The Tiger Forex Report 4-15-24

The Tiger Forex Report – Week of 4/15 – 4/19/2024

The DXY is looking to press the upside target #1. Geopolitics are sure to create some swings. Be nimble this week.

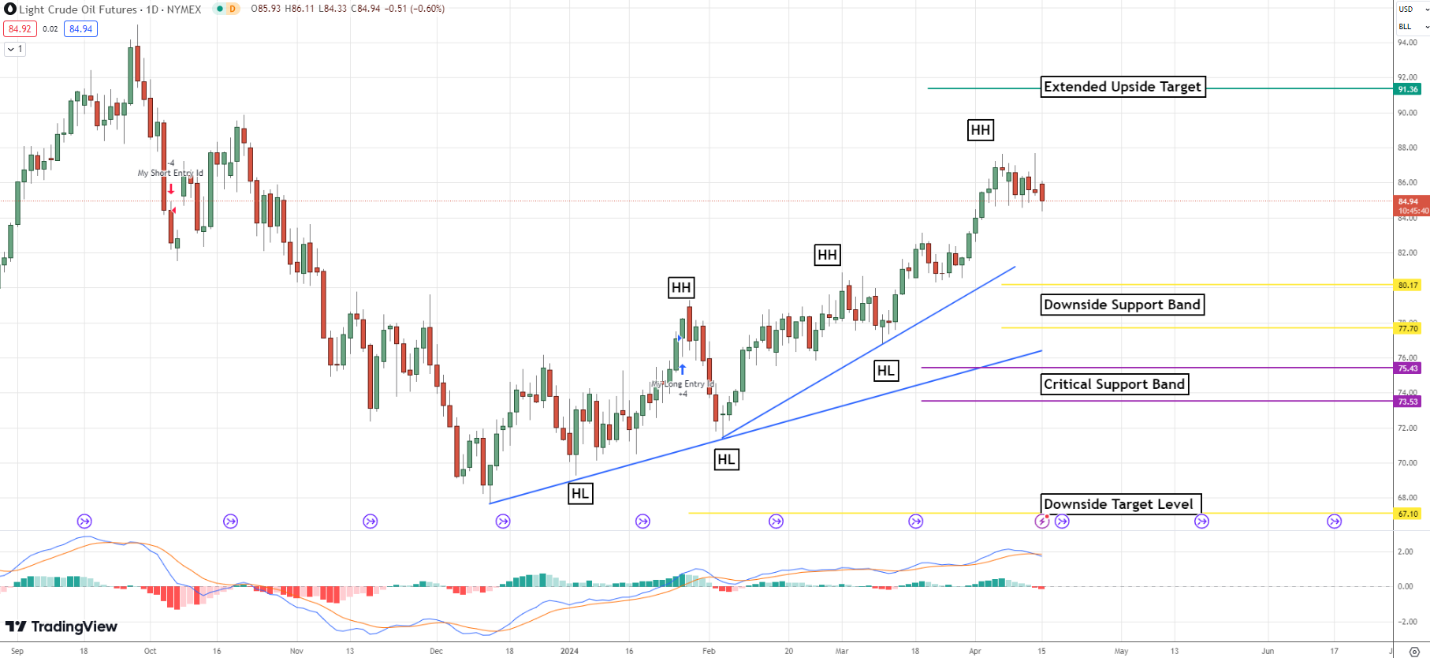

Crude Oil is starting to consolidate. More Bullish action is on the menu as Middle-East tensions grow.

30yr T-Bond Bears are in control as inflation fears rise. This reinforces the downtrend.

EURUSD Weekly Outlook:

Volatility in the EURUSD is heating up, and the Bears are in control. It is a sell rally forecast as the market tries to press new move lows to the downside target #1. This is about all that should manifest from an extended leg lower. Watch economic numbers. Every uptick in inflation should help to drive new move lows in this market.

Only a rally into the old critical support band would cancel the negative forecast. Trading in this area puts this currency back into the giant range trade mode. Do not be surprised if this occurs. We are likely testing the lower band of the range that this market may hold for the next few months to come. A close above the monthly directional pivot level would be needed to have any real Bullish shift in momentum.

GBPUSD Weekly Outlook:

The Pound is under the gun, but a bounce may be on the horizon. New move lows are pressing the downside correction band, and this is a key area. It is expected that the market will hold up in this area. If the GBPUSD gets below here there will be an update to figure out the extended downside forecast.

Above the downside correction band, the market will be in limbo up to the monthly directional pivot level. This is the hurdle to cross for any true Bullish confirmation. A violation here should ignite fresh buying. But do not get too excited. This just puts the GBPUSD into a wide-range trade zone. It would take a rally above the upside target #1 to confirm any multi-month shift in trend.

USDCHF Weekly Outlook:

USDCHF traders are trying to maintain the Bullish trend. Be careful. This Bull may be running out of gas. The upside target level is key. A breach of this area should touch off weak Stops and help propel this market up towards the 0.9300 level.

Below 0.9149 the Bears will be in a digestive phase back to the digestion area. This should be it for a pullback. The trend is strong, and unless there is a big sell-off in the USD, it is not likely that the USDCHF will get a big Bearish move. The critical short-term support band should be the floor for any harsh reversal for this currency pair.

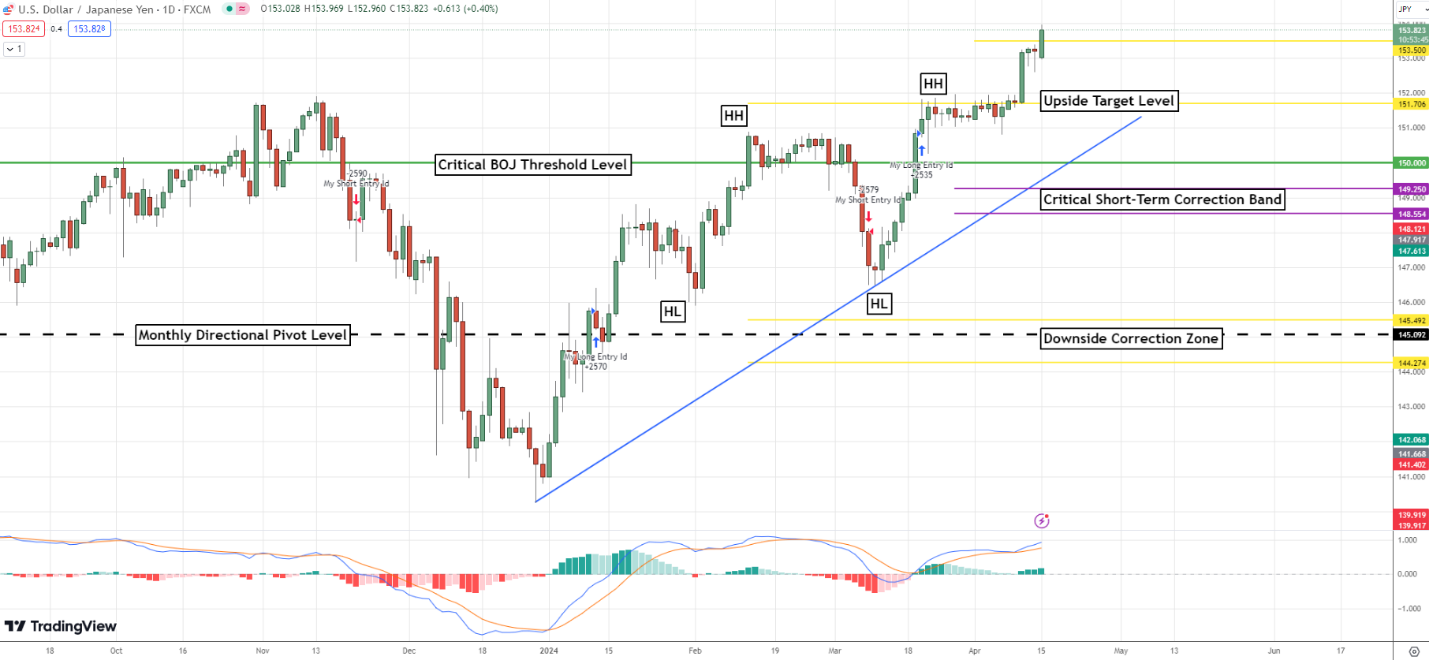

USDJPY Weekly Outlook:

The BOJ is not getting much rest lately with the USDJPY trading at these high levels. The market is hovering around the 153.50 key pivot level. Use this for the market’s bias. Below here the market should fall back on the old upside target level. This area is likely to become a new floor for the market, but a print under here could touch off fresh selling pressure. The critical short-term correction band is the Bearish objective.

It will be touch and go above the 153.50 level. As long as Crude Oil remains firm and Yields remain high there will be little incentive to get any strong selling pressure. 155.00 is the new upper target to aim for. But be ready for a spike high with a sharp pullback.

AUDUSD Weekly Outlook:

The Bears are in control, but momentum is weak. The AUDUSD is expected to ride support this week into the downside support band. The trend is more sideways than anything, and this market is likely to remain in the chop zone. It would be unwise to get too Bearish on this FX pair unless the USD gets a big rally.

A breach of the directional pivot level is needed to give the Bulls a chance at a fresh move. Trading above here would make the upside breakout level a viable target. But beware. The upside resistance band is most likely as high as the AUDUSD can get. Trading above here is unlikely unless the USD takes one hard on the chin.

NZDUSD Weekly Outlook:

Look out below as the NZDUSD tries to press new move lows towards the downside target level. Do not try and catch a falling knife. This currency has the potential to press lows into the critical support band. This is all that is likely out of an extended sell-off. A short-term consolidation phase is expected to develop soon.

It is a sell rally forecast up to the upside correction zone. Only a violation of this area would reverse expectations as the Bulls set this currency pair up to challenge the critical resistance band. Be careful if the NZDUSD gets back up into this area. There is not likely to be much upside potential above this area.

USDCAD Weekly Outlook:

The USDCAD is spiking through resistance, and a pause for the cause is likely. A choppy digestive trade is in the short-term outlook. The trend keeps this market pointed at the upside-bullish target level. This should contain the Bulls for a bit, and a consolidation phase is very likely. Keep your Stops tight. Only a close above the 1.3835 level would confirm any longer-term Bullish trend conditions.

If the market slips back below the 1.3700 level the Bears may spark a solid sell-off. Trading back in this area would have the USDCAD looking to fall back into the upper band of the last few months’ trading range. A failure from the downside breakout level is needed to confirm a fresh Bearish trend that targets the downside correction zone.