The Tiger Forex Report 10-9-23

The Tiger Forex Report – Week of 10/09 – 10/13/2023

The DXY fell off strong resistance last week. More profit taking is on the agenda if Yields pull back.

Crude Oil Bears had a nice correction. However, Middle East tensions may bring back the Bulls fast.

30yr T-Bond Bears pushed Yields to the extreme last week, and a short-term bounce is likely to occur soon.

EURUSD Weekly Outlook:

The EURUSD Bulls are trying to get a turn out of the Daily trend. This week it is very likely that the market is set to digest recent downside action. An early challenge of resistance is the call. Expect the critical resistance band to put up a big fight. Only a sustained trade above this area confirms strength. 1.0834 will be the Bulls big test. A violation here should spark fresh buying, and drive the market up to the upside target level.

New move lows are not on the radar this week. If the Bears take hold of this market again then 1.0400 is the first stop on a slide that could hit the 1.0344 level before there is a bounce. 1.0194 is the sell off extreme for any extended wave lower this week.

GBPUSD Weekly Outlook:

GBPUSD traders finally had some relief last week. If Yields stay stable, then this currency is expected to follow through to the upside. The first stop is the critical resistance band. If the market is going to run out of gas this would be the area to put a stop on a rally. Trading above 1.2474 would be a good indication that the market is going to make a run at the daily directional pivot level. 1.2732 is the extended upside correction target.

Above the Monthly Pivot Level, the market remains in a neutral posture as it tries to digest the recent Bear trend. Do not fight a dip below this area. Bearish momentum is expected to build below here especially if Yields press higher. 1.1739 is the extended sell off target.

USDCHF Weekly Outlook:

The USDCHF set a higher move high, and a lower move low last week. This has the currency ripe for a digestive pause in trend. Trading under the multi-month directional pivot level keeps the Bears in motion trying to press a correction back to the short-term correction band. If Yields come under pressure this week, then it should help the Bears hammer support in this FX pair.

There is not much expected to the upside this week as the trend seeks to digest the recent runaway Bull run. Only a breach of the upside breakout level confirms Bullish resolve and a fresh leg higher. 0.9345 is the first stop on a rally that has the potential to hit the 0.9539 level before the Bulls run out of gas.

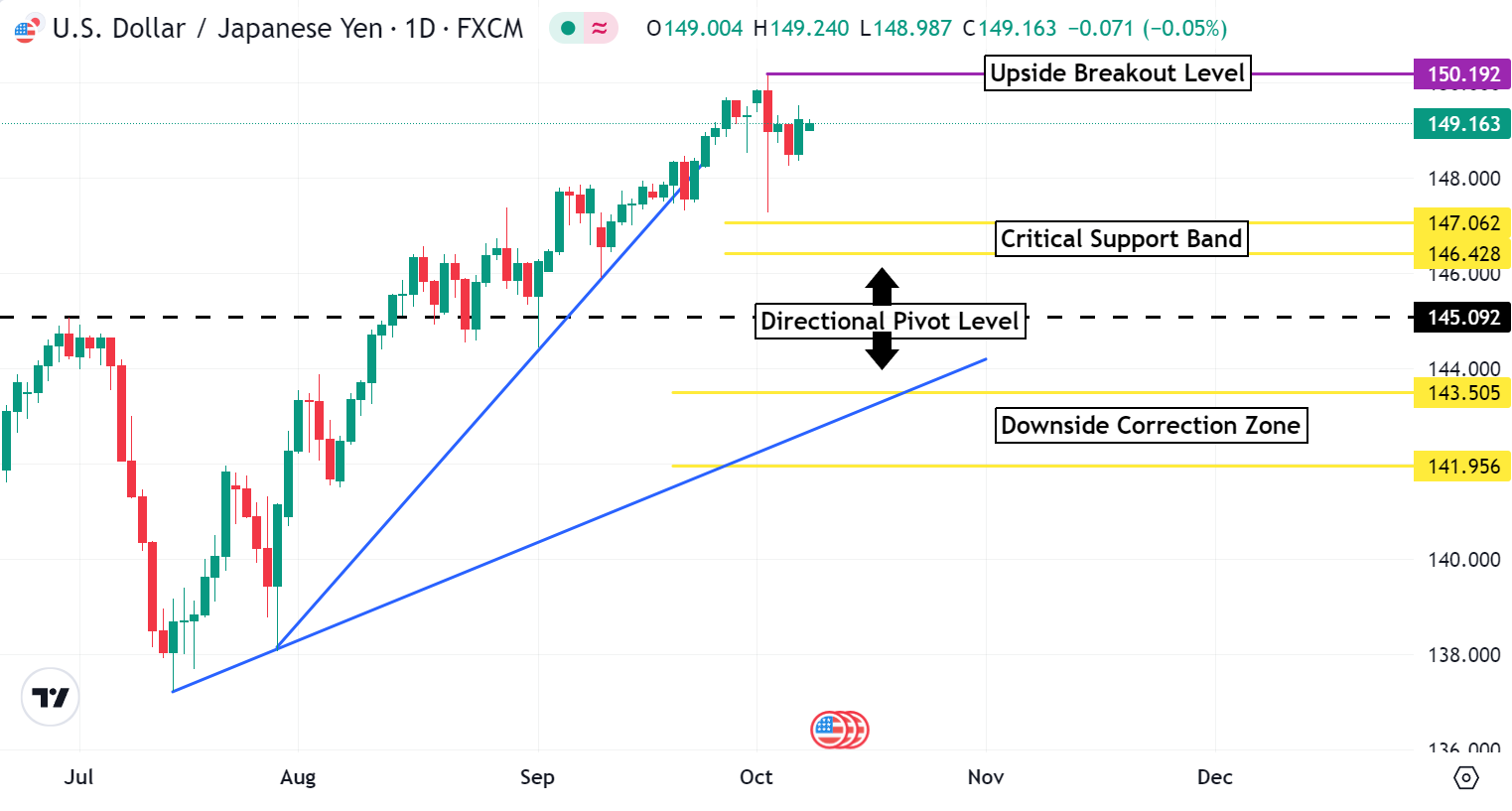

USDJPY Weekly Outlook:

USDJPY Bulls are starting to run out of steam. BOJ intervention rumors are rising and Yields are ready for a digestive phase. Trading under the upside breakout level keeps the Bears in control as the market tries to pull back to the critical support band. If the longer-term trend is to remain intact it is not likely that the market will get under this area. Trading under 146.42 however, extends the Bearish target to the directional pivot level. If Yields pull back sharply then the downside correction zone becomes a viable area to reach over the next couple of weeks.

If there is a violation of the upside breakout level it would be unwise to fight the Bulls. Trading above here could see a spike all the way to the 152.75 level. This is all that is likely out of a blow off rally. Until there is a close above the 152.00 level the USDJPY is more likely to touch off a correction then press new multi-month highs.

AUDUSD Weekly Outlook:

The Aussie has been a reluctant Bear as it has been trying to round out a bottom. Trading above the downside breakout level keeps the currency in a digestive phase trying to press through resistance. As long as Yields stay stable the Bulls are expected to make a run for the upside breakout level. This is a key area for the market to cross. Trading above this level would be a good indication that the Bulls could be setting a new correction in motion. 0.6685 is the upside correction target extreme for any strong change in market sentiment.

If there is a failure from the downside breakout level then all digestive market notions are on hold. Trading below this area is a good indication that the Bears are set to slam new move lows towards the 0.6160 support level. If Yields make new highs this week, then the Bears could press a new leg lower all the way back to the 0.6075 – 0.6066 support band.

NZDUSD Weekly Outlook:

Of all the Forex markets the NZDUSD has been the first to establish a solid range trade to slow the recent Bearish trend sell off. Could this be the market to stay in a range trade? Yes. This is the market to watch out for. A tight trade is the call for the week. Not much follow through is likely unless there is a major move in the USD. The upside correction zone is all that is expected out of any Bullish spike. If Yields pull back there may be a play for this area.

If the NZDUSD falls below the downside breakout level, then the Bears could take the market back to the 0.5665 downside target level. This should only occur if the USD gets a huge boost in strength. 0.5610 is the extended sell off objective.

USDCAD Weekly Outlook:

Wow the USDCAD Bulls just do not want to give up the trend. A newer move high set last week keeps the market in an aggressive bullish posture. An early challenge of last weeks high is on the agenda for the week. A breach of this area should set the currency up for a challenge of the 1.3816 level. 1.3950 is the longer-term upside target.

If Yields fall back this week and the if the USD pulls back, then the Bears may get some action this week. The critical support band is a viable sell off area to shoot for. If this is just a corrective move, then this should prop up the USDCAD in this area. Trading under 1.3532 would negate the positive outlook, and set this FX pair up to slide towards the downside breakout level. 1.3050 is the long-term downside trend target.