The Tiger Forex Report 10-2-23

The Tiger Forex Report – Week of 10/2 – 10/06/2023

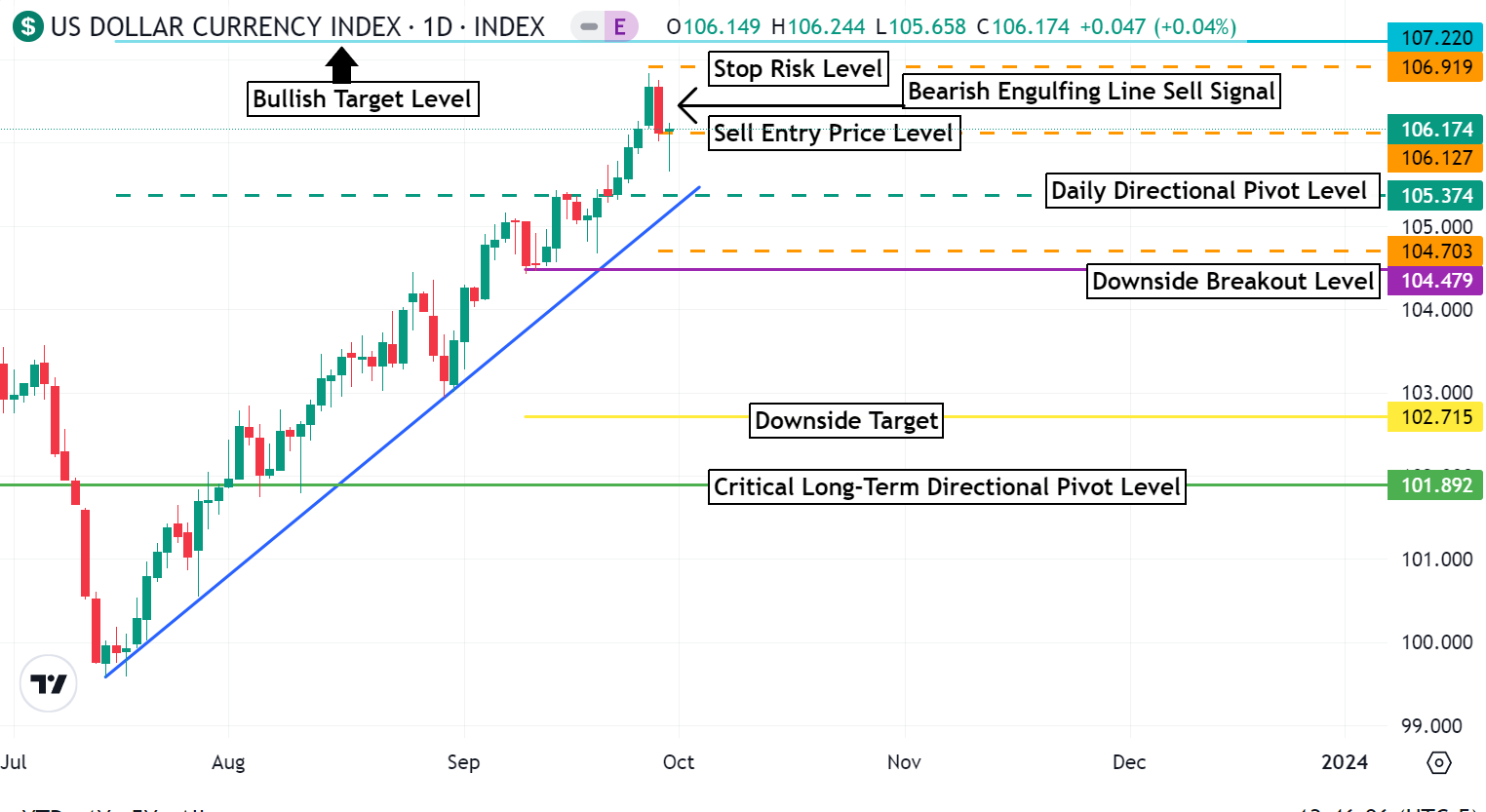

The DXY gave a short-term sell signal. The USD is due for a correction. Profit taking time.

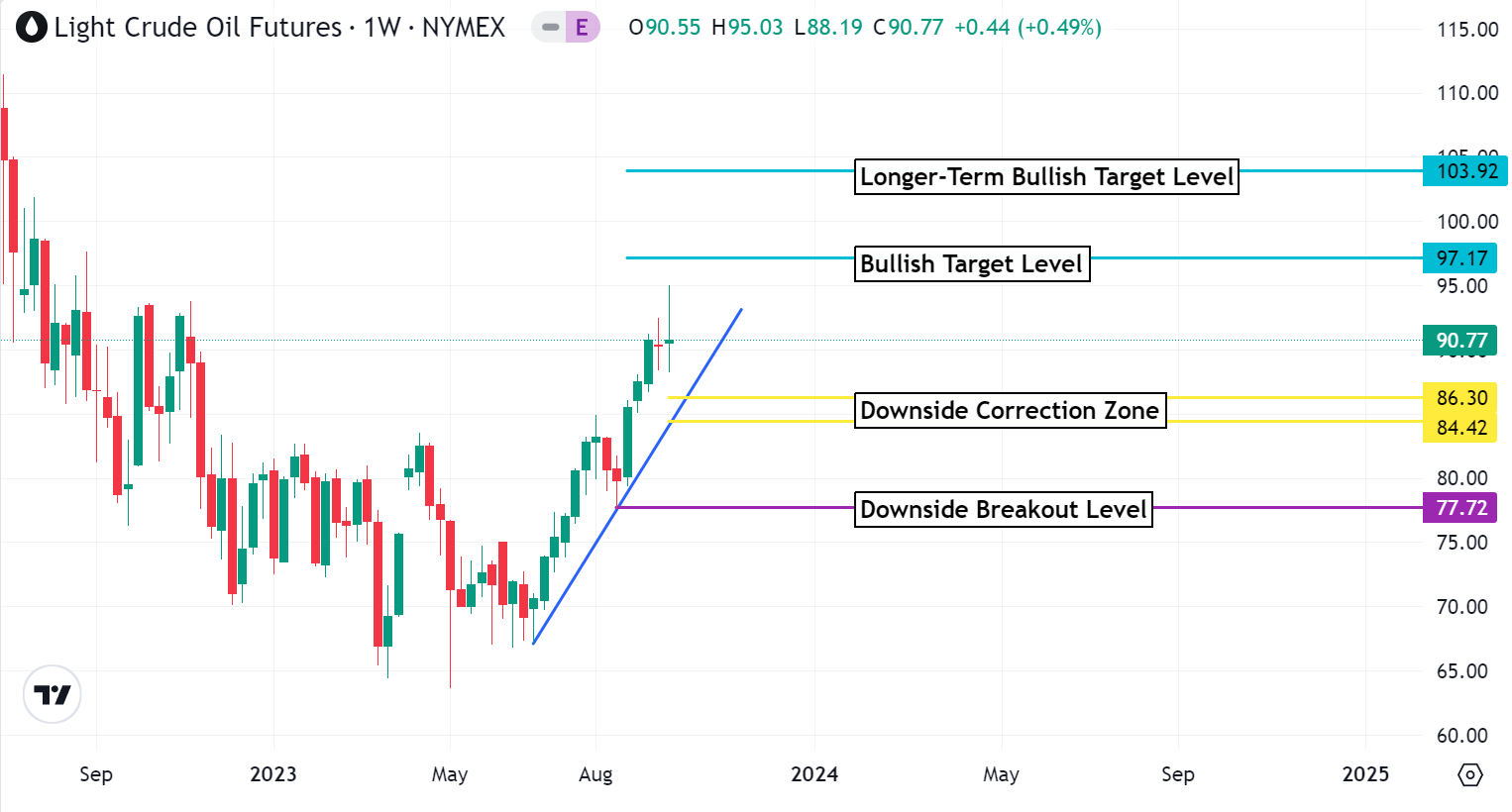

Crude Oil hit our price target. A profit taking break may be the call this week. The Bears are likely to make a play for the downside correction zone.

The 30yr T-Bond continues to push long-term Yields higher. This is the market that is driving recent trends in Gold, Equities, and the Forex markets. Use this for direction this week.

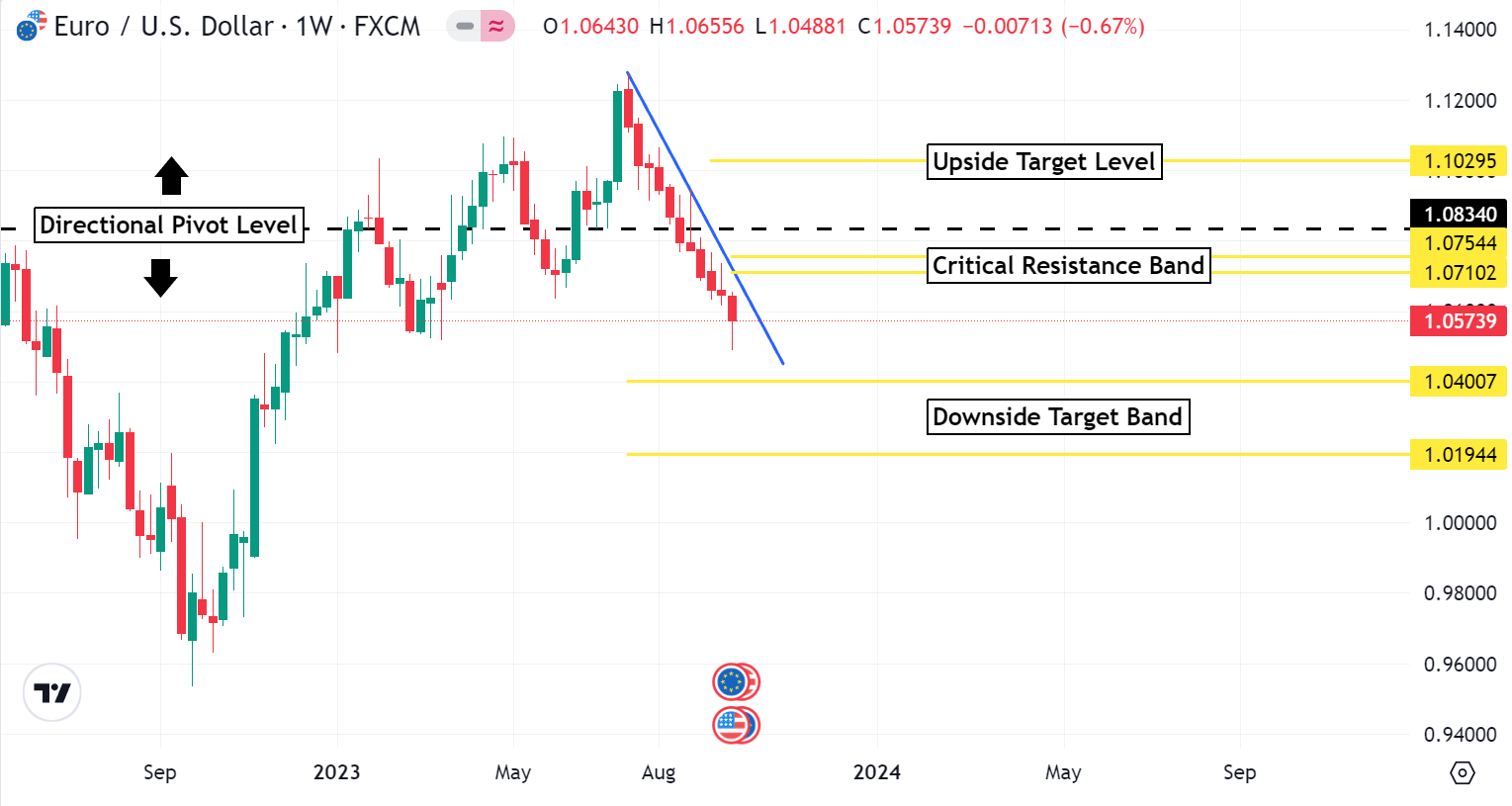

EURUSD Weekly Outlook:

The EURUSD had another wild week ahead, and remains under pressure. There is a sell signal in the USD that may help give this market some relief. An early rally that targets the critical resistance band is the call for the beginning of the trading week. This is all that is likely from a bounce. Only a rally above the directional pivot level confirms strength for an extended corrective leg higher aimed at the upside target level.

If Yields continue their march to higher levels, then the EURUSD Bears are likely to take this FX pair back to new move lows. The downside target band is the ultimate trend objective, and it is a good area to expect a digestive trade to develop. Fundamentals for this market remain weak, and the slope of the trend is rather steep. Keep your Risk parameters tight if you are trying to fight this breaking market, and wait for a valid buy signal in this currency too.

GBPUSD Weekly Outlook:

The USD rally is helping to drive the GBPUSD Bears into overdrive. This currency cross has been getting slapped into submission. An early test of support is on the agenda if Yields continue their terror to higher move highs. 1.2064 is the objective early in the week. If there is going to be a bounce, then this would be a great spot for it to happen. Do not fight a dip below the 1.2064 level. Trading under here is a big indication that downside momentum is going to press the market all the way to 1.1739.

The Bulls are losing the fight to bet a bounce, but Yields may help offer some relief this week. If Yields pull back, then a rally should manifest itself. The key is challenging the daily directional pivot level. If the market gets above here then the Bulls should press newer move highs up towards the upside correction target level. No much is likely above here. Only a close above 1.2732 confirms longer-term strength. 1.2850 is the extended upside target.

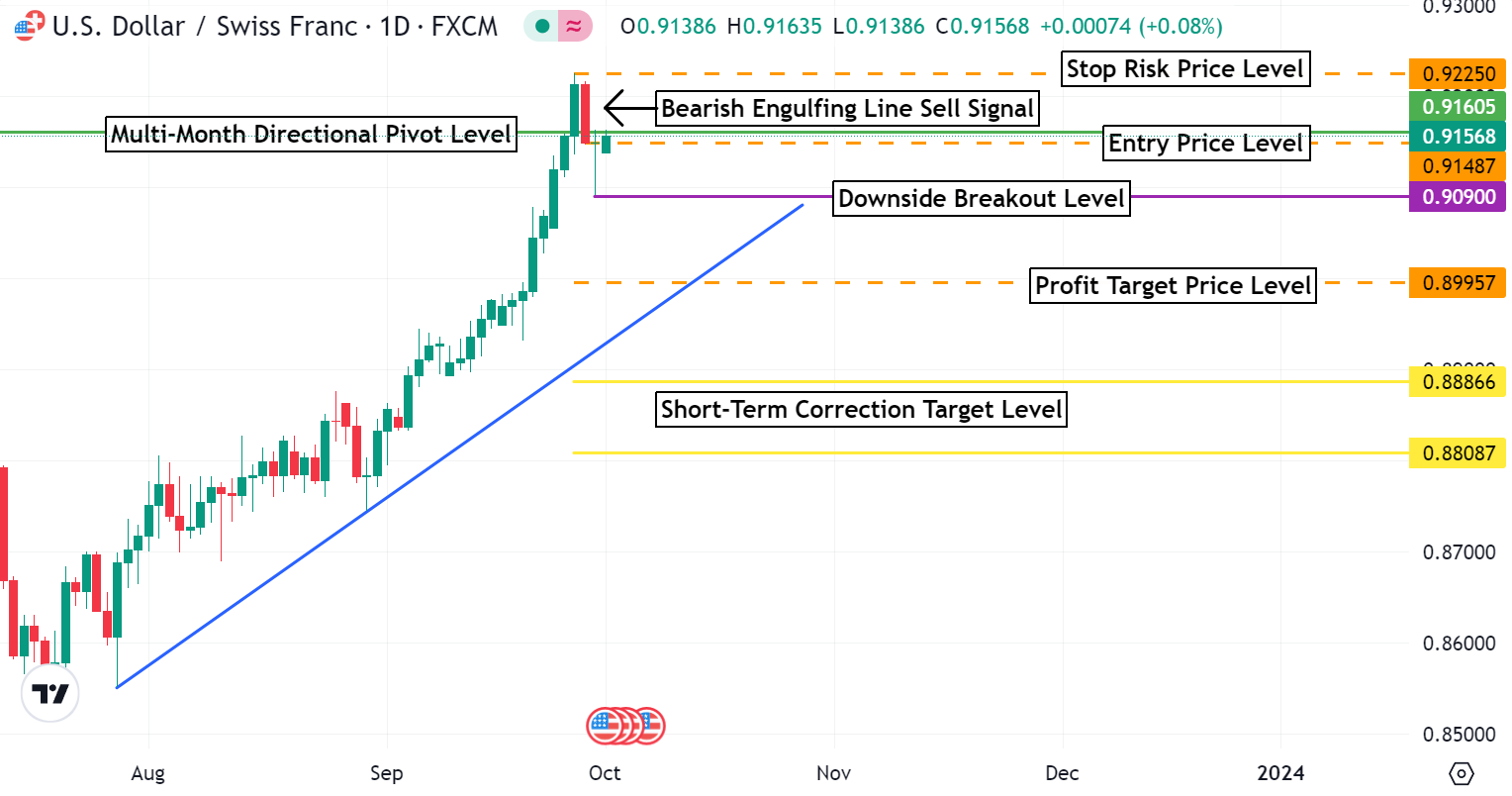

USDCHF Weekly Outlook:

A short-term sell signal was triggered in the USDCHF at the 0.9148 level. 0.9225 is the Stop Risk level for the signal, and the downside target is 0.8995. This market is a Bull, and a turn to support will be viewed as a corrective move. The signal only has the currency getting back in this area, but if the USD gets hit the market has the potential to reach the short-term correction target level.

Only a rally above the Stop Risk level negates the sell signal, and confirms the Bulls intentions to take this currency higher. 0.9345 is the first objective for a fresh rally higher. It would be unwise to fade trading back in this area. Fresh buying may be able to blast the USDCHF all the way back up to the 0.9539 level before there is a pause.

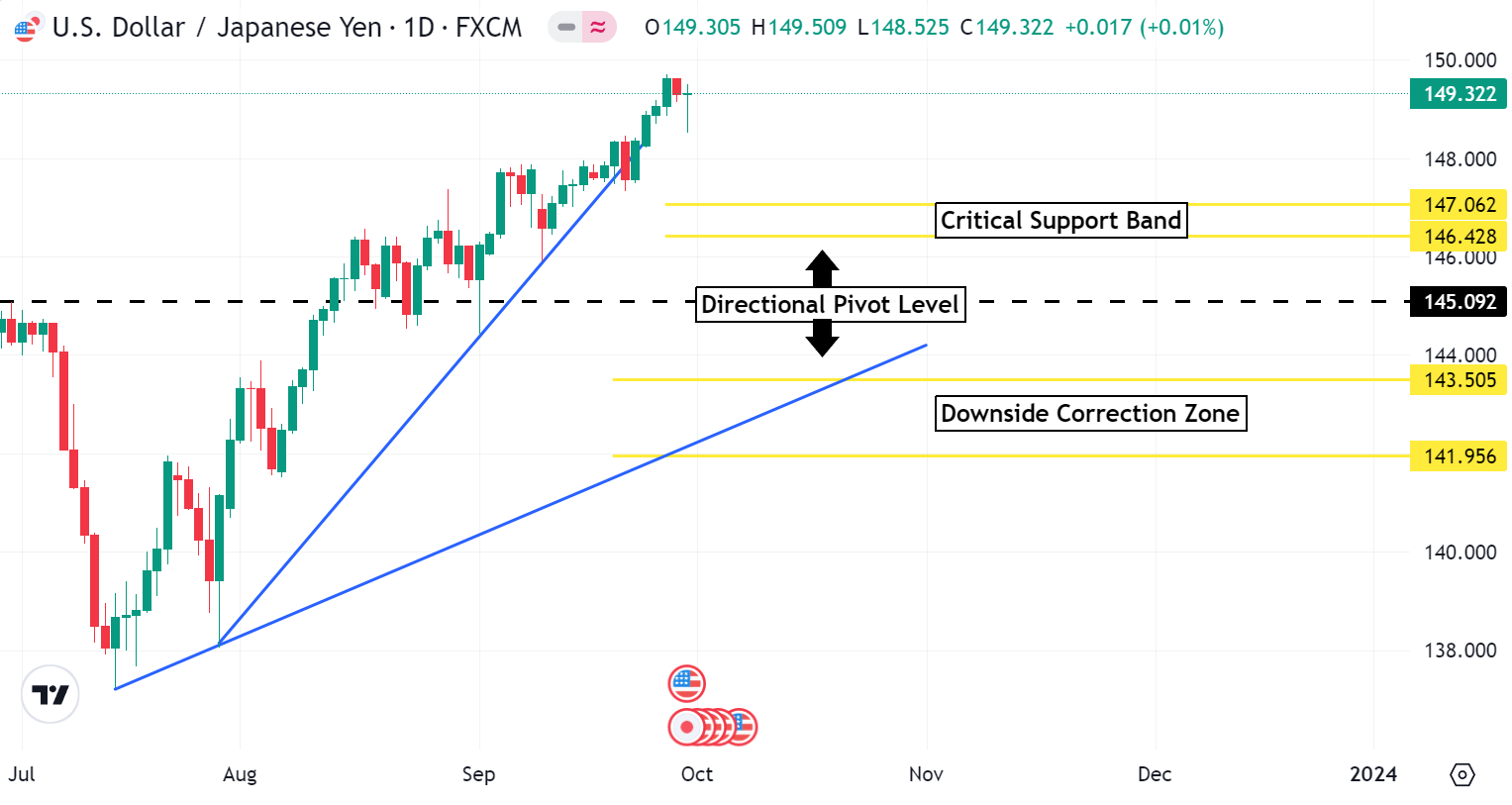

USDJPY Weekly Outlook:

USDJPY Bulls are riding the Yield curve higher. Momentum is obviously favoring the upside. Use Yields for directional bias to start the week. Higher trading Yields are likely to help push this market to new move highs up to the 150.88 – 151.17 resistance band. Use caution riding new move highs. It is not uncommon for this market to do an about face move in a flash. 152.75 is the long-term upside objective.

If Yields start to pull back, then the USDJPY may start to play with support. The critical support band is a good area for a short-term correction. This should be all that the Bears get out of a turn in the market. The trend is very strong, and should remain so until the BOJ starts to rumble again.

AUDUSD Weekly Outlook:

AUDUSD Bulls are trying to get a turn in direction. The Bullish Engulfing Line Buy signal sets the market up for another surge higher. A challenge of the upside breakout level is in the cards for early in the week. Use caution fading this move. Upside momentum has the potential to build as fresh buying should help to fuel momentum all the way to the upside target price level. 0.6685 is the upside correction target extreme.

The Stop Risk level is the floor for the current trend. If the market fails from this area the Buy Signal will be negated. If the market falls back on new move lows it is likely that the Bears will press support towards the 0.6290-0.6277 support band. 0.6160 is the longer-term sell off trend target.

NZDUSD Weekly Outlook:

NZDUSD traders are rounding out a bottom, and more upside action is likely early in the week. Expect a challenge of the upside correction zone. This is all that is expected out of a follow through rally higher. Fundamentals are poor for this currency, and the technical outlook is not much better. Over all any upside move in the short-term future is a rally to sell. Keep your Stops tight if you are Bullish.

If the Bears get a print under the downside breakout level the trend will be back in full force. 0.5665 is the first target on a slide that is likely to build. If Yields press new highs again this week, then the NZDUSD has the potential to fall all the way back to the 0.5610 level before there is another turn.

USDCAD Weekly Outlook:

A big limbo period may be developing for the USDCAD. The Bulls are pressing the critical resistance band. With Yields ready to pull back this area may keep a cap on the short-term uptrend. Only a breach of 1.3626 confirms the markets resolve to press on higher. 1.3695 is the extended objective on a move that has the potential to reach the 1.3764 level if USD strength starts another surge.

Yields may start to stabilize for a few sessions this week. If this occurs, then the Bears will be in a tough choppy trade back to the 1.3381 downside breakout level. Support is expected to fail if USD Bears start to gain control this week. 1.3321 is t he first target on a move that could pull the USDCAD all the way back down to the 1.3050 level before the trend settles down. Another scenario that traders should be aware of is that this market may be getting ready to set the boundaries for a longer-term wide range trade as we head into the fourth quarter. Can you believe we are now in the last quarter of the year? Ger ready for some wild swings before year end.