The Tiger Forex Report 11-4-24

The Tiger Forex Report – Week of 11/4 – 11/08/2024

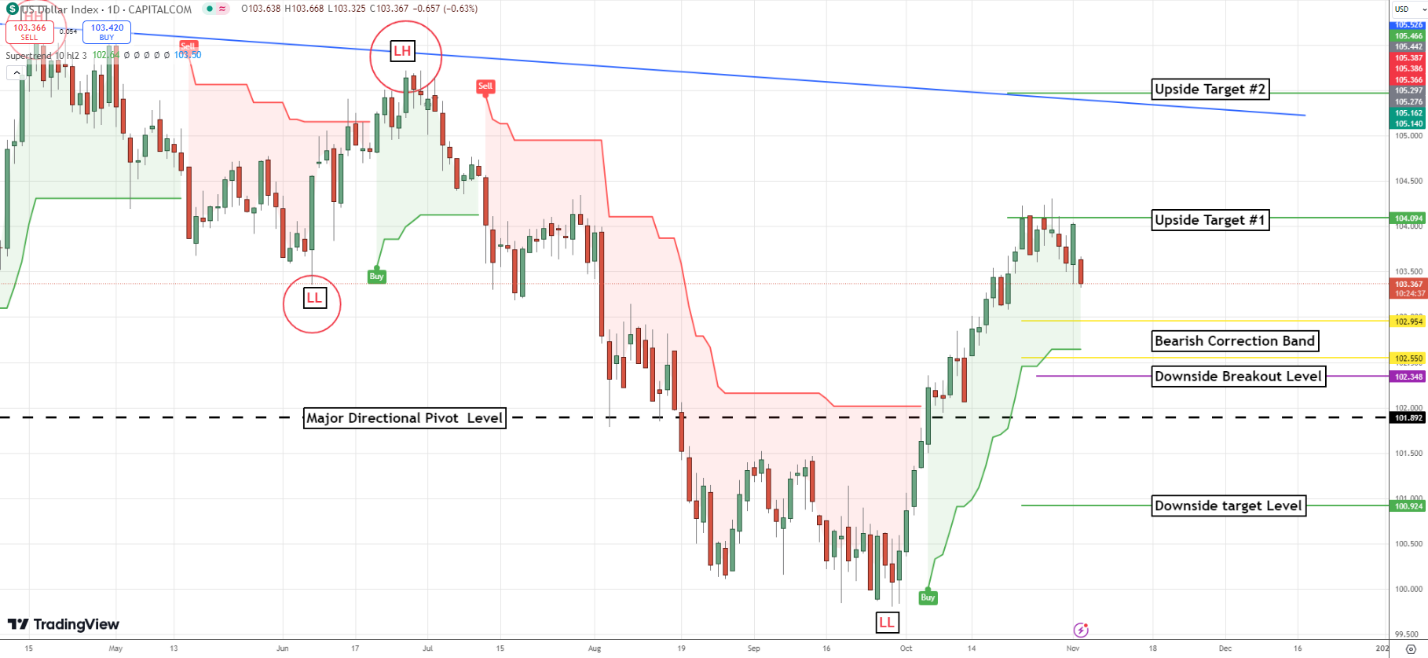

The DXY Bears are in control to start the week off. Be ready for a choppy ride until after the election and FED meeting.

Crude Oil Bulls are catching a nice profit taking move. Expect more follow through this week.

30yr T-Bond Yields are pulling back and are expected to continue to do so into the rest of the week.

EURUSD Weekly Outlook:

EURUSD Bulls have the edge to start the week off, and more upside action is on the menu for the next few sessions. The upside correction zone is the key area to pierce. A move above this area will have the market leaning on the upside breakout level. If the Bulls get above this area the upside target level becomes a viable trend target over the next couple of weeks.

Sustained trading below the upside correction zone puts a stop to the corrective rally, and sets the Bears up to hit support again. The monthly directional pivot should be where the market retraces back to. Do not fight a slide below here. A failure from this level would be an indication that the Bears are going to resume the down trend and aim for the downside target level.

GBPUSD Weekly Outlook:

The week is off to a Bullish start with a gap higher open to the week. This is a good sign that the Bulls are in control to touch off trading direction. If the GBPUSD rallies above last week’s high there is a good chance that upside momentum will build as fresh buying enters the market. Do not fight this move. Upside momentum is expected to build and press newer move highs into the upside correction zone.

Only a failure from last week’s swing low confimrs the markets resolve to hammer newer move lows and extend the downtrend. Trading below this area would signal that the trend momentum is building again. This would make the downside target level a viable objective over the next few trading sessions. Not much more is likely before the FED release is through on Wednesday.

USDCHF Weekly Outlook:

Swissie traders had a big range on Friday, and an about face sell off is in motion to start the week. The Bearish correction Band is the first stop on a fresh leg lower this week. Use caution trying to fade this slide. Fresh selling pressure is expected to enter the market. It would be unwise to try and pick a bottom here. If the market falls below the downside breakout level it could get ugly fast. The downside target level would become a reachable objective over the next week and a half or so. Wait for a valid Buy signal if you are looking to go against the trend in this situation.

Only a rally above last week’s swing high reverses the short-term outlook. Trading above here would signal a fresh bullish resurgence. The upside target #1 then becomes the area to shoot for. Should the Bulls muster up a new leg higher like this it would be an indication that the market is not expecting the FED to continue cutting rates moving forward after this week.

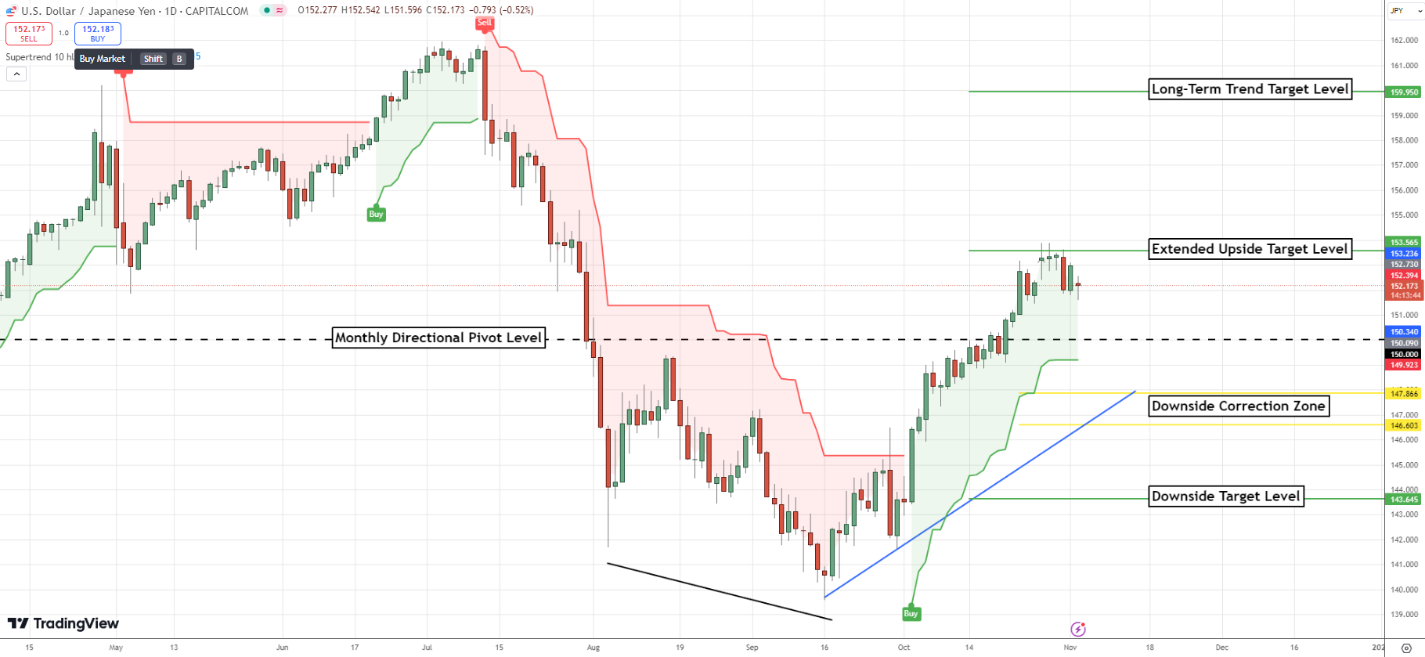

USDJPY Weekly Outlook:

USDJPY traders have a rough week ahead with the FED meeting this week. Further rate cuts are likely to add Bearish pressure to the short-term trend. Watch Crude Oil this week. If the oil market falls on support, it would add fuel to the fire for the Bears in this currency. A drop back to test the monthly directional pivot level is on the menu this week. Do not fight a dip below here. Downside momentum is expected to build here and drive this FX pair down toward the downside target level.

Not much is on the agenda to the upside this week. Only a rally above last weeks high would change the outlook. Trading above this area signals a resumption of the trend and gear the Bulls up to press on higher toward the long-term trend target level. This is all that is expected for a higher trending market.

AUDUSD Weekly Outlook:

The AUDUSD has been under extreme pressure, and a profit taking correction is in the cards this week. Fundamentals for the week are ripe to help the Bulls get a profit taking rally in motion. The recent slope to the Bear trend is steep and this means the market is gearing up for a rally that targets the upside correction zone. If this is going to be a corrective move the market is not likely to get above this area. If the Bulls get above here the upside breakout level becomes the next objective. Should the market get above here there will be an update.

It would take a break below last weeks swing low to reverse the short-term outlook. Trading in this lower range again would signal the markets resolve to continue to hammer through support levels. The major trend support level would then become a very reachable sell off target.

NZDUSD Weekly Outlook:

The Bears are in control of direction in the NZDUSD, but a Bullish correction may be brewing. With the FED meeting this week and a looming rate cut expected this market is setting up for a profit taking rally. In the short-term the outlook is slightly Bullish setting up the market for a profit taking rally. Considering the slope and velocity of the recent downtrend it is not unreasonable for a fresh leg higher into the upside correction band. This should cap a surge higher in the market. Only a rally above the upside breakout level would confirm longer-term strength. Be careful being long at these higher levels. Remember the trend is still Bearish.

A break below the downside target level is necessary to confirm that downside pressure is returning to the market. Be careful trying to fight a slide back to these levels. Bearish pressure could ignite fresh selling pressure and set the Bears up to make a play for the extended downside target.

USDCAD Weekly Outlook:

USDCAD Bulls are in control, but a pullback may be the call for the week ahead. With a FED rate cut on the table it is likely that the Bears will spark a profit taking slide this week. If a correction is gong to develop it is very likely that the market will fall back into the downside correction band. This is a big support area. Should this currency get below this area the downside target #1 becomes a viable longer-term sell off objective over the next few weeks.

The only way the negative outlook will be off the table is if this FX pair rallies above last week’s swing high. Trading above here is expected to build. 1.4010 and 1.4095 are the longer-term Bullish targets. Not much more is likely to the upside because fundamentals are just too weak. And the reality is that this FX pair is in a long-term range trade.