The Tiger Forex Report 2-24-25

The Tiger Forex Report – Week of 02/24 – 02/28/2025

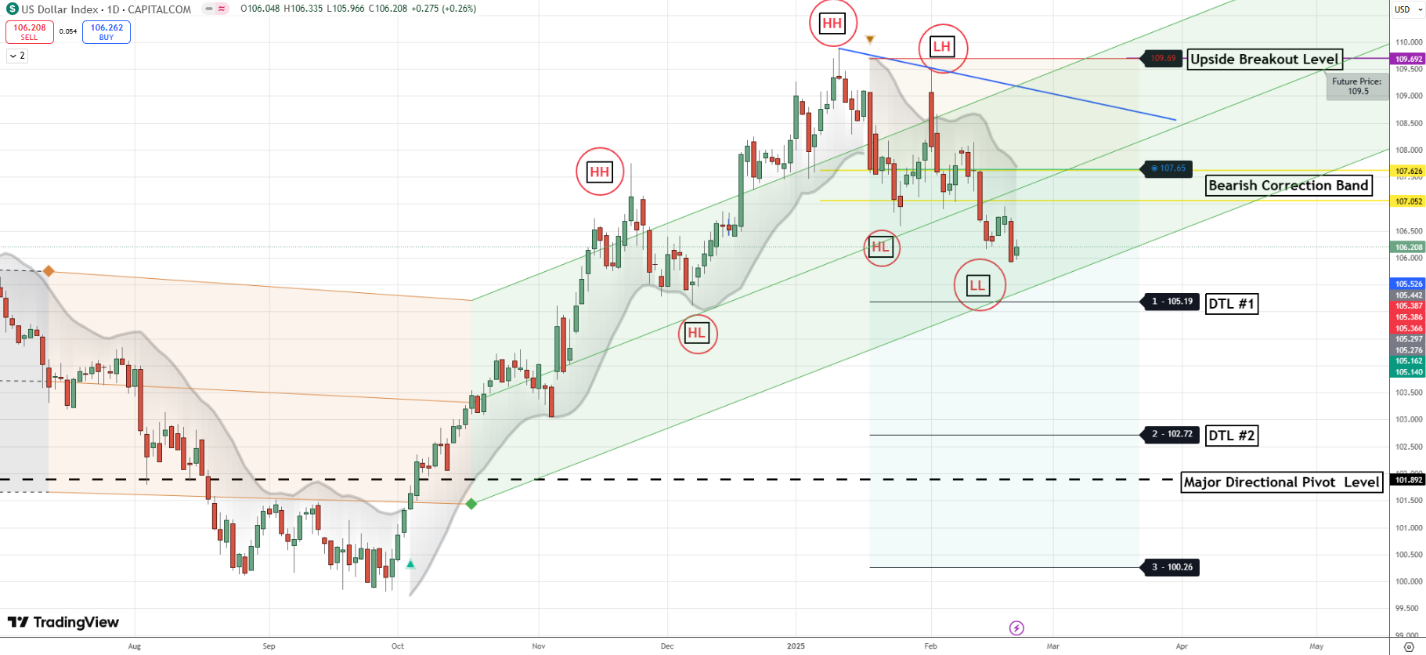

The DXY is on it’s heels with this correction slamming new move lows. Can we get a bounce this week?

Crude Oil Bears are set to bring down the price of Crude. New move lows are on the horizon.

30yr T-Bond Bulls are releasing the cord, and the balloon is ready for liftoff. Time to press Yields to the downside for a bit.

EURUSD Weekly Outlook:

The EURUSD Bulls are trying to make a move, but the realities of poor economic decisions weigh more. This market is in a sell rally forecast, and most likely is probing the upper boundary of the range it is in. A spike high may be looming as the USD takes one on the chin, but stay nimble. A Bearish turn is expected here. The upside correction zone is expected to cap any extended move higher. Below this area more of the same range trade conditions are expected. There are some economic numbers this week, but overall, it is a lack luster outlook. Do not try and force a trade this week. It will most likely not work out.

GBPUSD Weekly Outlook:

GBPUSD Bulls are just shy of the upside correction zone. This is the target for the week. A spike into this area is on the agenda. But be cautious here. The uspide target #1 is about the extreme that is expected for a higher trading market. The reality is that the UK is in very sad economic shape. Expectations for the year ahead keep getting downgraded. This means that the Pound is most likely going to continue to errode against the Greenback nomatter what is going on in the broad markets. If the Bears get below the upside breakout level look out below.

USDCHF Weekly Outlook:

The Bears are in control and have settled below the downside breakout level. This has the market targeting the Bearish correction band. Overall, the market is ripe for a nice slide. Be carful if you are going to be buying into this currency. Even if USD strength returns it will most likely not be very strong here. If you look at how the market traded last week it would be very unlikely that the Bulls will get a bounce. Only a rally above last week’s swing high would reverse the outlook. But if this occurs it would most likely be an indication that the market is going back to the range trade it was in since December.

USDJPY Weekly Outlook:

The BOJ is happy this week with the market below the 150.00 level. It is likely that the USDJPY will be snaking along the downside correction band. Do not try and catch a falling knife here. This market is in a Sell Rally outlook. If you are going to try and fade the trend, make sure you wait for a solid signal. As of now it is very likely that this currency is setting up to stretch this trend down to the DTL #2 over the next few weeks. Unless there is a close above the 150.00 level there is not much to get Bullish about. If Crude makes new lows this week…it is very likely that this FX pair will as well. The Fundamentals all line up for at least this week. If there is a radical change of events there will be an update.

AUDUSD Weekly Outlook:

The AUDUSD may have locked in a short-term high. Key off the High form Friday. Trading below here has the market set for a shift in direction. It is very possible that the market will fall back below the upside breakout level. If this does occur it would be a very good sign that the range trade conditions are back on the table. Remember that the rally over the past few weeks is viewed as a correction. Now do beware. If the Bulls get a rally above Friday’s high then all bets are off. New move highs then target the upside correction zone.

NZDUSD Weekly Outlook:

This market has had a nice run to the upside, but it is likely to run out of gas soon. Only a sustained trade above the upside correction band would confirm strength. This would make the upside breakout level the objective. Now here is the kicker… This is a technical view. Fundamentally this currency is a house of cards. No matter how weak the USD gets… the NZD is a disaster. Most likely a turn to support is going to occur. A dip below the upside breakout level gets us right back into the range trade of the last few months. Just make sure to keep it tight and pick your trades wisely here. A tough trade is most likely the call.

USDCAD Weekly Outlook:

Choppy and sloppy is the call for this one folks. The downside correction band is holding, and be careful about being short below here. A spike low is not out of the question. We are not trying to call a bottom, but this is a corrective trend move we are dealing with. If the market gets above the downside correction band the Bulls will most likely get a big move. Now do not get over zealous here. It just means that the market will get back into the range trade it has been in. Yeah, it sounds boring, but guess what? That is most likely the call. There are many things that are going to be hashed out politically with Canada over the next few months. This means there will most likely be a lot of indecision in the market place.