The Tiger Forex Report 1-30-23

The Tiger Forex Report – Week of 1/30 – 2/3/2023

DXY is falling into a holding pattern. The index may be setting a base.

Crude Oil is having trouble with direction, and may be setting a wide range trade situation.

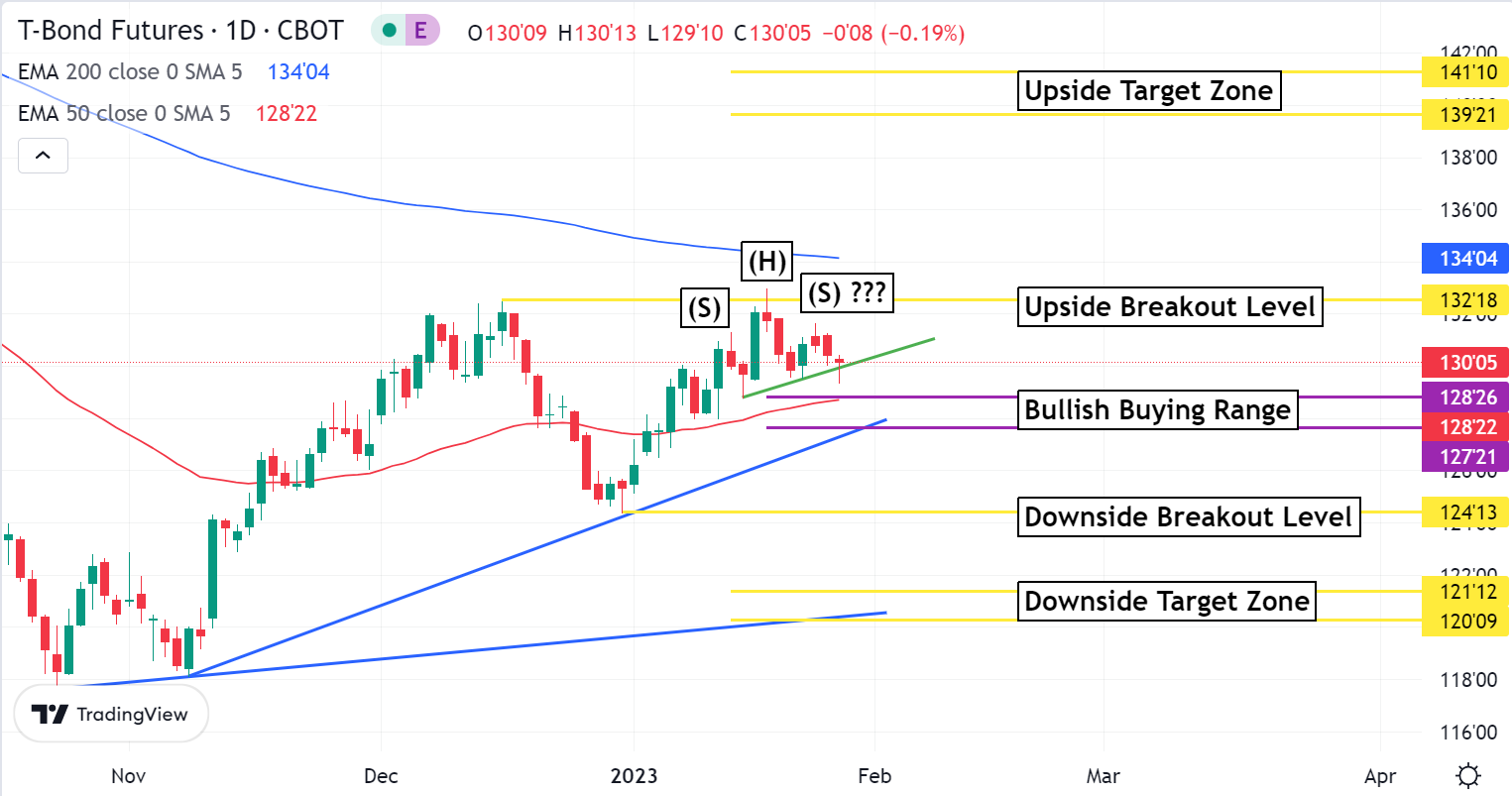

30yr T-Bond may be setting a Head & Shoulders pattern. Yields may start to get a boost again soon.

EURUSD Weekly Outlook:

EURUSD Bulls remain poised to press new move highs into the 1.0967-1.0840 upside target zone. The ECB is ready for another rate hike, and it should be at least a .50% raise. This is likely to help support the currency in the short-term, but how sustainable is it? A sideways trade is what is expected to develop over the next few weeks. The real question is if the Fed is done raising rates?

Trading back down towards the 1.0484 downside breakout level will be a nightmare of a trade. There is too much indecision about the next few months and central bank policies. Only a failure from 1.0484 confirms weakness in the EURUSD for a slide that targets the 1.0275 area. Not much more downside action is likely because of the ECB short-term Hawkishness. Sustainability by the ECB is not the only issue to beware of. Economic numbers have been mediocre at best, and are very fragile. Any spikes of inflation are sure to keep the Fed focused on curbing any such impact. This would not bode well for this currency, and a bearish trend may return.

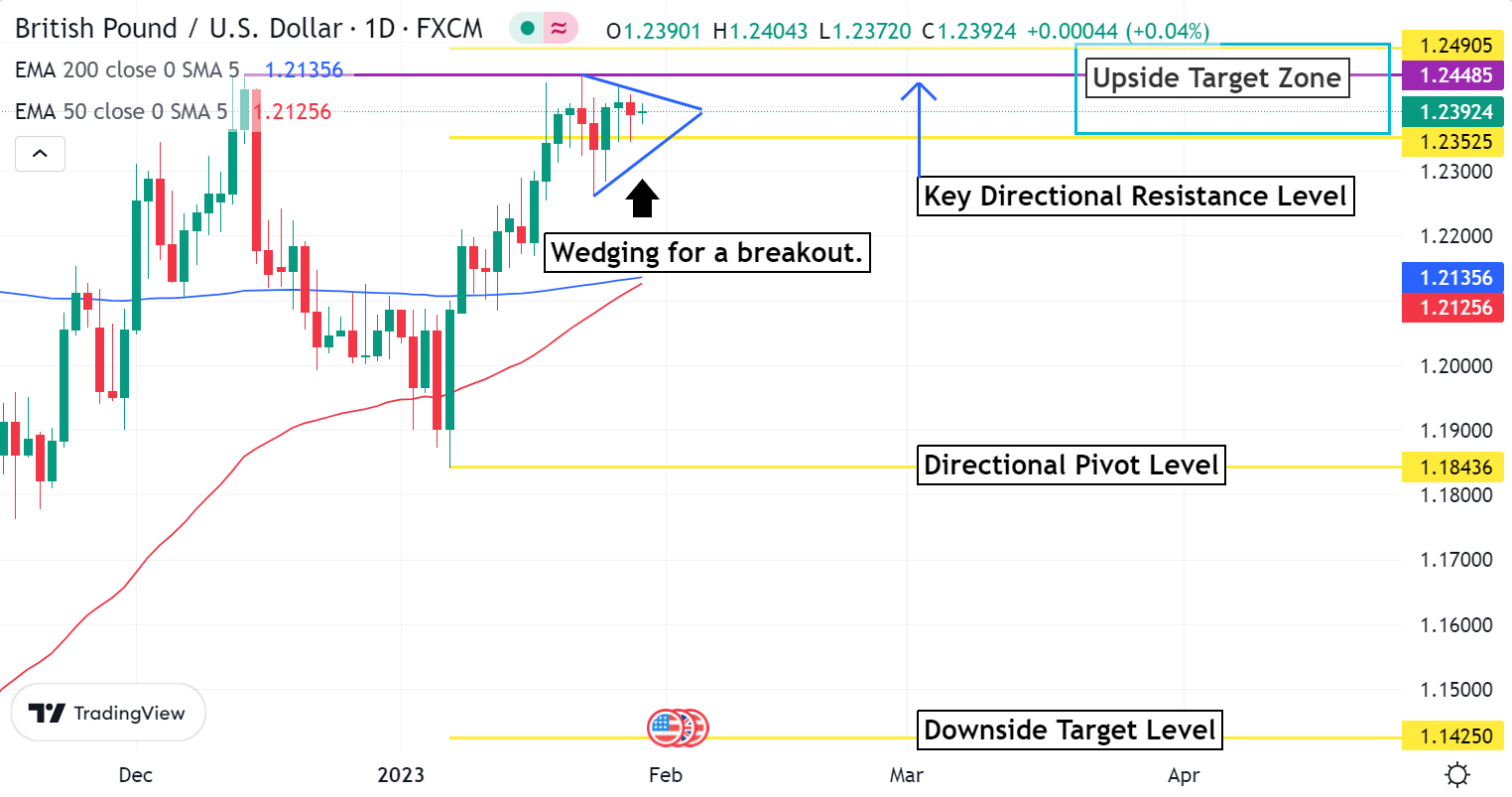

GBPUSD Weekly Outlook:

GBPUSD Bulls are struggling with resistance, and this currency pair is starting to wind up tight. For the past week the market has been set adrift in our upside target zone. Key off the 1.2352 level for directional bias this week. Trading above here keeps the Bulls set to press for higher move highs. A challenge of 1.2490 is not to be taken lightly. Fresh buying is likely to spark a new leg higher that targets the 1.2564 level.

Trading under 1.2352 should put this currency pair on edge for a break back towards the 1.2135 area. A lower trading market that develops may just drag the market back towards the lower part of the range that has been set over the past few months. Short-term the fundamentals are not strong enough to hammer the GBPUSD lower. 1.1843 is the extreme for any harsh sell off. Mostly this is because the Fed is no longer raising at an aggressive pace.

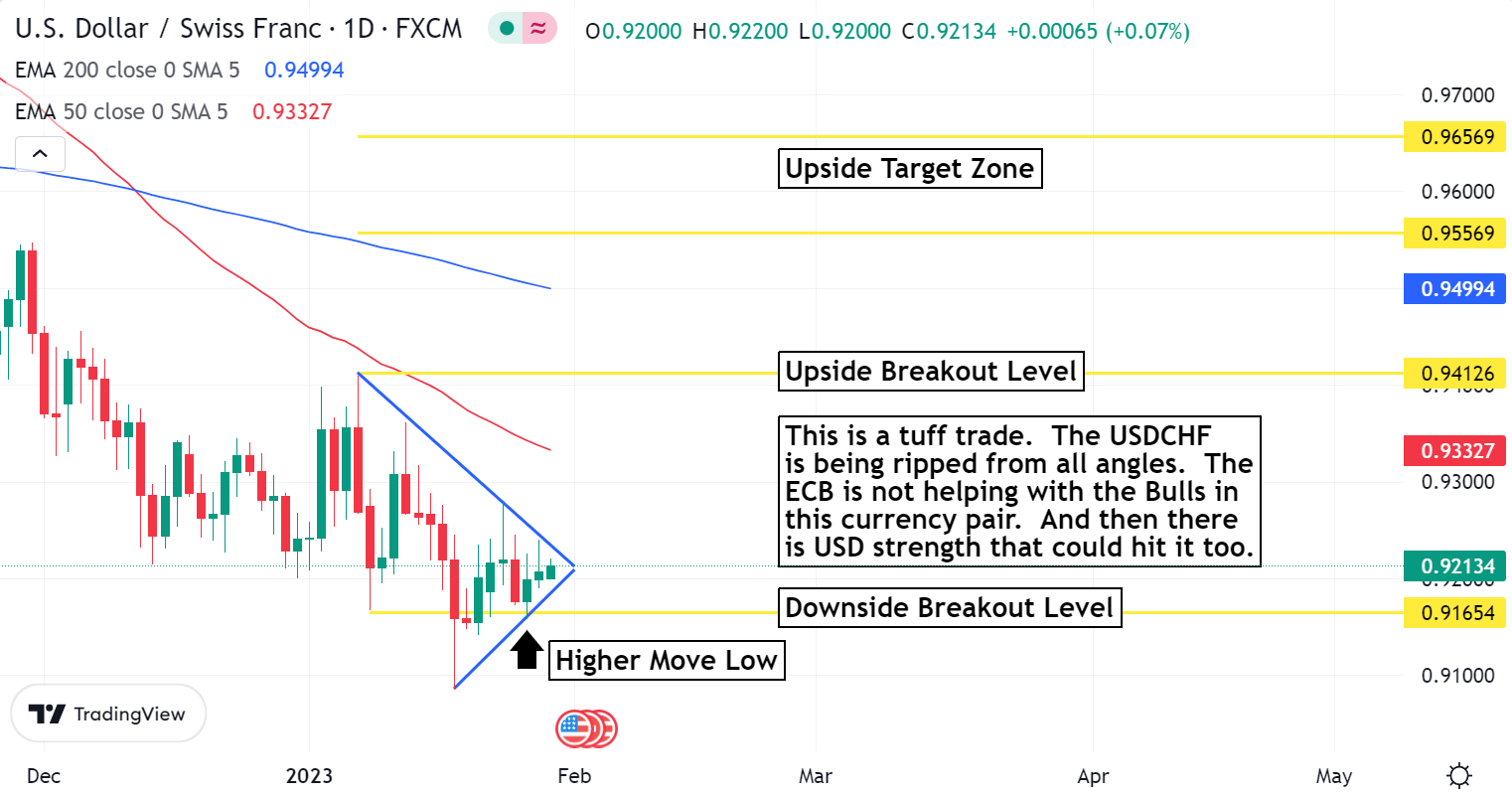

USDCHF Weekly Outlook:

Like the DXY, the USDCHF has been grinding around in a sideways trade. The question is if the market is setting a base, or is it just a pause before the next slide. Use the 0.9165 downside breakout level for directional bias. Trading above here keeps the market poised for a bounce. Even though the trend is lower, the fundamentals are pointing to a higher trading market. If the Bulls can get a print above 0.9300 a new Bull wave may begin. Trading back in this area should build as the currency makes a play for the 0.9412 upside breakout level.

Sustained trading under 0.9165 negates any bullish thoughts as the Bears tear the USDCHF apart. 0.9088 is the first stop on a slide that has the potential to hit 0.9044 before any digestive trade unfolds. Trading back down in this region would confirm the trend remains intact, and that the USD is becoming very weak in general. A close below 0.9100 this week would be a negative signal for the long-term direction for this currency.

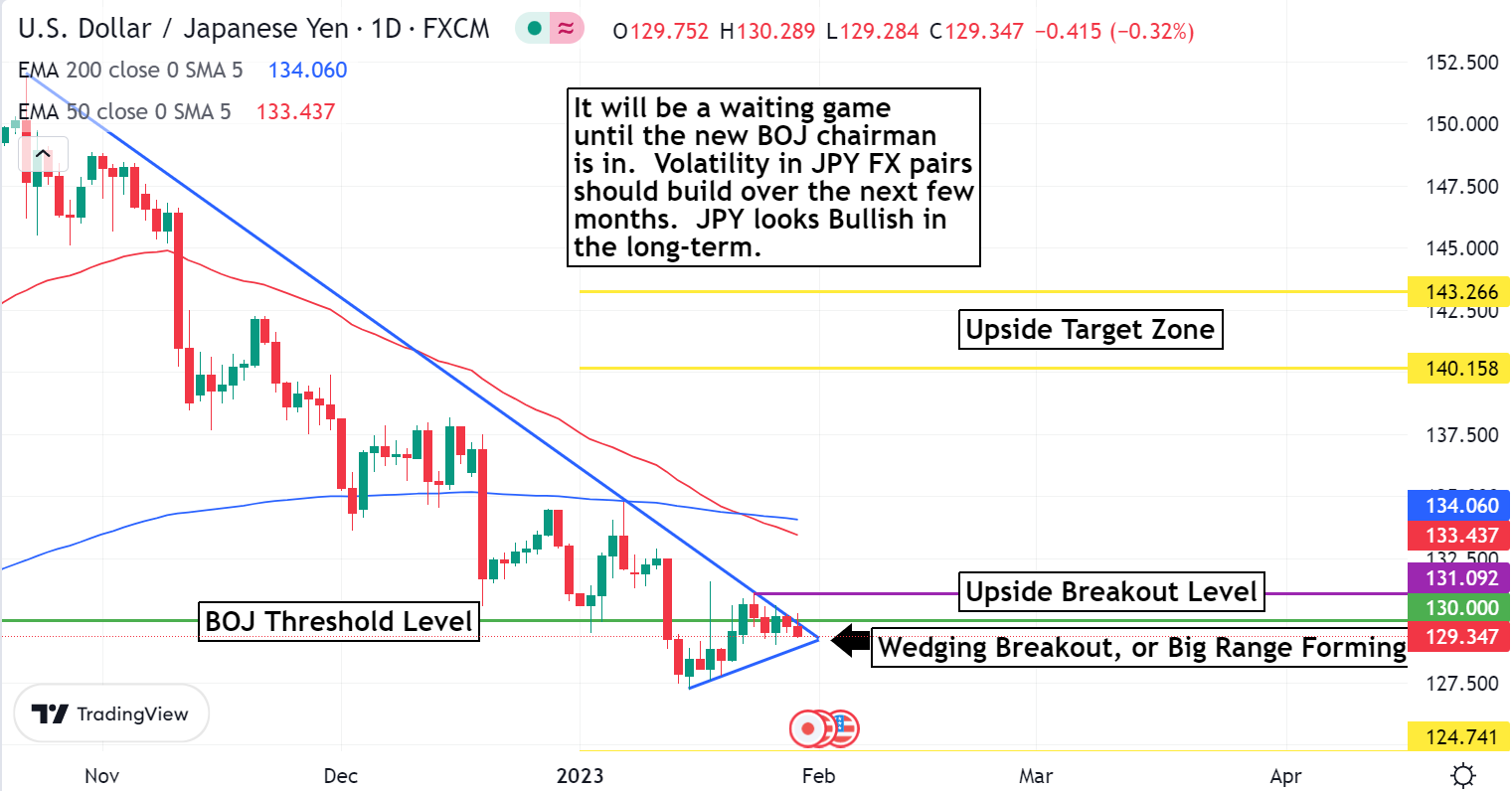

USDJPY Weekly Outlook:

Like many of the Forex pairs the USDJPY is stuck in a rut. Is the trend on pause, or is the trend turning? Watch yields for direction. If yields rise, then the Bulls are set to return and make a play for the 131.09 upside breakout level. Do not fight a rally above this area. Fresh buying is likely to propel the currency up to the 133.43 level. This area is likely to be touch and go. Sustained trading at these levels would be a bullish indication that the market is going to make a run at the upside target zone before slowing down.

Trading under the 131.09 level keeps the USDJPY in the gutter drifting along down to the 127.50 level. Do not try and catch a falling knife here. Remember the market is factoring in new leadership at the BOJ in a couple of months. This helps to reinforce the bearish tone to the market. 124.74 is the extended downside objective.

AUDUSD Weekly Outlook:

Wow what a strong trend here. If there is a market that is helping to keep the DXY down it is this one. The bulls are in an aggressive buy posture, and higher move highs are on the menu. A challenge of the 0.7261-0.7358 upside target zone is the call. It has been a very strong run, and a pause may occur in this area. Watch DXY for clues. If the Dollar Index is on its lows all week, then expect the AUDUSD to keep pressing newer highs.

Any short-term sell off is likely to be a pause for the cause before the next leg higher. Be careful. Only a failure from the 0.6900 level negates this outlook, and sets the currency up for an extended slide. .6631 is the downside objective should USD strength come back into the broad market. A bounce should occur in this area if the trend is to remain intact. All trading below this area would negate the neutral to higher bias, and reverse the trend to a bearish tone.

NZDUSD Weekly Outlook:

The NZDUSD is riding the coattails of the lower trending DXY. Expect a challenge of the 0.6493 upside breakout level this week. Trading above here is likely to fuel higher move highs, but not that extreme. 0.6721 is the upside target, and it should put a cap on the market. The fundamentals for this market are very weak, and it would be surprising if a very big rally manifests.

Trading below 0.6516 keeps the market in limbo for a neutral trade down to the 0.6321 level. Only a failure from here confirms weakness for a fresh leg lower. 0.6193 is the downside target. In the short-term it is very unlikely for the market to get under this area. Only a very strong rally in the DXY would change this outlook. If this occurs then the downside objective is extended to the downside target zone.

USDCAD Weekly Outlook:

USD weakness is reinforcing the Bear trend in the USDCAD. Below the 1.3388 downside breakout level the currency remains hard pressed down into the 1.3157-1.2988 downside targets zone. The trend is your friend. If the DXY and Yields remain lower, then this currency is not likely to see a bounce anytime soon. This locks in a sell rally forecast for the market until a valid trend reversal sign occurs.

Trading above 1.3388 puts the Bears on hold as the market makes a play for the 1.3516 upside breakout level. This is a key area of resistance, and the market is not expected to get above here anytime soon. Do not fight a breach of 1.3516. Trading above here confirms fresh strength and an extended rally up towards the 1.3941-1.3991 upside target zone.