The Tiger Forex Report 12-12-22

The Tiger Forex Report – Week of 12/12 – 12/16 /2022

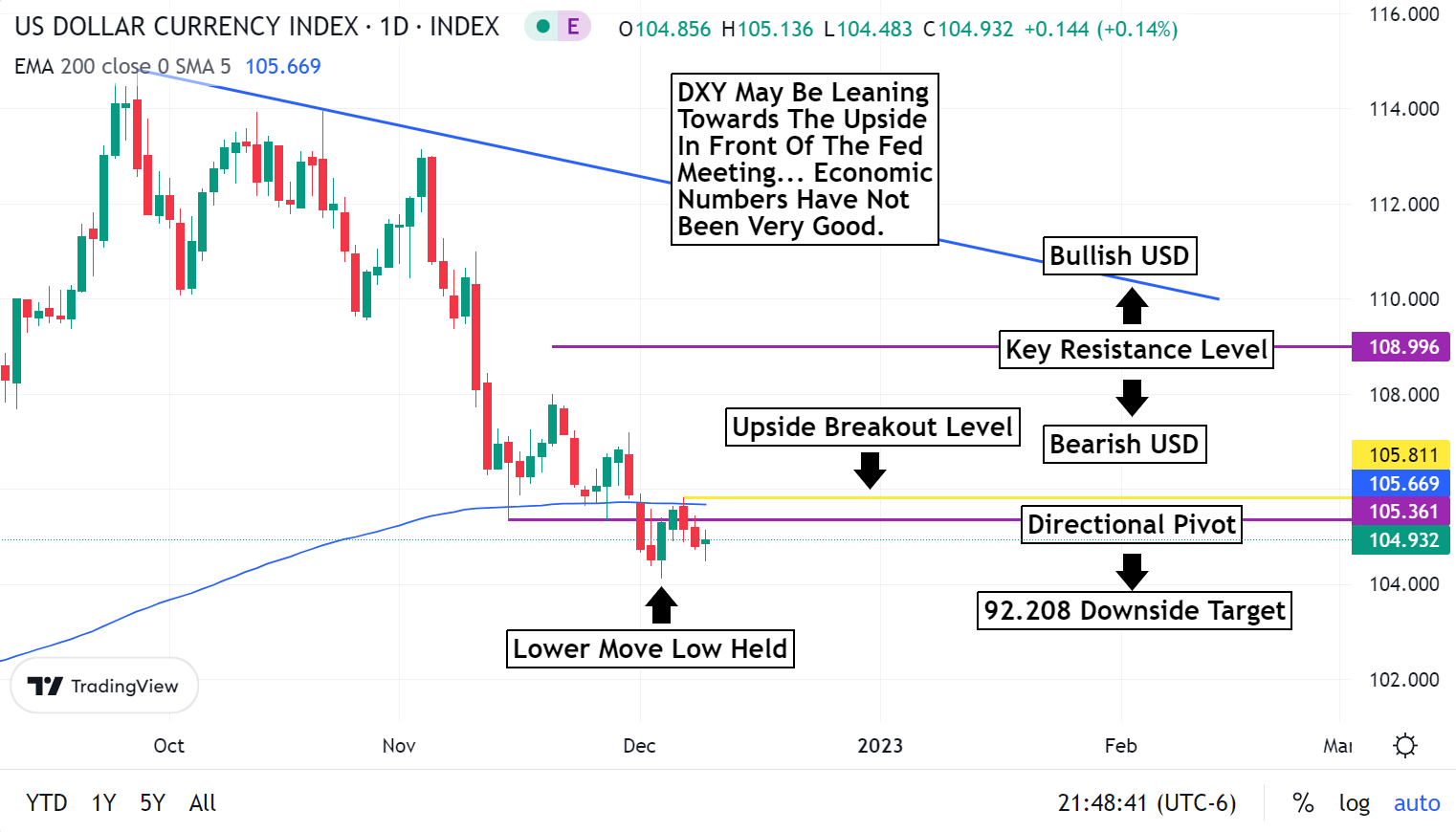

DXY is floating below the upside breakout level, and the Fed meeting should help the Bulls out.

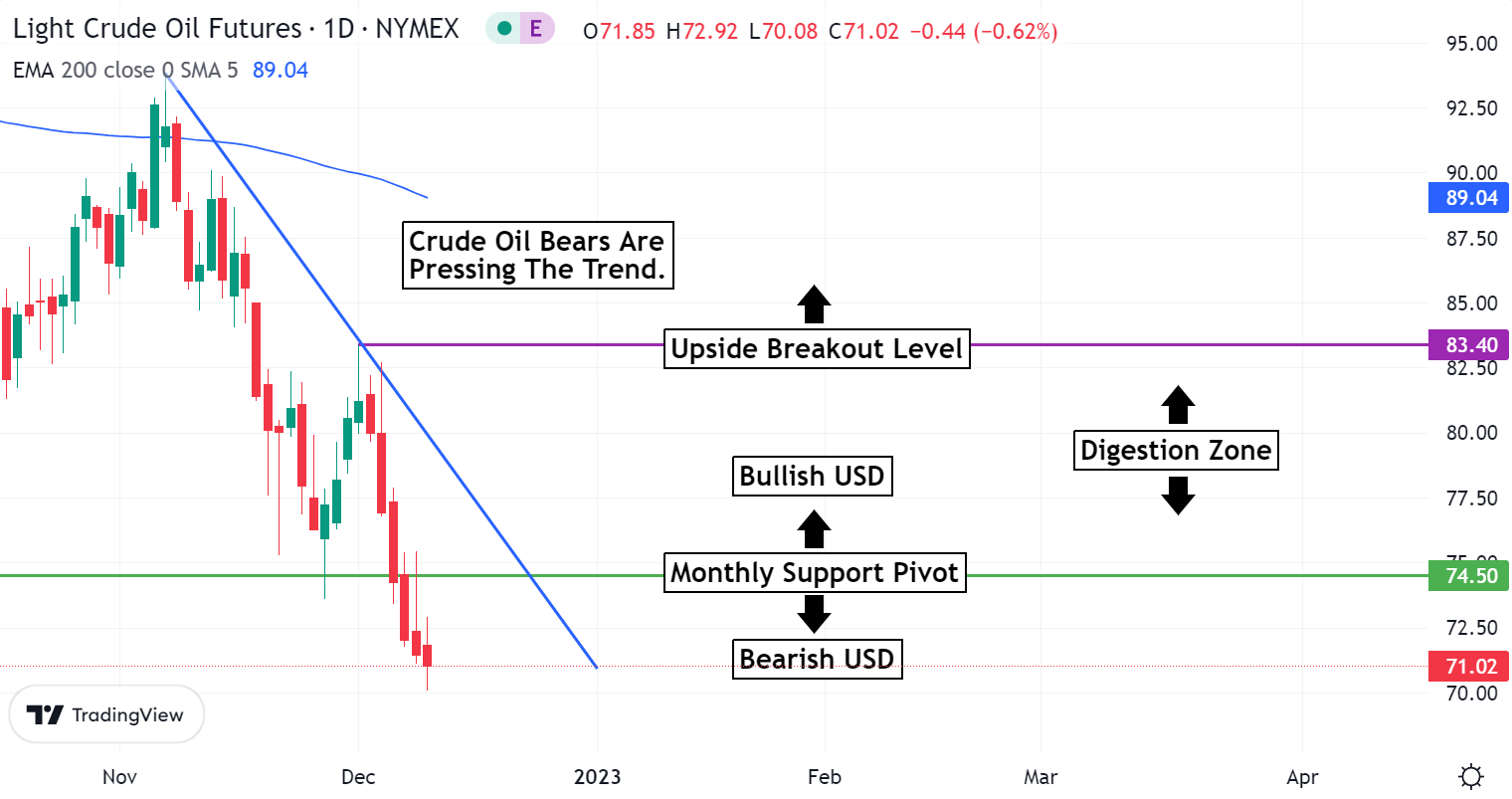

Crude Oil is slamming support and the slope is steep. A bounce to the upside is expected.

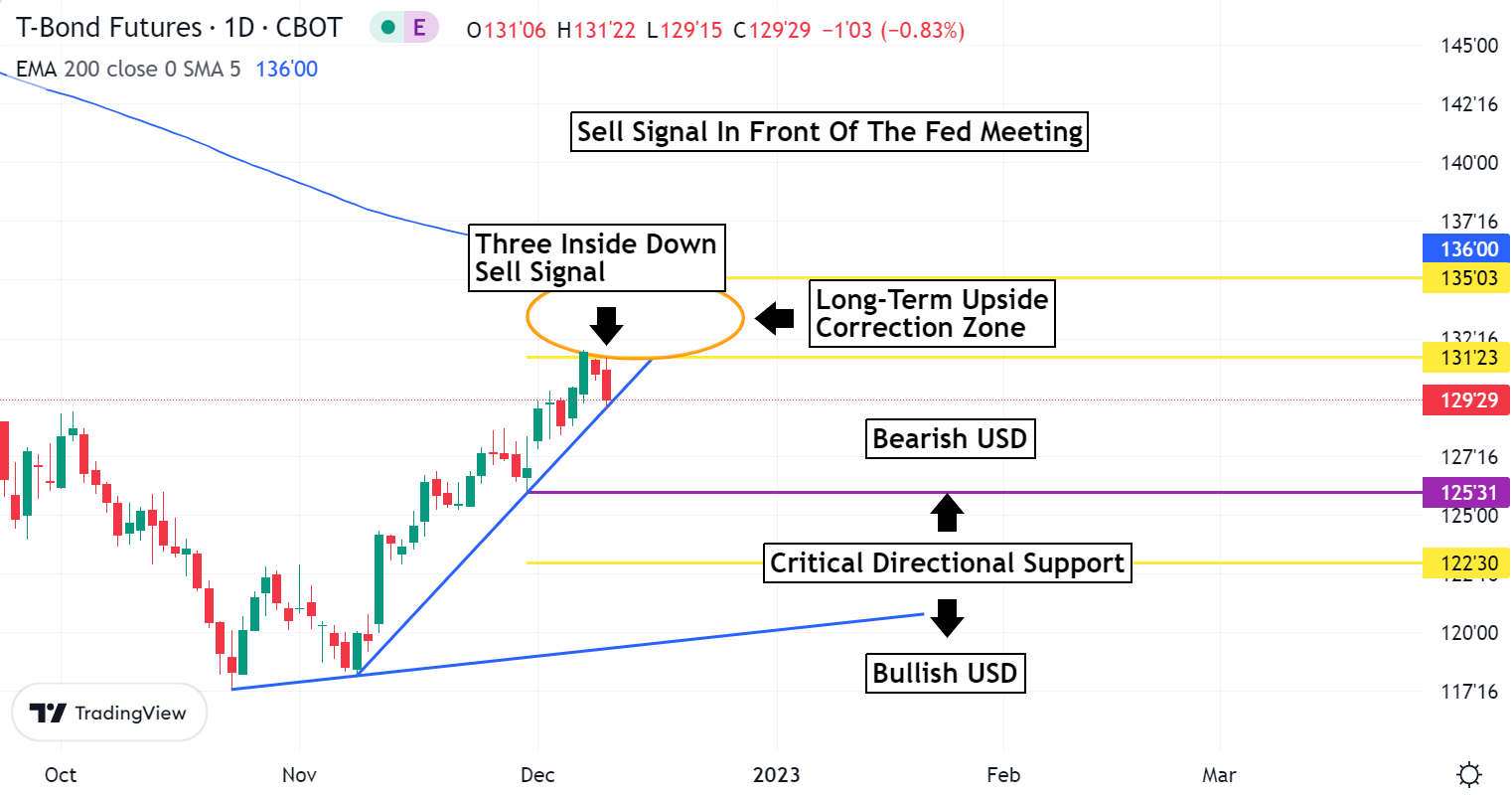

30yr T-Bond gave us a Sell signal on Friday completing a Three Inside Down Sell Pattern.

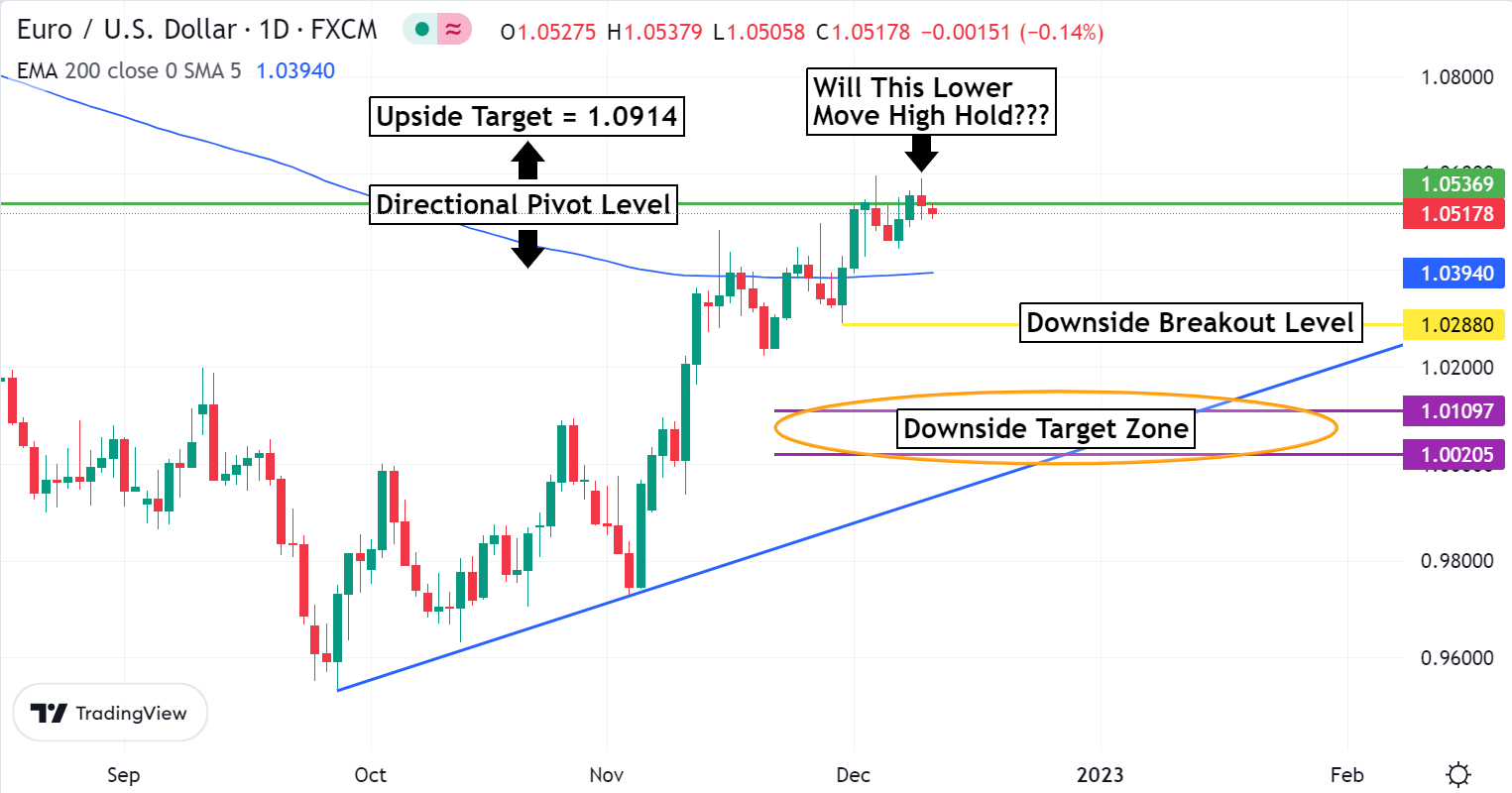

EURUSD Weekly Outlook:

The interest rates are showing signs of a short-term reversal. If this is true, then it is likely to hold back the EURUSD Bulls. Use the directional pivot level as a base for direction. Sustained trading above 1.0536 sets the market up for a strong push to the upside targeting the 1.0914 level. This rally started in late September, and if the interest rates turn this currency pair should reverse gears as well.

Under 1.0536 this market will be in limbo down to the 1.0394 200-day EMA level. Only a failure from 1.0288 is likely to spark fresh selling pressure. The 1.0109-1.0020 downside target zone is a solid area for the EURUSD to retrace back to. If the Fed raises the expected half a point, then selling pressure should pull the market back into this area. In 2023 the first Fed meeting is expected to yield at least one more hike. The big question is, will the ECB aggressively push their rates higher to hold the EURUSD afloat???

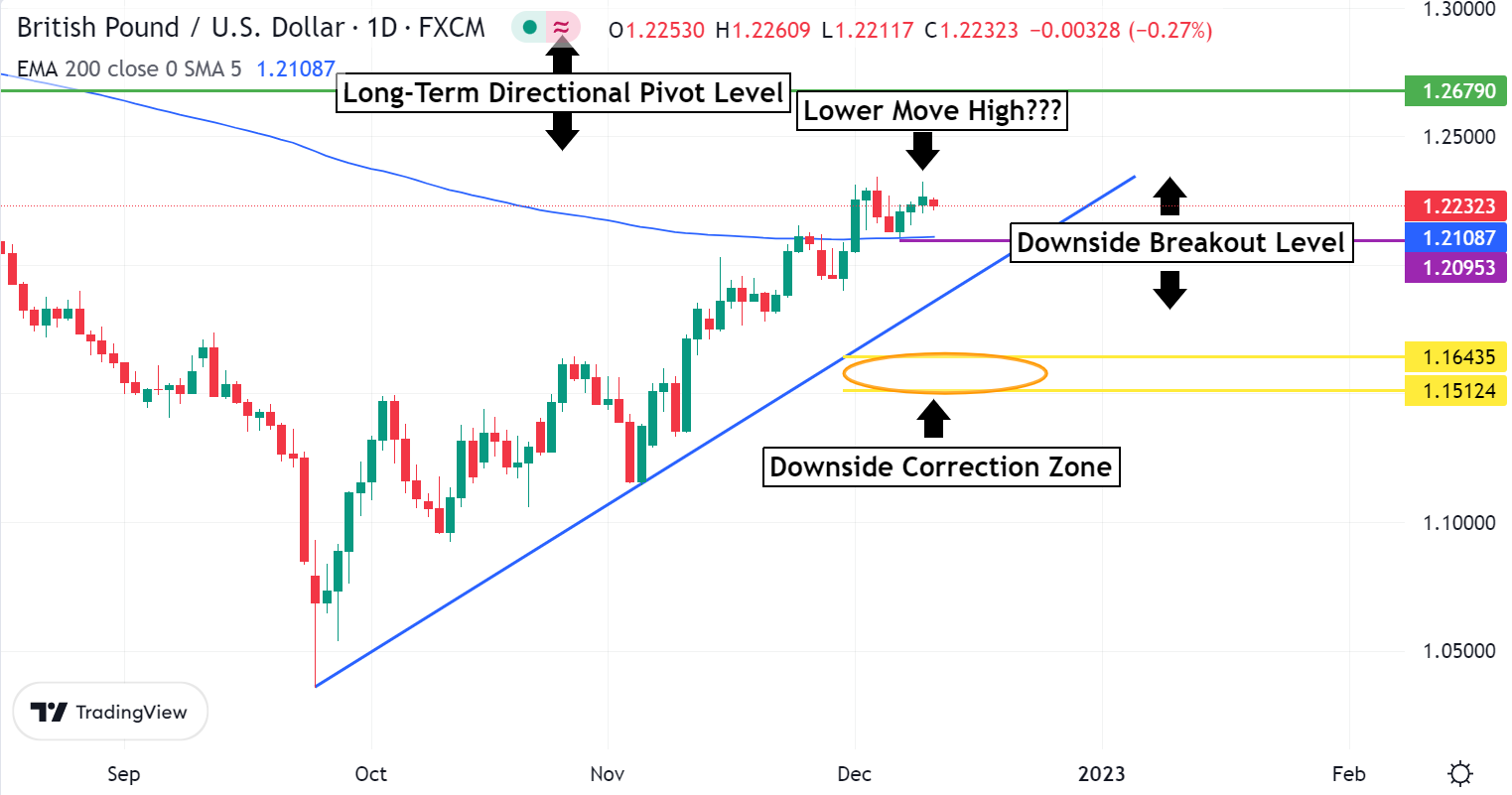

GBPUSD Weekly Outlook:

GBPUSD Bulls held this market up last week, and the market is poised for a follow through rally. There is strong support from the 1.2095 level up to 1.2108. This area should hold if the Bulls are going to continue to make newer move highs. Watch interest rates. Lower yields should help the Bulls flirt with another leg higher. 1.2679 is the long-term directional pivot the market is eyeing.

A slide under 1.2095 is needed to confirm a fresh Bearish release. Trading in this area is expected to generate fresh selling pressure that targets the 1.1643-1.1512 downside correction zone. The key to the Pounds direction will lay in the hands of the BOE’s response to the Fed rate hike. Will they raise in tandem, or even more aggressively? We will need to see what the response is. The short-term sell signal in the interest rate markets should help the GBPUSD bears slow down the current upside momentum.

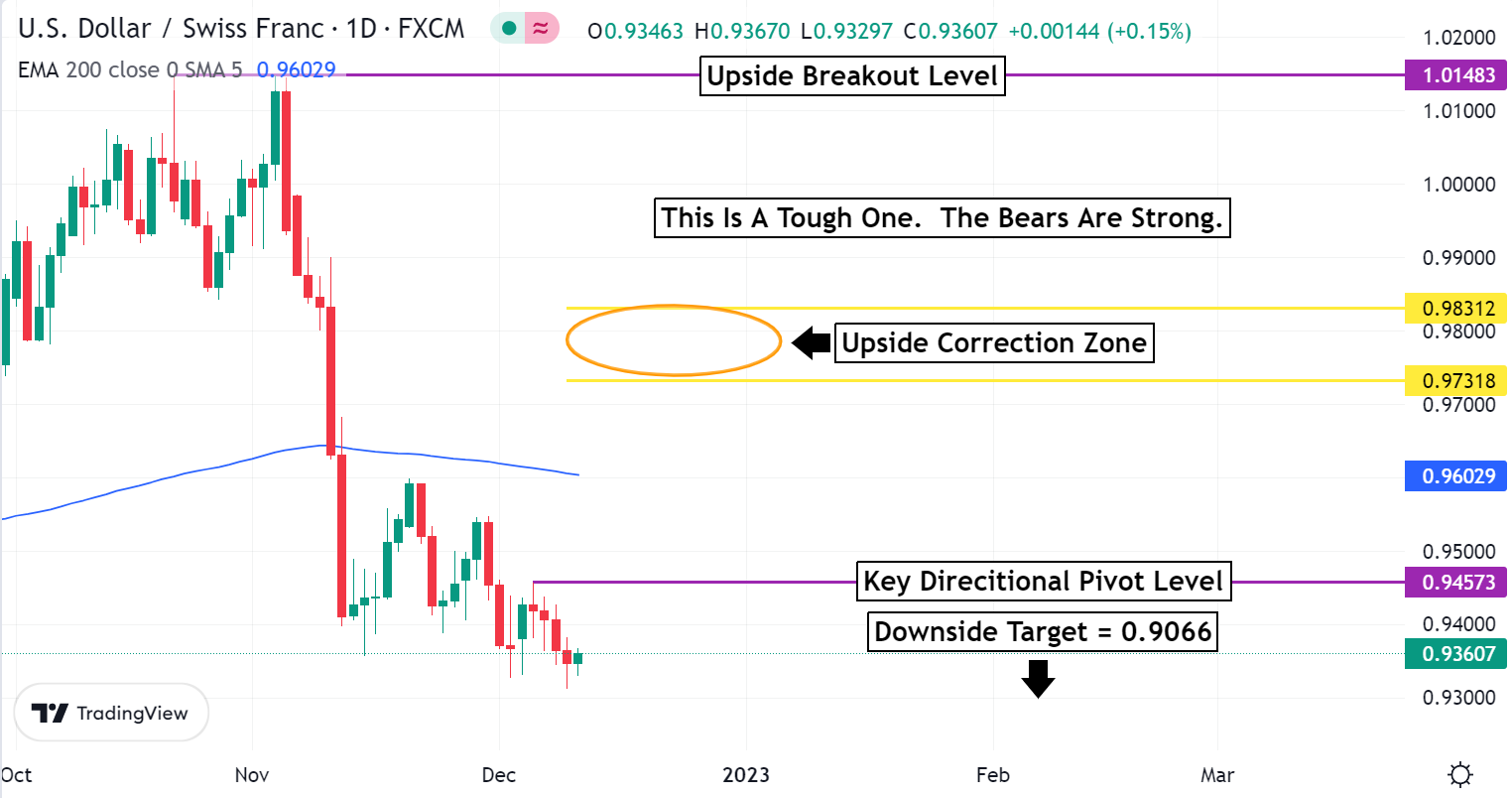

USDCHF Weekly Outlook:

Swissie Bears have this currency on edge slamming support. Trading under 0.9457 holds this market in an aggressive sell posture that targets the 0.9066 level. Has the tide turned for the USD vs the CHF? Probably not. This breaking market is most likely overdone. Beware of a violent turn to the upside. Markets tend to go out like they come in.

If yields start to get stronger again then it is likely that we may have a balloon under water rally. Do not fight a breakout rally above the 0.9457 directional pivot level. Sustained trading above this area is not necessarily bullish, but it may start to level off the trade in this currency pair. If the Fed shows indications of inflation fighting follow through in 2023, then the Bulls have the potential to lift the USDCHF back up into the 0.9731-0.9831 upside correction zone. Let us see how the meeting goes down on Wednesday.

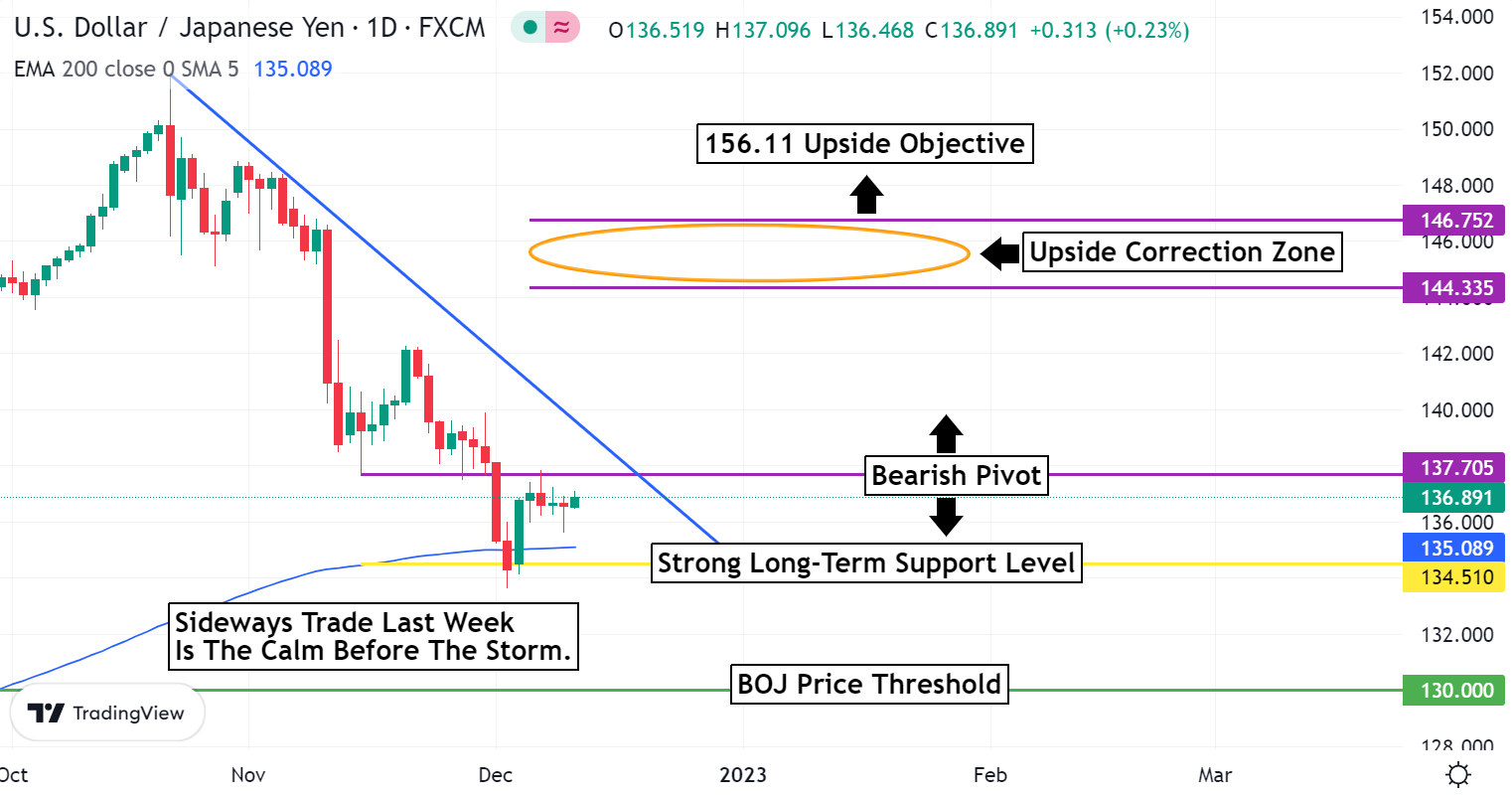

USDJPY Weekly Outlook:

There was very little action last week in the USDJPY, and it may be a flatliner until after the Fed release on Wednesday. Use caution, and wait for a move. Use the Bearish pivot for direction. Below here the market is set for more sideways action then any Bearish sell off. Only a break under 134.51 confirms fresh weakness that targets the 130.00 level.

A breach of 137.70 confirms strength and a short-term reversal up towards the 144.33-146.75 upside correction zone. This is all that is expected to the upside. The BOJ is not a threat until they do something, but lower Crude Oil is helping to give strength to the JPY. If there is a big rally in yields coupled by a rally in Crude, then expect a big Bullish turn of events for the USDJPY.

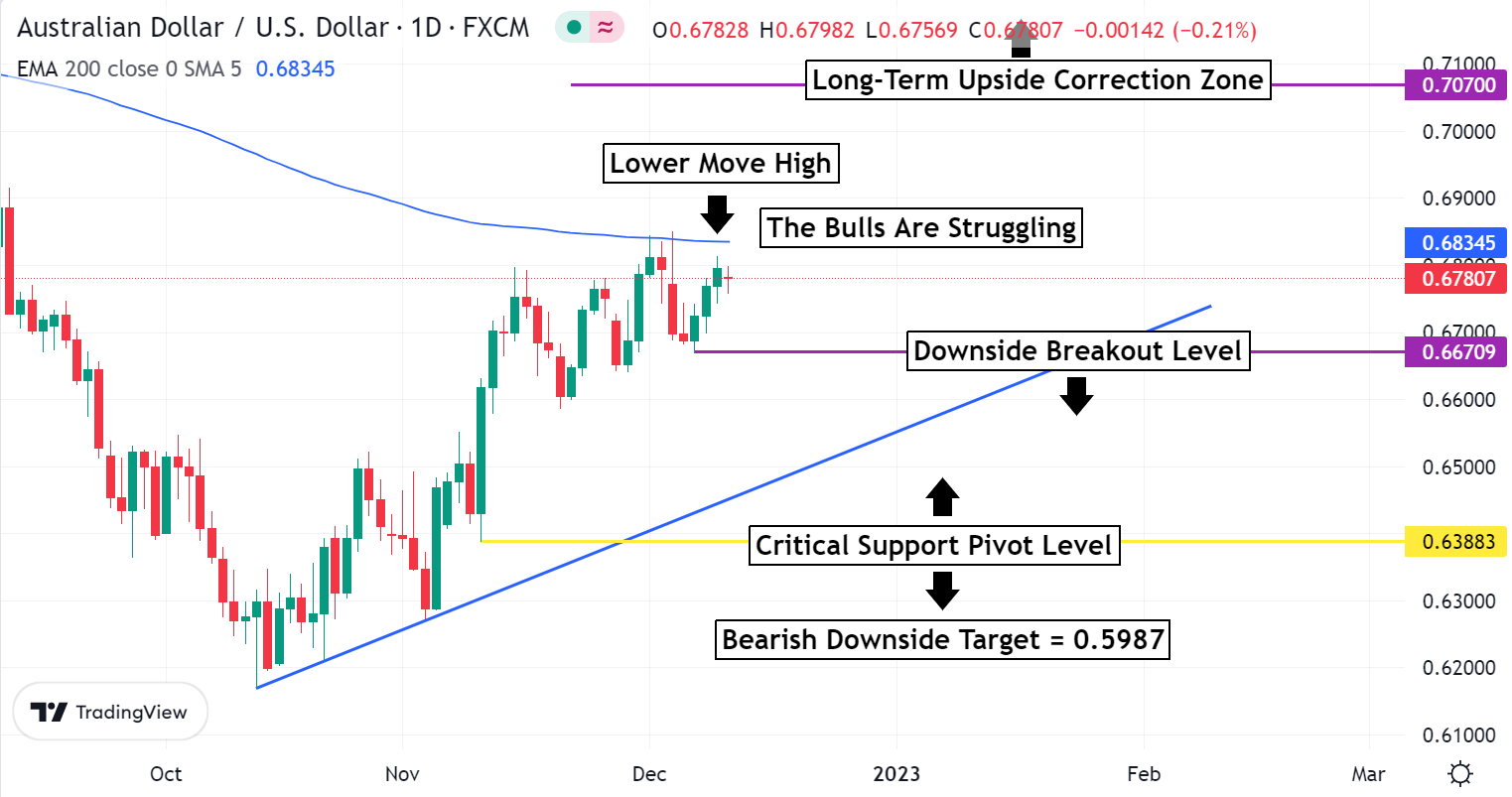

AUDUSD Weekly Outlook:

Aussie Bulls are flirting with a follow through rally, but are they running out of gas? An early test of support is on the agenda for this week. The 0.6670 downside breakout level is the target. If the market slips below here then expect selling pressure to build. Rising yields would also confirm fresh weakness in this currency for an extended break down to the 0.6388 support pivot level.

Use last Monday’s high as confirmation of strength. A rally above here confirms Bullish momentum is building. 0.7070 is the upside target. This is about all that is likely from a new leg higher. We need to see how the BOA will react to this Wednesday’s Fed release. Inflation woes still linger, and it is likely the Fed will slow down their Hawkishness. However, if the BOA and other banks get aggressive, then expect the Fed to continue to raise rates as well. The Fed was firm in their response to market conditions in 2022, and it is unlikely they will roll over for other central banks in 2023.

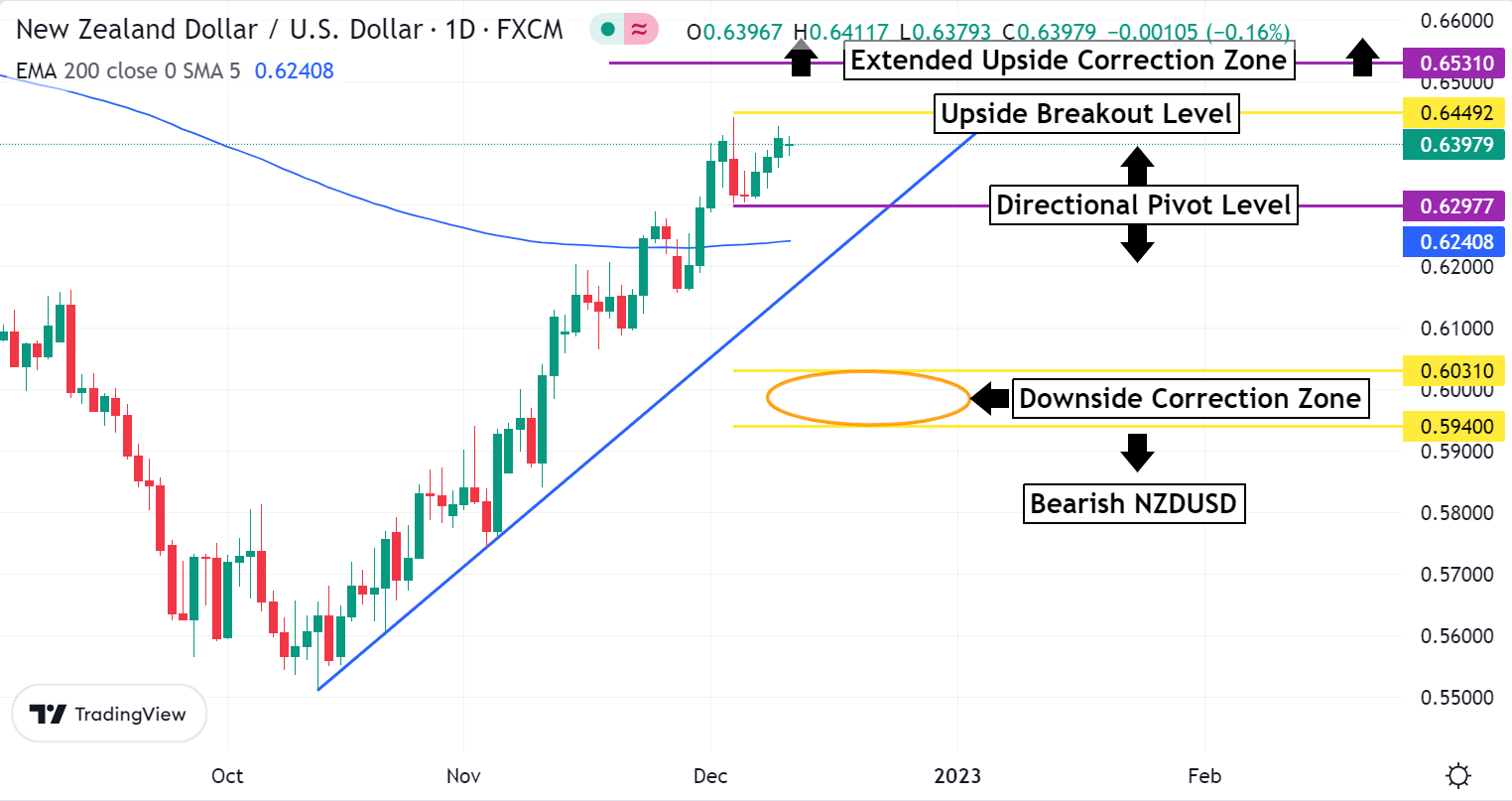

NZDUSD Weekly Outlook:

An aggressive Bullish posture is the outlook for the NZDUSD until there is a signal to change the outlook. Expect a challenge of the 0.6449 upside breakout level. A move above here should have the Bulls pressing the 0.6531 extended upside correction level fast. If the market gets back up to this area a pause is likely. The current rally has been very strong, and a short-term correction to the downside is likely as we head into the end of the year and holiday markets.

Only a failure from the 0.6297 directional pivot level is likely to initiate fresh selling pressure. If yields are rising then that should reinforce any weakness. If this is the case then an extended correction down towards the 0.6031-0.5940 downside correction zone should get set in motion. This is all that is expected from a lower trading market. The Fed expectations need to be evaluated after Wednesday to see what tone the NZDUSD may have moving forward into the end of the year.

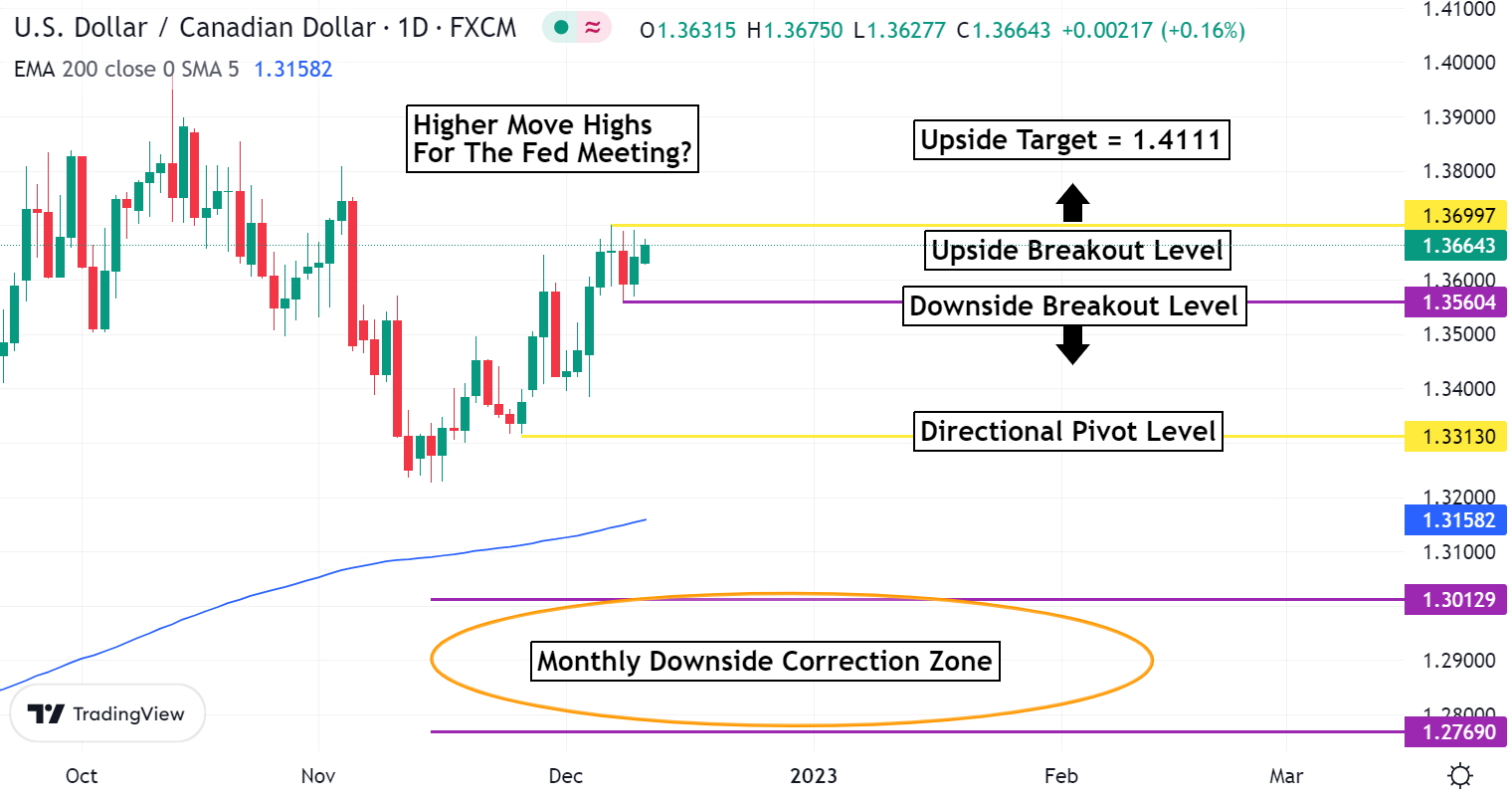

USDCAD Weekly Outlook:

USDCAD Bulls tried to make a run at resistance, but ran out of steam. With the looming Fed meeting it is likely we will see an early challenge of resistance. Use the 1.3697 upside breakout level for direction. A rally above here targets 1.4111. Economic numbers are supporting the current trend, and until there is a change it is likely that this market will continue to press for higher move highs.

Only a break under the 1.3560 downside breakout level confirms weakness that targets 1.3313 directional pivot level. This is the line in the sand for a Bearish correction. A failure from this area would be a negative sign that the Bears are back in control. 1.3158 will be a key level. If the USDCAD gets below the 200-day EMA it would be a negative signal. The 1.3012-1.2769 monthly downside correction zone is the long-term downside target area.

NOTICE: On Thursday, December 15th, Basil Chapman will be hosting an intraday "Live Trading Webinar" from 8:30AM to 2PM ET! Click Here to learn more!