The Tiger Forex Report 12-5-22

The Tiger Forex Report – Week of 12/05 – 12/09 /2022

DXY is getting slammed by lower Yields. Rates are still expected to rise, and so will the USD.

Crude Oil is bouncing off Support and is in a limbo range trade.

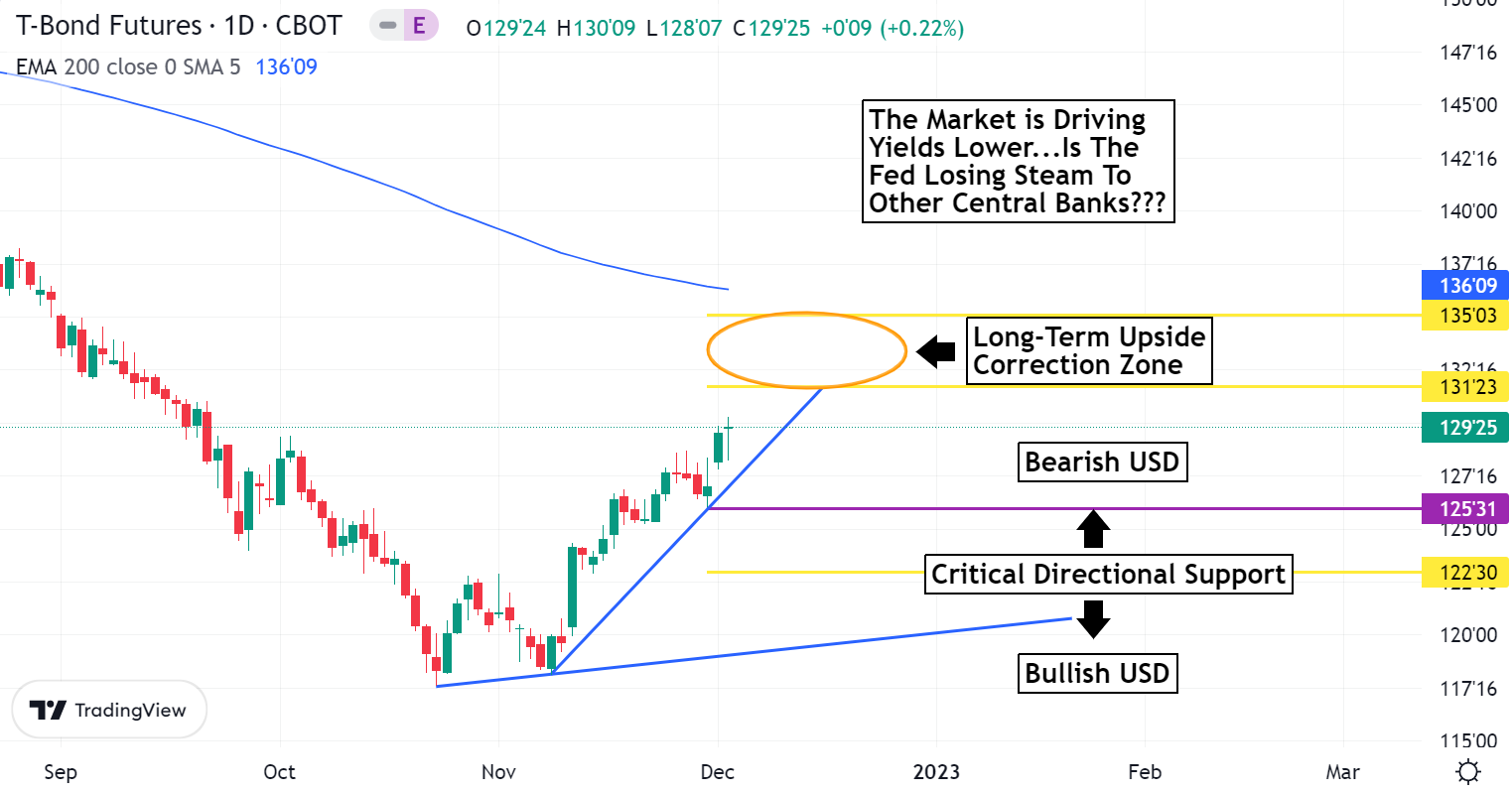

30yr T-Bond is helping to ease the pain of Yields. But a reality check is looming.

EURUSD Weekly Outlook:

EURUSD is finally pressing through resistance. Keep your sights on higher move highs early in the week with trading above the 1.0540 level. A challenge of 1.0592 is likely. Be mindful of yields. If yields keep pulling back, then the Bulls have the potential to press this rally up to 1.0905. A reversal in the interest rate market should reverse the outlook, and give the USD Bulls a reason to come charging back.

Only a sustained trade under 1.0540 confirms that this market is set for a digestive phase. The slope on the current rally is steep, and it is likely that this currency pair might settle into a range trade. If yields start to go up again, then the EURUSD should set off a profit taking break. Volatility is high, and a downside correction could unwind fast. The 1.0109-1.0020 downside target zone is where support is likely to hold. However, if the Interest Rate markets are slamming new move lows, then this market should follow.

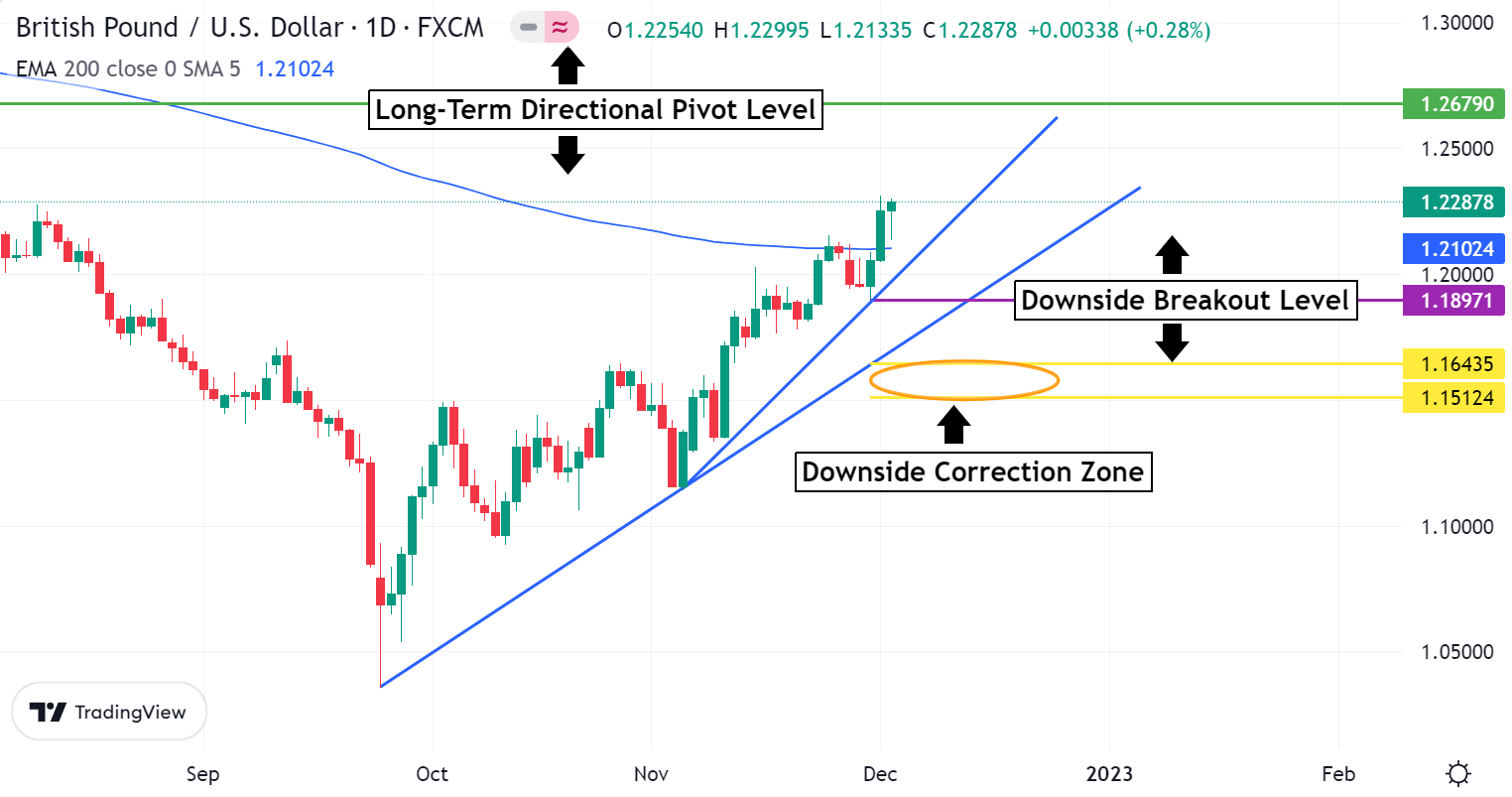

GBPUSD Weekly Outlook:

Bully I say! This currency is taking advantage of lower moving market yields. The trend is your friend targeting newer move highs. 1.2679 is the long-term directional pivot to shoot for. Fundamental and technical indicators are ready for a sell off, but prices are saying otherwise. Just watch out for any strong sell off in the interest rate markets. If this occurs there is likely to be a slow down in GBPUSD upside momentum.

Trading down to 1.1871 level keeps this currency pair in limbo. However, a failure from this level sets up a fresh wave of selling pressure for a move that targets the 1.1643-1.1512 downside correction zone. With the BOE raising rates the GBPUSD is likely not to get hit as hard as it has recently. But watch out for the economic numbers. Inflation is still here, and if inflation explodes again there is a likelihood of the Fed pressing higher rates to the extreme. This would most likely be very Bearish for this market in the long run.

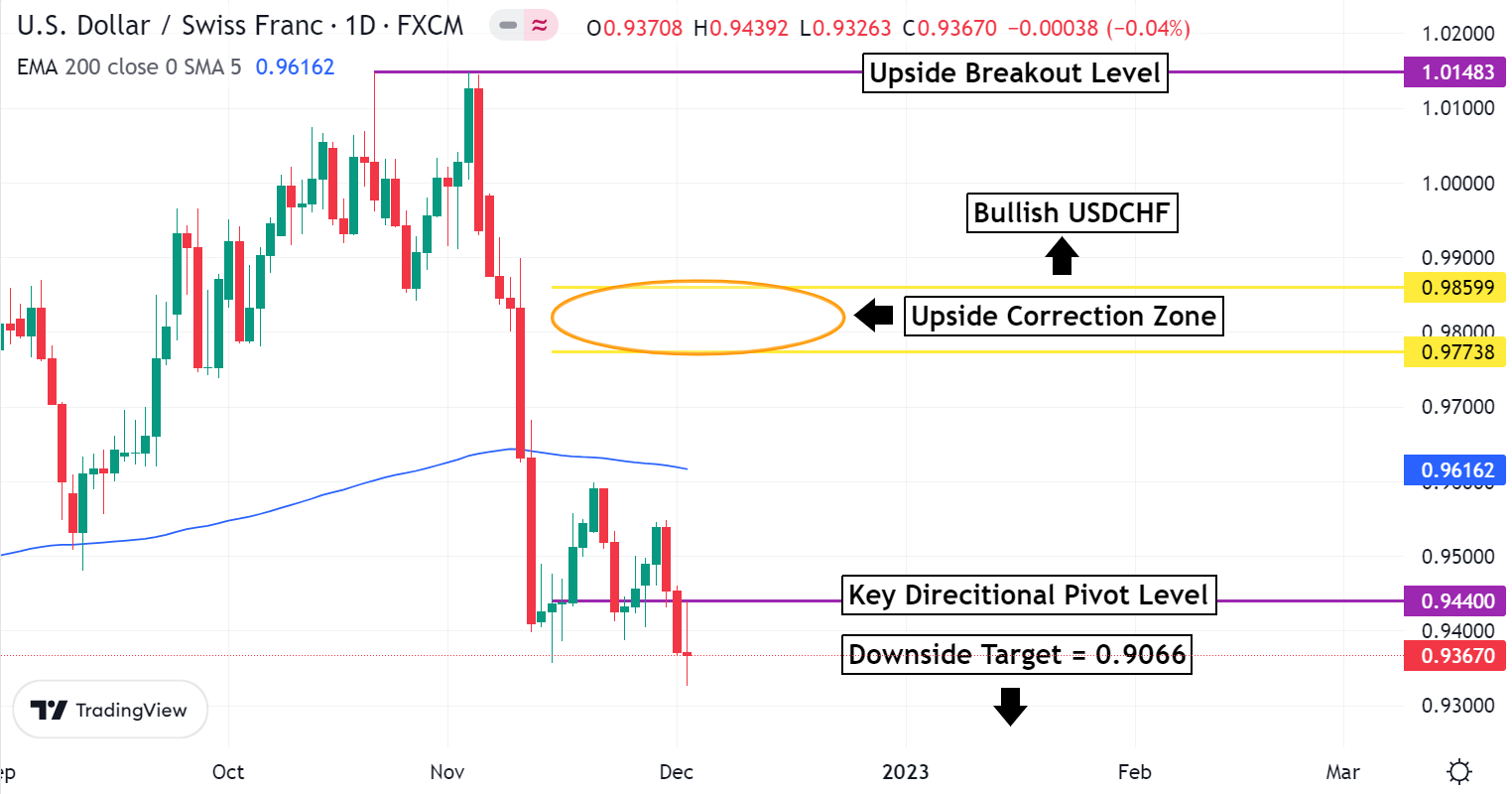

USDCHF Weekly Outlook:

This market is bouncing on support. USDCHF Bears will most likely keep on grinding lower, and it will be tough fading this slide. The trend is still intact so it would be unwise to try and buy in to it. There may still be another release with the potential to hit 0.9066 before the market stabilizes. If market yields are in retreat the Swissie is likely to remain on edge below the 0.9440 key directional pivot level.

Only a sustained trade above 0.9440 confirms a break in downside momentum for a choppy digestive trade back towards the 200 EMA at around 0.9616 area. The trend is aggressive, and it will be a fight to get the market above this area. If yields reverse gears and head higher, then the USDCHF has the potential to press a rally up into the 0.9773-0.9859 upside correction zone. There is a Fed meeting in a week and a half, and that may help shore up a Bullish move.

USDJPY Weekly Outlook:

USDJPY Bears took advantage of lower yields and slammed new move lows down to very strong support. 130.00 is the BOJ target, but can the downside momentum hold? Key off the 137.58 Bearish pivot. Trading under here keeps this market on edge flirting with support. 130.00 is about all that is on the menu for a lower trade this week. Yields are not expected to stay on their lows much longer. The Fed meeting is closing in, and it is likely that the USDJPY will turn with the interest rate market.

Trading above 137.58 is required to reverse gears on the trend for this FX pair. The trend is negative, but a balloon under water rally may be on the horizon. If there is a strong rally in the interest rate markets, then expect fresh buying to drive the USDJPY up towards the 144.83-146.53 upside correction zone. 156.11 is the extended upside target for any major shift in trend.

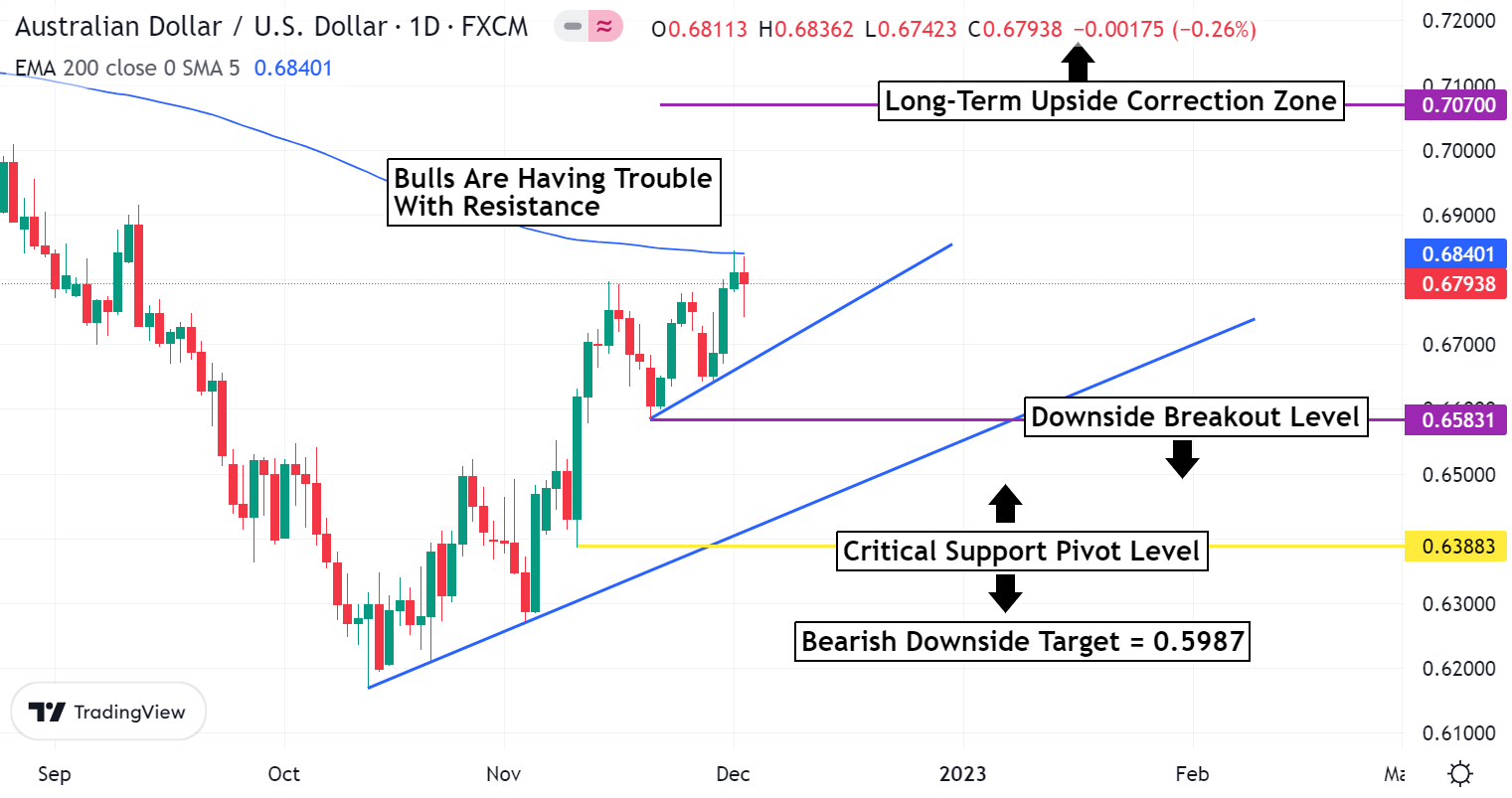

AUDUSD Weekly Outlook:

The Aussie traders keep riding the Bullish strength in this market, but momentum is running out of gas. Use the 200 EMA for direction. Trading above 0.6840 extends the recent leg higher targeting the 0.7070 long-term upside correction zone. This is about all that is likely from another Bullish leg higher. Yields are likely to head higher this week, and that should slow the Bullish campaign.

Trading under 0.6840 pulls the reigns back on this market, and a short-term reversal should begin. If the market is just going to digest recent gains, then a pull back to the 0.6583 area should be about all that occurs from a pull back. A failure from the 0.6583 downside breakout level targets the critical support pivot level at 0.6388. 0.5987 is the longer term sell off objective in the event that yields start to aggressively move higher.

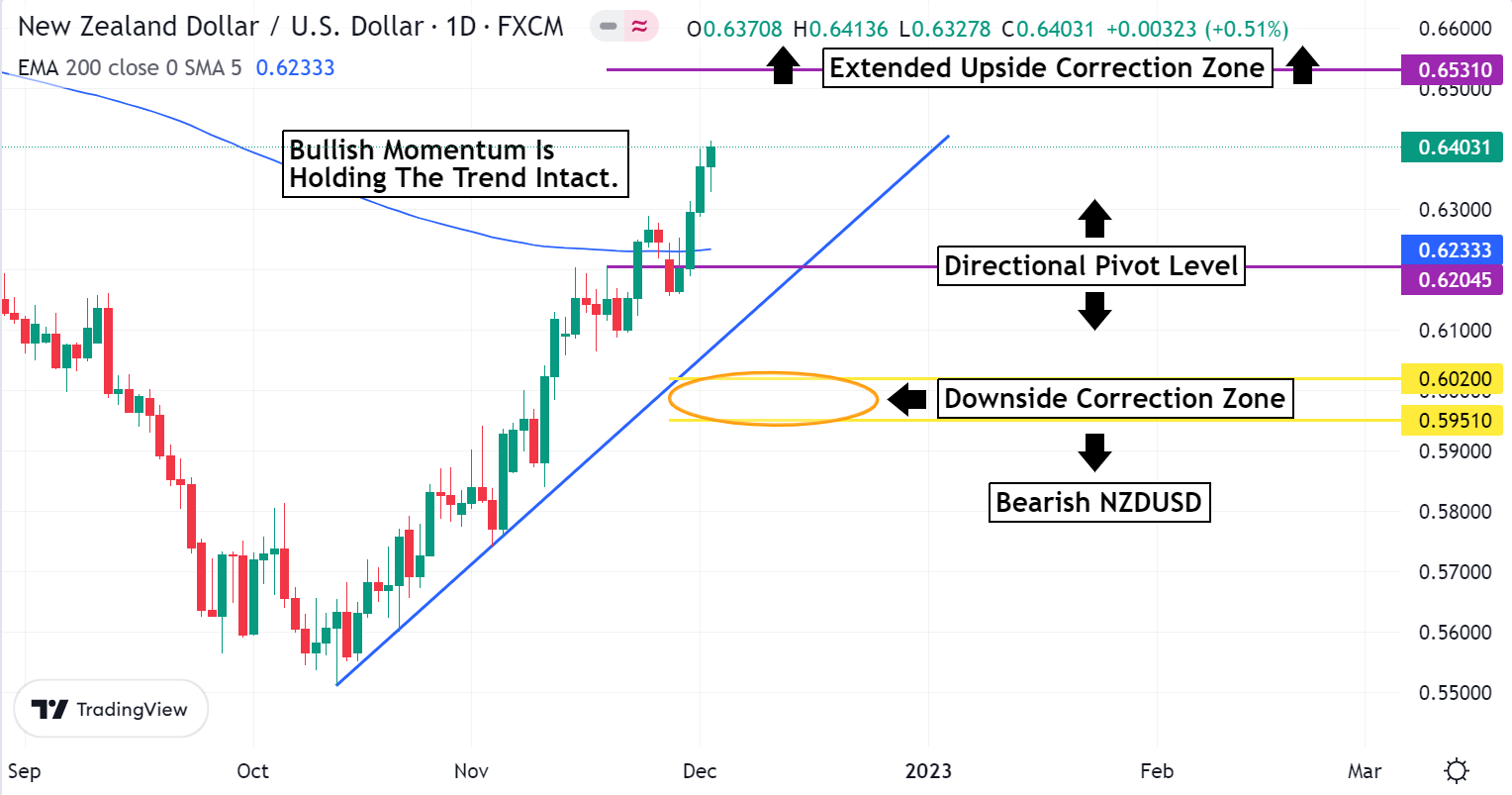

NZDUSD Weekly Outlook:

NZDUSD Bulls were relentless last week, and this market is set to continue the rally. Expect an early challenge of resistance up towards the 0.6531 upside correction zone threshold. With the Fed meeting looming it is not likely that this currency pair will get beyond this area. Fundamentals for this market are not that good, and it is likely to slow the Bulls down.

If interest rate markets start to sell off big this week, then look for a pull back towards the 0.6204 directional pivot level. The trend is very solid, but if the NZDUSD dips below 0.6204 it is likely that a fresh wave of selling pressure could fuel a slide back towards the 0.6020-0.5951 downside correction zone. The market is not expected to get below here. If the market dips under this area it would be a negative indication that the longer-term Bear trend is trying to regain control.

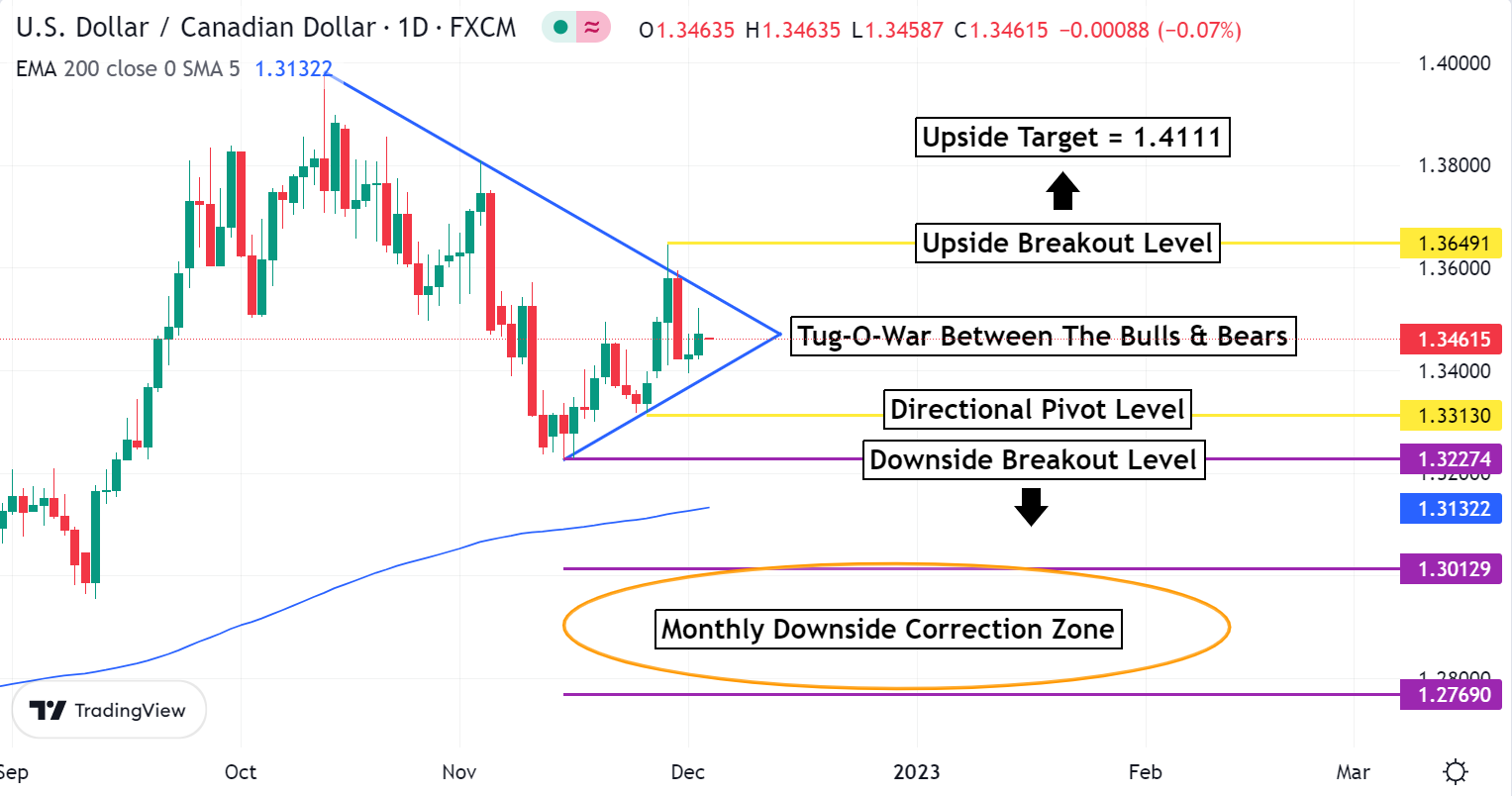

USDCAD Weekly Outlook:

Last week the USDCAD bounced around but went nowhere. The coil is winding up and is ready to spring. Use the 1.3313 directional pivot level for market bias this week. Trading above here keeps the Bulls posed for a choppy trade up towards the 1.3649 upside breakout level. If the Bulls poke through this barrier another wave of fresh buying may unfold if yields start to rise in tandem. 1.4111 is the longer-term upside objective.

If the market falls under the 1.3313 directional pivot level the Bears will be looking to press the 1.3227 downside breakout level. Do not fight a failure from here. Trading under 1.3227 is a negative indication that the Bears are set to slam this currency back down into the 1.3012-1.2769 monthly downside correction zone. With a looming Fed meeting it is not likely that the Bears will be able to manifest such an extreme sell off unless the BOC jumps in and raises their rates too.

NOTICE: TFNN has launched their Holiday Tiger Dollar Sale, available only until December 12th! Get up to a 40% bonus on your Tiger Dollars.

Click here for more information.