The Tiger Forex Report 2-26-24

The Tiger Forex Report – Week of 2/26 – 3/01/2024

The DXY pulled back last week, and should remain under pressure. A bit more profit taking for USD Bears.

Crude Oil is stuck in a range trade, but there are signs of a Bearish tone. Friday’s close indicates that the Bears may get a short-term sell off. A pull back into the critical support band is on the menu.

30yr T-Bonds ended the week with a bounce, and Yields are likely to continue to pull back a bit. Friday the market settled with an upside breakout. A rally up towards the critical long-term directional pivot level is likely.

EURUSD Weekly Outlook:

EURUSD Bulls spiked higher last week, and another run at resistance is expected. Above 1.0834 the market will be poised for a challenge of the upside breakout level. This would put the critical resistance band int the market’s sights. Not much more is expected this week unless there is a large pull back in Yields. Upside target #1 is the longer-term Bullish objective.

Below 1.0834 the EURUSD will be leaning on the critical support band. Use caution fighting a pull back to these levels. Trading back in this area is a negative indication that this currency pair is on a mission for newer move lows. 1.0514 is the downside target extreme. The EU Unemployment number is this week, and it may cause a tizzy. Be on guard.

GBPUSD Weekly Outlook:

The Bulls have the momentum in the GBPUSD. A follow through leg higher is the call for the beginning of the week. If the Bulls breach the upside breakout level the market will be pushing the upper end of the range trade in place. This would make the upside target #1 a viable objective. 1.3020 is the extended upside target.

Only a failure from the directional pivot level reverses gears for this currency. In this event, the Bears will be flirting with the downside breakout level. If there is a dip below here, a nice sell off should develop. New move lows should not be taken lightly. Downside momentum is expected to build and make the downside target band the longer-term Bearish target area.

USDCHF Weekly Outlook:

Swisse traders are on edge as the market eyeballs newer lows. The directional pivot level is the first test for the Bears. If the market gets below here there should be fresh selling pressure to knock the market back into the downside correction zone. This is it for a slide unless Yields retract sharply. Not likely with economic numbers looking inflationary again.

The trend remains a Bull, and a violation of the upside breakout level confirms new move highs are looking to hit the upside correction zone. If this scenario pans out it is likely that the market will settle into a digestive phase before continuing higher. Watch Yields. If there is a boost in Yields then the trend for the FX pair should hold a Bullish posture.

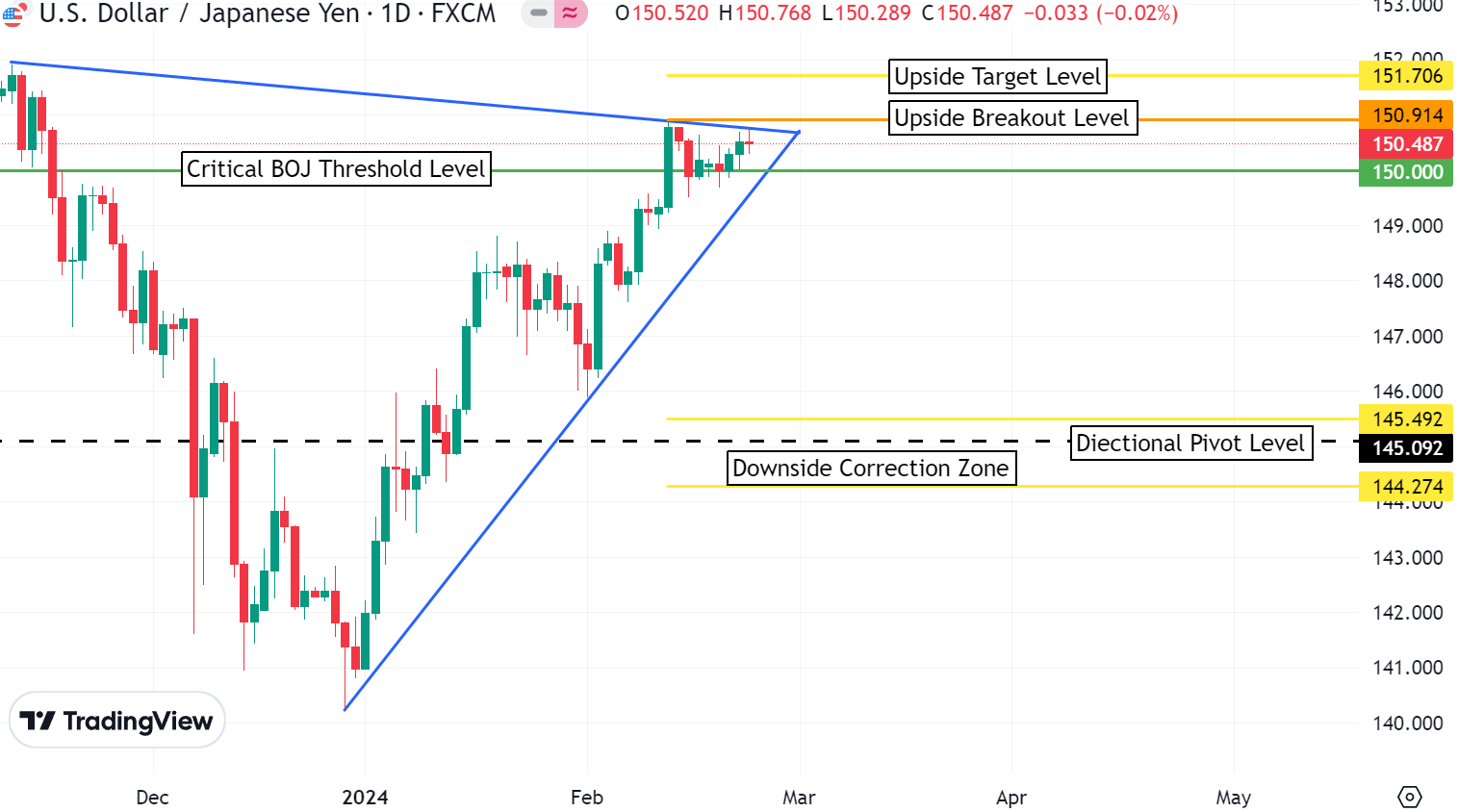

USDJPY Weekly Outlook:

Ugg what a tough trade. The Bulls are in a holding pattern just above the 150.00 critical BOJ threshold level. With Yields and Crude in retreat it will be hard to keep this market up. A dip below 150.00 is a good indication that the market is ready to press a correction. USDJPY Bears will be looking to set off fresh selling. This would put the downside correction zone into the markets’ sights. When this currency gets back into this area there will be an update.

Sustained trading above 150.00 keeps this market’s head up and set for a challenge of the upside target level. It is not likely that the USDJPY Bulls can generate much else in the short-term future. 153.25 is the longer-term bullish target. If there is a big boost in Yields and a rally in Crude, then the Bulls in this market may be able to hold a fresh leg higher.

AUDUSD Weekly Outlook:

AUDUSD traders are pressing the correction higher. It may be a grind, but the Bulls should put pressure on the upside breakout level. A breach of this level would be a fresh Buy signal that extends the Bullish objective to the critical resistance band. This is all that is on the agenda for a higher trading market this week.

Below the upside breakout level this currency may be set to build a wide range trade. If fresh selling enters the market, it is not likely to hammer this currency. A Bearish move could press all the way back into the downside correction zone if Yields catch a strong bid. However, this is unlikely to happen. Fundamentals and technical indicators are mixed. Take this as a sign that solid swing trades may be on hold for a while.

NZDUSD Weekly Outlook:

NZDUSD bulls are leaning on the critical resistance band. If the Bulls are going to hold the trend intact the market should get above the 0.6242 level. Use caution. Sustained trading above here is likely to build extending the rally up towards muti-month highs to the upside target level.

If the Bulls run out of steam there could be a pull back to the downside correction zone. This is all that is likely to occur under the current conditions. Only a big rally in Yields would change this outlook. If this should develop, then the downside target level becomes a viable objective.

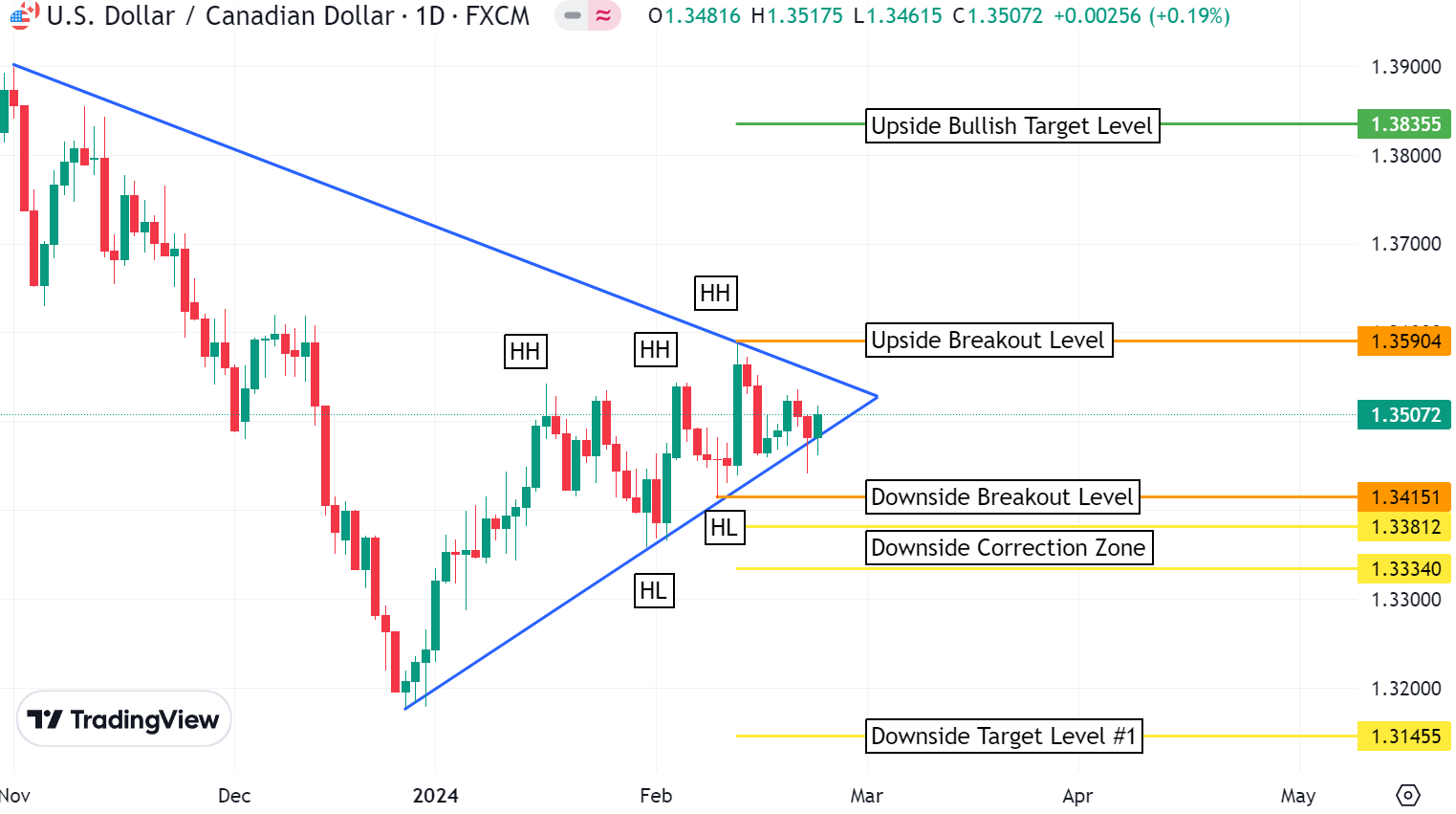

USDCAD Weekly Outlook:

USDCAD Bulls are maintaining a slight trend higher. A challenge of the upside breakout level is necessary to confirm the markets intentions to press higher move highs. With Yields under pressure, it is not likely to get above here. Only a sustained trade above 1.3590 confirms strength. The upside bullish target level is the longer-term upside objective.

A failure from the downside breakout level is needed to touch off fresh selling pressure. This puts the downside correction zone in play. Be careful fading the Bears. Trading back at these levels is a negative indication that the Bears are going to slam newer move lows. The Downside target level #1 becomes the new multi-month low objective. Look out below!