The Tiger Forex Report 2-21-23

The Tiger Forex Report – Week of 2/20 – 2/24/2023

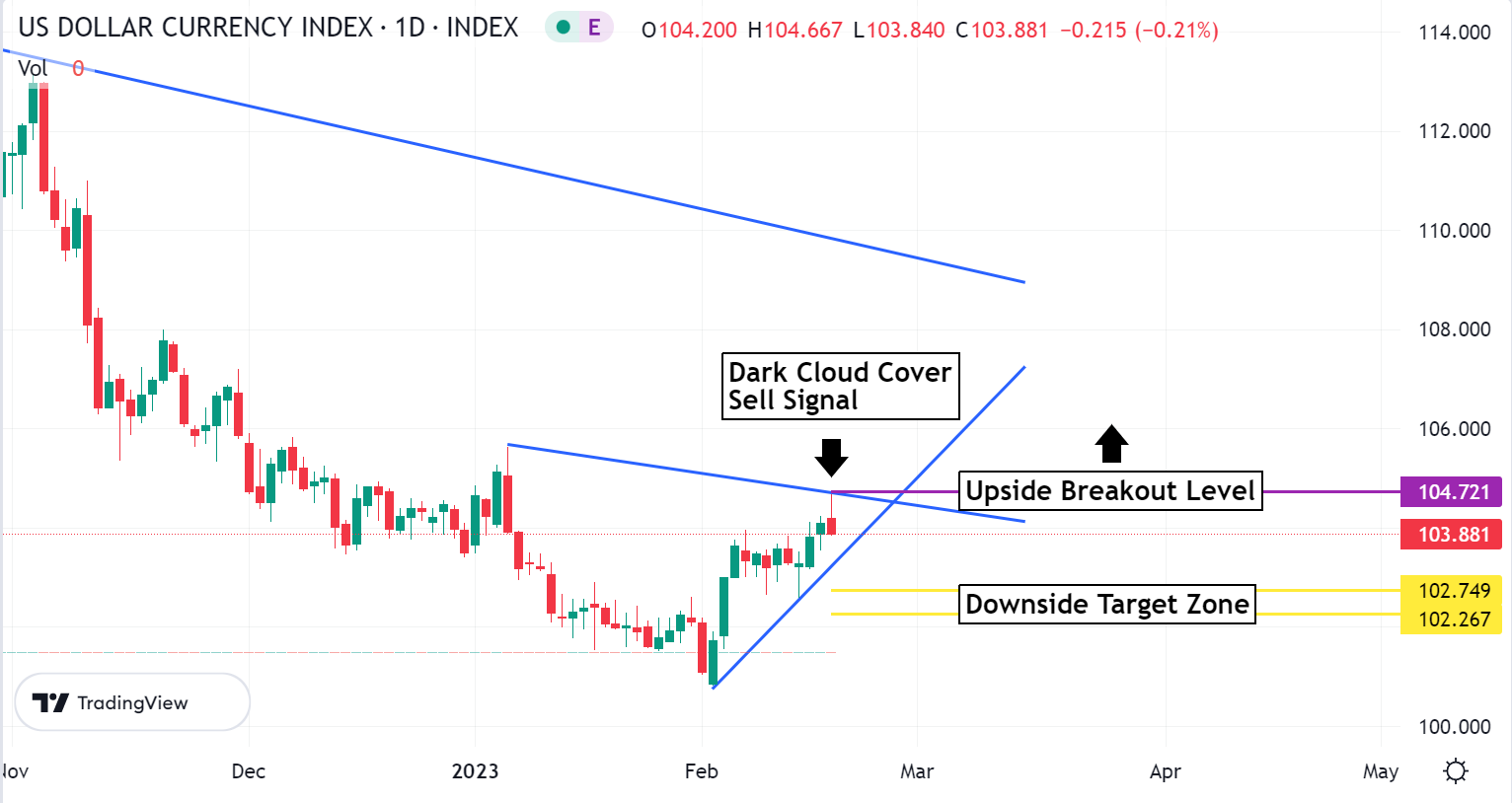

DXY sell signal may put a stop to the recent correction higher. A lower trading market is highly likely for a few sessions this week.

Crude Oil fell under pressure last week, and the market continues to stay in a range trade.

The 30yr T-Bond has fallen on key support. A short-term pause is the call early in the week, but over all this market is a Bear. Yields are expected to continue to rise over the next few months.

EURUSD Weekly Outlook:

The EURUSD flirted with a break last week, but there was very little follow through. Trading above 1.0613 keeps the market in a holding pattern up to 1.0806. A year of sanctions on Russia are taking a toll on the EU. A break below 1.0613 confirms weakness. Fresh selling is likely to enter the market fueling downside momentum. 1.0385 is the first target on a move that has the potential to hit 1.0227 before there is a bounce.

A rally above 1.0806 reverses gears for the EURUSD. Trading back at these levels puts the trend back on track. Watch the economic numbers for the EU. It is very likely that the ECB will react aggressively a few more times before their hands are tied. A reaction such as this would help the Bulls in this market. 1.1070 is the first stop on a move that could top out around the 1.1160 area.

GBPUSD Weekly Outlook:

New move lows in the GBPUSD keep this market poised for lower. Momentum is not that strong, and it is likely to be a grind through support. Key off the 1.2035 level. Trading under here will keep the market aimed at the 1.1713 level. 1.1654 is the lower extreme for a lower trading Pound. This currency pair is in a short-term Bear trend, but no harsh sell offs are on the agenda. This is most likely because of the looming BOE Hawkish stance. Short-term the BOE is holding up the market, but it is only slowing the weakness in the market.

Trading above 1.2035 should keep the GBPUSD in a sideways range trade back up to the critical swing high. The trend is a Bear, and should hold the Bulls back. However, a rally above 1.2267 confirms strength, and a turn in trend. Trading back at these levels sets the market up for new monthly highs. 1.2510 is the upside breakout objective. Be careful. Resistance is going to be strong at these higher levels, and it may contain the market. The last four months have been a big range trade. A close above 1.2267 would confirm long-term strength, and reverse the negative outlook.

USDCHF Weekly Outlook:

More sideways action in the USDCHF last week keeps this market in limbo. More of the same is the call for this week. The sell signal in the DXY may help to turn this market on support. A Bearish bias targets the downside breakout level. A failure here holds the Bear trend intact and targets the 0.8975 level. 0.8850 is the longer-term Bearish objective.

Only a show of strength in the USD is likely to give a lift to the USDCHF. Use caution with any resistance. Only a breach of 0.9408 confirms the markets resolve for higher levels. 0.9595 is the first stop on a move that could hit 0.9737 before there is a pull back. Use the Dollar Index as your guide for direction this week.

USDJPY Weekly Outlook:

Strength in the USDJPY remains intact, but can it hold? There is a turn over of leadership soon for the BOJ, and that is likely to bring volatility to the market. Hold onto your hats folks it is sure to be a bumpy ride ahead. Currently the market is aimed at the 139.54 and 142.58 levels. This upside target zone is expected to put a halt on the current rally. With looming BOJ Hawkish action hanging over the market it will be hard to maintain long-term strength.

If the Dollar Index falls under pressure the USDJPY may get a nice sell off. A failure from 129.76 is needed to confirm weakness. The longer-term trend is still a Bear, and fundamentals reinforce more downside action. 126.40 is the first stop on a slide that could hit the 124.00 level before there is a significant bounce.

AUDUSD Weekly Outlook:

The AUDUSD fell on solid support last week. The question is will it hold? The trend is a short-term Bear, and a retest of support is likely. Key off the 0.6901 level. Trading under here targets the downside target zone. Watch the Dollar Index. If it is trading higher, then this currency will most likely remain under pressure.

If the DXY is starting to fall apart there should be a bounce in the AUDUSD. The current lower trending market is a correction, and is likely to reverse gears. A challenge of the upside breakout level is likely if strength returns to the market. 0.7240 is the first stop on a rally that could hit the 0.7365 level.

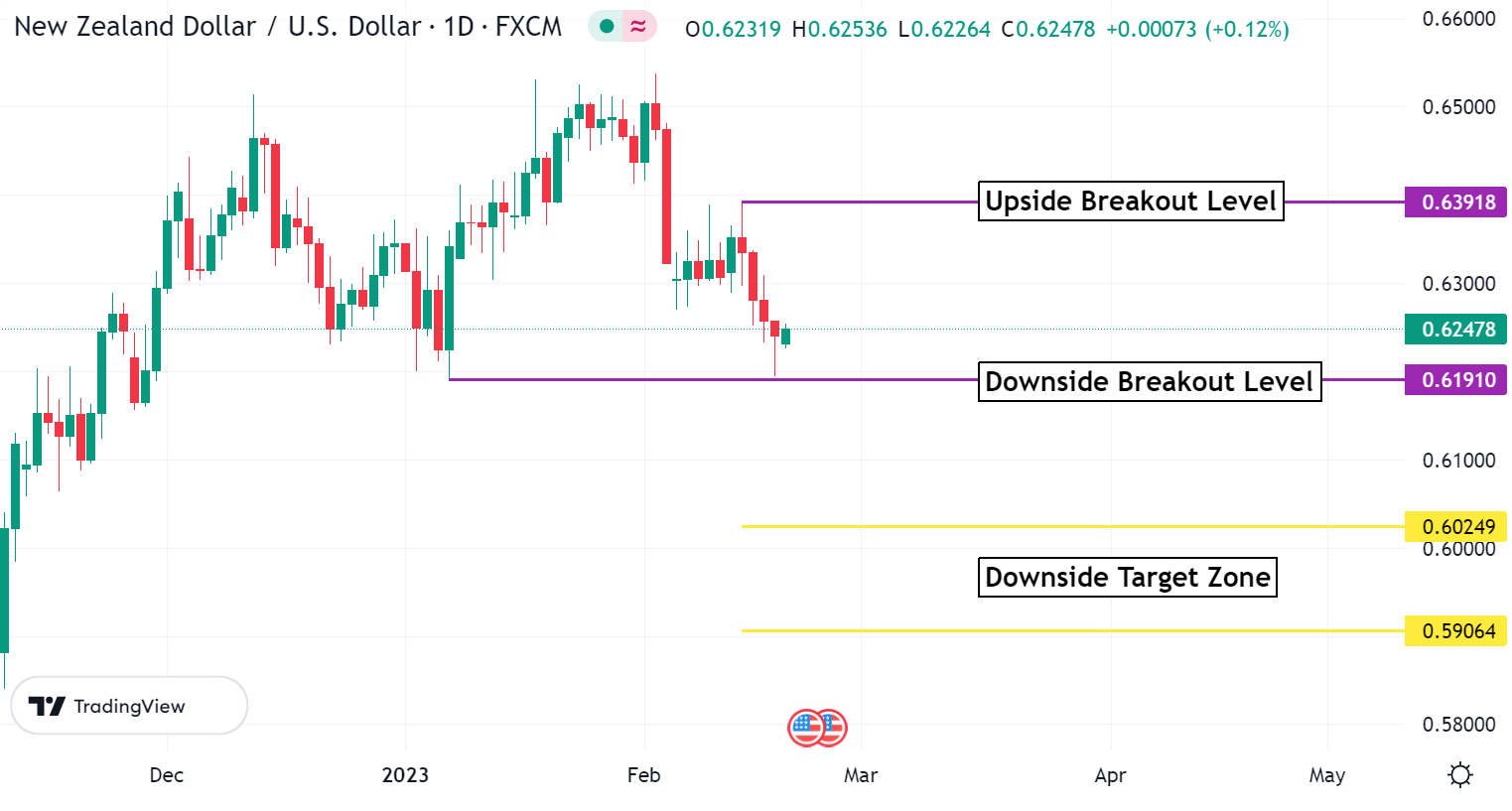

NZDUSD Weekly Outlook:

Bearish pressure is hitting the market hard. A test of the downside breakout level is on the menu early in the week. A failure from here is a negative indication that the Bears are still in control. The downside target zone is a viable sell off objective for the NZDUSD. Fundamentals are a disaster for this currency, and there is no sign of change.

Trading above 0.6191 keeps the market in a holding pattern up to the upside breakout level. The Dollar Index may pull back this week, and if it does, there may be a Bullish boost for the market. If the Bulls regain control it will be a fight back up to the upside breakout level. Only a breach of this area confirms strength for an extended move that targets the 0.6500 level. 0.6625 is the extended upside objective.

USDCAD Weekly Outlook:

Bullish momentum has driven the market into the upside target zone. How convenient. The DXY is looking Bearish, and that may put a short-term cap on the rally. If this scenario pans out the USDCAD will be in a state of limbo. More sideways action to come. Only a failure from the downside breakout level confirms extended weakness that targets the 1.3115 area.

If the Bullish resolve holds for the USDCAD then there should be a rally above the 1.3533 level. It would be wise not to fight an extended rally. Upside momentum has the potential to make a play for the upside breakout level over the next few weeks. With recent economic numbers looking the way they are it is likely the FED will remain Hawkish. This may be the hidden gem of support for the USDCAD. It would be wise to wait for a valid sell signal before trying to fade any extended bullish strength.