The Tiger Forex Report 4-24-23

The Tiger Forex Report – Week of 4/24 – 4/28/2023

DXY Bulls caught a bounce, but now multiple FX pair divergence has caused a sideways range trade.

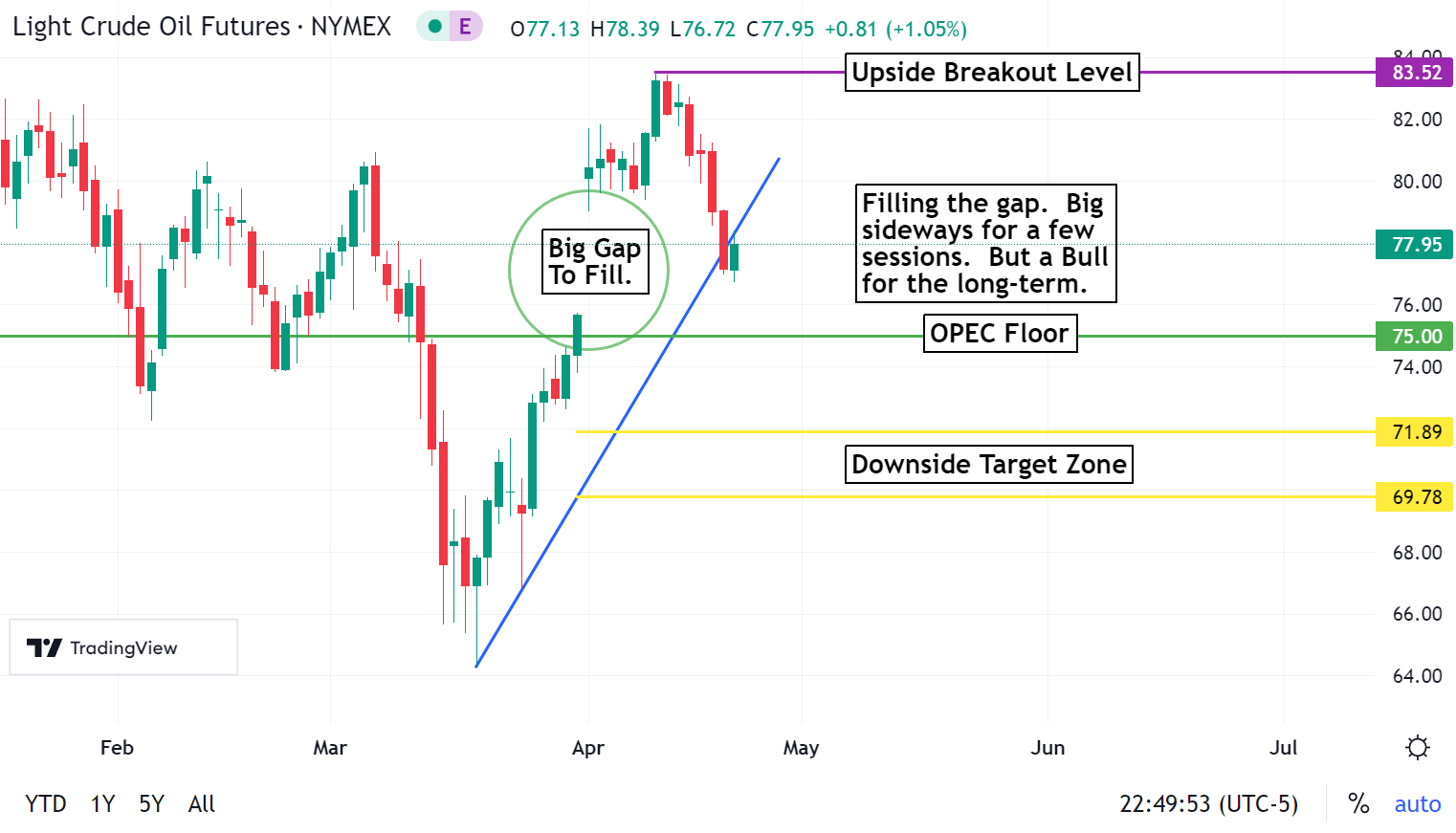

Crude Oil Bears are trying to fill the downside gap, but do not get too negative on this market. A bounce is expected, and this should be viewed as a corrective move.

The 30yr T-Bond fell on strong support last week, and a sell rally forecast is the call for this week.

EURUSD Weekly Outlook:

The top currency pair in the DXY fell on support last week, and was trapped in a tight range trade. A breakout for the EURUSD is very likely this week. Trading below the upside breakout level keeps this market poised for another test of support. There is still a sell signal that sets this FX pair to test support into the downside target zone. If this is just a correction, then this is where there should be a bounce. Trading under 1.0730, however, would change the long-term outlook to very Bearish. In this case new multi month lows would be likely extending the downside objective towards the 1.0516 level.

Only a rally above the upside breakout level confirms a new leg higher that targets the 1.1165 – 1.1205 resistance band. Unless the Fed reverses gears on their hawkishness it is unlikely that the EURUSD will get much higher than this. Even with ECB hikes, the economic outlook for the EU just does not support a strong currency. At least not until the sanctions on Russia are revoked…and that is not happening any time soon.

GBPUSD Weekly Outlook:

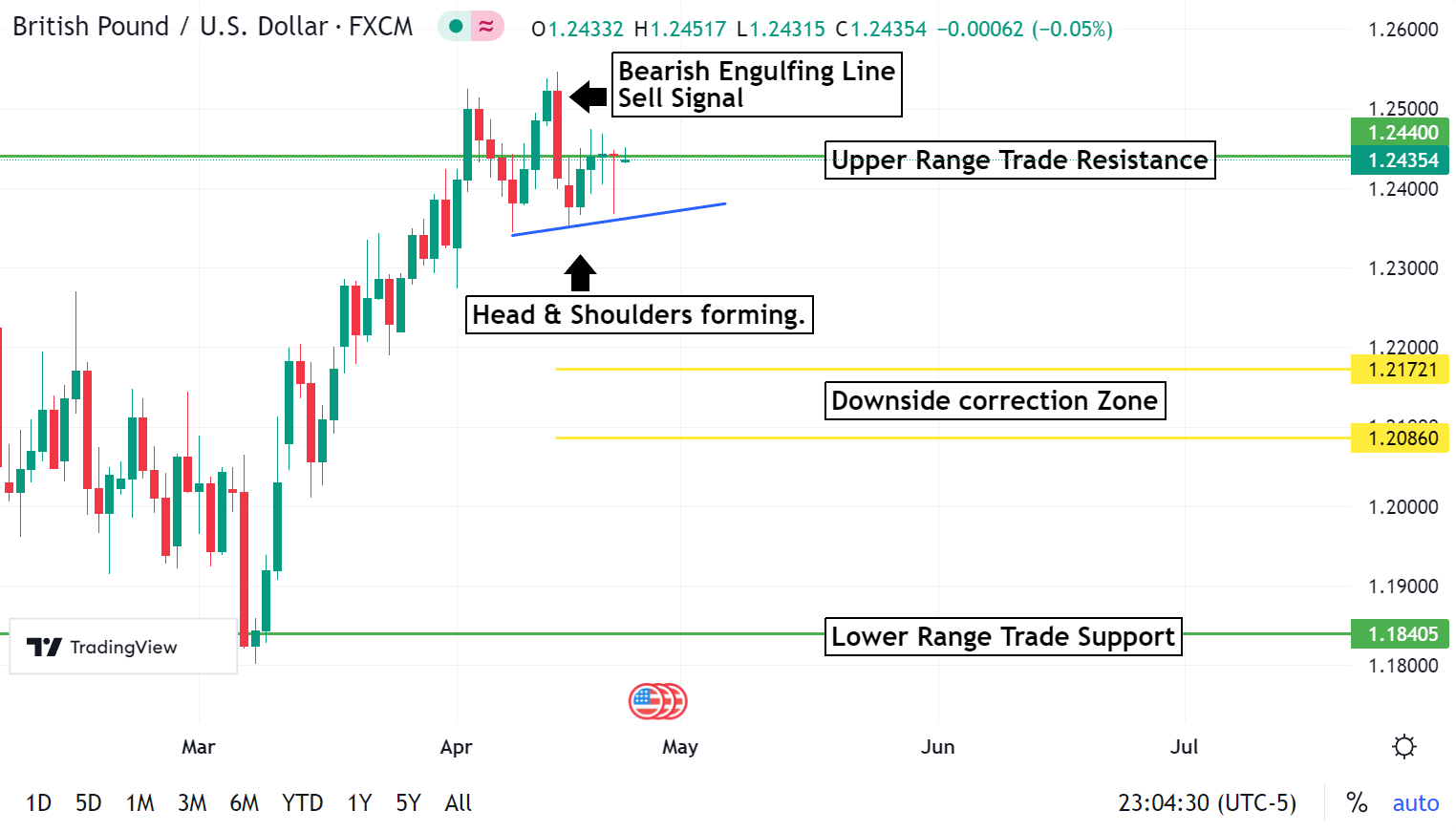

Another sell signal is brewing in the GBPUSD. While the Bearish Engulfing Line sell signal is still in place a Head & Shoulders Sell pattern is beginning to form. Key off the upper range resistance level for direction. Only a sustained trade above here confirms the markets resolve to stifle the Bulls, and spark a fresh leg higher. Use caution selling into new move highs. A violation of 1.2525 should touch off a fresh wave of buying that targets the 1.2740 level. The BOE has a dilemma on their hands, and inflation is just the tip of the iceberg. 1.2850 is the extended upside objective.

Trading below 1.2440 is a good indication that the Bears will make another run at support. If the market slips below 1.2375, then new move lows are likely. Trading back in this area would give a good indication that the GBPUSD is ripe for a slide back into the downside correction zone. This is about all that is likely from a new wave lower until there is more clarity from the Fed and the BOE.

USDCHF Weekly Outlook:

The USDCHF Bulls are having a struggle trying to lift this market. Overall trend momentum is keeping this currency hard pressed for another test of support. Use caution trying to buy into a break back towards the downside breakout level. If there is a failure here it is likely that the Bears will pound new lows towards the 0.8760 level. This is the first stop on a break that could hit 0.8690 before there is another bounce.

Sustained trading above the downside breakout level keeps this market in a holding pattern. Long-term trend pressure is overwhelming. Only a big surge in USD overall strength is likely to change this outlook in the short-term. If the Bulls can get back above 0.9000, then there is a good chance of pressing an upside correction towards the upside target zone. If the market gets back into this area make sure to keep your Stops tight. The USDCHF is very likely to fall off this area fast and hard.

USDJPY Weekly Outlook:

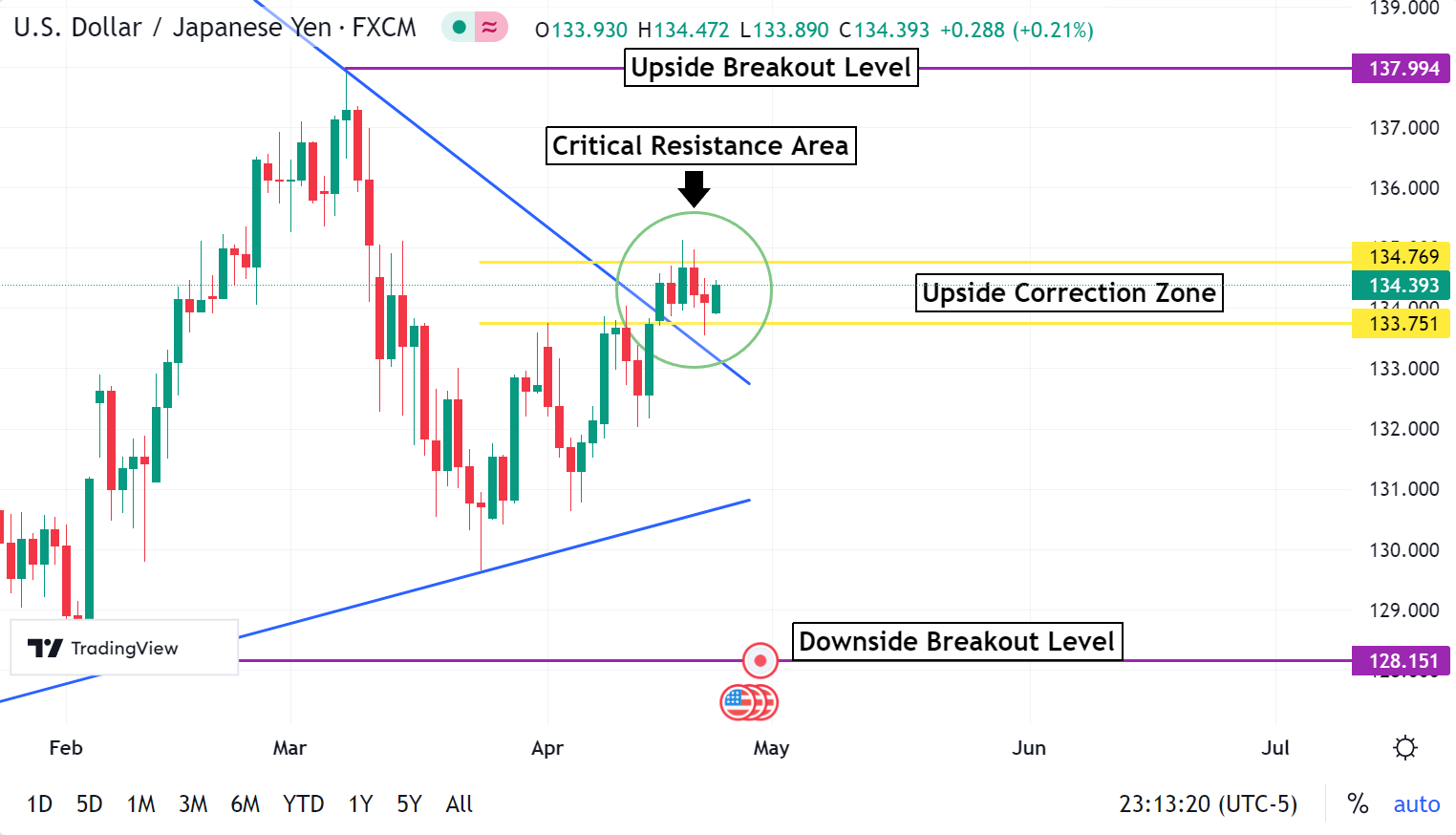

USDJPY traders caught a nice rally into the upside correction zone, and this is the area to use as a directional guide. If the Bulls can sustain a trade above 134.76 then a follow though rally is likely that targets the 136.50 level. This is about all that is on the agenda for a rally. If the Fed maintains its Hawkish stance for months to come, then the Bulls have a chance at reaching the upside breakout level. 142.10 is the long-term upside rally target.

If the USDJPY starts to fall below the 133.75 level, then the correction may be in jeopardy. A test of 132.00 is likely, and a failure from here targets the downside breakout level. With a looming rate hike by the BOJ, it is not unreasonable for the market to fall back into this area. However, a failure from the 128.15 level, although a bearish sign, only extends the downside objective to the 126.85 level.

AUDUSD Weekly Outlook:

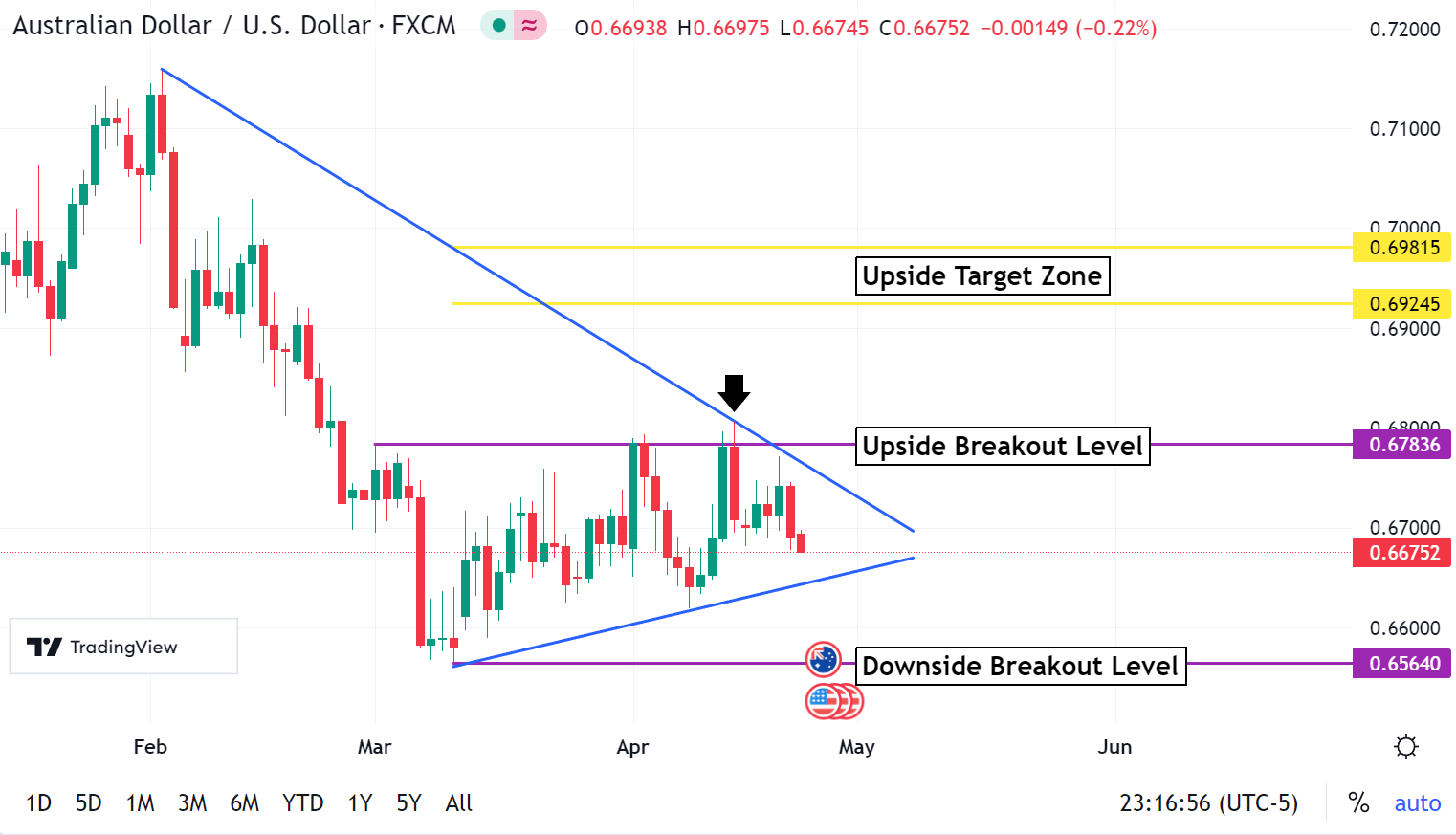

What a can of worms this currency is. The AUDUSD is unlikely to maintain any show of strength for the next few months. The BOA is under siege. Two new members have been added to the BOA, and it is suggested that all the rest be fired. An independent review is shredding the actions and plans of the current central bank leaders. This keeps the market in a bearish posture set to make a play for the downside breakout level. The trend is your friend, and this currency is targeting multi month lows down towards the 0.6332 level.

Only a sustained trade above the upside breakout level confirms enough strength to make a play for the upside correction zone. With economic woes, and central bank uncertainty it is unlikely that the AUDUSD will trade outside of this range. If the market can get a close above 0.6981, then the upside target is extended to 0.7110.

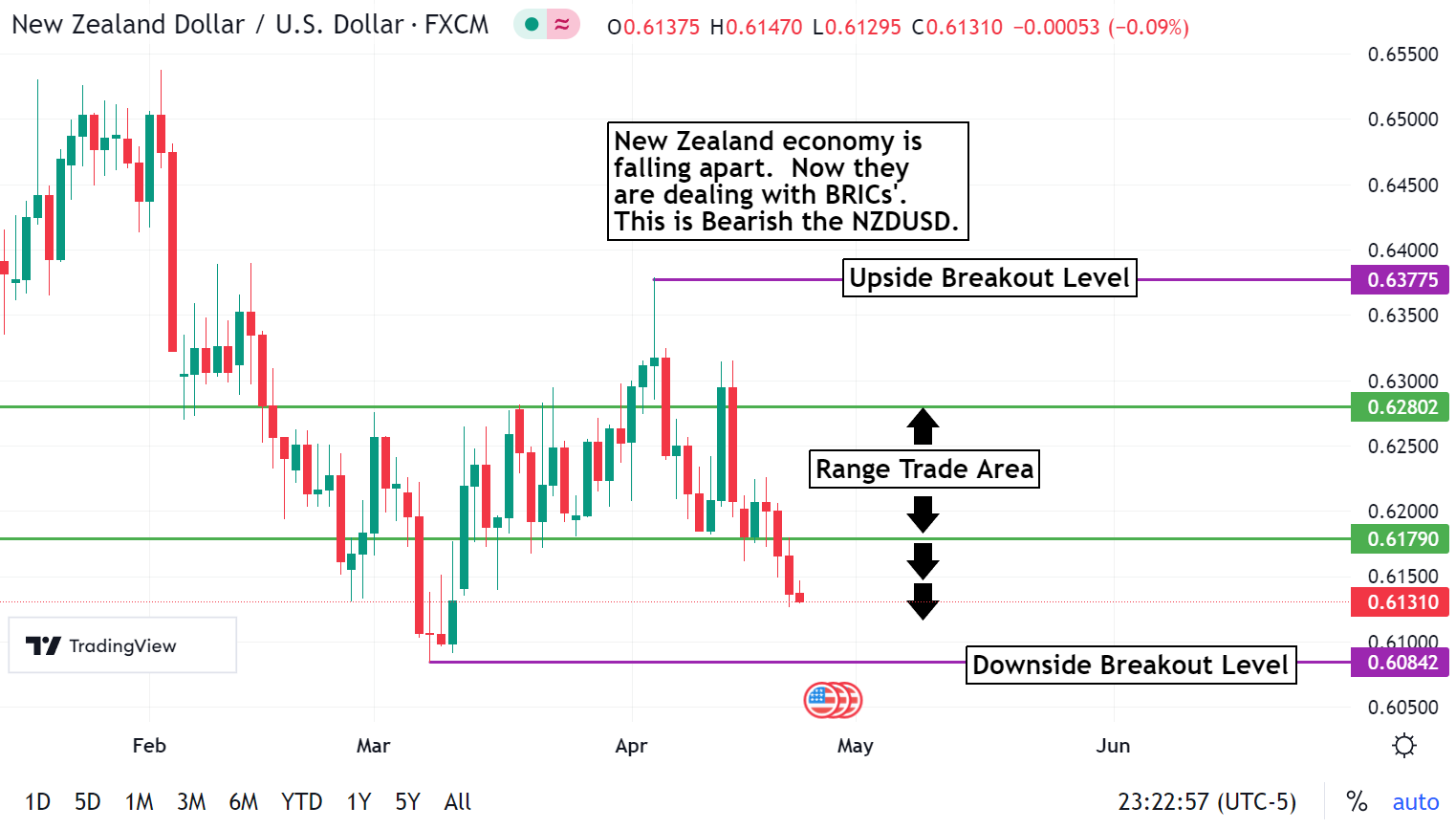

NZDUSD Weekly Outlook:

This currency may be set for a nose dive break this week. New Zealand is getting very chummy with the BRICs, and is breaking away from its status as a U.S. ally. Couple that with a collapsing economy, and this market is set to test the downside breakout level. A failure here should accelerate momentum and press new move lows downs to the 0.5990 level. 0.5745 is the extended long-term downside target.

The NZDUSD is not likely to hold any upside momentum, but a breach of the 0.6280 level may touch off the Stops of weak Shorts. If this is the case then the market should poke its head up towards the upside breakout level. However, it is unlikely to get very far. Only a rally above 0.6377 reverses the short-term outlook, and extends the upside objective to the 0.6505 level.

USDCAD Weekly Outlook:

If there was any strength to be found in the USD last week it was in the USDCAD. A new swing high was formed, and a follow through move into the upside target zone is likely. This should put a cap on the rally, and a sideways trade is most likely the call for this currency. Only a close above 1.3645 confirms extended strength for a rally that targets the 1.3809 upper range resistance level. Overall, this currency is set for a wide range trade. Be careful getting married to any potential trend trade.

Key off the 1.3555 level for any downside bias. A sustained trade under here sets the USDCAD up for a rough trade back towards the 1.3361 level. The short-term trend is a Bull, but otherwise momentum is neutral to Bearish. If the market falls back below the 1.3361 level it is likely that the market will take out the downside breakout level and press new lows towards the 1.3112 level. Fundamentally this market is completely up for grabs, and technically there is not much more to go on. Keep this in mind, and wait for strong signals before messing with this currency pair.