The Tiger Forex Report 10-30-23

The Tiger Forex Report – Week of 10/30 –11/03/2023

The DXY made a lower move low and a higher move high last week. Expect more sideways range trade conditions until the FED meeting is over.

Crude Oil fell off critical resistance with a higher move high and then set a lower move low last week. Use the downside breakout level for the markets bias this week.

30yr T-Bond Yields are stabilizing in front of the FED meeting. It is likely to be a thin sideways trade for the first few sessions this week. Unless geopolitical tensions rise more. Syria is now in play.

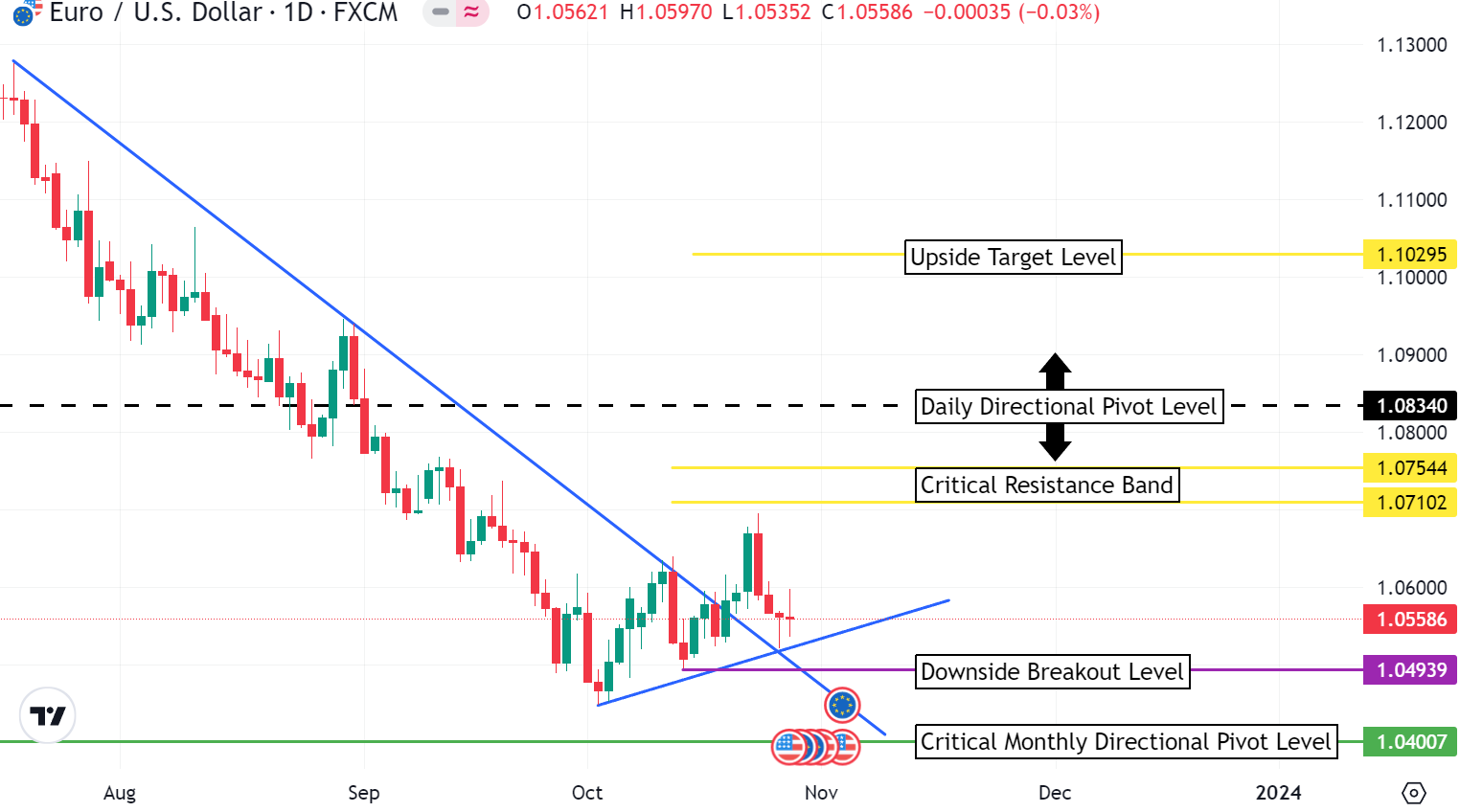

EURUSD Weekly Outlook:

EURUSD Bulls had a tough time of it last week. Be careful up until the FED meeting this week it may be a choppy range trade. Key off the downside breakout level for directional bias. Trading above this level keeps the Bulls in a hopeful posture looking to make a play for the critical resistance band. If the recent trend higher is just a correction, then this is about where the market should start to look for a turn. 1.0834 is the area holding the longer-term trend in play. Any breach of the daily directional pivot level is likely to spark fresh buying pressure. The upside target level is the longer-term Bullish trend target.

A failure from the downside breakout level should have the Bears pressing the critical monthly directional pivot level in a heartbeat. It would be very unwise to try and fight a slide into this area. 1.0344 is the first stop on a sell off that has the potential to reach 1.0194 before there is any bounce. It has been a long time since the EURUSD has traded at these lower levels. With the world on the verge of more conflicts, Europe in complete chaos, and winter ahead. This market is very likely to be below parity levels before the holidays arrive.

GBPUSD Weekly Outlook:

The GBPUSD is fighting to grind out a bottom. Not much is expected until after the FED meeting on Wednesday. Use the monthly pivot level for directional bias this week. Trading above 1.2064 will keep this currency in a range trade up to the upside breakout level. Only a rally above here confirms Bullish strength that should propel the market up into the critical resistance band. This is about all that is in the cards for Bullish action this week. 1.2732 is the longer-term upside correction target in the event of a big sell off in the USD this week.

A dip below the monthly pivot level puts this market back on edge for a test of the 1.1739 level. The overall trend for the GBPUSD is a Bear, and the momentum is likely to build if U.S. Yields press newer move highs. Inflation is back, and the credit markets are imploding. After the FED meeting let us see if the BOE counters with a stronger move or outlook. Keep your Stops tight this week, and be cognizant of economic releases. Bad volatility is very likely to be present this week to slice and dice Bulls and Bears alike. Happy Halloween.

USDCHF Weekly Outlook:

The Swissie has bounced off strong support, and it looks like the Bulls are ready to resume the trend. If this rally is going to give out then the short-term critical correction band would be a good area for the Bulls to run out of gas. Do not fight a move above the multi-month directional pivot level. Fresh buying is expected to enter the market, and fuel an extended leg higher that will be eyeballing the upside breakout level on the Daily chart.

It may be a sloppy trade in front of the FED meeting so use caution. A failure from the 0.8886 level is needed to touch off a new swing low, and an extended sell off that targets the 0.8808 level. Trading in this area is very unlikely unless there is a strong break in the USD coupled with a large pull back in Yields. If this occurs, we will have an update during the week.

USDJPY Weekly Outlook:

This currency pair has been a virtual flatline as it butts up against strong resistance. A short-term sell signal was triggered on Friday. Use the critical resistance level for the markets bias this week. Trading under here has the USDJPY set for a drop down to the sell signal target level. The signal ends here, but the Bears may be able to push a pull back into the critical support band. This should be it for a sell off before the FED meeting. It is very unlikely that the Bears will get a print below 146.42 unless there is a big turn in the USD and Yields.

A breach of the critical resistance level confirms the Bulls resolve to press through resistance. 152.75 is the Bullish target if the trend starts to press on. It will be tough in this upper area. The BOJ does have a threshold for the USDJPY relationship. Trading up at these higher levels is very likely to get the BOJ to do something. So do not get married to any Longs. A spike high situation is ripe to catch Bulls off guard. 154.22 is the longer-term upside target.

AUDUSD Weekly Outlook:

The Aussie traders are having a tough time of it lately. A newer move low last week was a non-event for the market. A sideways trade is very likely to resume early in the week until after the FED meeting. Sustained trading above the downside breakout level keeps the AUDUSD in limbo. The fundamentals for this currency are abysmal, and that is likely to keep the Bear trend in place. So be very careful with any Long plays. Short-term the Bulls may get a rally up towards the 0.6466 level. In the event that the Bulls get above here there is a good chance that this currency could hit the upside correction target extreme. A strong USD sell off could reinforce this scenario.

A failure from the downside breakout level is a good indication that the AUDUSD is ready to press newer move lows down towards the 0.6160 level. If this occurs it would be unwise to buy into this area unless there is a valid Buy signal. The Bears could press newer move lows all the way down into the 0.6075-0.6066 support band. If the USD gets hammered this week the odds of the Bearish forecast should increase.

NZDUSD Weekly Outlook:

This currency is under pressure, and should remain so with all trading below the directional pivot level. It would not be a good idea to fight the Bears on this one until you have a strong Buy signal. Downside momentum has the potential to hit newer move lows into the 0.5610-0.5595 support band. 0.5375 is the longer-term downside trend target.

If the NZDUSD can sustain a trade above the 0.5858 level the Bulls may have a chance at slowing the overall Bear trend. The upside correction zone is the objective, but it will be tough to reach before the FED meeting. There is not much else expected out of a Bullish correction because the fundamentals are very poor. Only a strong sell off in the USD would change the outlook, and then there will be an update.

USDCAD Weekly Outlook:

If there is a currency pair that is showing USD strength it is the USDCAD. Be careful trying to fight the Bulls this week. It may be a tight range trade until after the FED meeting, but unless there is a pull back in the USD it would be unwise to fight the Bull trend. 1.3950 is the first target on a rally that has the potential to reach the 1.4075 level before there is a pull back. Unless there is a confirmed turn in the USD this FX pair remains in a buy dip posture.

If the Bulls run out of steam it will be a grind of a trade back to the critical support band. Most likely this area should hold up. However, if there is a strong pull back in U.S. Yields and the USD, then the USDCAD could extend a short-term correction for a while. This would extend the downside Bearish objective to the downside breakout level. If the USDCAD falls back into this area it would be a good sign that the longer-term trend for this currency pair is turning.