The Tiger Forex Report 1-3-23

The Tiger Forex Report – Week of 01/02 – 01/06/2022

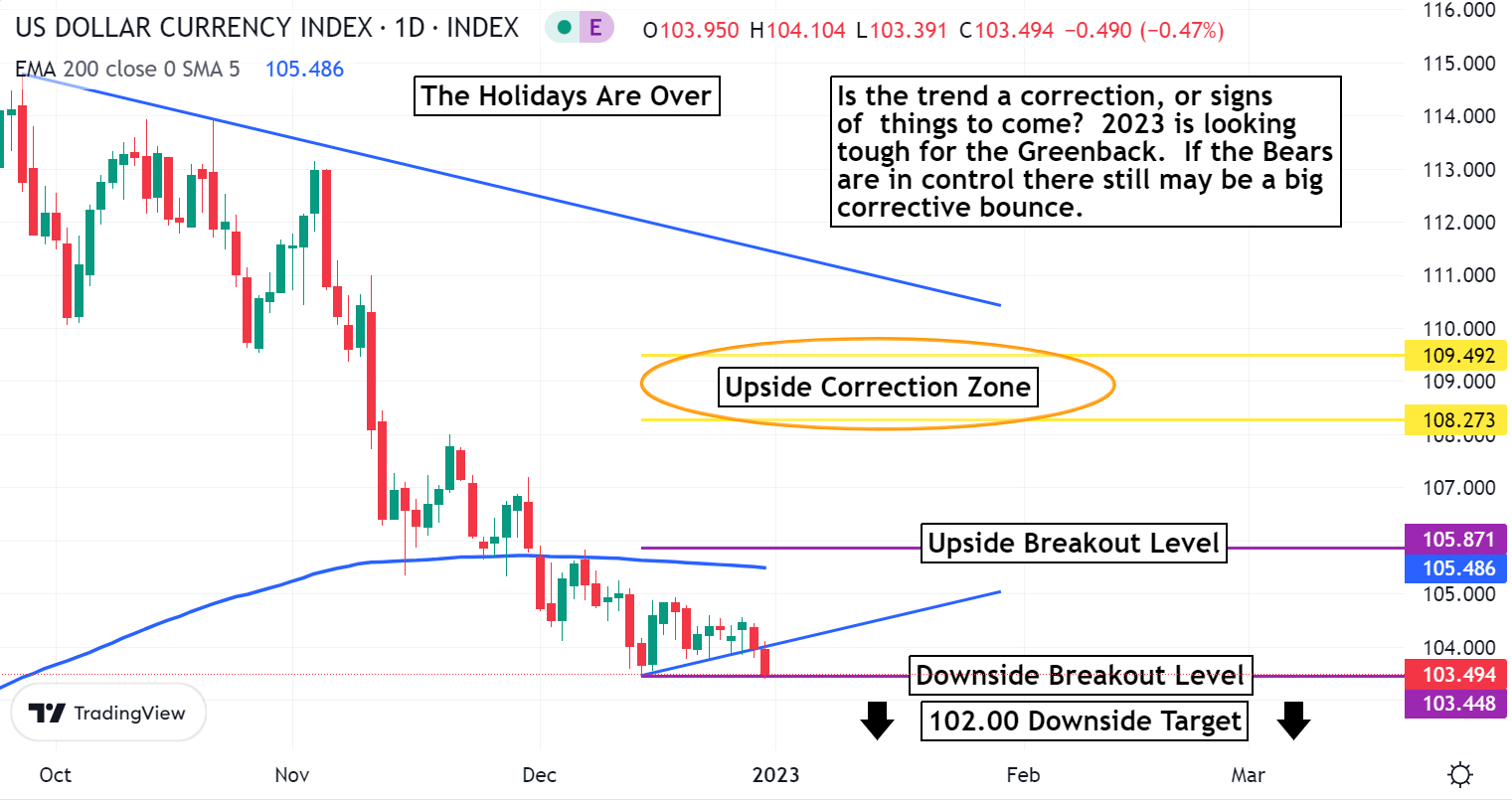

DXY Bears are leaning on new move lows to start 2023. Is this more than a correction?

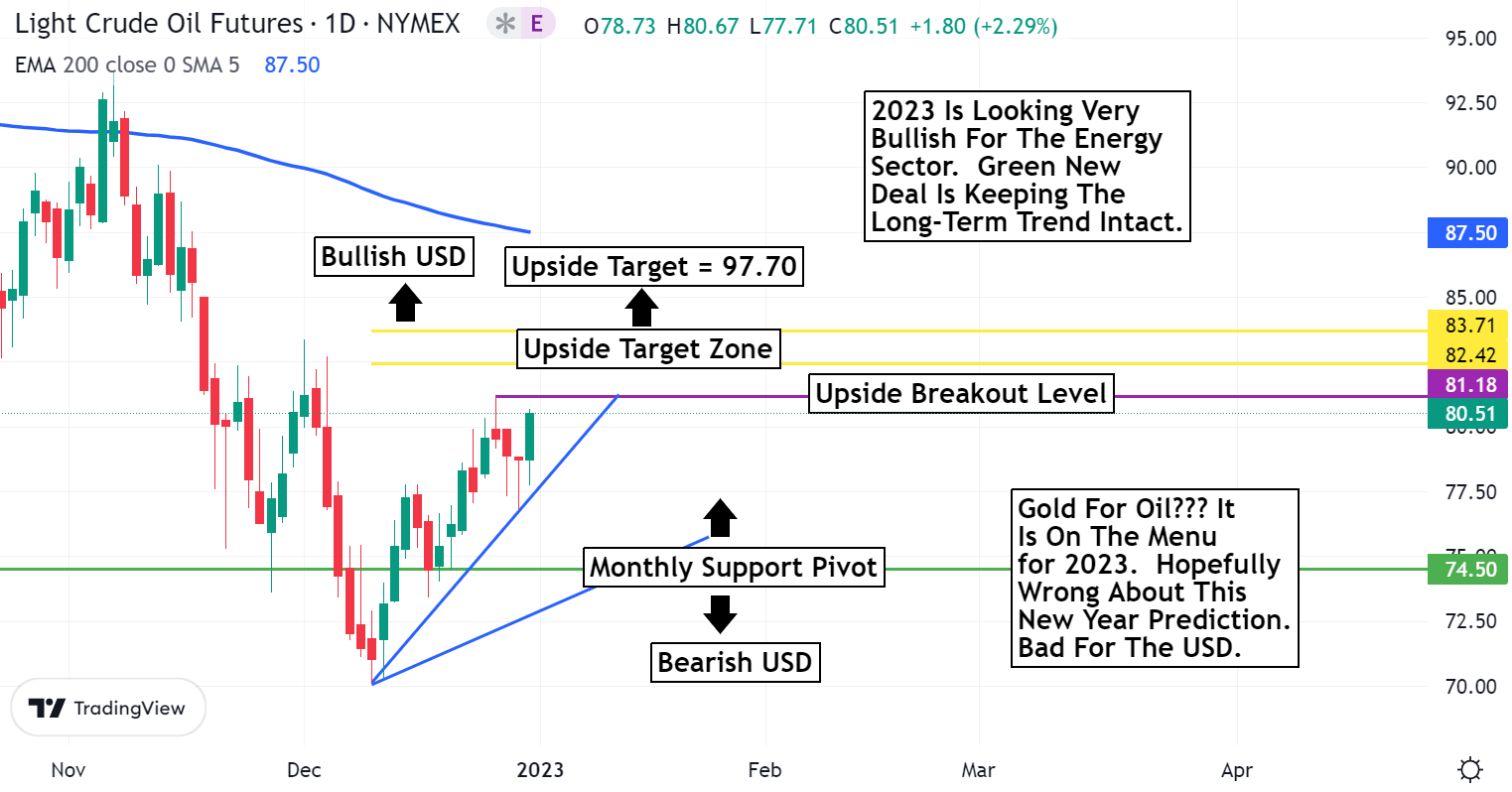

Crude Oil Bulls are looking to press the upside correction.

30yr T-Bond settled down for the holidays markets, but they are over. Another Break is expected.

EURUSD Weekly Outlook:

Waiting for a move. The EURUSD will not be an easy trade this year. Trading between the directional pivot level and the upside breakout level will be a tough range trade. A challenge of resistance is expected early in the week. Bulls are in control of the trend, and this market could hit 1.0914 before there is another pause.

A break below 1.0536 sets this currency on edge for a slide that will be looking to test the 1.0443 downside breakout level. This is it for a slide if the short-term trend is to remain. A failure from here is a negative sign that fresh selling is returning to the market. The 1.023-1.0115 downside target zone is the extended downside objective. If the market falls back into this range, it is likely to hold if the long-term trend is to remain a Bull. Otherwise, the EURUSD may unwind in a big way.

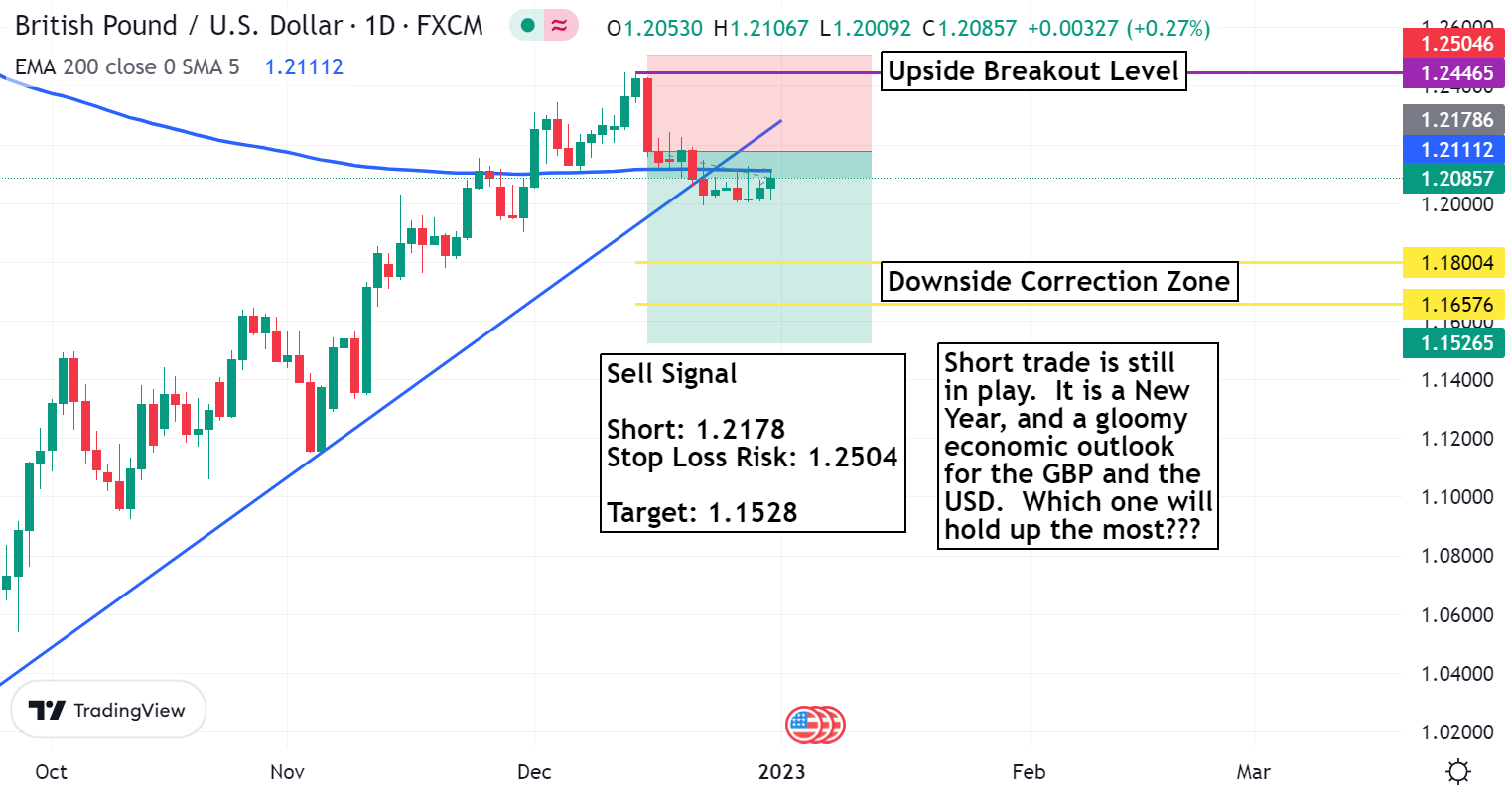

GBPUSD Weekly Outlook:

GBPUSD traders should expect an early test of support this week. The sell signal is still active, and the Bears should make a play for the downside correction zone. Trading in this area would satisfy the signal, and if it is just a corrective break, then the market should hold up. All trading under 1.1657 would extend the negative outlook down towards the 1.1477 level.

Up to the upside breakout level this market will be in limbo. Only a rally above this area confirms Bullish strength that targets new move highs up towards the 1.2650 level. Under the current market factors, it is unlikely the market will get above here. A big drop in yields would most likely be needed for an extended rally to manifest.

USDCHF Weekly Outlook:

If there is a currency that is likely to hurt the USD this year it is the CHF. Short-term the Bears are flirting with newer mover lows. Be careful not to try and catch a falling knife. A dip below last Friday’s low is a negative indication that the market is ready to make a play for the 0.9066 level. Over all the forecast is a sell rally outlook for the USEDCHF moving forward into 2023.

This market has been under pressure, and a corrective bounce is likely on any major show of USD strength. Up to the upside breakout level this market will be in a corrective mode, and may only yield a sloppy range trade environment. If there is a breach of 0.9606 then the Bulls have the potential to drive the market up towards the 0.9860 upside target.

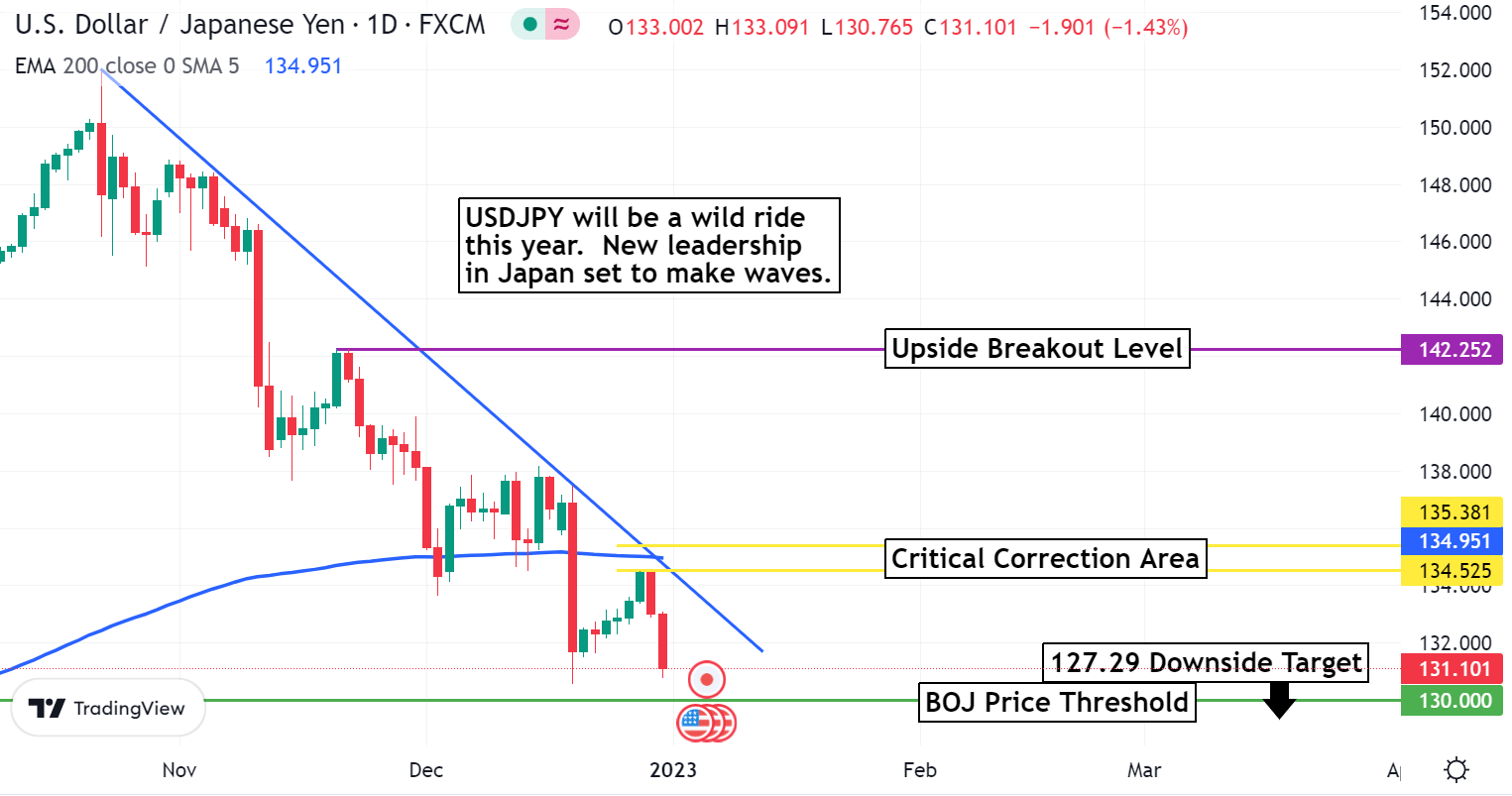

USDJPY Weekly Outlook:

Another market that the USD may have trouble with this year is the USDJPY. There is new leadership for the BOJ this year, and other economic variables that will make the JPY less weak than the past year. Short -term the outlook is negative, and a test of the 130.00 level is on the menu. Sustained trading under here would confirm extended weakness that targets the 128.45 area.

A rally back into the critical correction area is needed to put the Bearish campaign on hold. It will likely be touch and go in this area. If the Bulls can hold a trade above this area, then a correction back towards the 142.25 upside breakout level is the forecast. Use caution if the USDJPY trades back up at these levels. Unless there is a strong rally in yields it will not be easy for the market to sustain any upside action beyond this area. However, if there is a heavy sell off in the 30yr T-Bonds, then the Bulls will have the opportunity to lift this market back up towards the 146.25 level.

AUDUSD Weekly Outlook:

Aussie Bulls are looking to ring in the New Year with a Bullish test of the upside breakout level. Be careful selling into newer move highs. Upside momentum is expected to build and drive this market up towards the 0.7070 upside target. 0.7264 is the extended upside objective.

Trading under the upside breakout level has this market set for sideways. If the Bears are going to get feisty, they will flirt with the downside correction zone. Current market forces should keep the market firm in this area. Only a failure from 0.6510 confirms weakness, and an extended slide that targets the critical support pivot level. This should hold up any extended slide. However, a big rally in yields could change the outlook, and give the AUDUSD Bears a shot at hammering new weekly lows beyond this area.

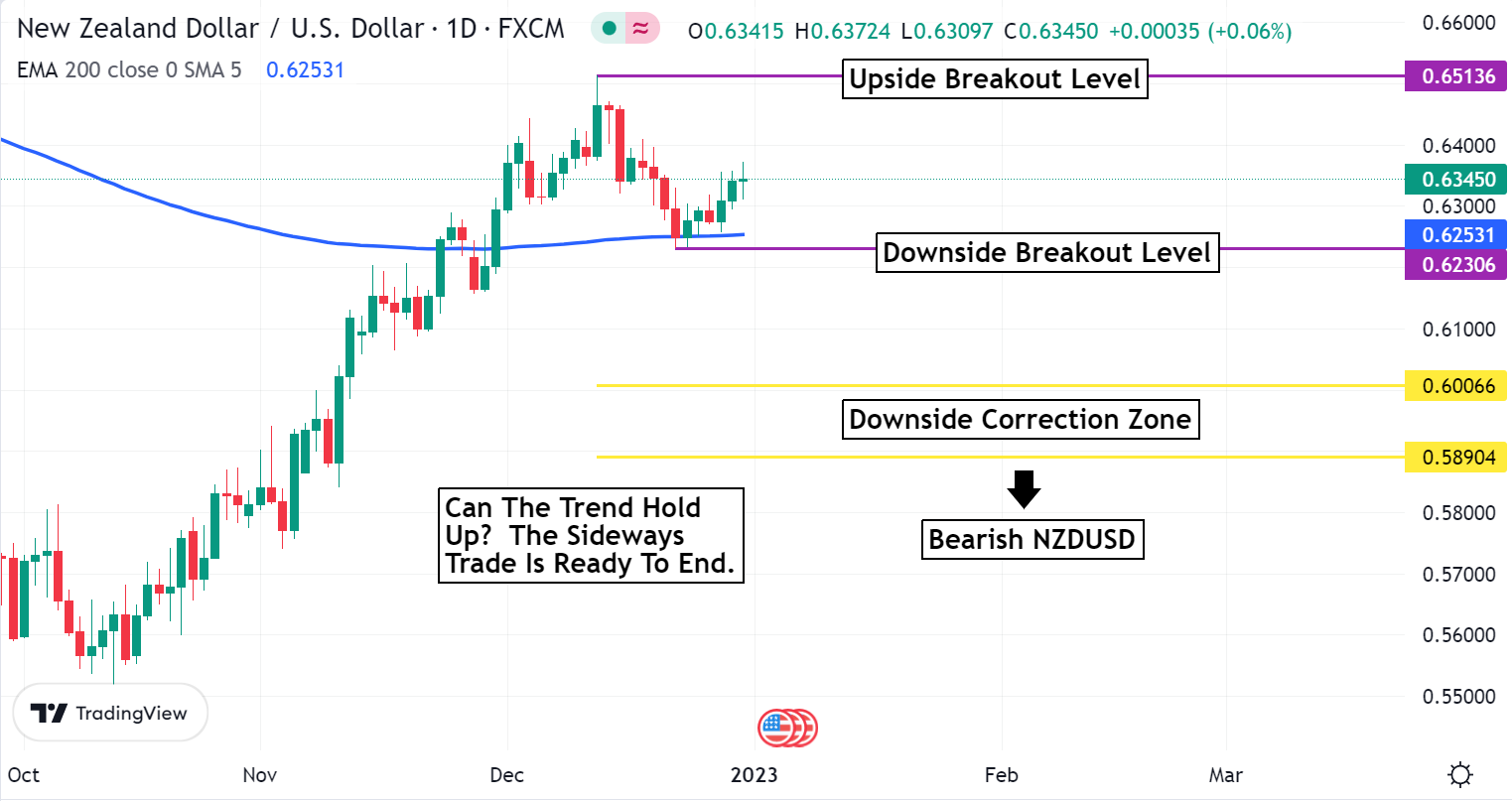

NZDUSD Weekly Outlook:

NZDUSD Bulls are fighting to hold this market up. Trading above the downside breakout level keeps the Bulls in motion for a grind of a trade up towards the upside breakout level. Do not fight a rally above the 0.6513 area. A breach of this resistance is likely to fuel fresh buying that targets the 0.6710 level.

If the Bears dip under the downside breakout level it would be a negative sign that the Bears are set to make a play for the downside correction zone. If the overall trend is stabilizing, or becoming bullish then, this is about all that should manifest out of a lower trading market. A failure from 0.5890 would change the longer-term outlook for this currency pair, and extend the downside target towards the 0.5688 level.

USDCAD Weekly Outlook:

Happy New Year USDCAD traders. Will the market bust out of this wide range trade in 2023? Well, most likely it will. However, it may take a while. Right now, it will be a grind higher with the market flirting with the downside resistance channel line keeping the trend under pressure. If the Bulls can press newer daily highs, then a play for the upside breakout level is likely. If yields firm up then it may help to support a move back up to these levels. Any print above the upside breakout level should spark fresh buying that targets the 1.4111 upside target level.

Down to the directional pivot level the USDCAD will be set adrift in a tough trade. A failure from the 1.3317 level is necessary to confirm weakness that targets the Monthly downside correction level. A slide back to this area is not very likely unless there is a strong pull back in yields, and an overall weak USD versus the broad market of FX pairs. Once there is a close under the directional pivot level, we will have an update on the likelihood of extended bearish weakness in this market.