The Tiger Forex Report 1-27-24

The Tiger Forex Report – Week of 01/27 – 01/31/2025

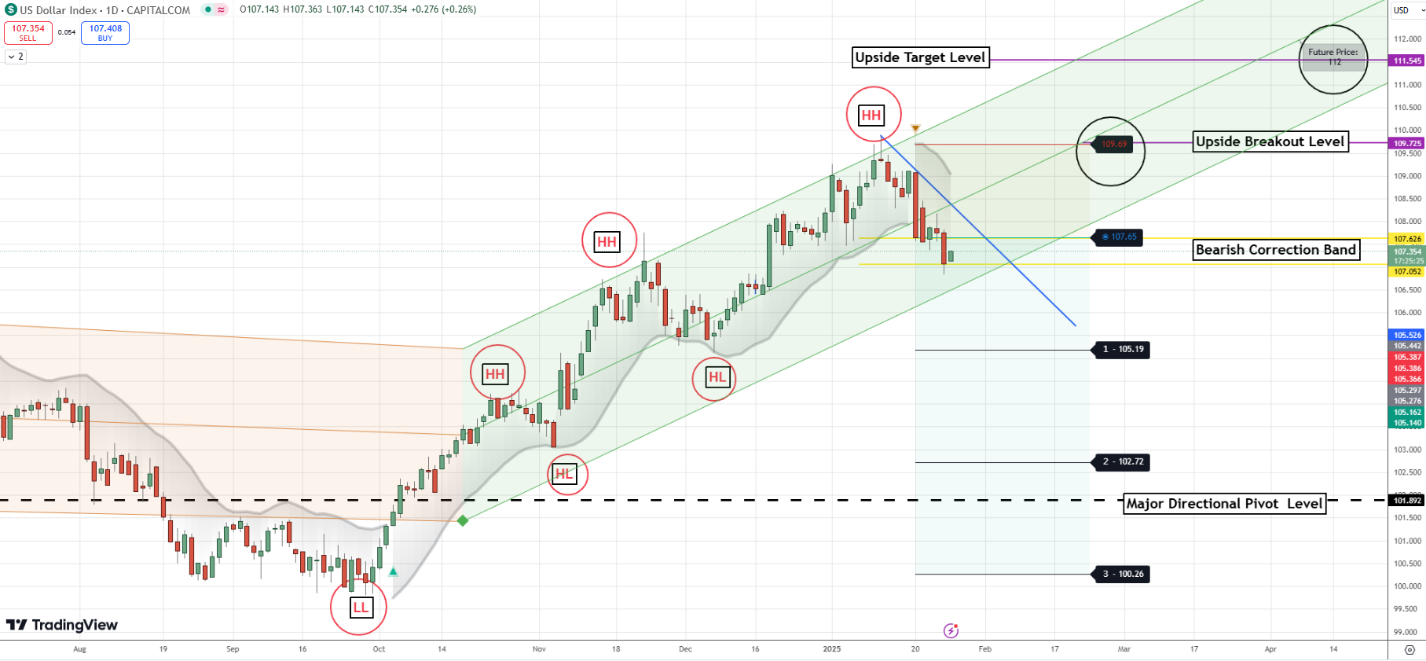

The DXY is on edge as we get close to the first FED meeting of the year. Range trade conditions expected through Wednesday’s trade.

Crude Oil is flirting with yet another lower mover low and more Bearish action is likely.

30yr T-Bond Yields are in retreat as we head into the FED meeting. It will be a waiting game for most of the week ahead.

EURUSD Weekly Outlook:

Is the EURUSD corrective rally running out of steam? Most likely it will settle into a tight range trade until after the FED meeting on Wednesday. The upside correction zone should cap the recent Bullish move. If there is a close above here the market should continue to press on toward the upside target level. This is all that is on the agenda for an extended leg higher. With Yields in retreat, it will be hard for the Bears to spark a fresh move. Only a close below the downside breakout level would change this outlook to very Bearish. Trading below this area would be a good indication that this market will be hinting for new move lows below parity.

GBPUSD Weekly Outlook:

GBPUSD Bulls are trying to press the recent rally into critical resistance. A challenge of the upside breakout level is the early call. If there is a close above here then the Bulls are likely to continue to grind higher into the upside correction zone. This could get more support if Yields continue to pullback. Because of the FED meeting there may be a drag on upside momentum. This would most liekly produce a range trade through Wednesday. If there is going to be a revesal of fortune the Bears need to get below the critical downside correcrtion area to confirm that this currency is set to resume the overall Bearish long-term trend.

USDCHF Weekly Outlook:

A test of the downside breakout level is on the menu for this week as the market goes into pause mode while waiting on the FED release. It is time for a profit taking correction. The Bearish correction band is a solid area for the market to fall back into. There is not much more likely to the downside unless the Bears get a close under this area. That would be a very negative indication that an extended corrective slide is building and will be looking to head toward the downside target level over the next few weeks. The Bulls are not likely to show up this week. It would take a rally above the recent Daily high to confirm that a new trend rally is setting up. Otherwise, it will be a sell rally forecast for the next week.

USDJPY Weekly Outlook:

Lower Yields and lower Crude Oil prices may be able to get the Bears a nicer move this week. Fundamentals are leaning in a Bearish way, and a sell rally outlook is the call for the beginning of the week. A test of last weeks low is likely, and a fresh wave of selling pressure should enter the market. If this occurs, it would be a good indication that the market is looking to start to trend toward the critical BOJ threshold level and the downside correction band area. If the Bulls want to regain control it would take an explosive rally above the critical resistance band.

AUDUSD Weekly Outlook:

Aussie Bulls got a leg up last week, and more resistance challenging is in the cards for the week ahead. Do not get over confident. This is viewed as a short-term upside correction, and the rug is likely to get ripped out from under the Bulls hooves soon. Sustained trading above the upside breakout level would be a positive sign that the market is trying to make a play for the upside correction zone. Not much more is likely to the upside because the AUD forecast is a disaster. Remember after the FED meeting it is very possible that the Bears will return in full force and body slam this currency back to the recent trend lows.

NZDUSD Weekly Outlook:

Well, there is not much to say about the NZDUSD except that it is in a digestive range trade with weak Bullish intentions. This currency is trying to get a corrective rally going, but NZD fundamentals are just that bad that it will be hard to maintain any rallies this week. A choppy trade is the forecast so be warned. Wait for a valid signal. The upside correction zone is the extreme for a higher trade this week and if the market gets back to these levels, it will most likely be a spike high situation. Only a failure from the recent Daily low will cancel the sideways outlook. Trading under here would confirm that the long-term trend is back in play and the long-term Bearish target will be in traders’ sights.

USDCAD Weekly Outlook:

Ho hum trading is the call for this market through Wednesday’s FED meeting. Trading is likely to be contained between the upside breakout level and the downside correction band. The market will be riding the lower end of this range most likely until after the FED meeting is over. The best advise is to wait for a new tend move confirmation either way. A close above the upside breakout level should set the market up to continue higher into the critical resistance area. If the Bears are going to retake control there needs to be a close below the downside correction band. Thus, indicating that this currency will be working its way back toward the downside breakout level.