The Tiger Forex Report 12-27-22

The Tiger Forex Report – Week of 12/26 – 12/30/2022

DXY has stabilized for the holiday markets. An early test of Resistance is likely.

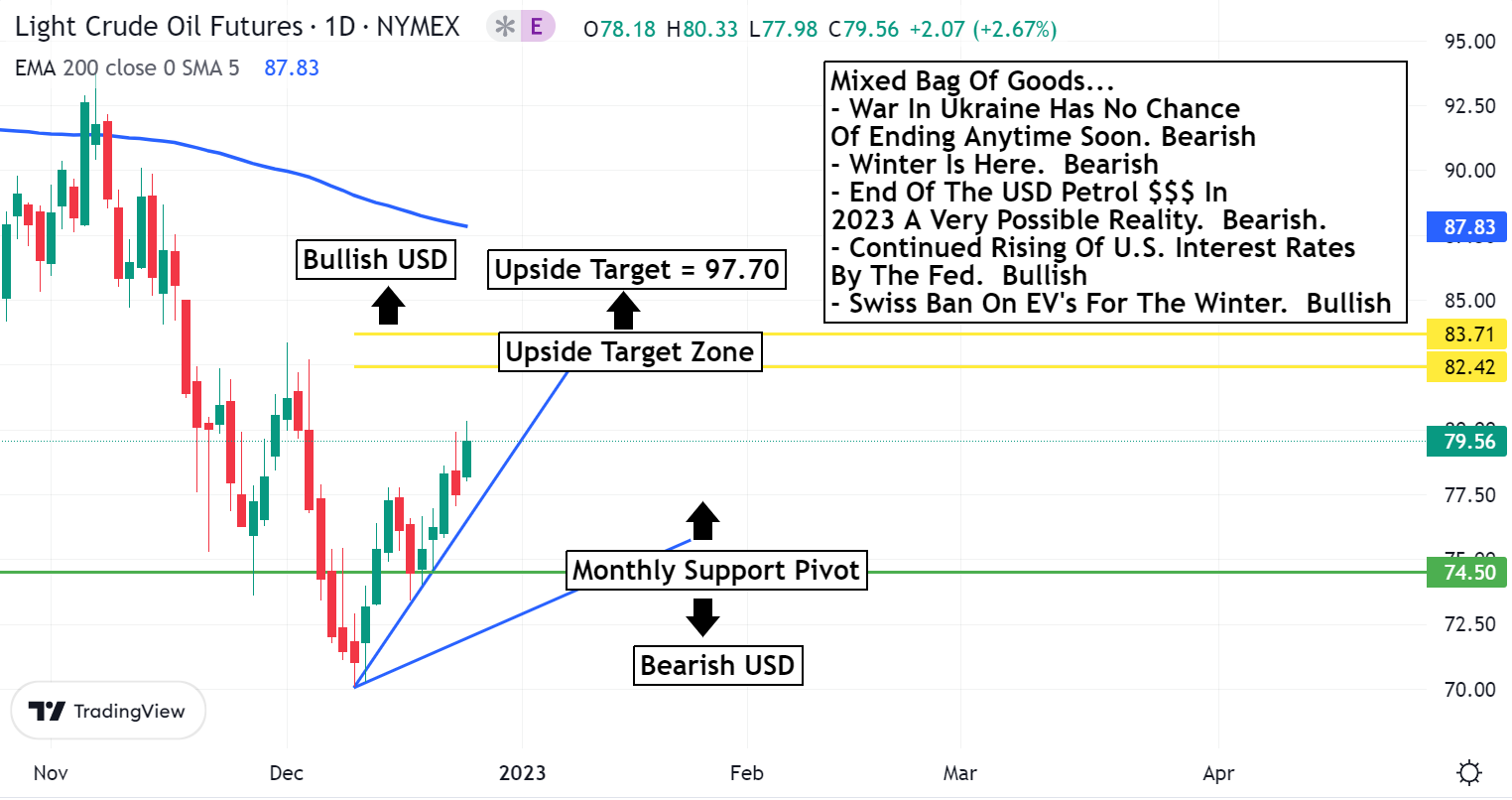

Crude Oil remains in a short-term Bullish posture. After this weekend’s announcements it is very clear that Ukraine has no desire for peace talks. Long-term this supports the Crude Oil Bulls.

30yr T-Bond Bears are getting a holiday sell off. With the Fed stance remaining Hawkish it is likely that the market will make a play for the 124^31 – 123^08 downside correction zone.

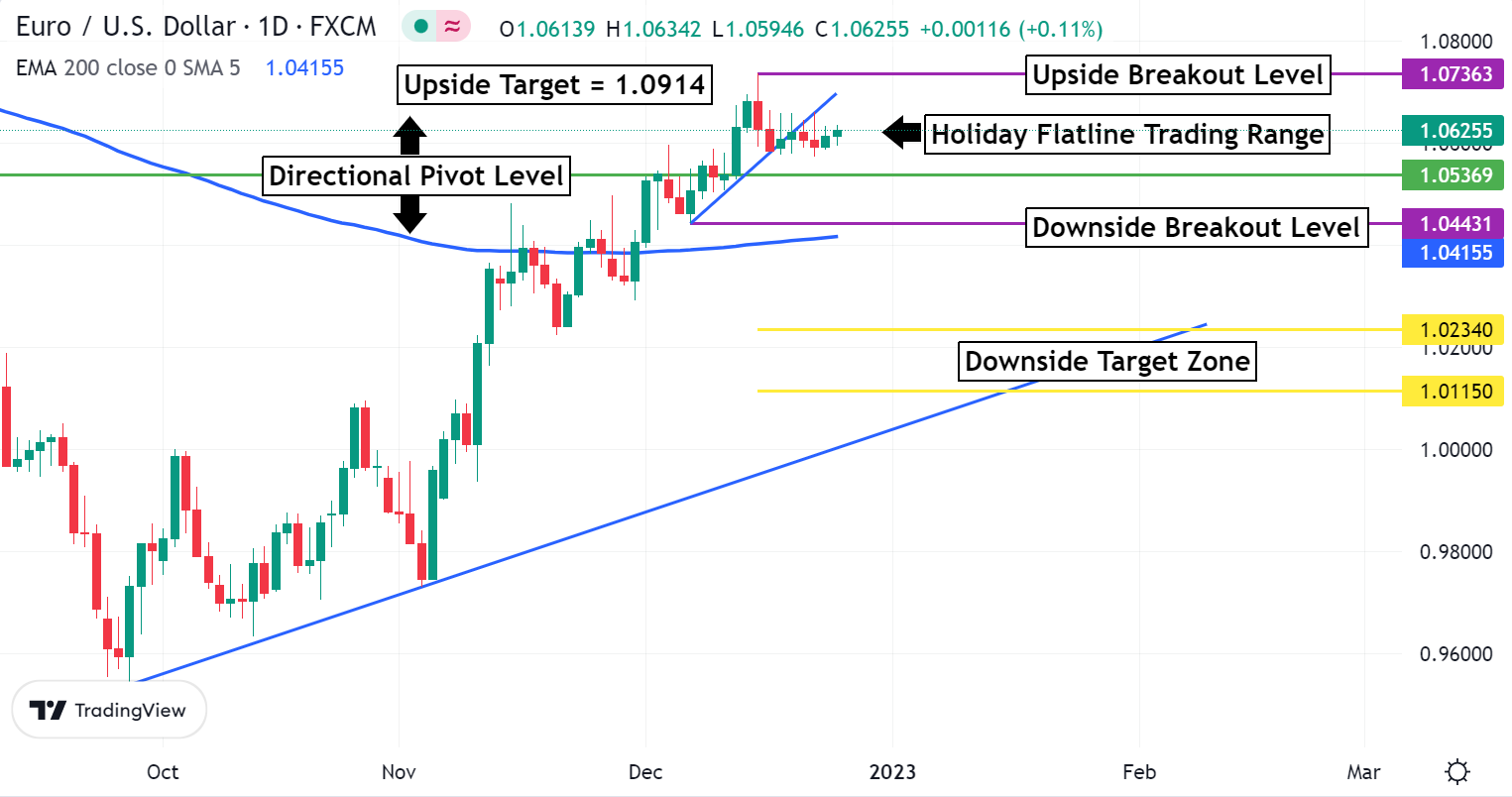

EURUSD Weekly Outlook:

EURUSD traders had little opportunities last week, and a breakout is on the agenda. An early test of the 1.0536 directional pivot level is expected. This is a key area. If the market fails here, then fresh selling should press the lows towards the 1.0443 downside breakout level. Look out below if there is a print under this area. The 1.0234 – 1.0115 downside target zone is the extended Bearish objective.

Sustained trading above the 1.0536 level keeps this market in a choppy range trade. Only a breach of the 1.0736 upside breakout level changes the outlook. Fresh buying is likely to enter the market at these levels. 1.0914 is the longer-term Bullish objective. However, with the Fed posture remaining Hawkish it will be a struggle for EURUSD Bulls to continue to press newer move highs. A collapsing EU economy is not helping shore up this currency either. Even ECB Hawks will have trouble supporting the EURUSD.

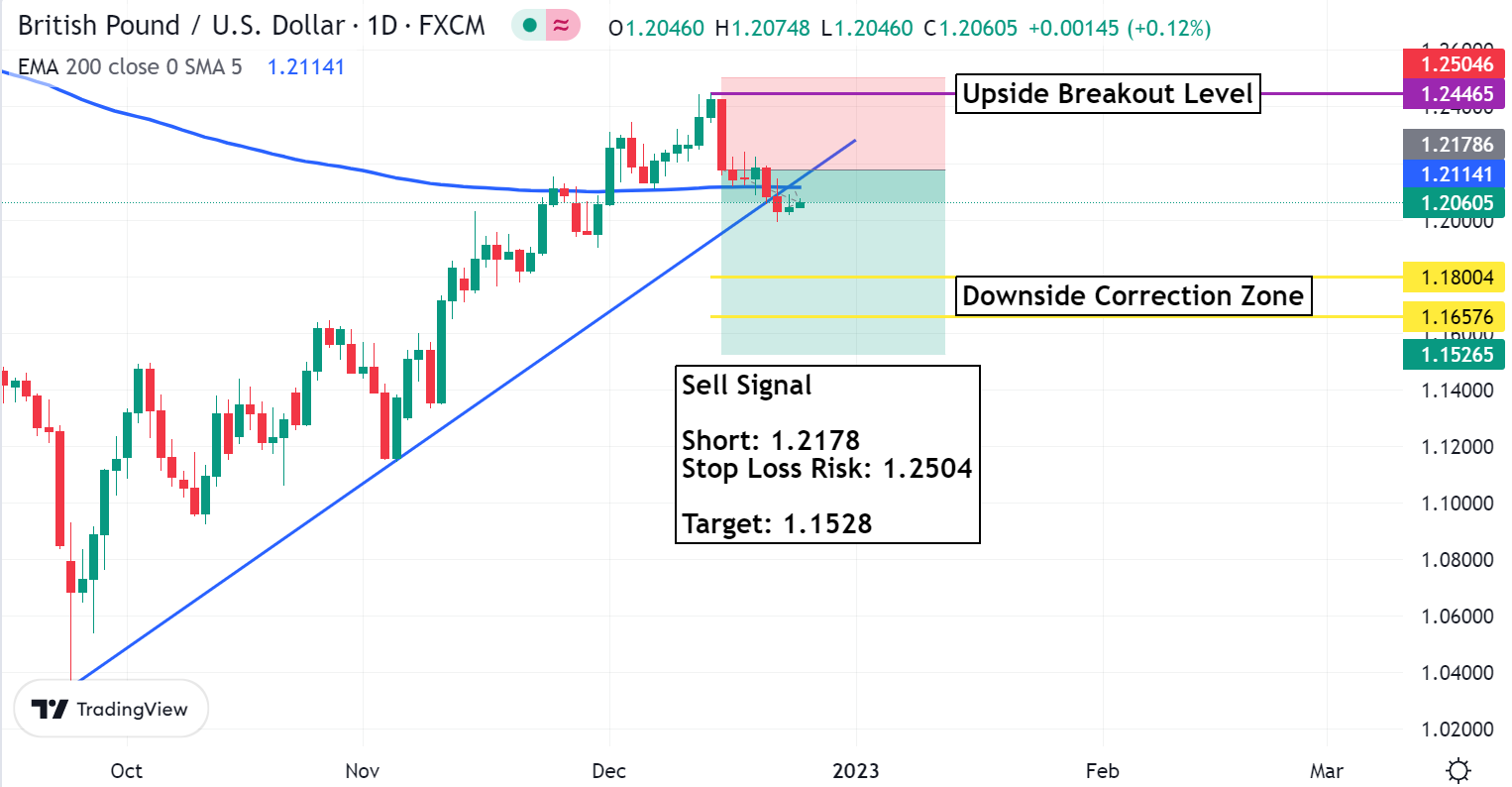

GBPUSD Weekly Outlook:

GBPUSD Bears have a hold on direction for this market, and follow through trading to the downside is very likely. An early test of support this week is on the to do list reinforcing the sell signal from the week before. Bears are targeting the 1.1800-1.1657 downside correction zone. Use caution if the market falls back into this area. Downside momentum may have the potential to press fresh lows towards the sell signal objective of 1.1528 before there is a bounce.

Only a breach of 1.2446 confirms strength in this market, and an extension of the present Bullish trend to newer highs. Unless there is an incredibly strong Hawkish change in posture from the BOE it is not likely that the Bulls will be able to bet back to higher levels any time soon. A close above 1.2446 is needed to confirm trend strength, and an extended upside target of 1.2728.

USDCHF Weekly Outlook:

USDCHF traders find themselves wondering if support will hold. Trading above the 0.9214 downside breakout level holds this currency in a range trade in the critical range area. The holiday trade may have set the market adrift, but it is likely that the Bulls may get a chance to challenge resistance. Sustained trading above 0.9214 should solidify a base for the Bulls. 0.9606 is the bullish target in the short-term. If USD strength starts to build, then this area will be crucial if the long-term trend is going to strengthen. 0.9860 is the extended upside target.

Be careful of a failure of the 0.9214 downside breakout level. The overall trend is still Bearish. 0.9066 is the downside target if the Bears decide to press newer new move lows. This scenario is not likely unless the DXY starts to fall apart again this week. Use that as a guide for overall direction for the USDCHF this week. Remember it is still the holidays, and a shortened week across the globe. We may have a non-event style week with trading mimicking last week’s range trade conditions.

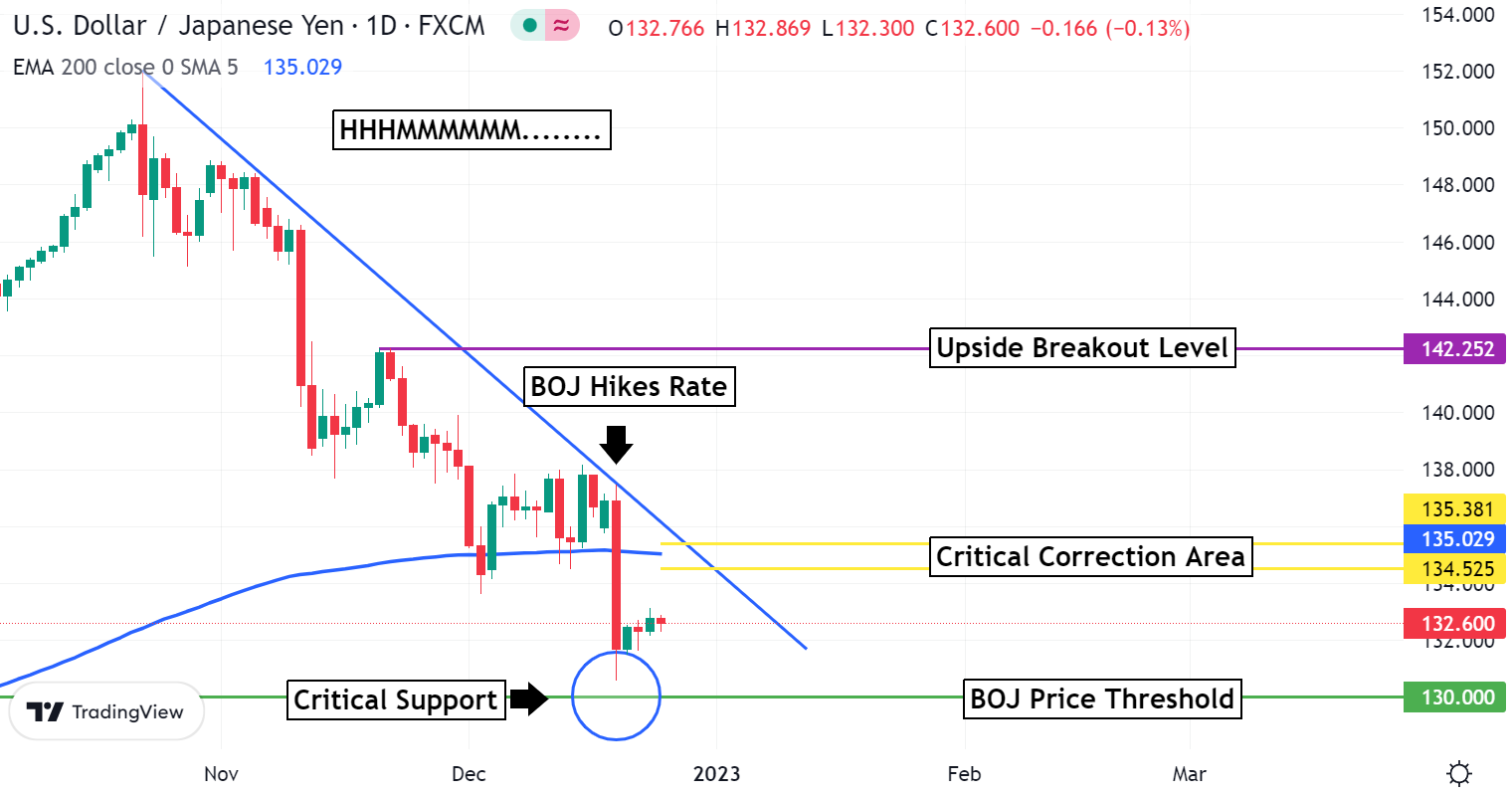

USDJPY Weekly Outlook:

The BOJ gave the world a surprise gift of a holiday rate hike. However, it resulted in only a one day sell off. Key off the 130.00 BOJ price threshold for the USDJPY market bias. Trading above here keeps the market looking to find a base. This is the first move by Japan in a very long time. There is new leadership taking over in a few months, and this may be foreshadowing of a new regime. The key word there is “MAY”. Short-term it is likely that there will be a bounce back up towards the 134.52-135.38 critical correction area. Only a rally above this area confirms longer-term strength to press a positive move back up towards the 142.25 upside breakout level.

Trading under 130.00 will be a fight. Do not view newer move lows lightly. Bearish momentum has the potential to build below here driving the Bears down towards the 127.50 long-term support level. Although this scenario is possible, higher trending U.S. Yields will make this potential future unlikely for a couple of months to come.

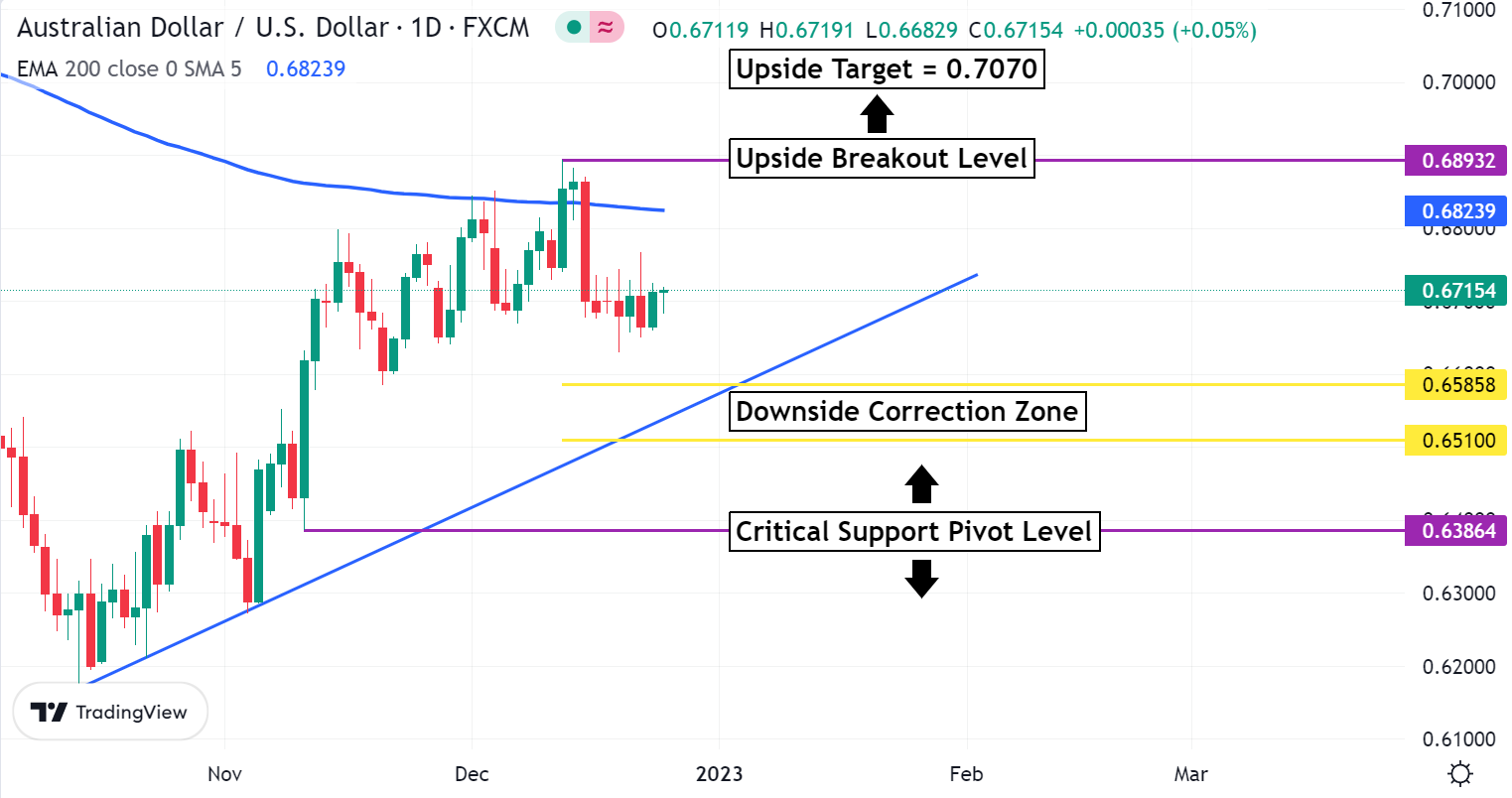

AUDUSD Weekly Outlook:

Expectations for this market are low after last weeks holiday performance. AUDUSD traders may have to endure another week of sideways action before there is a move. The short-term correction still has the Bears aiming for the 0.6585-0.6510 downside correction zone. Strong support rests in this area, if the intermediate trend is to remain Bullish then this will be it for a downside follow through move. A drop under 0.6510 would be a very negative sign that the longer-term Bear trend is trying to take control.

Only a breach of the 0.6893 upside breakout level confirms strength for a move that targets the 0.7070 level. Technically this is a great idea, but the real world may have other ideas. Yields in the U.S. are likely to be in front of any BOA counter measures. If this is the case, then the AUDUSD Bulls will have a very rough fight ahead of themselves for the next couple of months. Wait for supporting fundamental information before getting overly Bullish this currency pair.

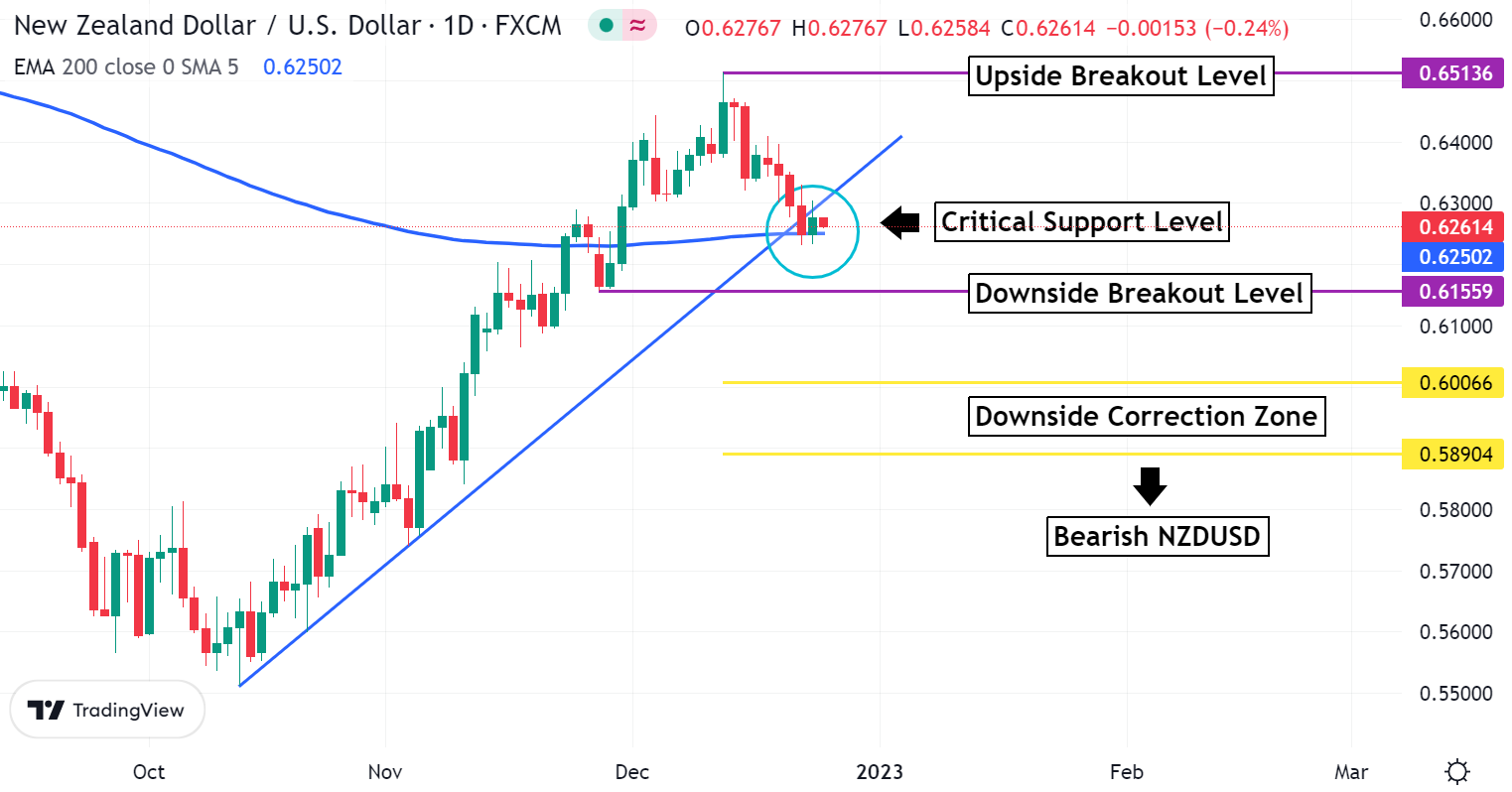

NZDUSD Weekly Outlook:

The holiday market seemed to be of no interest for NZDUSD Bears last week. The market fell into strong support, and gave traders some opportunities. There is still another week of holiday trading, and maybe this market will settle into a range bound trade for a few sessions. The short-term trend is on edge, and the outlook is sideways to lower. If the market is going to hold up there will be no trading under the 0.6155 downside breakout level. A failure from here and all bets are off for a bounce. Bearish momentum should build under this area pressing a slide into the 0.6006-0.5890 downside correction zone.

A buy signal is necessary before the Bulls are likely to recapture any strength. Only a rally up to challenge the 0.6513 upside breakout level takes us off the Bearish outlook. If the NZDUSD pierces 0.6513, then the upside target is extended up towards the 0.6744 level. Trading is expected to be thin, and the algos will be pushing this market around. If there is a radical spike higher, then it will most likely be machine driven volatility. The best advise may be to wait this one out until the New Year. Remember to always let the market come to you. Do not force a trade…it usually does not end well.

USDCAD Weekly Outlook:

Another market that settled into a sideways trade is the USDCAD. With Yields rising and a neutral DXY the USDCAD remains in a flat to higher outlook. The trend is slightly Bullish with a challenge of resistance likely. Newer move highs target the 1.3808 upside breakout level. This is a key area holding the trend back. A breach of this level is a good indication that the Bulls will make a play for the longer-term upside target of 1.4111.

If the USDCAD starts to trade lower it will be in a wide range trade down to the 1.3317 directional pivot level. Under current conditions it is unlikely that the market will drop under this area in the short-term future. Only a failure from 1.3317 confirms weakness and a solid turn in direction. Trading below 1.3317 is likely to unwind as this currency pair makes a play for the 1.3012 Monthly downside correction level. It will be hard to pull this market back into this area unless DXY starts to weaken and Yields start to fall lower in a strong way.