The Tiger Forex Report 2-27-23

The Tiger Forex Report – Week of 2/27 – 3/3/2023

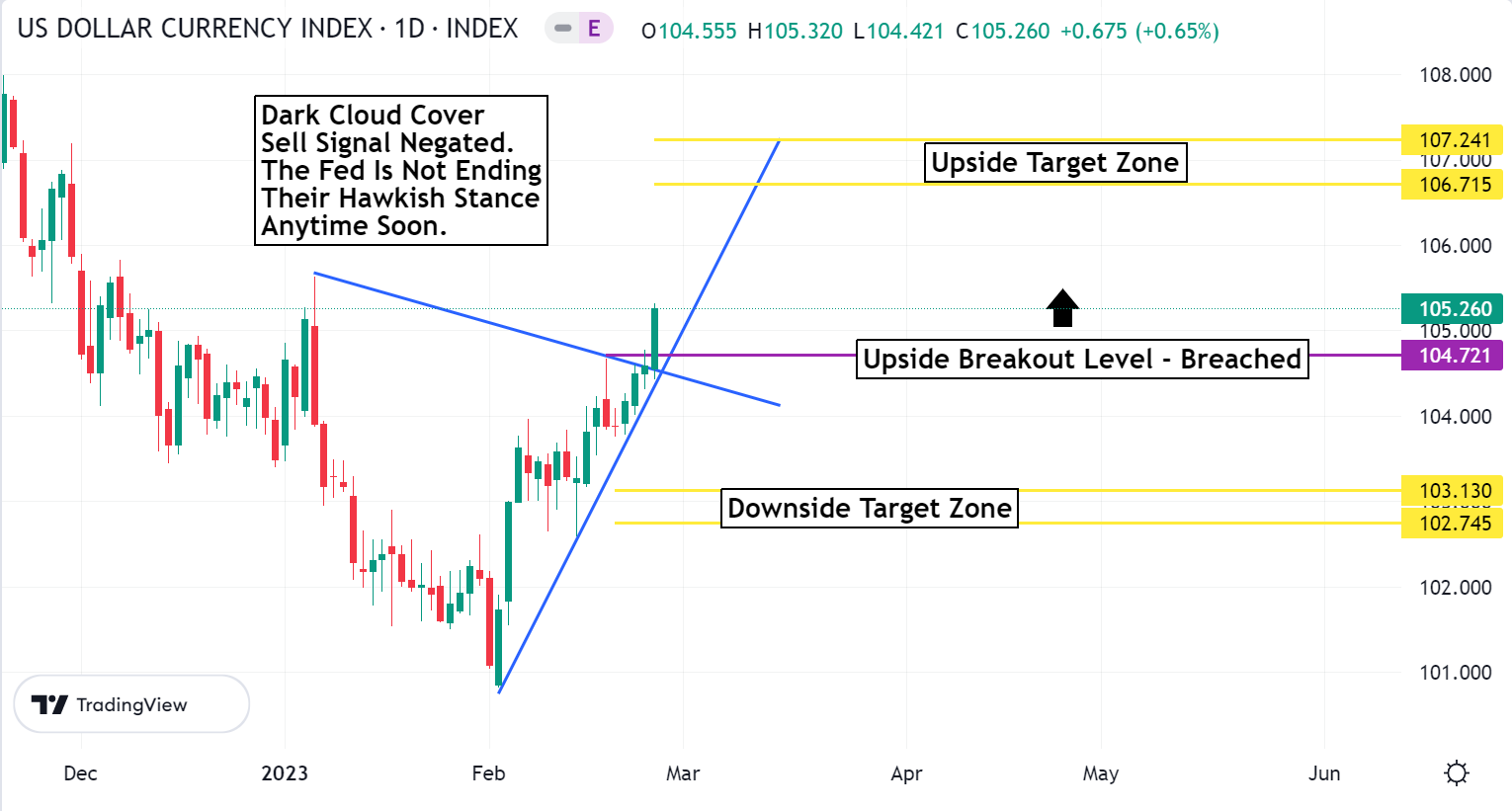

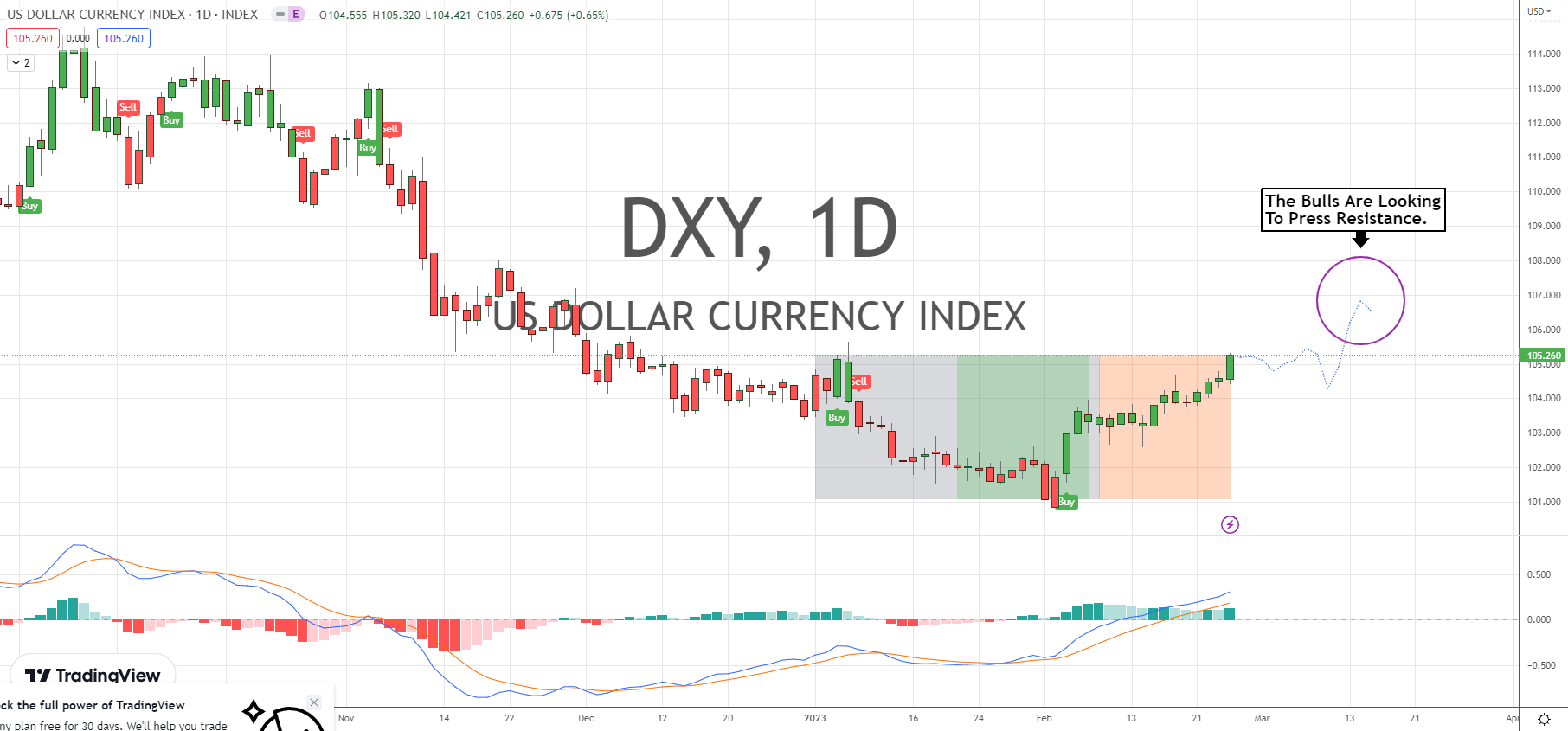

DXY Bulls are aimed at the Upside Target Zone. Key resistance was breached, and higher move highs are on the agenda.

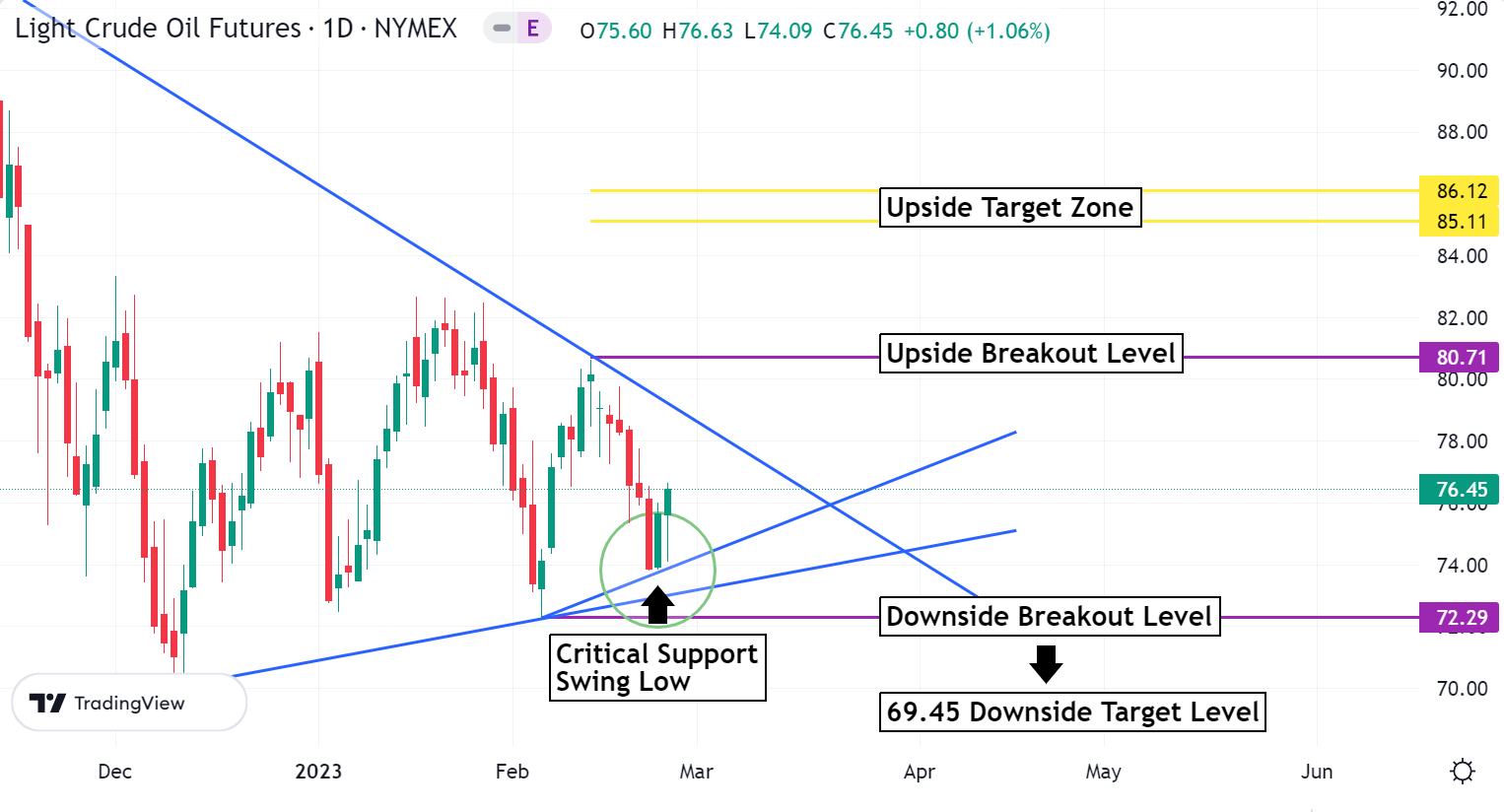

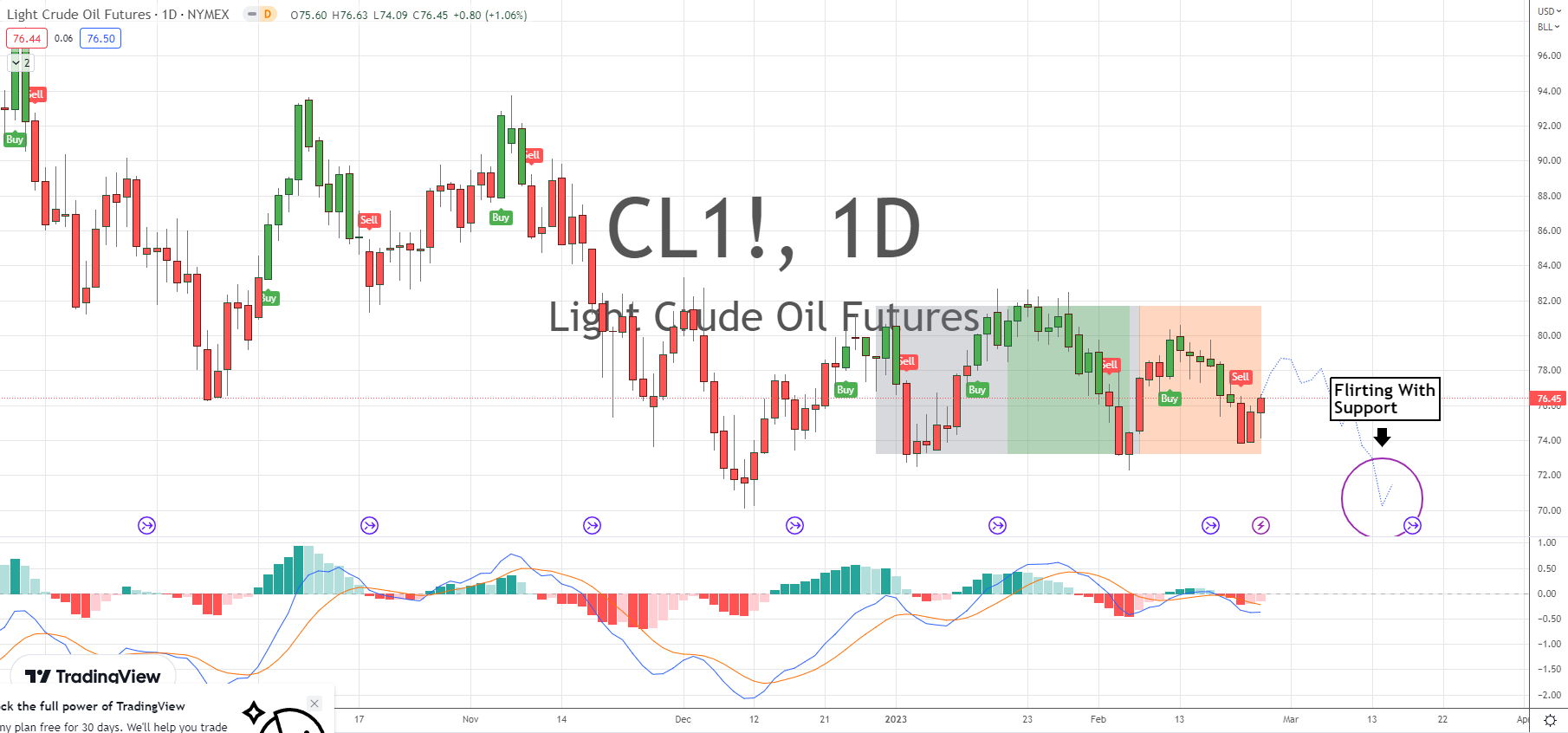

Crude Oil is flirting with support, but had a nice bounce to end the week. Key off the last swing low for direction.

30yr T-Bond has the talking heads scratching their wigs. Yields are expected to continue to rise slowly. It may be time for a bit of digestion after the recent slide.

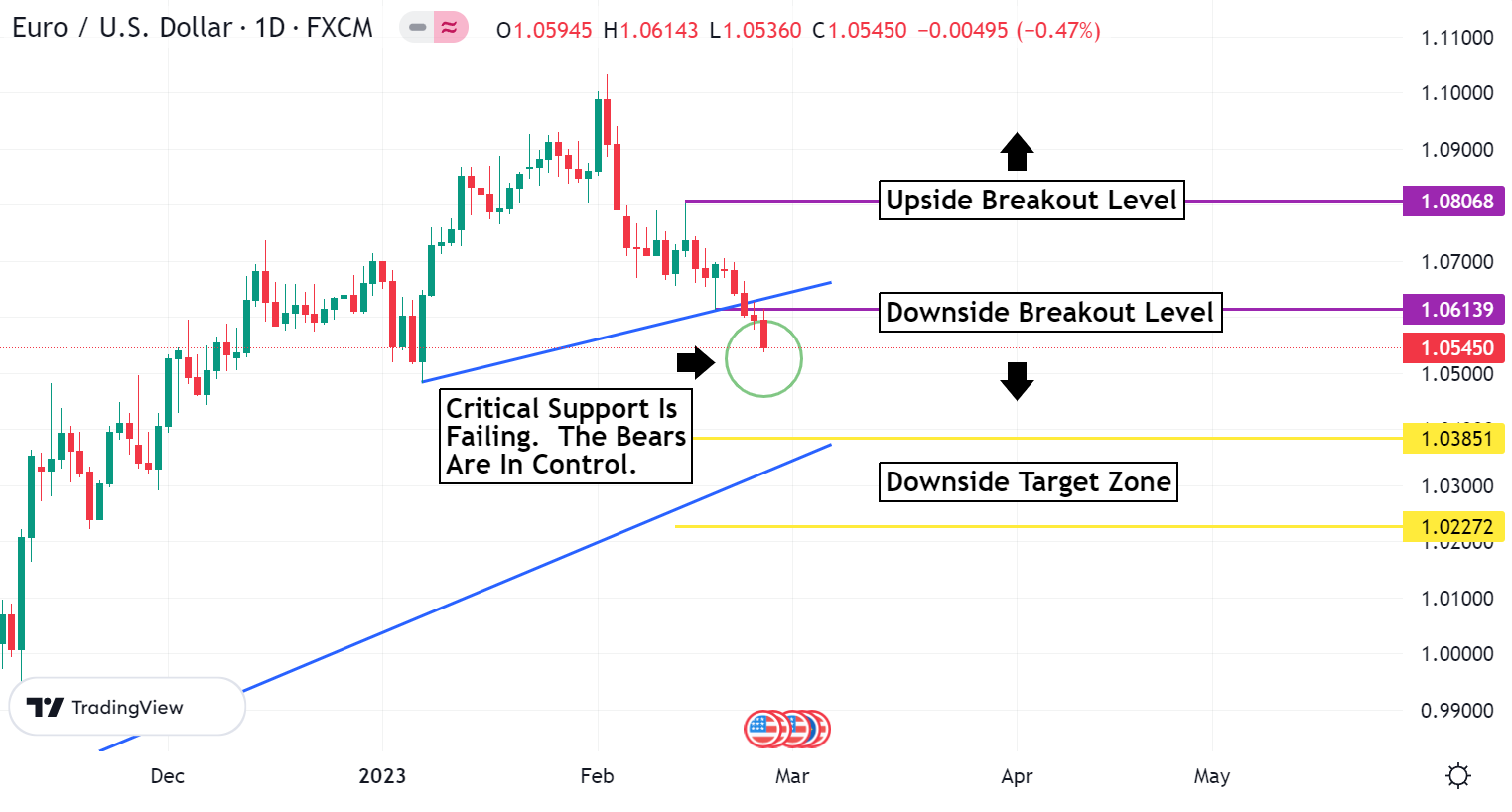

EURUSD Weekly Outlook:

EURUSD Bears are still pushing support. Key off the downside breakout level. Trading under here keeps the market pointed lower towards the downside target zone. Indicators are showing a Bearish bias, and that helps to reinforce the sell rally outlook. Do not get too caught up though. There is a good chance that this currency is going to grind out a short-term low. The ECB still has a bullet or two to fire off.

A rally above the downside breakout level puts a halt to downward momentum. This is not necessarily a Bullish scenario, but it may be time for some consolidation. Sustained trading above 1.0613 targets the upside breakout level. It is the milestone to cross. A breach of this level reverses gears as the EURUSD tries to recoup losses. If yields have a strong pull back then that could help a Bullish trend. Coupled with another ECB move on the horizon the EURUSD could be set for a wide range trade. Time will tell.

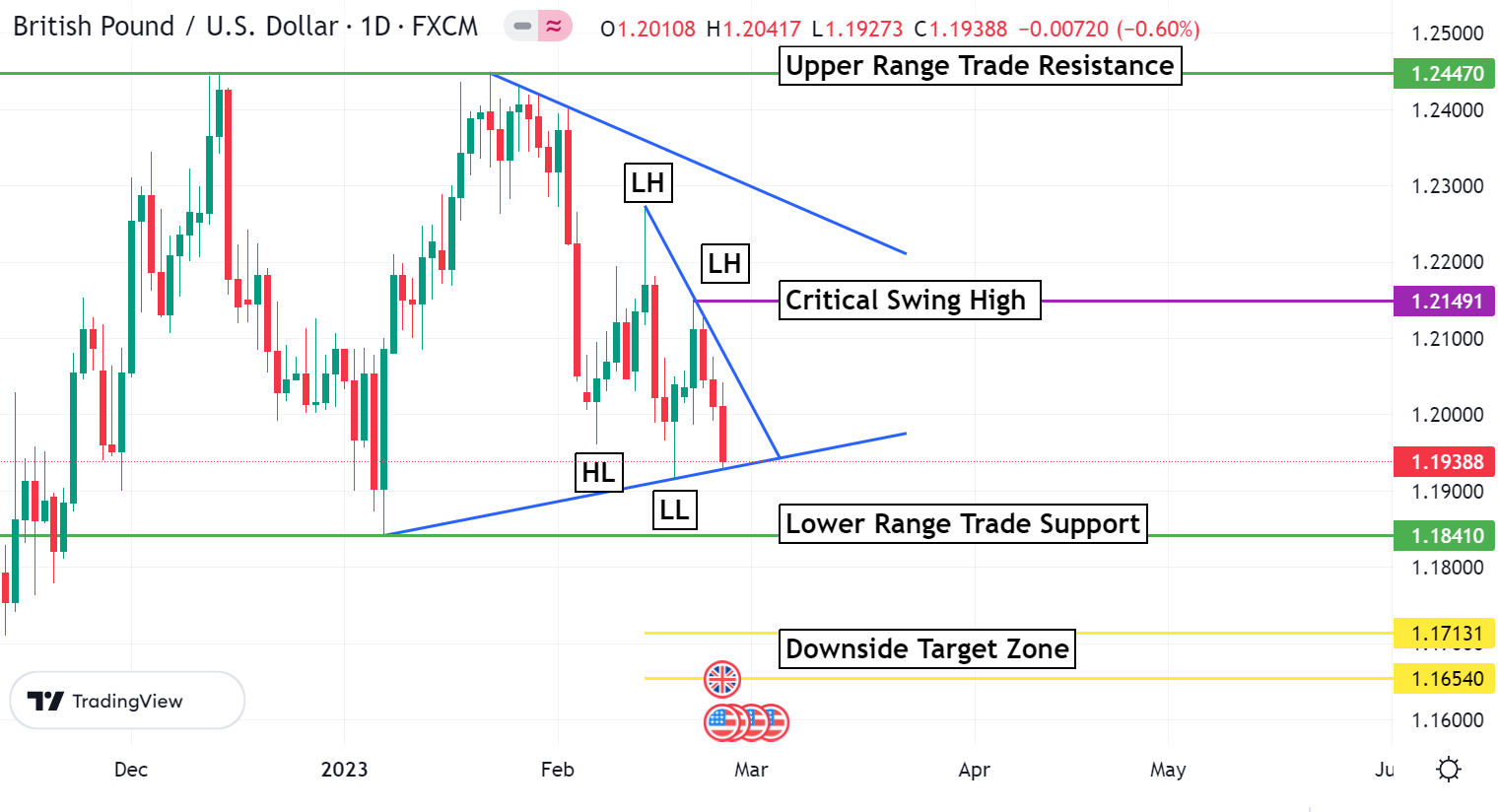

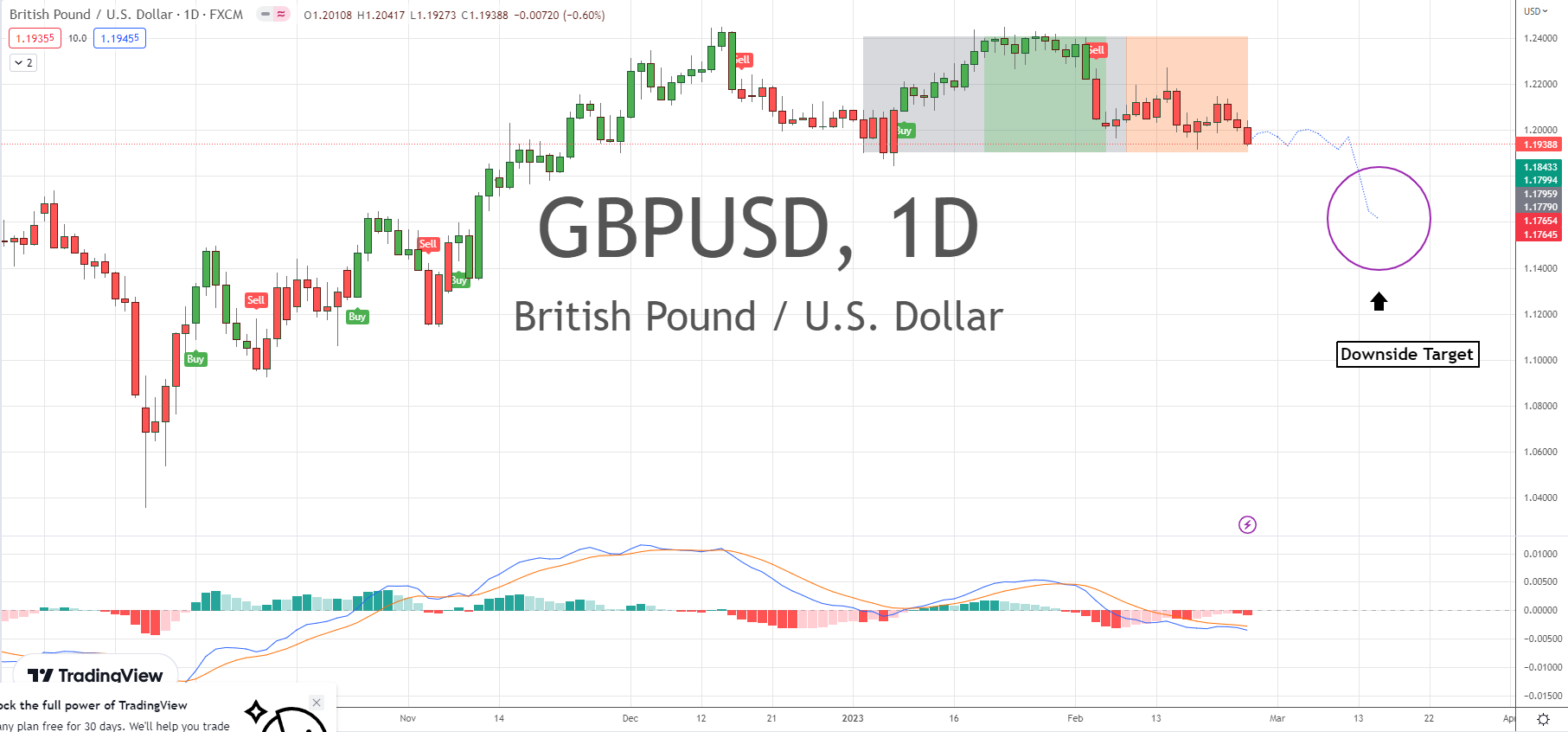

GBPUSD Weekly Outlook:

Bearish momentum is looking to touch off new move lows down to the lower range trade support level. Look out below if there is a failure here. Trading below 1.1841 is a negative indication that the GBPUSD is going to make a play for the downside target zone. This is about all that is likely out of an extended leg lower. The BOE is still a question as to how much they are going to react. That is likely to reduce weakness in the GBP.

Only a rally above the critical swing high level takes us off the sell rally forecast for the GBPUSD. Sustained trading above 1.2149 puts the market in a big range trade up towards the upper range trade resistance level. Use caution. This currency is likely to run out of gas before hitting the upper extreme of the range. We may be in for a choppy range trade for a few weeks. Especially if U.S. Yields retrace a bit. Then it would be ripe for the range trade outlook.

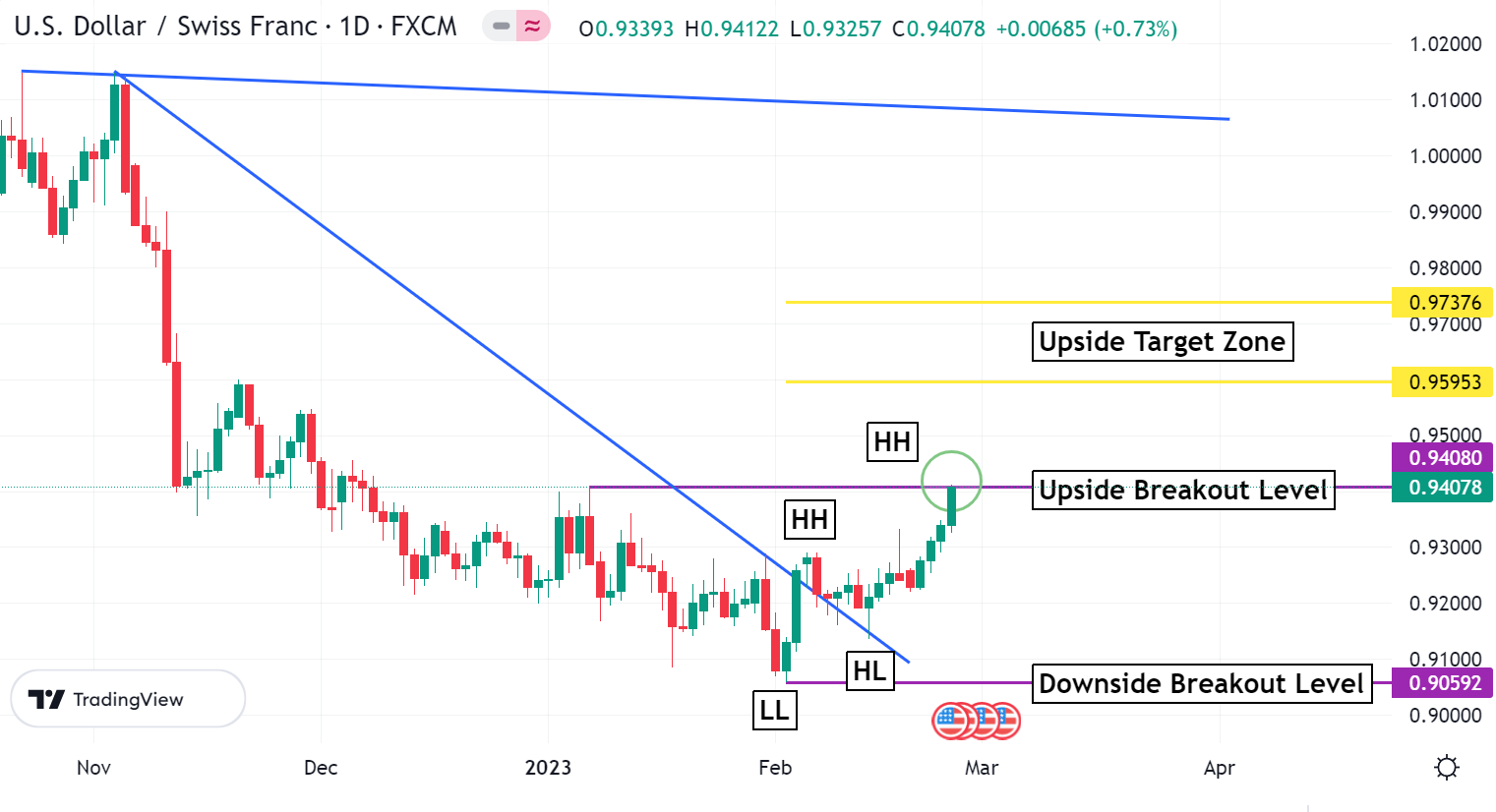

USDCHF Weekly Outlook:

USDCHF Bulls are ready to take higher move highs above the upside breakout level. Be careful fighting the Bulls. Trading above 0.9407 may accelerate into high gear. A rally up into the upside target zone is a very likely objective. This market had been overdue for a bounce. This is a short-term outlook. We have no reason to indicate any long-term weakness in the Swissie.

Trading under the upside breakout level will have the Bulls and Bears in a pillow fight over direction. It may become very choppy. Just look at how this currency has traded over the past few months. Only a failure from the downside breakout level confirms weakness, and fresh selling pressure. 0.8870 is the downside objective. This is about all that is likely if the market falls back hard on support. If anything, it is more likely that range trade conditions may resurface. Yes. We are in this type of market. The environment has markets changing trends, and creating divergence in new ways as well. Add this all together and it equals a tough trading environment. Stay nimble.

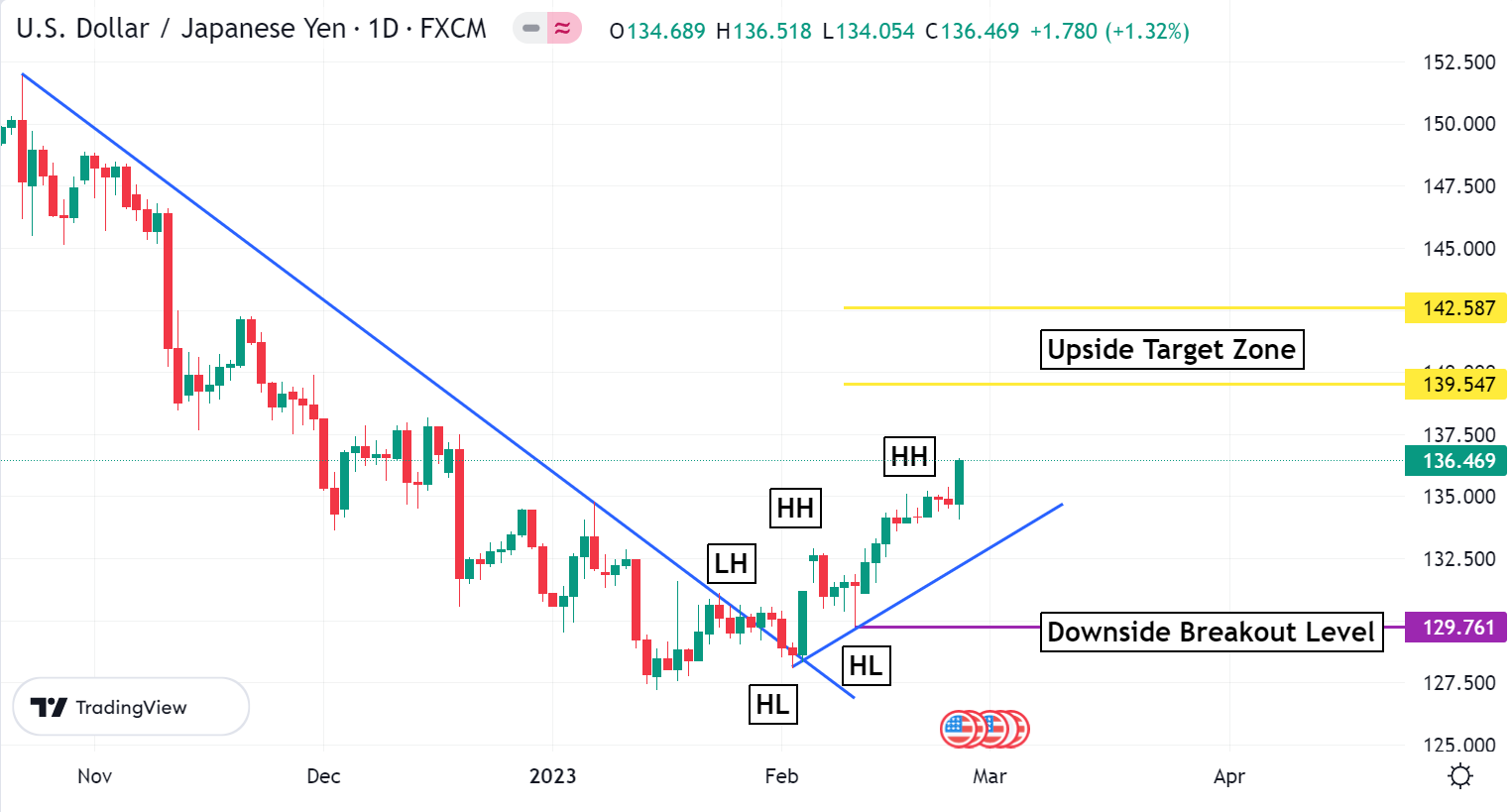

USDJPY Weekly Outlook:

USDJPY is not as indecisive as other markets. This Bull is pressing its way on towards the upside target zone. This is about all that we are looking for in a rally. Only a close above 142.58 would confirm the Bulls resolve to drive the trend even higher. We are weeks away from the BOJ change, and it is likely to add to selling pressure over the next month via profit taking from longs. Keep that in mind.

A failure from the downside breakout level is needed to confirm a turn in the market. Trading under 129.76 would be a fresh sell signal that targets new move lows on a monthly basis. 125.44 is the first target on a break that could reach the 123.00 level. If the current rally is just a correction, then it is very likely that the USDJPY will fall back to these levels over the next couple of months.

AUDUSD Weekly Outlook:

Slam-O-Rama! The AUDUSD blasted through support and is likely to hit the downside target zone. The long-term trend is now Neutral. Time will tell if this is just a correction, or the beginning of a long-term turn in the trend. Either way it would be wise to wait for a solid buy signal before trying to fight the Bears on this break.

Only a rally above Friday’s high would put this market on pause. If the market can get back above 0.6915 then there is a chance for the Bulls. Trading back at this level would be a good indication that the recent sell off is just a correction, and that the Bulls are coming back. If U.S. Yields fall back then it would help to support the AUDUSD rally. The long-term trend is still a Bull. Beware of a balloon under water rally. The AUDUSD could still pop above the upside breakout level.

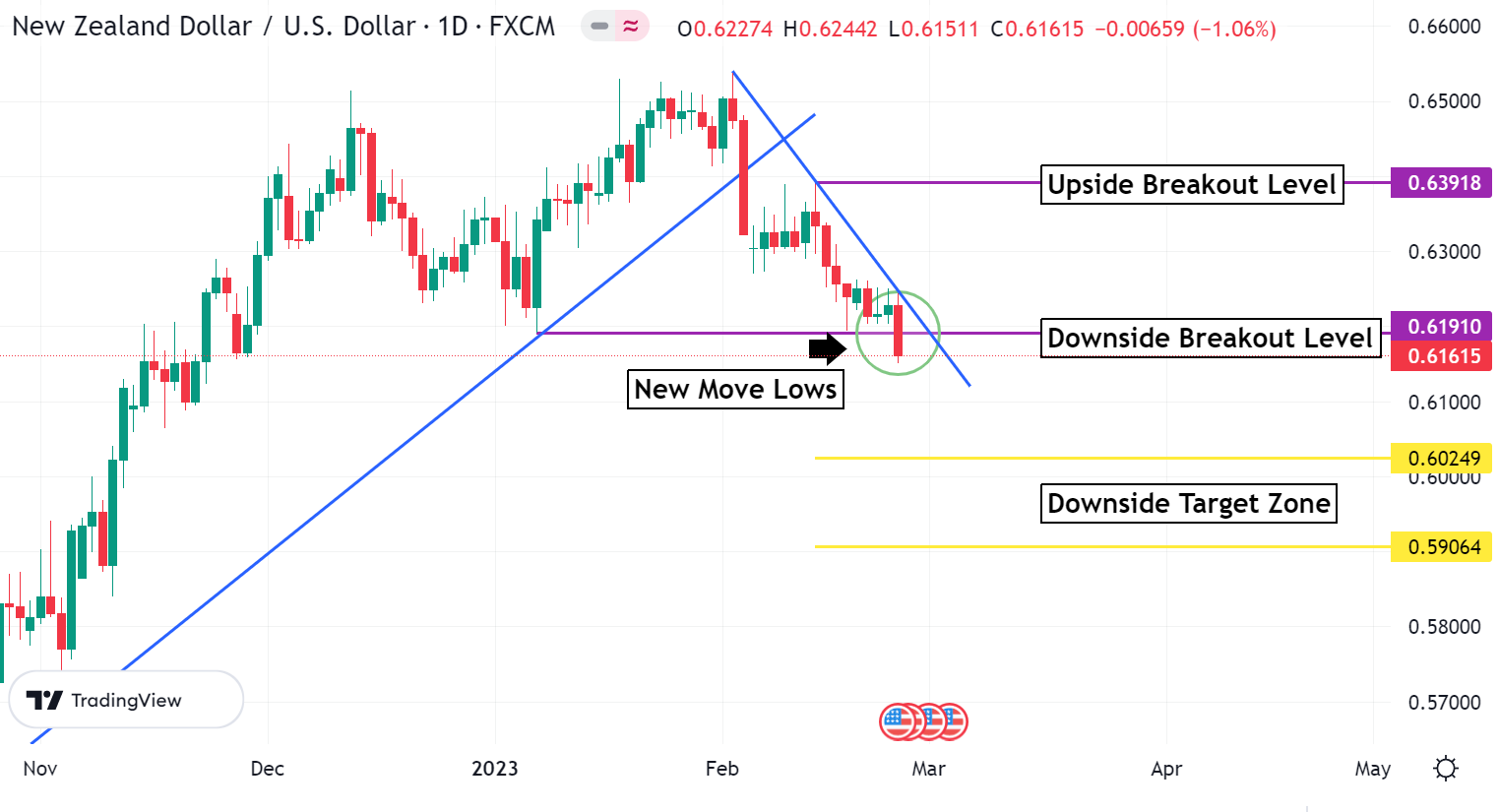

NZDUSD Weekly Outlook:

NZDUSD took it hard on the chin last week, and more pounding is likely. New move lows target the downside target zone. The trend has been faltering, and the range trade is now turning into a Bear. Be careful buying into this market. Wait for a solid buy signal. Oversold or not, this market is in the doghouse both technically and fundamentally. Take that into account when viewing this currency pair.

Only a sustained trade above the downside breakout level puts the Bearish forecast on ice. Trading above here will be a fight all the way up to the upside breakout level. A rally above 0.6391 is the key to finding fresh buying. It is likely there will be a pocket of weak shorts in this area that could fuel a nice extended rally. If U.S. Yields take a dive, then this Bullish possibility becomes more plausible.

USDCAD Weekly Outlook:

USD strength helped ignite a moon launch rally falling just shy of the upside breakout level. Momentum is our guide, and another play for higher levels is the call. If the market gets a print above the upside breakout level, then the Bulls are likely to target the 1.3809 upper range trade resistance level. 1.3960 is the long-term upside target if the Bulls rally get a new trend going.

If the USDCAD starts to fall onto support it may be more of the same. Remember this FX pair has been in a long-term range trade. If DXY falls back hard on support, then this currency pair may fall in tandem. Trading under the 1.3484 level targets the downside breakout level at 1.3261. The key is the 1.3226 lower range trade support level just a bit lower. A failure here would be a very negative sign that the overall Neutral trend is turning Bearish.