The Tiger Forex Report 4-10-23

The Tiger Forex Report – Week of 4/10 – 4/14/2023

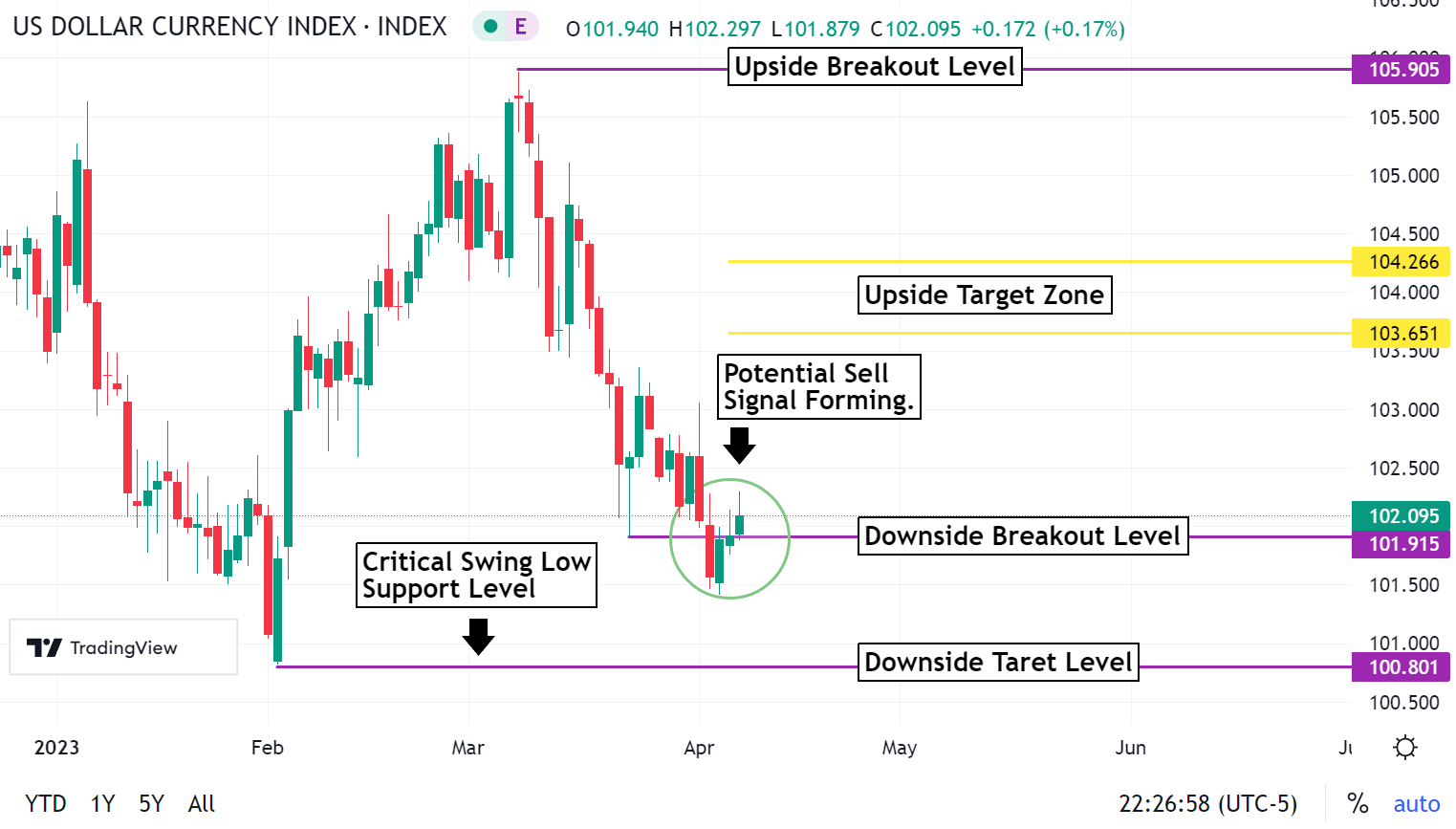

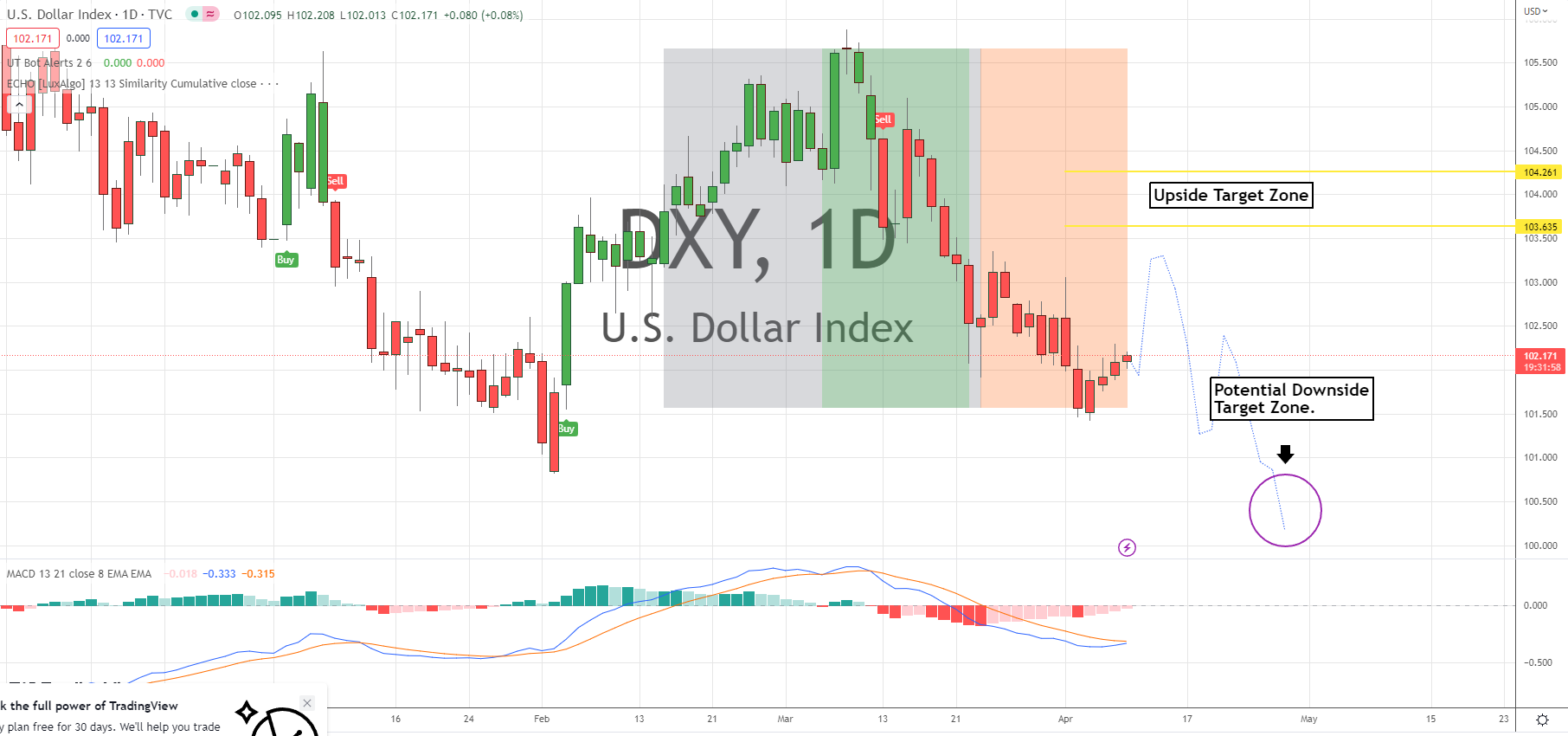

The DXY probed new move lows flirting with an extended leg lower, and more trading to the downside is on the agenda.

Crude Oil had a big leap to the upside last week, and left a large gap to fill. If the rally persists it will assuredly cause a spike in inflation.

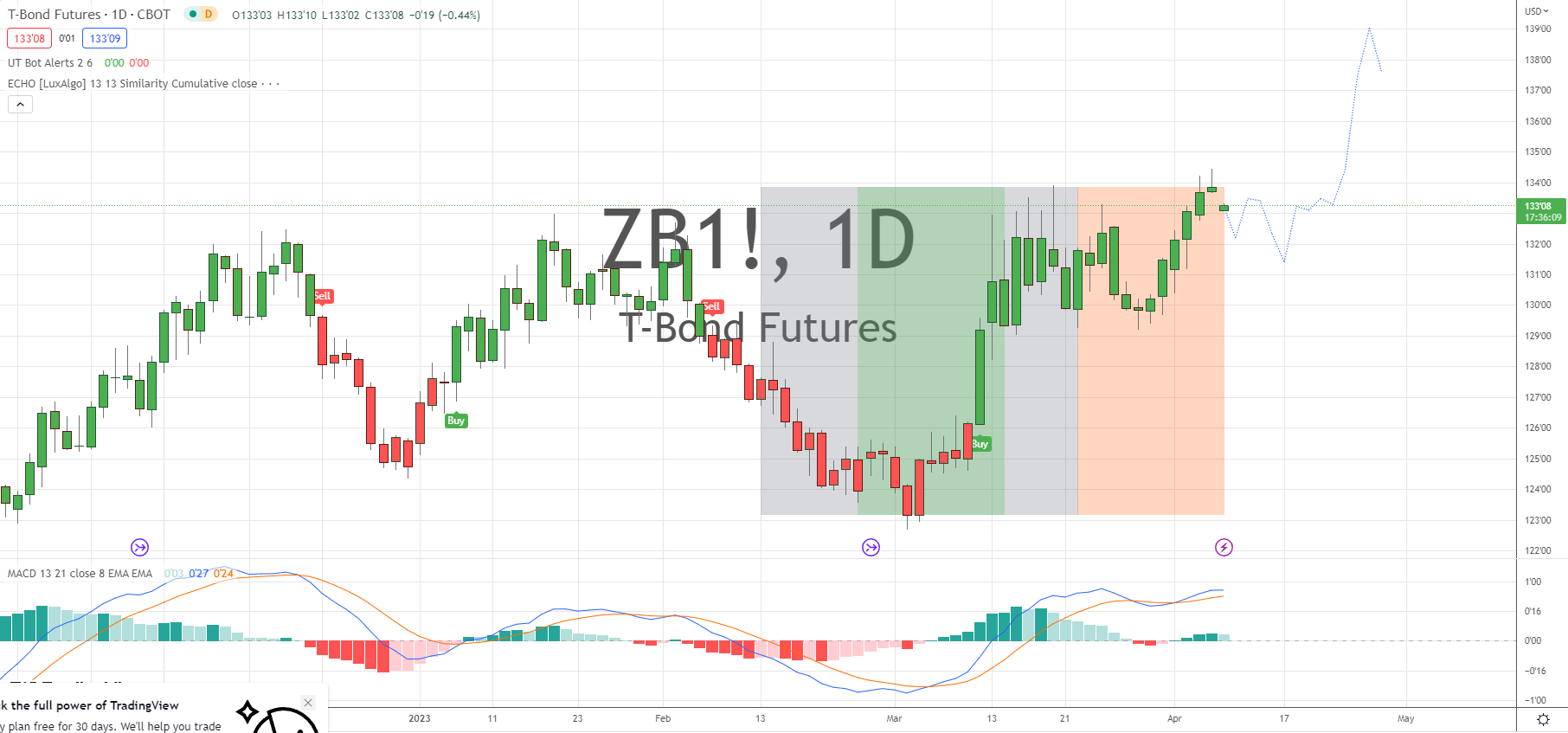

The 30yr T-Bond is pressing newer move highs dropping yields to multi month lows. Key off the upside breakout level for direction.

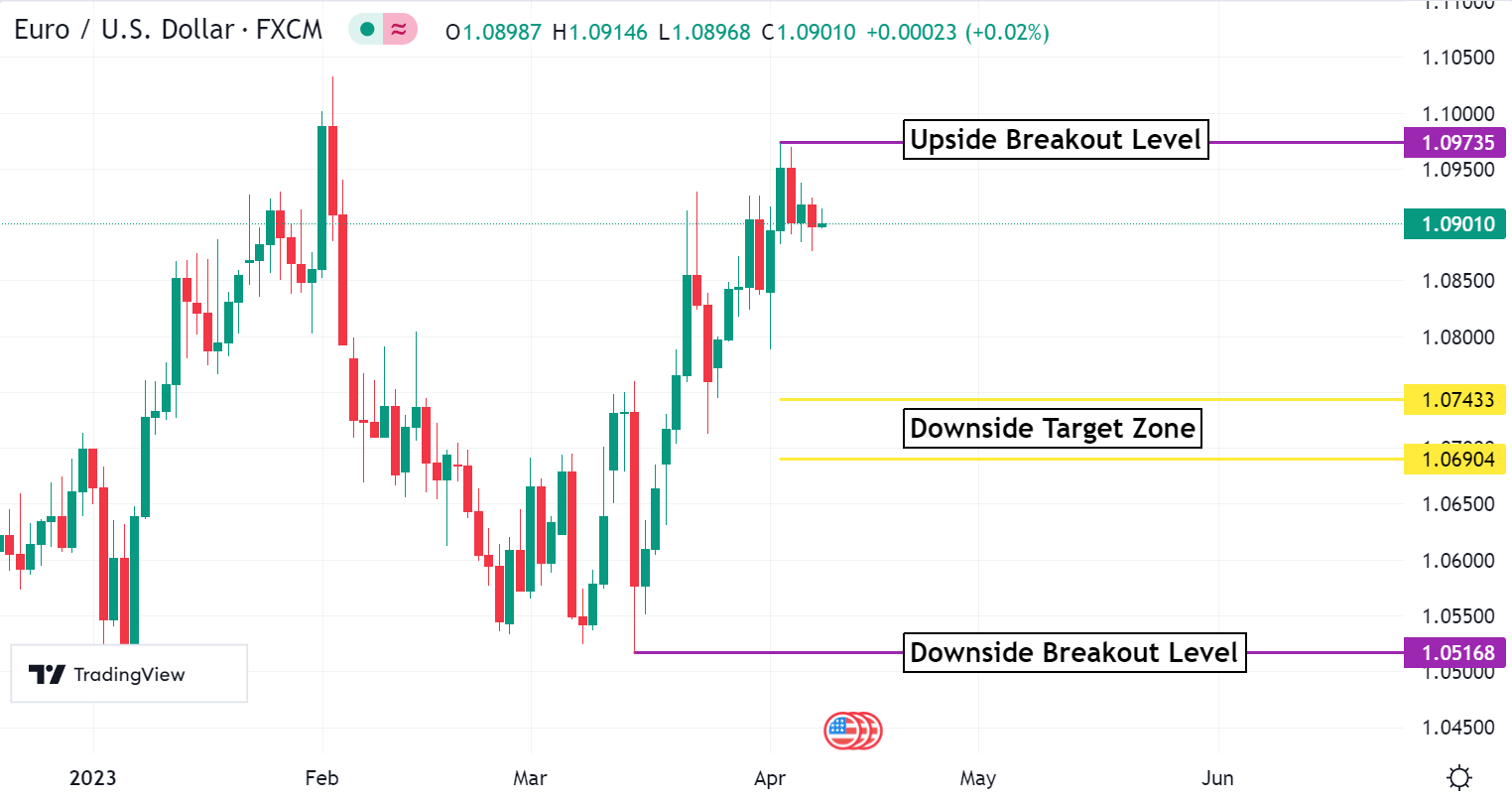

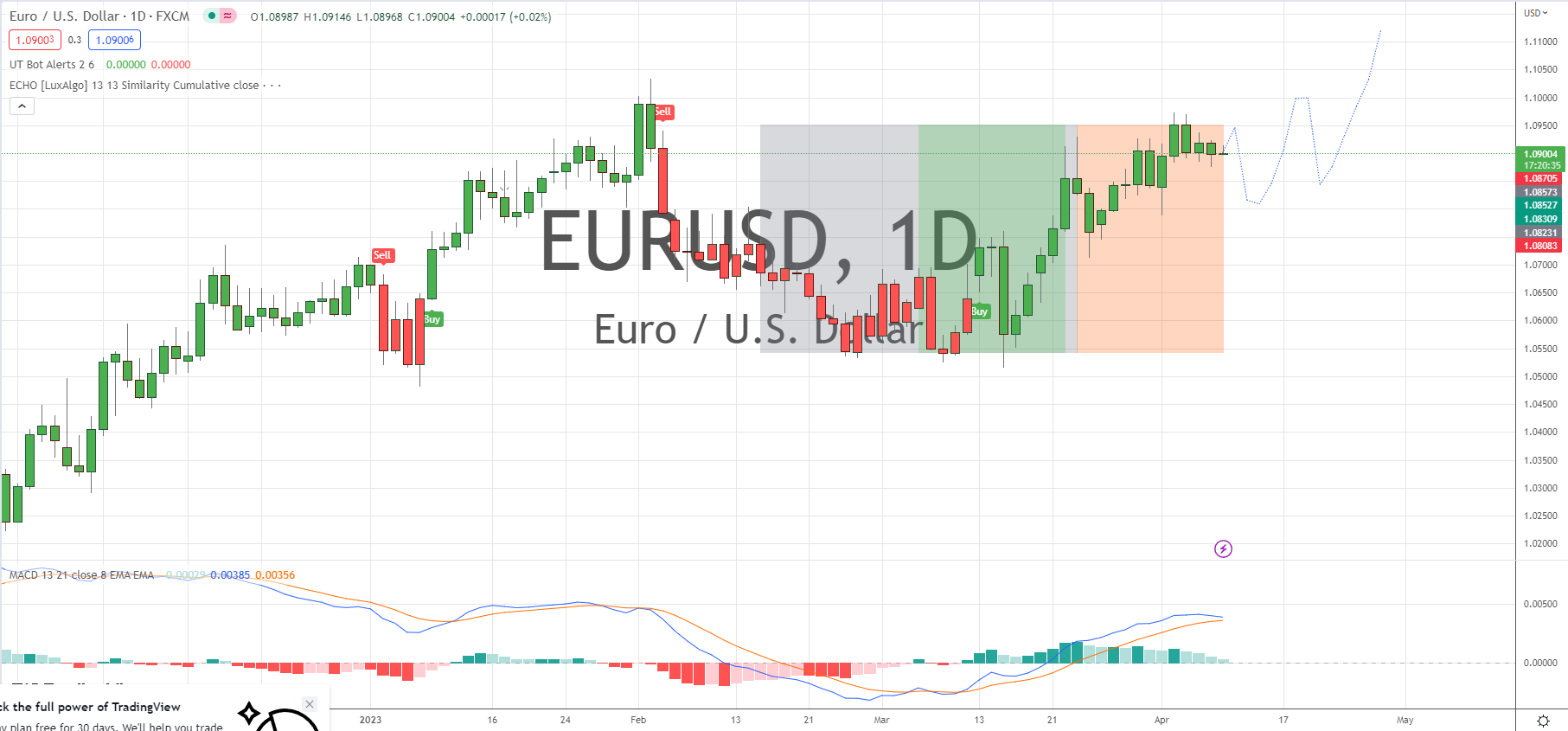

EURUSD Weekly Outlook:

The Bulls pressed resistance, but fell back into a choppy trade. While technical factors support the rally, fundamentals may start to wear on the market. Use t he upside breakout level for direction. Another rally above this area sets the EURUSD in motion to make a play for the 1.1100 level. With central banks focused on the banking crisis more than inflation it is unlikely that the market will get much higher than this area.

Trading under the upside breakout level will have the market in a consolidation mode. The EURO, USD, and GBP are under attack by the BRICs’ and this should keep the EURUSD under pressure for a break towards the downside correction zone. As more trade deals are rewritten to break away from Western currencies the EURUSD is likely to fall into a holding pattern as fundamental factors cause conflict between Bulls and Bears. Especially with Crude Oil on the upswing it will be tough for the EURUSD to maintain any solid trend. Be aware of the 1.0690 level. Trading below here is a negative sign that targets the downside breakout level.

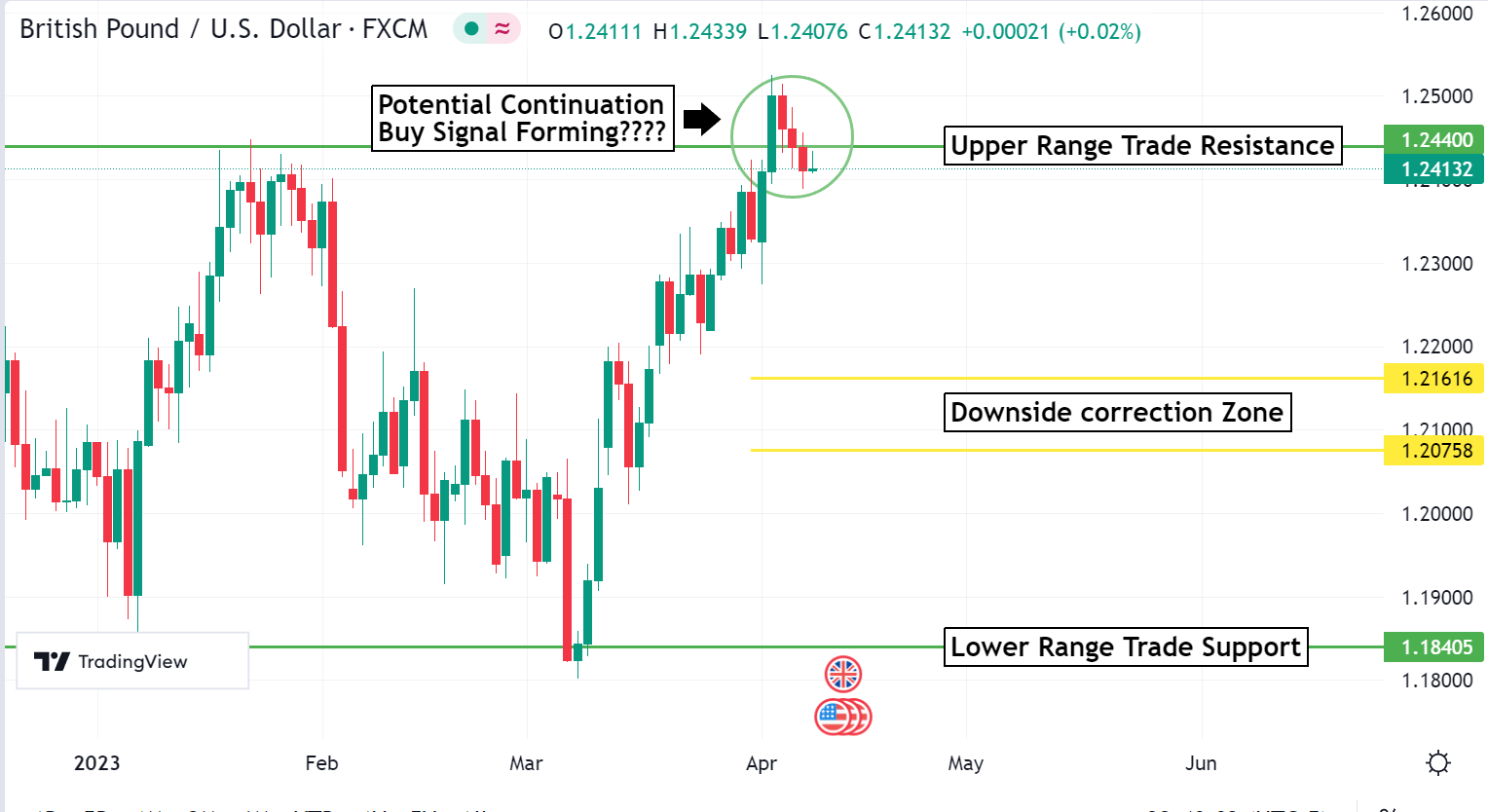

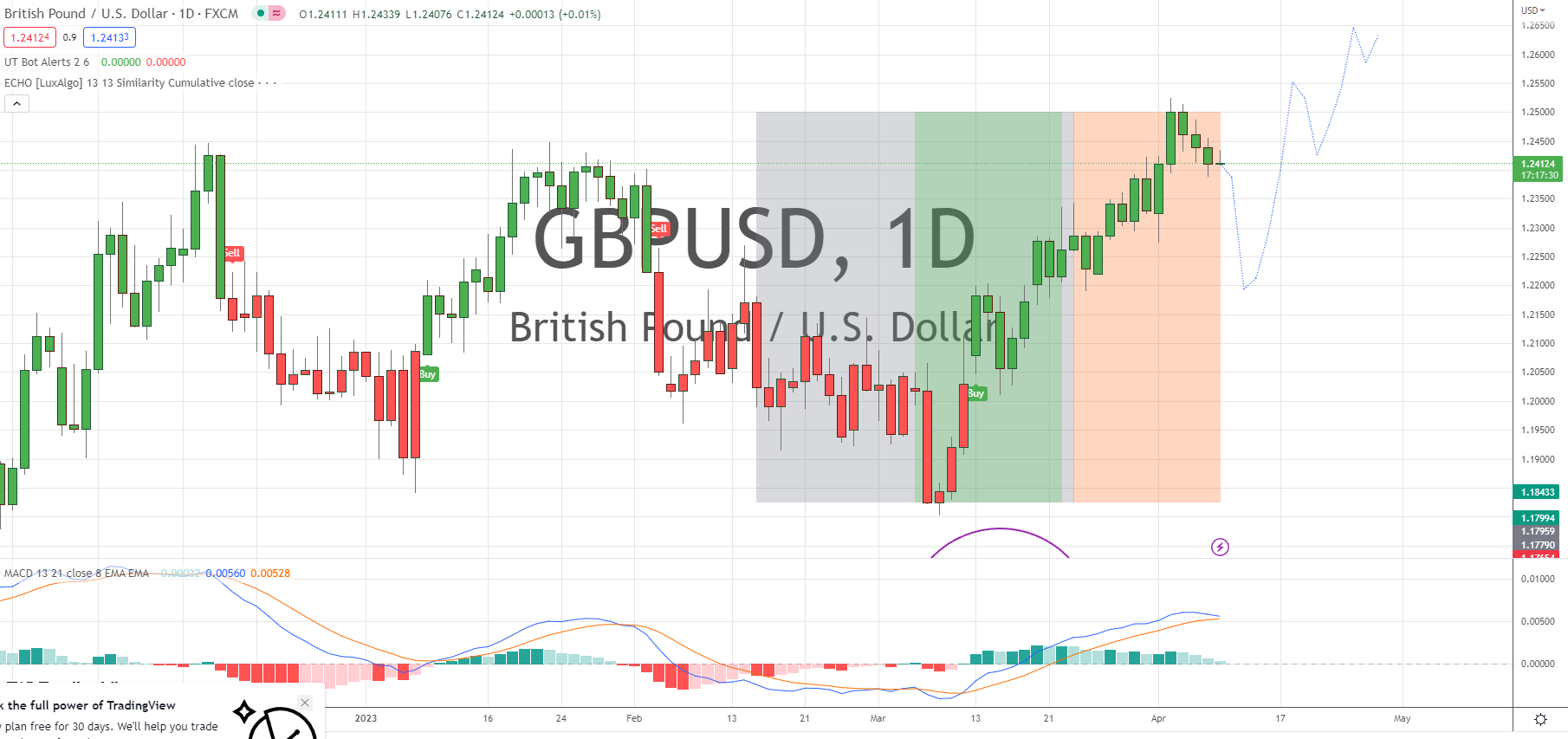

GBPUSD Weekly Outlook:

GBPUSD traders pressed through resistance last week and are trying to maintain momentum. Use the upper range trade resistance level or directional bias. If the market can maintain a trade above this level, it is likely that the Bulls will make a run for newer move highs. 1.2600 is the upside objective. Be careful trying to fade this rally. Momentum is strong to the upside in the short-term, and it would be wise to wait for a valid sell signal before trying to sell into this rally.

Below the upper range trade resistance level, the market will be on pause for a digestive range trade. If the U.S. Yields start to lift this week, then the Bears may be able to press a break back to the downside correction zone. This should be it for a correction lower. Only a dip below 1.2075 confirms weakness, and extends the downside objective towards the lower range trade support level. It will be very important for GBPUSD traders pay attention to BOE actions over the upcoming few weeks. This will be the key to honing in on the longer-term directional bias for this market.

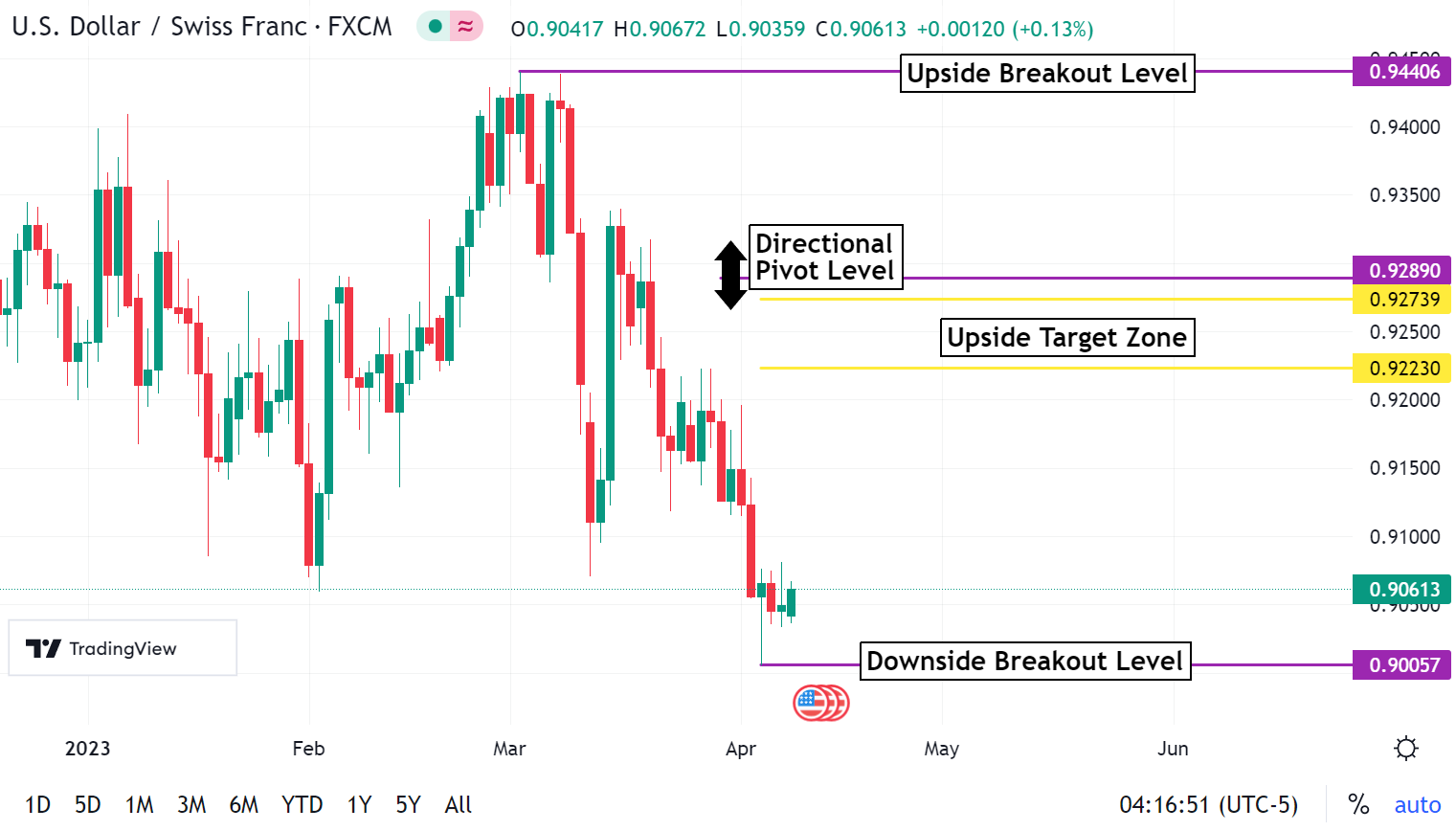

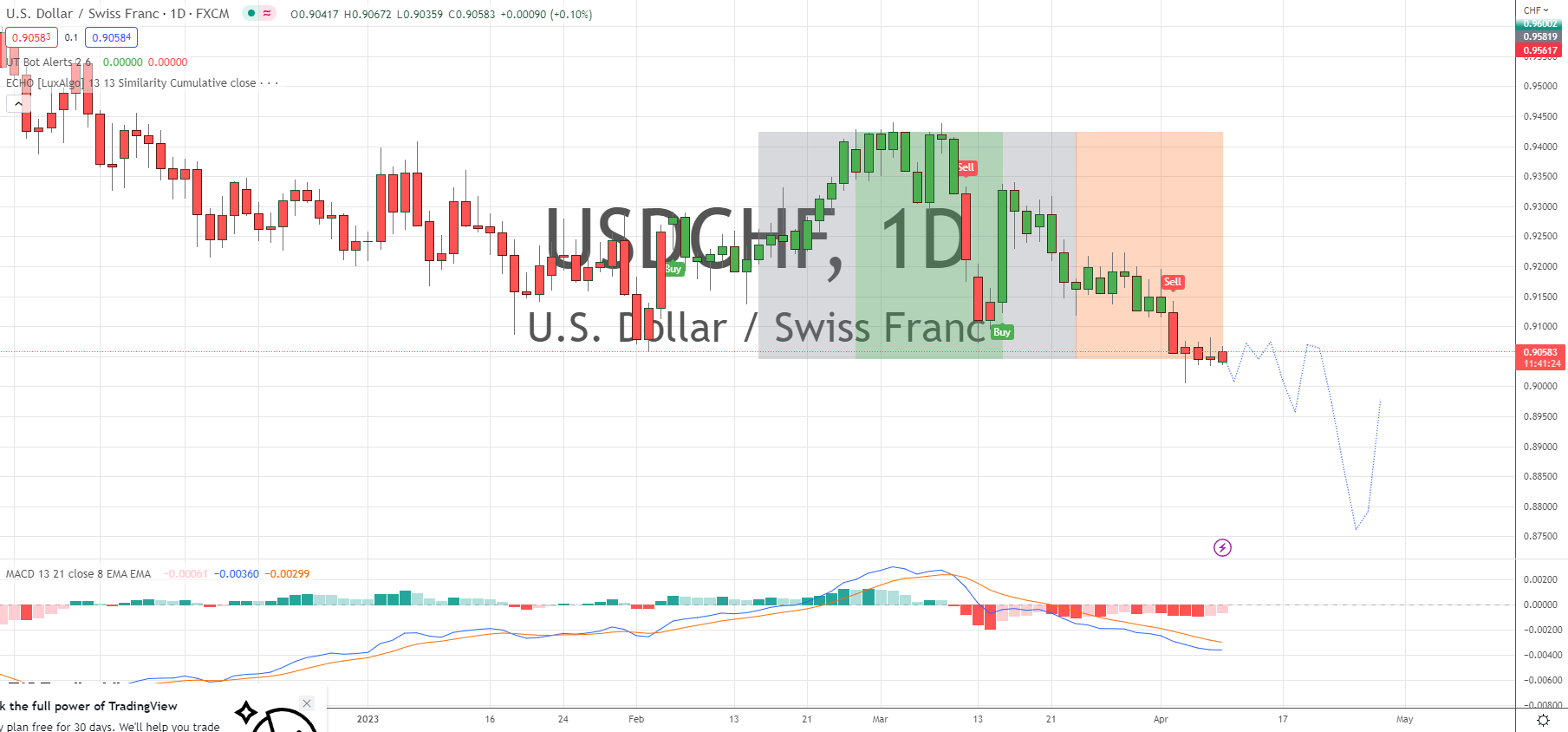

USDCHF Weekly Outlook:

USDCHF traders are riding the Bearish wave, and the long-term trend is reinforcing the move. As the USD remains under attack it should benefit the Swissie for months to come. If there is divergence anywhere it is in this currency. Newly released Covid rules (No Jabs unless “Doctors” accept all liability for any patient reactions.) also should lock in a stronger Swiss economy in the months to come. Remember that the Swiss are not part of the EU, and they are on a different path both politically and economically. In the short run it is very unlikely that the EU will follow suit. This should keep traders on the Bear path set to test the downside breakout level. All trading under here confirms an extended slide that targets the 0.8825 level.

If the market can sustain a trade above the downside breakout level the USDCHF may muster up the strength to make a play for the upside target zone. This is about all that is likely for the Bulls. Only a breach of the 0.9289 directional pivot level reverses the outlook for a rally that has the potential to lift the USDCHF back up towards the 0.9440 upside breakout level. The only way this is likely to happen is if the U.S. yields rise sharply. Watch the interest rate markets for an indication for a change in USD strength.

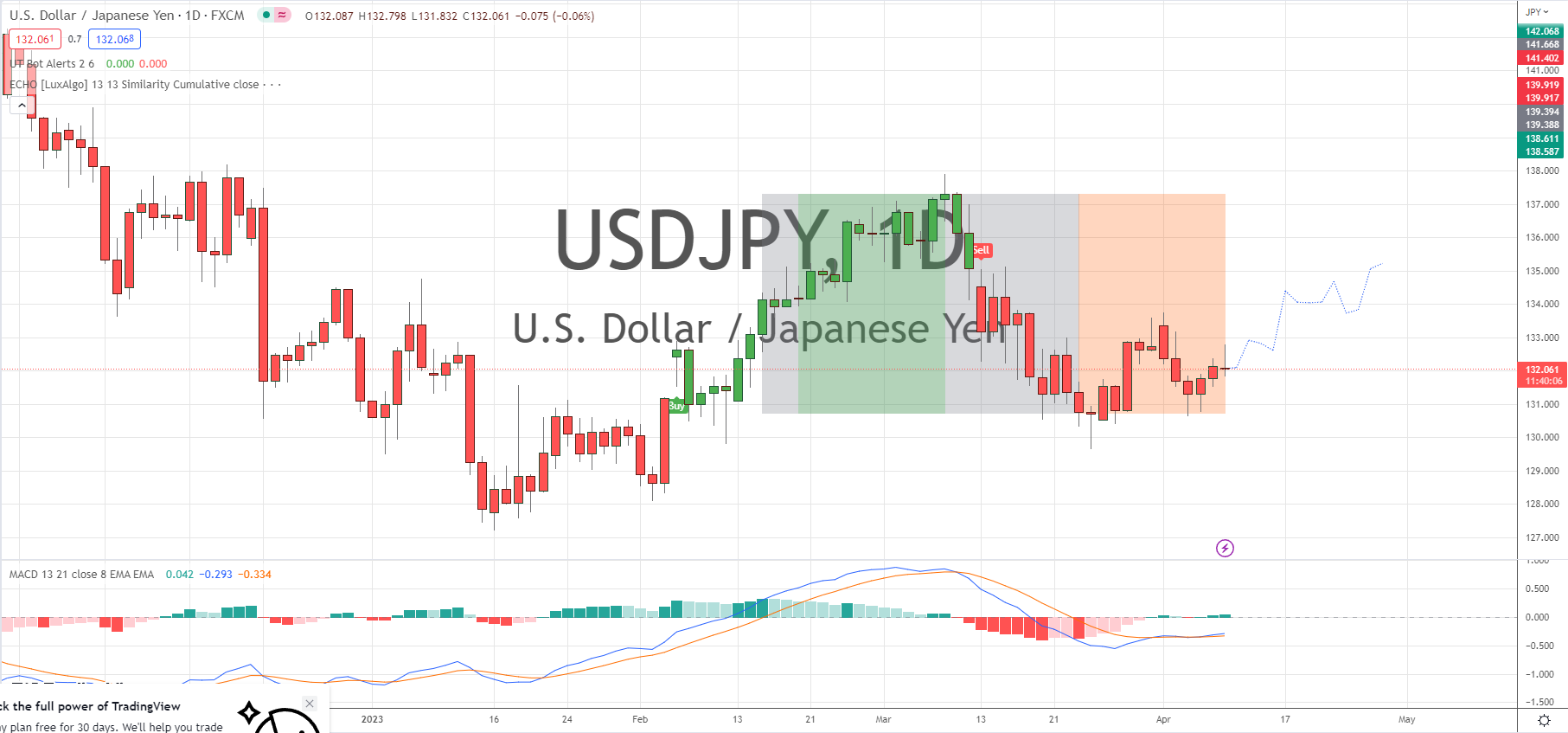

USDJPY Weekly Outlook:

USDJPY traders are poised to rally into the upside correction zone. This should be it for the Bulls. However, the recent strength in Crude Oil may change this outlook. If Crude continues to rally then the market should keep the Bulls in motion for an extended move up towards the upside breakout level. Since the BOJ is working with the Fed on the banking scandal management it is unlikely to see any strong Bearish sell off.

Below the upside correction zone the market will be in limbo. Only a failure from the downside breakout level confirms weakness. Do not fight a slide below here. All bets are off with trading under 128.15 level. 1.2590 is the longer term sell off target. Once the BOJ gets back on track this scenario becomes more likely. Or…If Japan continues to make Oil deals in other currencies. Yes, it is true. One of our strongest allies is ready to break away from the petrodollar. Can you blame them???

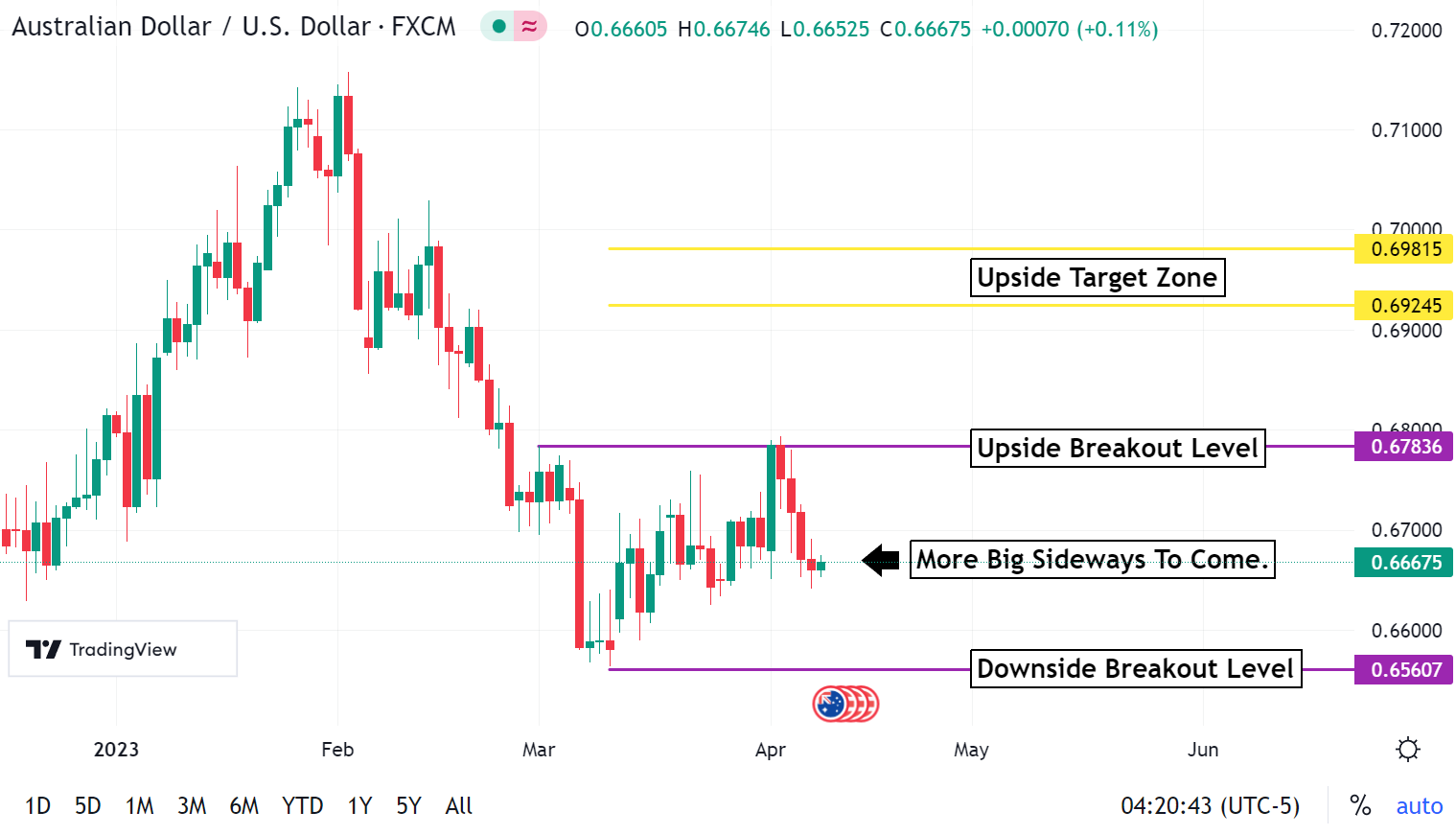

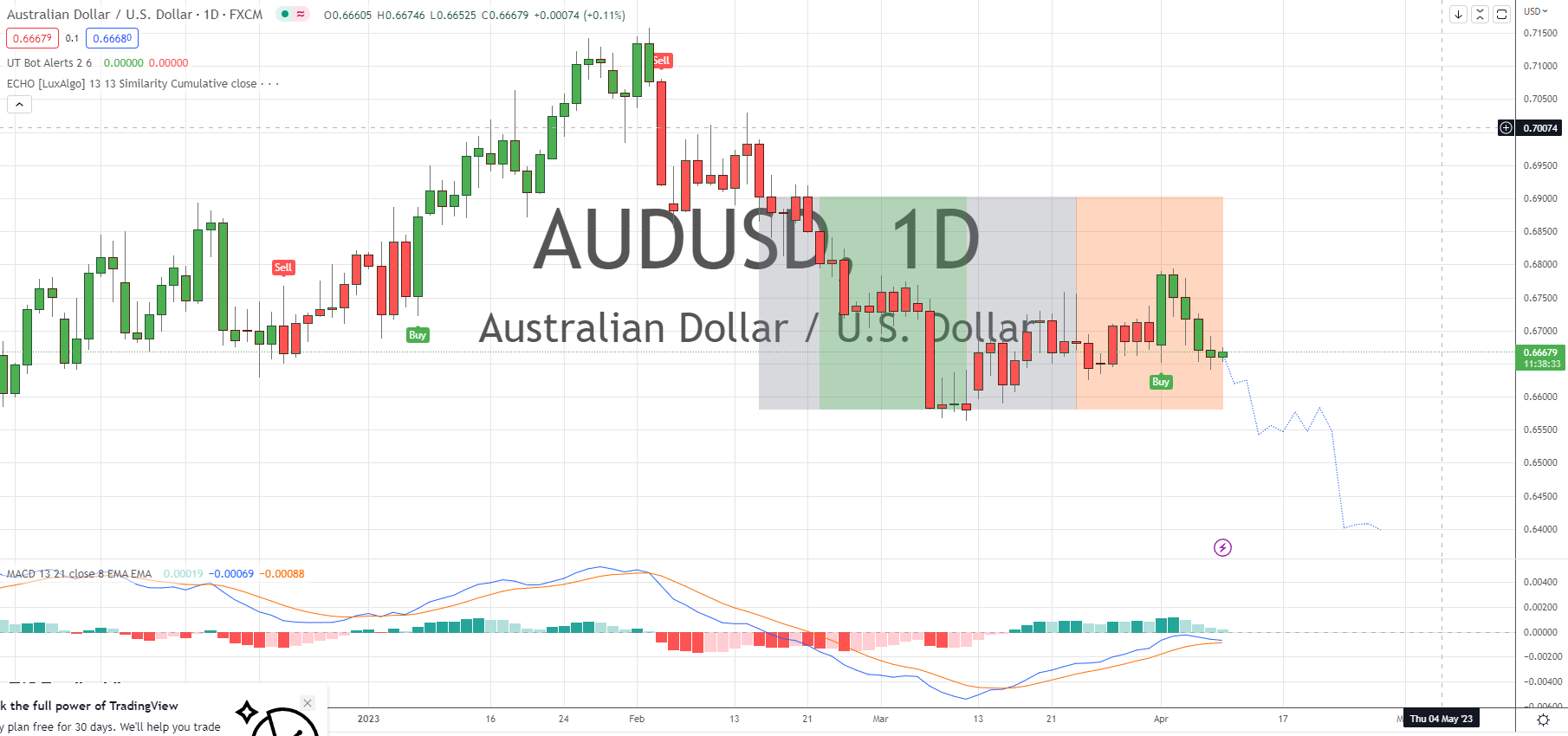

AUDUSD Weekly Outlook:

Are you ready for more of the same. Sorry everyone. This market is set for more sideways. Use the breakout levels as an indicator for direction. If the AUDUSD can rally above the upside breakout level, then expect a rally up towards the upside target zone. If U.S. yields stay under pressure the market may be able to continue a fresh Bull trend. However, do not expect too much beyond this area. Fundamentals are gloomy for Australia, and it should help to keep rallies from holding up.

If the AUDUSD falls below the downside breakout level it would be unwise to fade the slide. A print under 0.6560 is a fresh sell signal that targets the 0.6375 level. 0.6150 is the longer-term downside target. If U.S. Yields rise sharply then the Bears are very likely to slam this currency to new multi month lows.

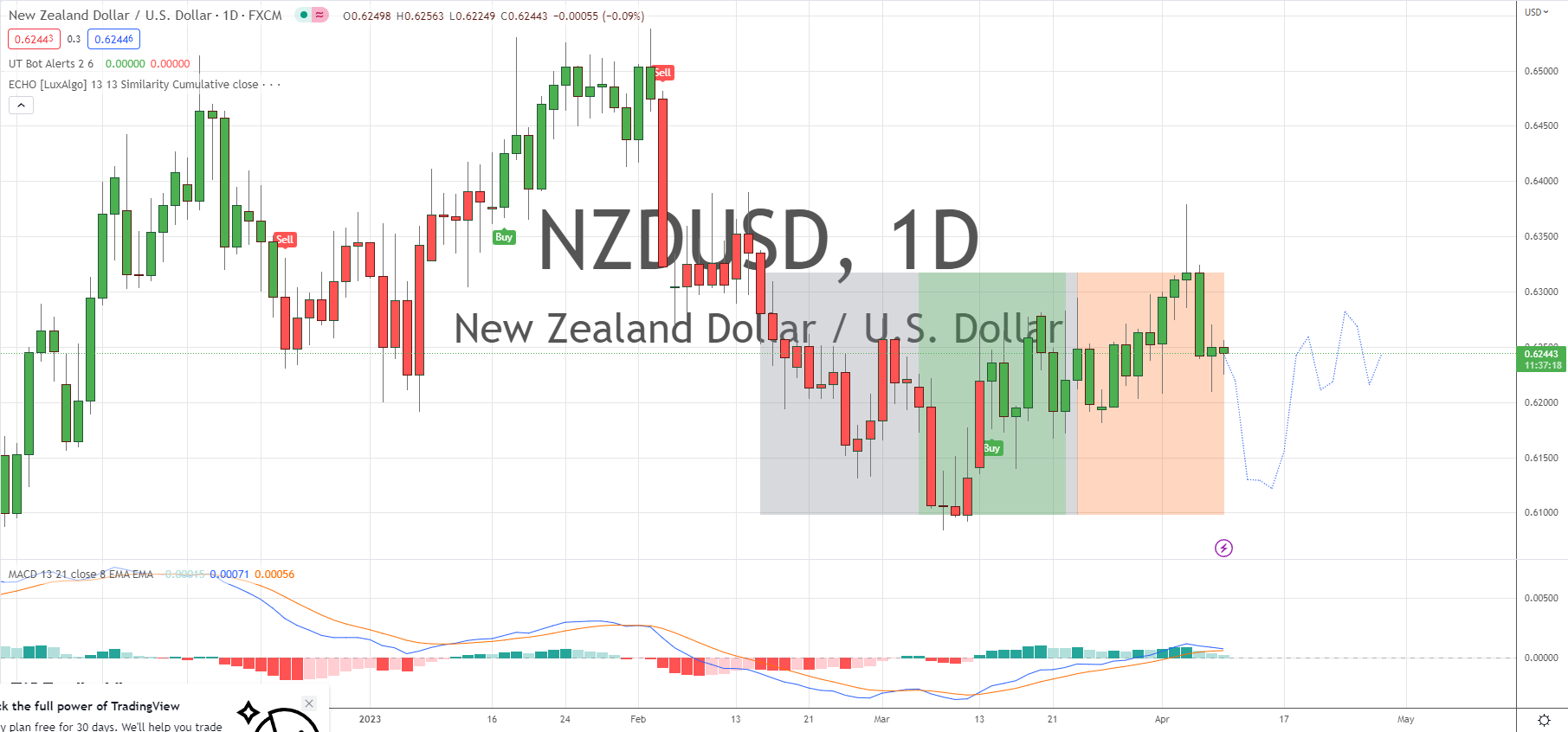

NZDUSD Weekly Outlook:

Hmmmm. NZDUSD traders spiked higher into the upside correction zone just to fall back into our established range trade area. Fundamentals are weak for this currency, and it is likely to become more neutral in the week to come. Yes, the market has continued to make higher highs, and higher lows. The trend is in place, but Bearish influences are strong. Only a sustained rally above 0.6280 confirms the markets resolve for higher move highs. 0.6450 is the extended rally target.

The short-term trend is setup to falter. If the Bears can break under 0.6179 then there should be a wave of fresh selling. Trading under here sets the market up for a test of the 0.6084 downside breakout level. Do not fight the market below this level. Downside momentum is likely to build driving the market back down towards the 0.5775 level. Should this occur, the longer-term trend will be reestablished confirming major weakness. 0.5410 is the extended downside target.

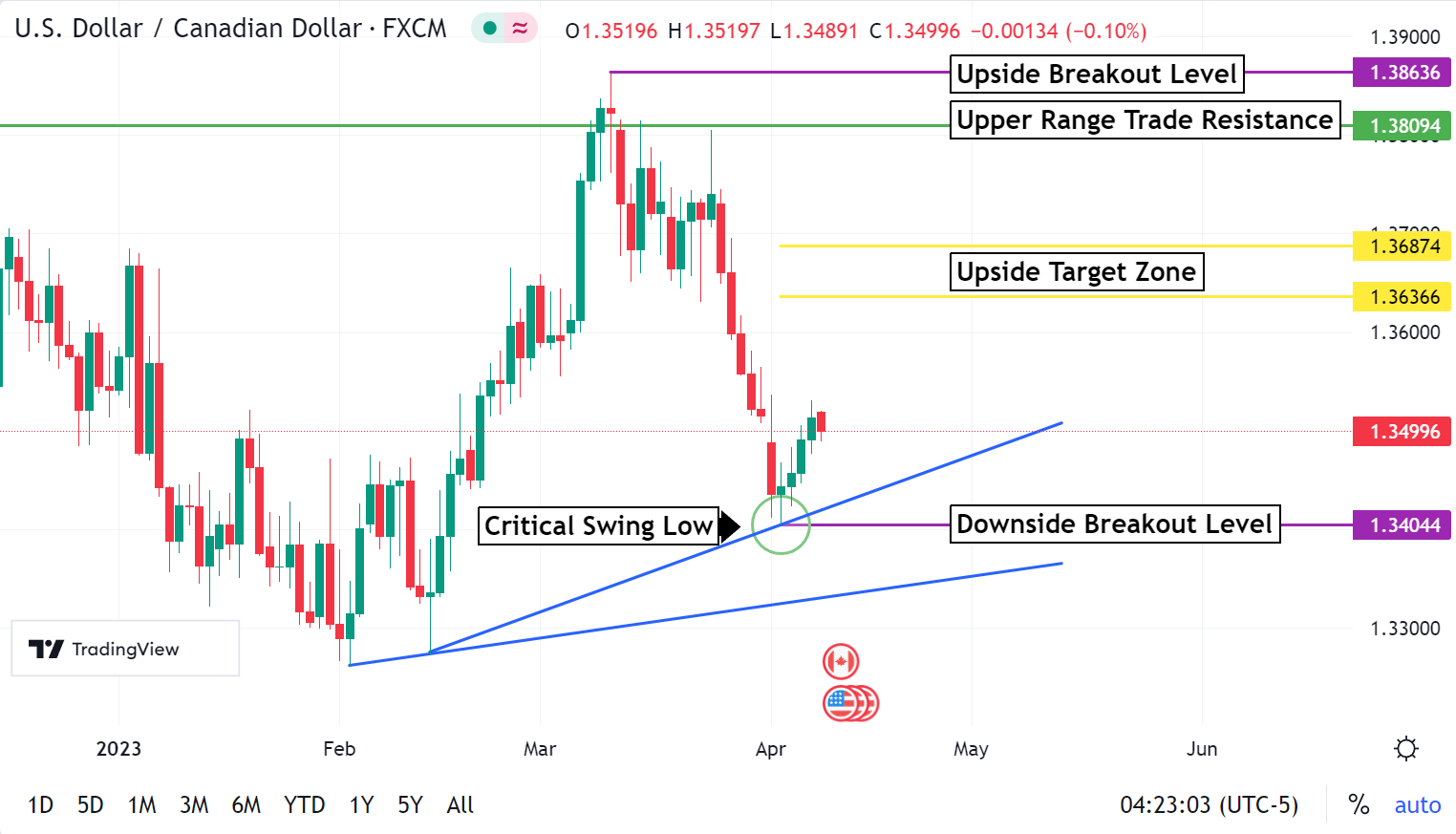

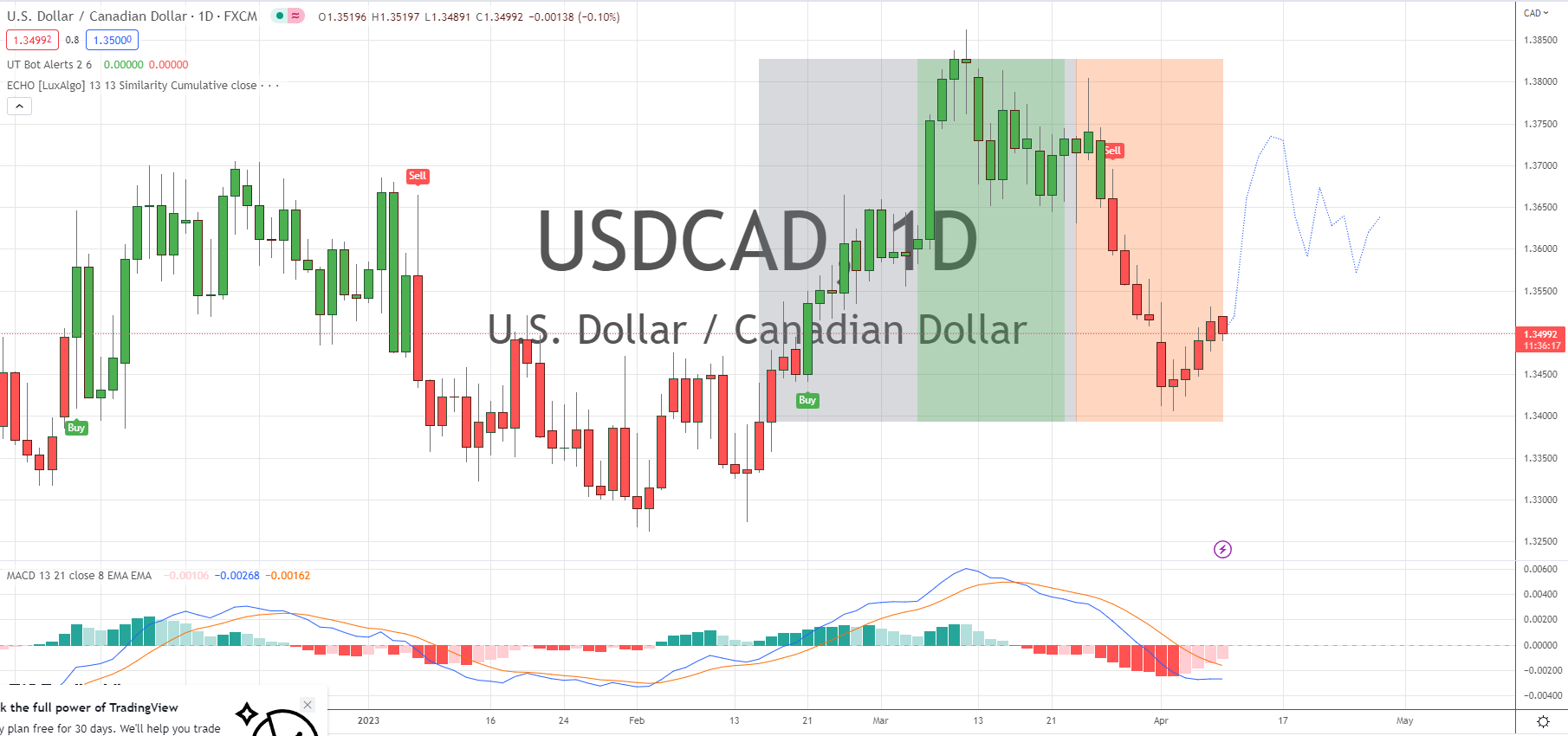

USDCAD Weekly Outlook:

The USDCAD established a critical swing low last week. Key off the downside breakout level for direction. A failure from this area is a negative indication that the Bears will press new lows down towards the 1.3175 level. Remember this market has been in a big range trade for months, and it is likely that this will continue. Not much else is expected to the downside.

Above the downside breakout level, the market is poised to make a play for the upside target zone. If the USDCAD can rally above this area then Bears should not fight the market. Trading above 1.3687 should keep the Bulls in motion all the way up to the upper range trade resistance level. Keep your Stops tight should the Bulls get back into this area. The market is expected to maintain the long-term sideways trend. Fundamentals are very mixed for this currency pair.