The Tiger Forex Report 3-13-23

The Tiger Forex Report – Week of 3/13 – 3/17/2023

DXY Bulls had a setback last week, and ran into a brick wall. Key off the Upside Breakout Level for direction.

Crude Oil fell back into its range, and with yields in retreat expect demand to come back.

30yr T-Bond has retraced into a Critical Resistance Zone. The Fed tone is still Hawkish, and the current rally is considered a correction. This market is set to turn sharply. Look out below. New lows ahead.

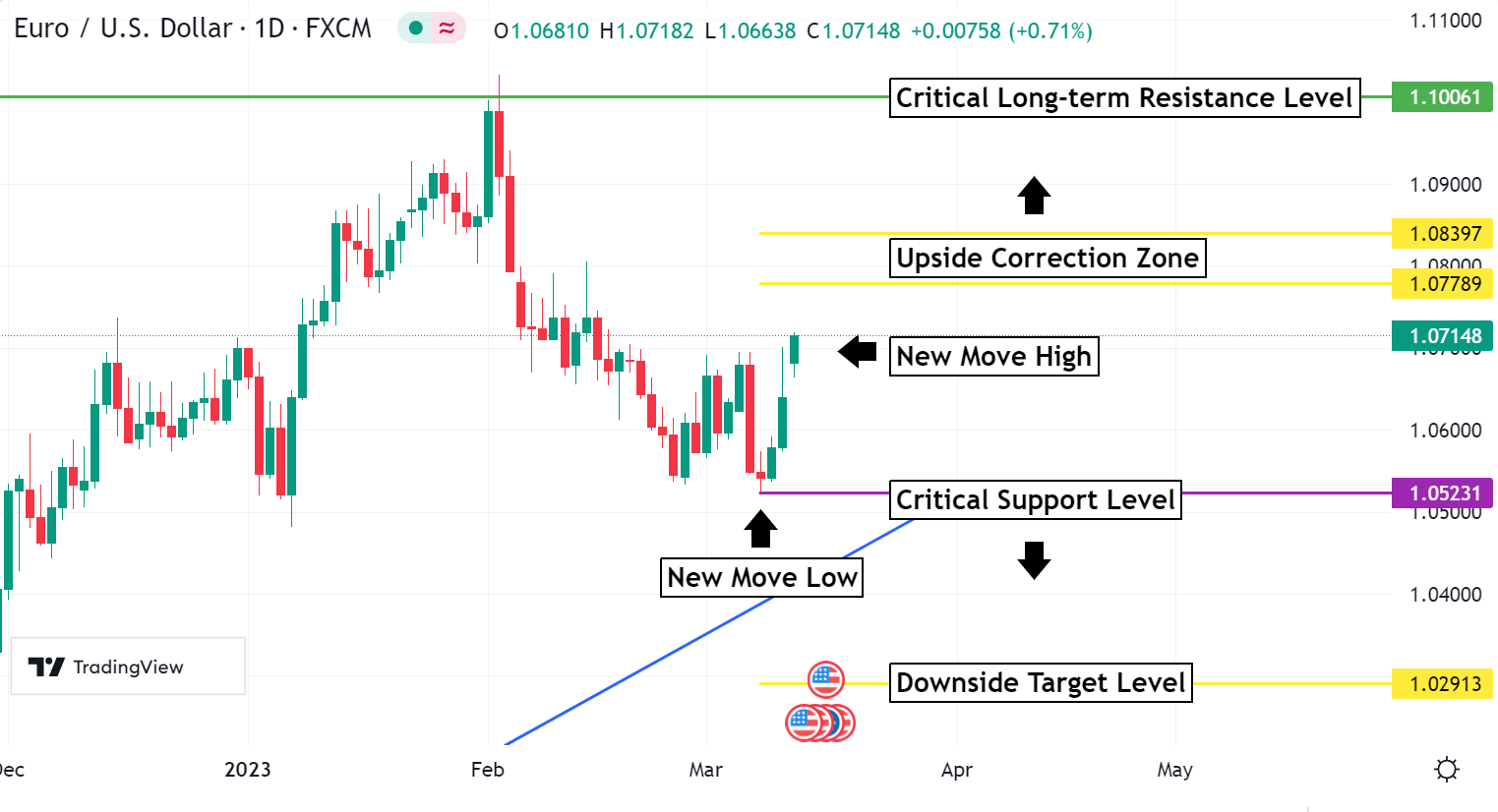

EURUSD Weekly Outlook:

The EURUSD Bulls are starting the week with follow through, and it will be hard to halt the move. A challenge of the upside correction zone is likely unless yields start to rise again. As long as yields are stable to lower then the rally most likely has room all the way up to 1.0839. Only a sustained trade above here would confirm enough buying pressure to extend the upside target to the critical long-term resistance level. With the Fed outlook as it is, it would be hard to hit these upper extreme targets.

Since we have a newer move swing high after a newer move swing low to start the week, the market will remain strong above the critical support level. Only a failure here reverses gears for the EURUSD, and confirms the Bears intentions to make a play for the downside target level. If this currency pair falls back on support this hard, there will be an update. The 30yr T-Bond would need to make new monthly lows for this currency to get back to these lower levels any time soon.

GBPUSD Weekly Outlook:

What a strong turn of events last week for the British Pound, and a follow through rally to start the week is on the agenda. Hold on to your hats and expect a bumpy ride this week folks. A challenge of the upside correction zone is very likely if yields continue to soften. Only a close above 1.2305 would confirm any long-term strength in the GBPUSD. The Fed has more work to do, and how much will the BOE retaliate??? If yields are just correcting, then this currency will likely pull back before pressing new highs.

The trend is still a Bear, but it will be a sloppy trade back down to the downside breakout level. A print below here is needed to set off fresh selling pressure. Trading below the 1.1800 level should keep the market in the gutter all the way back to the downside target zone. With the Fed in a Hawkish stance long-term, the outlook looks very positive for the Bears in the GBPUSD.

USDCHF Weekly Outlook:

The rug was ripped out from under the Bulls in the USDCHF last week. Slamming support is the most likely call for early in the week. If the market can get below the long-term critical support level, then new multi month lows are not out of the question. Trading below here sets the market up for a test of the 0.8975 level. 0.8725 is the longer-term downside target. Even if the DXY rallies big, this currency may not get hit. There may even be major divergence from other currencies.

If the market starts to digest the recent sell off it could get choppy. Up to the upside breakout level this market is in a big neutral range trade. Only a rally above 0.9440 confirms long-term resolve by the Bulls. Trading above here has the USDCHF ready for a challenge of the upside target zone. It is unlikely that the Bulls will get back to these upper levels until there is a strong rally in yields.

USDJPY Weekly Outlook:

USDJPY Bears are getting a ton of help to start the week. As long as U.S. yields are in retreat it is likely that this currency will stay pointed southbound. The downside target zone is the first stop on a move that has the potential to test the downside breakout level. This is about all that is expected for a pressed sell off. Yields are expected to rally again soon, and that should give the USDJPY Bulls a ton of fuel. Be mindful of this.

Trading back up to the upside breakout level will have the USDJPY in a tough range trade. However, if the Bulls get above 137.87, then there is a chance that the Bulls will make one last big play. The upside target level is the extreme for any extended leg higher to newer move highs. Even with a very Hawkish Fed, there is the new changes at the BOJ to be ready for.

AUDUSD Weekly Outlook:

The AUDUSD did not bounce versus the USD like many other currencies did last week. Instead, its divergence is a good indicator of its overall weakness. Use caution to the upside as the Bulls start the week off making a run at newer move highs towards the upside breakout level. Only a rally above here confirms strength for a challenge of the upside target zone. This is about all that the Bulls are likely to muster up as they fight to spark a correction higher.

A failure from the downside breakout level confirms weakness in the AUDUSD and a very likely test of the downside target zone. Even if the DXY is weak be careful thinking that this currency will benefit. There are too many negatives that weigh on the AUD. This means that it will be very hard to get any major rally. Long-term this market is a Bear, and 0.6145 is the extended downside trend objective.

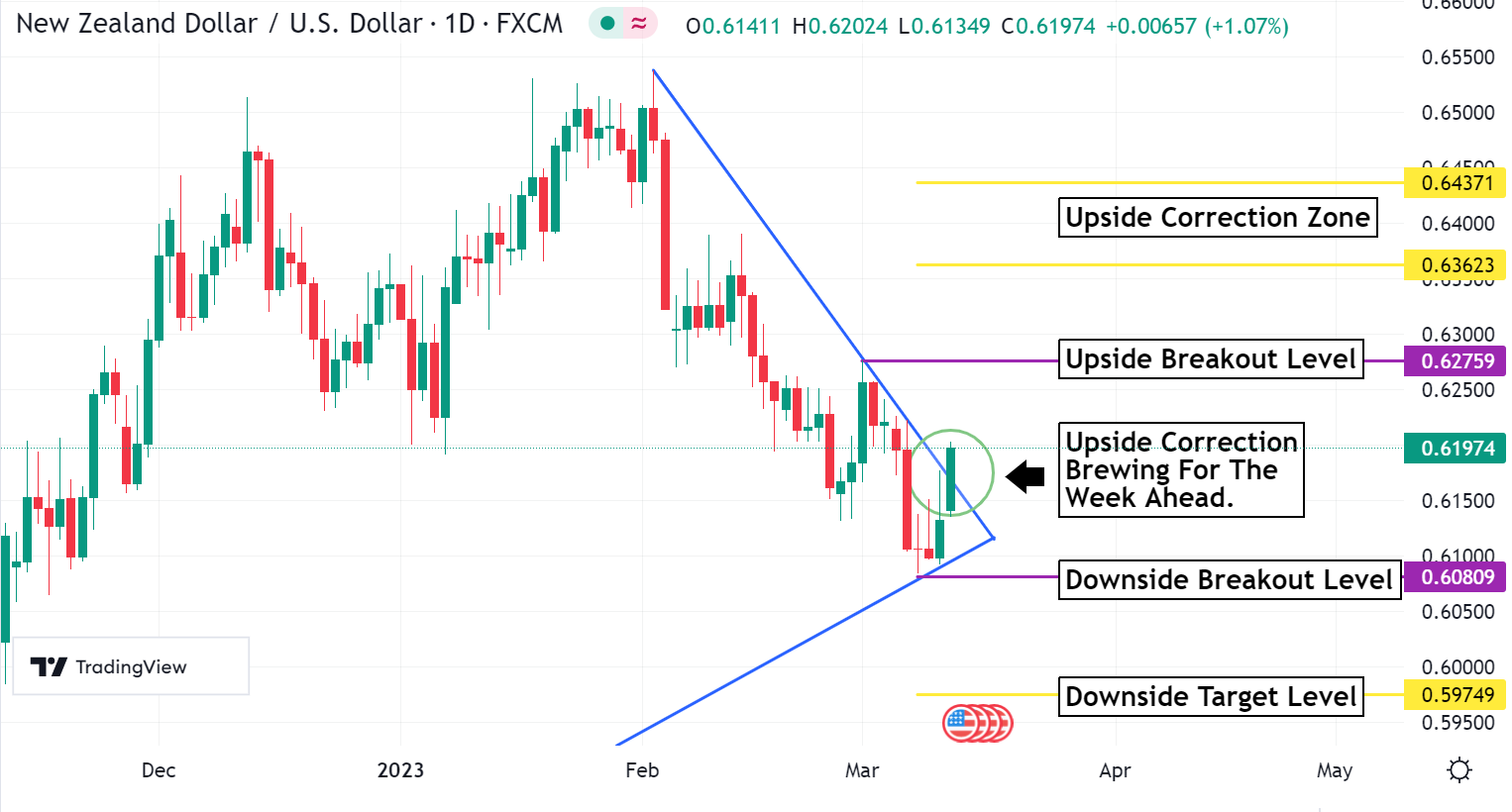

NZDUSD Weekly Outlook:

NZDUSD Bulls caught a break last week and found a short-term bottom. Is there a true upside correction going to happen this week? It looks as if the Bulls are in control, and a challenge of the upside breakout level is the call. Since U.S. yields are in retreat this bounce has a chance. But be mindful that it will be short-lived support. Only a close above 0.6275 confirms the markets intentions to press a rally all the way up into the upside correction zone.

If the market slips back below the downside breakout level you better not get caught long. A failure here is a negative sign that the market is set to resume the overall Bear trend. New move lows in this case will have the 0.5974 downside target level a very viable objective. Once the Fed starts to unload more bullets it is very likely to see the NZDUSD at these lower levels.

USDCAD Weekly Outlook:

Breakout your crystal balls. This market aims to disappoint. Key off the upside breakout level set from last weeks swing high. The USDCAD is starting the week off squeezing out the weak longs. More support bashing is likely for the next few sessions. It will be an ugly range trade back into the downside target zone. Remember that this currency has been an overall nightmare of a choppy trade for months now. Lately the swings have just seemed to be nice moves. Yet, relatively speaking they are not that large. The recent swing high was right below long-term resistance that has contained this market. Back to support for now.

Only a rally above 1.3863 confirms the markets will to press newer move highs on a grand scale. Trading above here targets the 1.4055 level. Even with a strong Fed outlook, it is not so dominant a factor here. The USDCAD has problems of its own that yields do not outweigh. Time will tell once the Fed has a few more rate hikes. If they are very strong, then the market has a very good chance of lifting the trend out of the long-term range trade it has been drifting in.