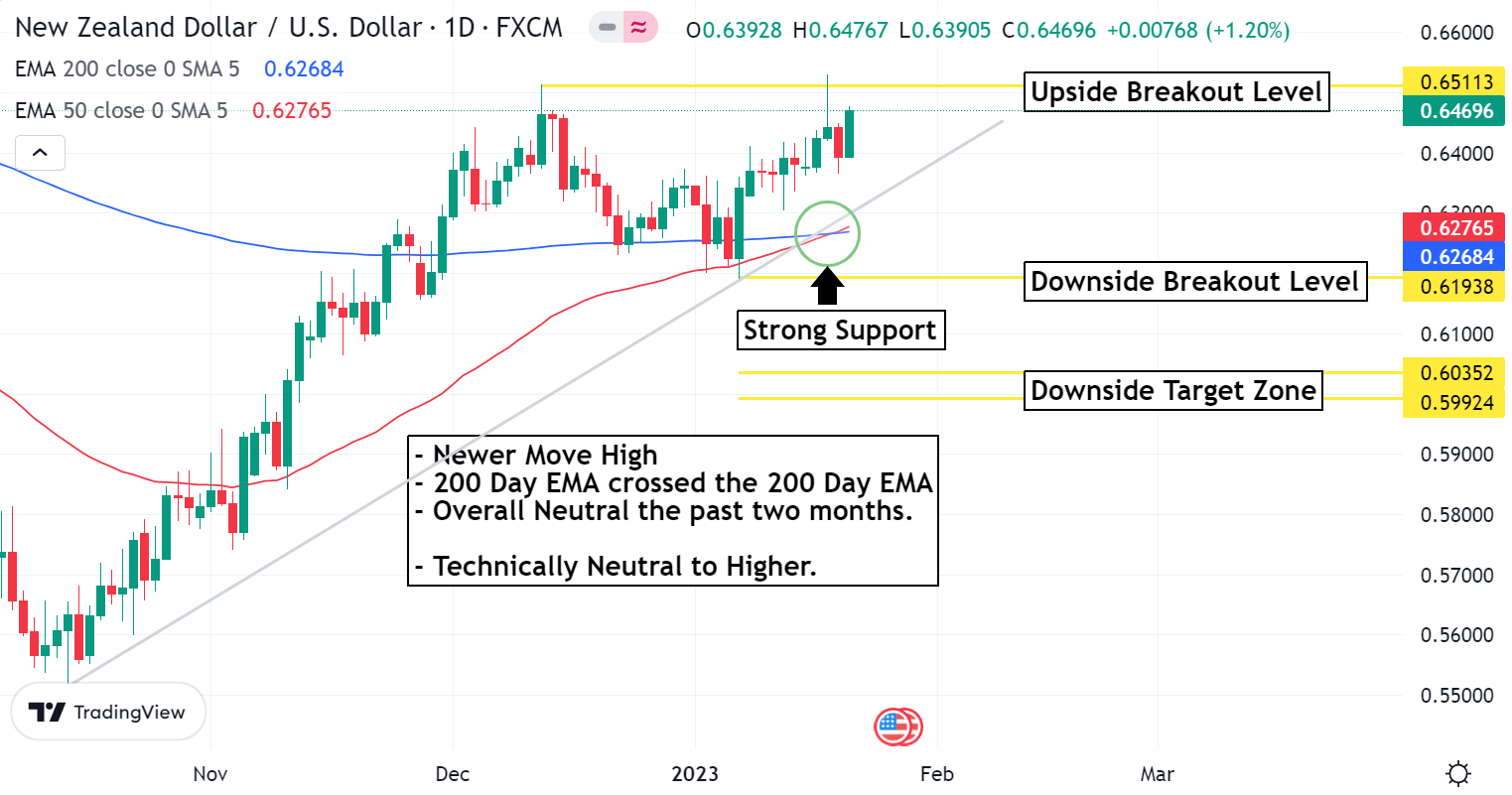

NZDUSD Weekly Outlook:

The NZDUSD is making a weak attempt at holding the bullish trend. A close above the 0.6511 upside breakout level is necessary to confirm that the trend is holding firm. Should this occur, then the upside target extends newer move highs up towards the 0.6721 level. If the Fed starts to prove it is not going to remain Hawkish there may be a hope for such a rally. But that need to be confirmed by the Fed.

Below 0.6511 the market is in a wide range trade back down to the 0.6193 downside breakout level. This is a big pivot point for the NZDUSD. A break under here targets the 0.6035-0.59992 downside target zone. There are many mixed signals for the future direction for this currency cross, and it is going to be a challenge to say the least for the next few months.

USDCAD Weekly Outlook:

USDCAD Bears are falling off a lower move high, and a search for lower move lows is now the challenge. Trading under the 1.3388 downside breakout level sets the market up to make a go at the 1.3157-1.2988 downside target zone. The technical and fundamental elements to this currency are very mixed, but the trend is a clearly a Bear. If you are looking to buy into the current slide, then make sure to wait for a strong Buy signal.

Trading above 1.3388 would keep the market in neutral up to the 1.3516 upside breakout level. If the USDCAD gets back into this area it is likely to be a choppy trade. Only a close above 1.3516 confirms the Bullish resolve of this FX pair. If Yields rise fast and strong, then there is a likelihood of the market accelerating through resistance. The long-term objective then becomes the 1.3941-1.3991 upside target zone.