The Tiger Forex Report 1-8-24

The Tiger Forex Report – Week of 1/8 – 1/12/2024

The DXY fell of key resistance. Use Friday’s high as a bias for direction, and keep an eye on Yields. Any downturn in rates, and the USD is likely to fall back on support.

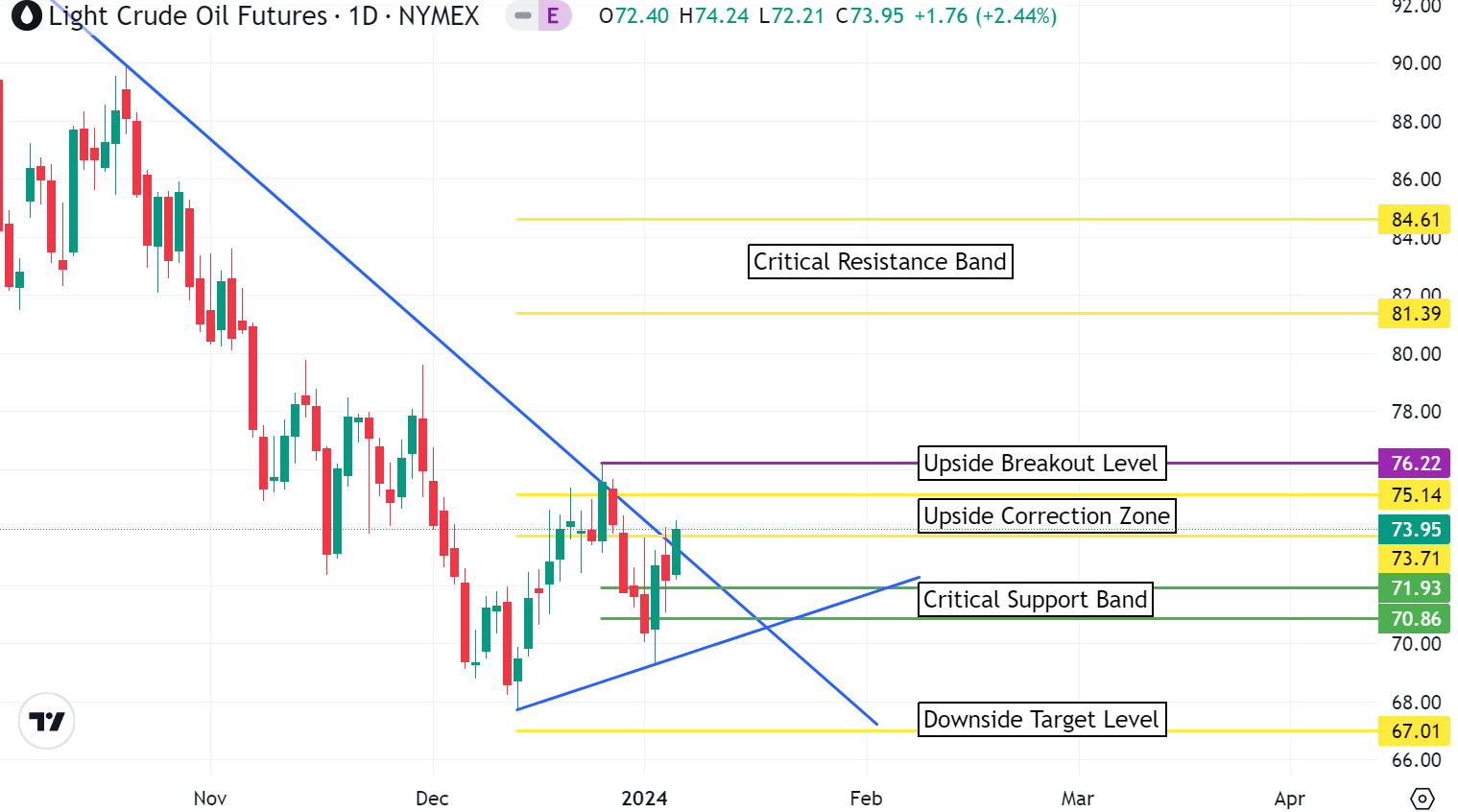

Crude Oil is settling into a sideways trade. It may be a bit of a buzzsaw between $70 and $75 a barrel.

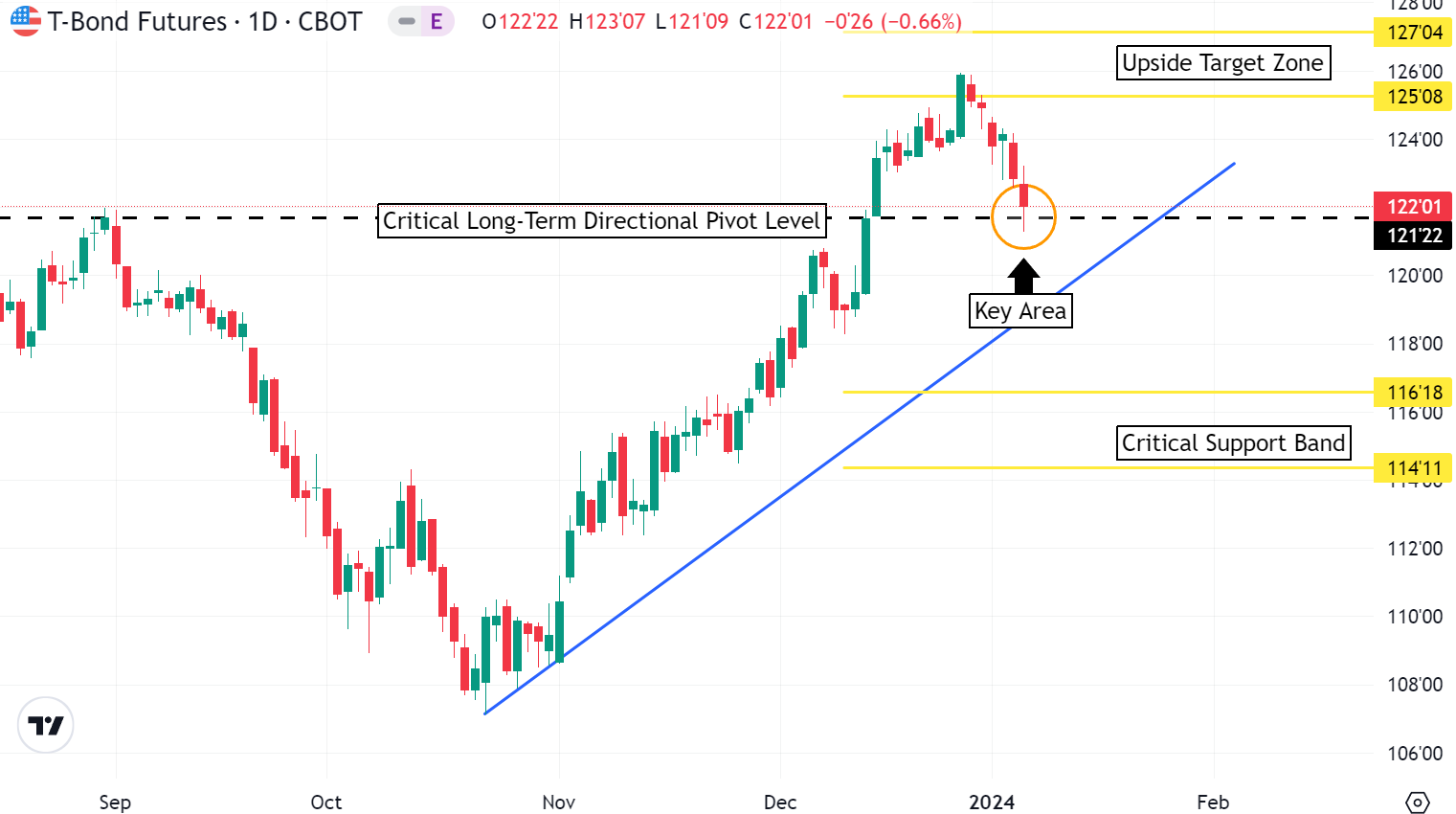

30yr T-Bond traders have pressed a nice profit taking slide into the end of last week. The critical long-term directional pivot level will be key for directional bias in the days ahead.

EURUSD Weekly Outlook:

EURUSD traders found some strong support last week. Key off Friday’s low. Above here the market will be fighting to get back up towards the upside breakout level. If Yields pull back early in the week, then this currency pair should see some nice Bullish action. Above 1.1140 the bulls target the 1.1236 level. 1.1295 and 1.1350 are the longer-term Bullish targets. With the FED facing an election year it may be that the EURUSD will be stuck in a wide range trade for the next eight to ten months. Yes. That is correct. Swing trades will still occur, but the trend will be tough to hold.

If the market falls below the 1.0876 low from last week the Bears will be leaning on some critical support. A failure from 1.0834 is likely to touch off weak Stops and fuel downside pressure. Unless the FED looks like it will behave in a Hawkish way, the EURUSD should not get hit to hard to the downside. It is very likely that the market will find a floor in the 1.0793-1.0713 critical support zone. If the market falls back in this area, we will evaluate how Bearish things are in the EURUSD. Fundamentals do support a move to these lower levels, but the question is what will the FED and the ECB do in the weeks to come.

GBPUSD Weekly Outlook:

Look out Pound traders. A critical swing low was set last week. Trading above the daily directional pivot level keeps the market flirting with a challenge of the upside breakout level. A rally above 1.2793 should not be taken lightly. Bullish momentum is expected to lift the GBPUSD up towards the 1.2969 upside target level. 1.3114 is the longer-term Bullish trend target.

The low from last week is at a key correction spot. Also, upside trend channel support comes in right at the daily directional pivot level. Should the Bears dip below 1.2594 that would be a fresh sell signal that would set the Bears up for a toboggin ride down into the critical support band. Both the FED and the BOE are being watched closely. So, it is unlikely that there will be any extended longer-term trend action. In fact, it may be very likely that we are going to be range bound for a few months as we press on through the first quarter of 2024.

USDCHF Weekly Outlook:

Not too exciting of a trade to start the year off in the USDCHF. This is not a good sign. Between the downside breakout level and the directional pivot level the currency my be set for an ugly range trade for a few weeks. Wait for a valid signal, and a sell rally bias is the call below the 0.8666 level. Unless there is a big rally in Yields it is not likely that this FX pair can sustain a rally for very long. However, a rally above 0.8666 would be a good sign that the Bulls will make a play for the upside correction zone.

Only a break under the downside breakout level would confirm that he Bears are back in full control of the longer-term trend. 0.8193 is the downside objective. Not much more is likely out of newer monthly lows until the FED confirms a dovish bias. The fundamentals are overall very Bearish for this market. Short-term the outlook is a bit murkier. Geopolitical situations are wearing on the USD so waiting for sell signals may be the best way to trade the USDCHF for the next few months ahead. 0.8080 is the Long-term monthly Bearish target.

USDJPY Weekly Outlook:

USDJPY Bulls are holding firm just below the directional pivot level. Use this for directional bias this week. Trading above 145.09 should spark another wave of buying and lift this currency into the upside correction zone. If Yields continue to firm up, then this market has the potential to extend Bullish strength. This would target the critical BOJ threshold level at 150.00.

Below 145.09 the Bears will be flirting with support. However, do not get ahead of yourself. Trading to the downside is expected to be a grind and choppy. Only a failure from the 140.77 level would change this outlook. Should the Bears collapse to these lower levels the sell off should not be taken lightly. Downside momentum is expected to build down in this area. The 137.65-136.49 critical support band would then become a very viable multi-week sell off trend target area.

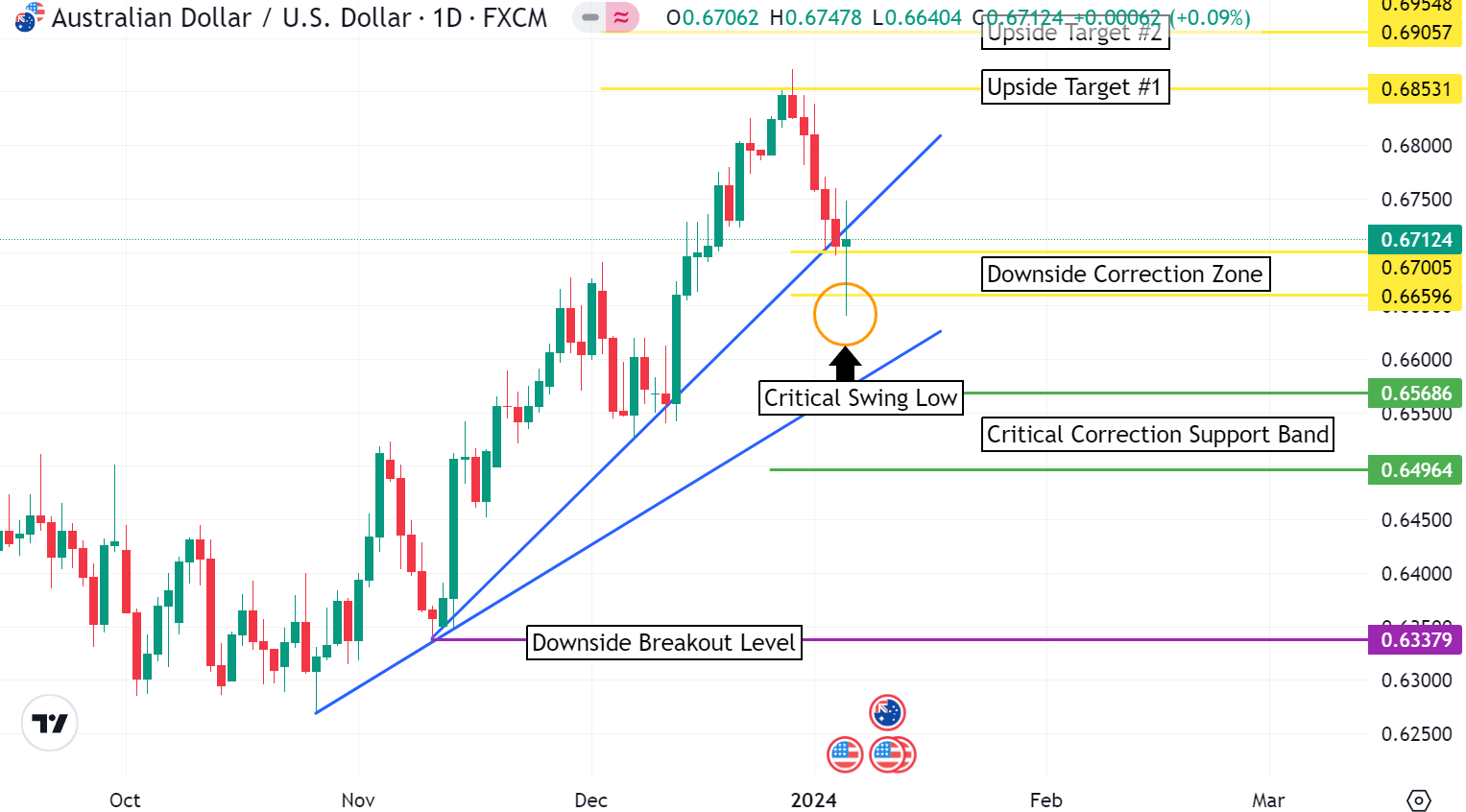

AUDUSD Weekly Outlook:

AUDUSD Bears planted a solid swing low on Friday. Trading is likely to make a run for higher levels early in the week. Odds are very good that the market will begin a rebound and continuation of the longer-term trend. The upside target #1 is the big hurdle to cross. If the Bulls breach this area fresh buying should lift the currency all the way to the 0.6905 level. 0.6954 is the extended upside target.

Only a failure from last week’s low confirms the Bears resolve to press support in a big way. 0.6568 is the first stop on a break that could hit 0.6496 before the AUDUSD stabilizes. If the Bears are in corrective mode the market should not slip under this area. Trading at these lower levels would mean that we may be setting the boundaries for a wide range trade over the next six months. It is an election year with much central bank action to watch out for. Stay nimble my friends. And keep your expectations rational.

NZDUSD Weekly Outlook:

Tough call for this currency pair. Friday’s lower move low is key. The trend is a Bull, and the last swing low is holding up the current rally. An early challenge of resistance is likely this week. Overall, a run for the upside target level is very possible to occur as we get through the first full trading week of the year. If Yields start to pull back sharply, then the NZDUSD could see a surge in fresh buying momentum. 0.6520 is the longer-term upside target.

Should the Bears take out the 0.6181 low from last week it is very likely that the downside breakout level will be in play. A correction would be healthy even if the longer-term trend remains a Bull. The downside correction zone is all that is on the menu for a lower trading market. Only a strong uptick in Yields would change this outlook.

USDCAD Weekly Outlook:

USDCAD Bulls and Bears had quite the day on Friday with little change. Use last weeks high for confirmation of direction. A rally above 1.3399 is a Bullish indication that the market will try and grind through resistance some more. The upside correction zone becomes a viable target especial if Yields continue to press a bit higher. This area should cap any exuberant leg higher. Unless there is a fundamental reason to boost the USD the market will have a very tough time maintaining any sustained long-term rally.

Below 1.3355 the Bears will try and drag this FX pair back to lower levels. If Yields begin to fall back to lower levels again the USDCAD is likely to make a run for the last swing low from two weeks ago. Riding the Short side is going with the overall trend, and there is more potential here than to the upside. The downside target #1 is a key level to reach. Trading back in this area would not just mean newer swing lows, but it would extend the Bearish objective to the 1.3055 and1.2792 levels.