The Tiger Forex Report 5-20-24

The Tiger Forex Report – Week of 5/20 – 5/24/2024

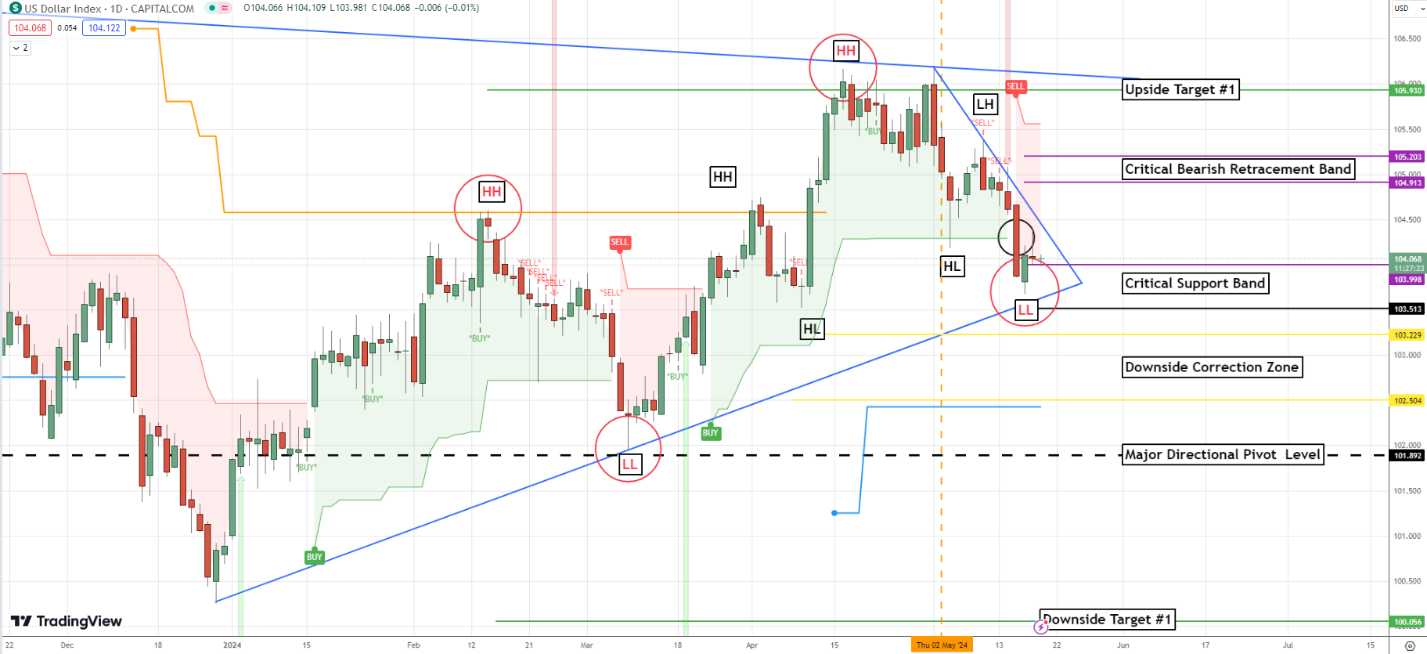

The DXY fell on key support this week. Watch Yields. If they firm up it should help the index get another Bullish move.

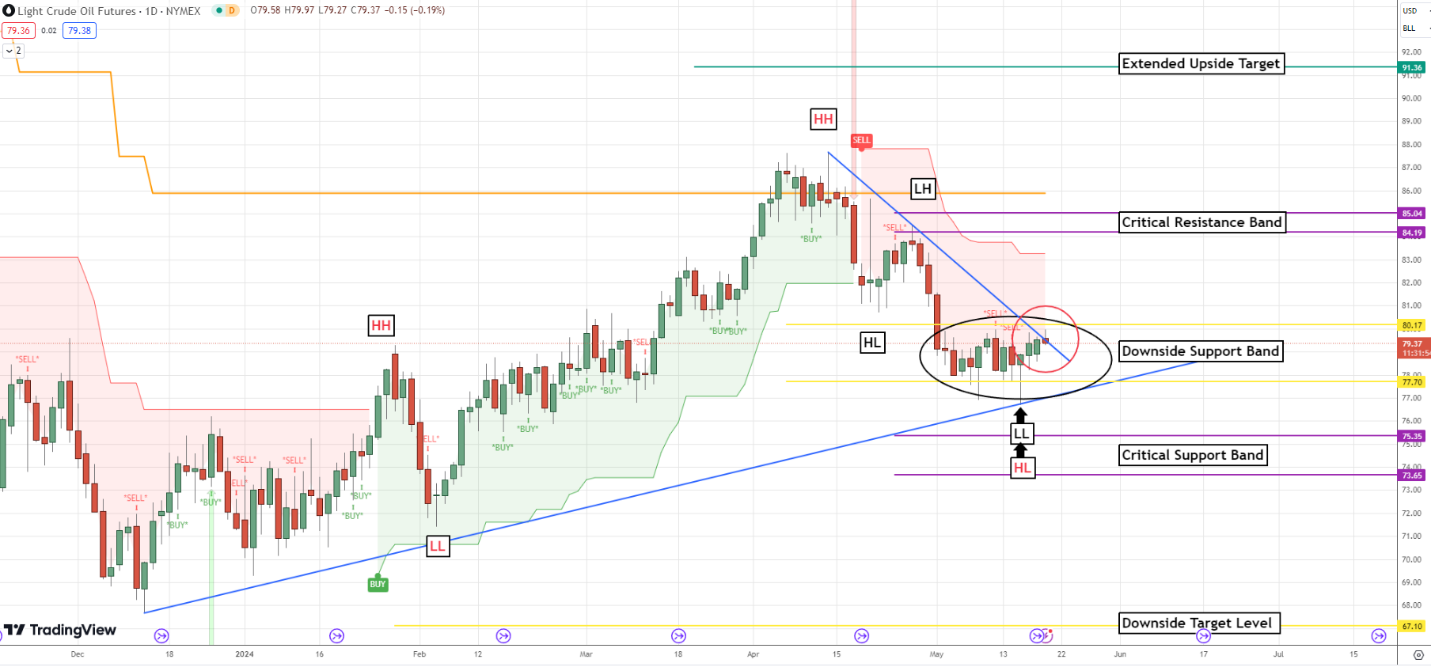

Crude Oil traders are in a tough sideways trade. Expect more choppy conditions this week.

30yr T-Bond Bulls spiked higher last week. Key off of last Thursday’s high for market direction.

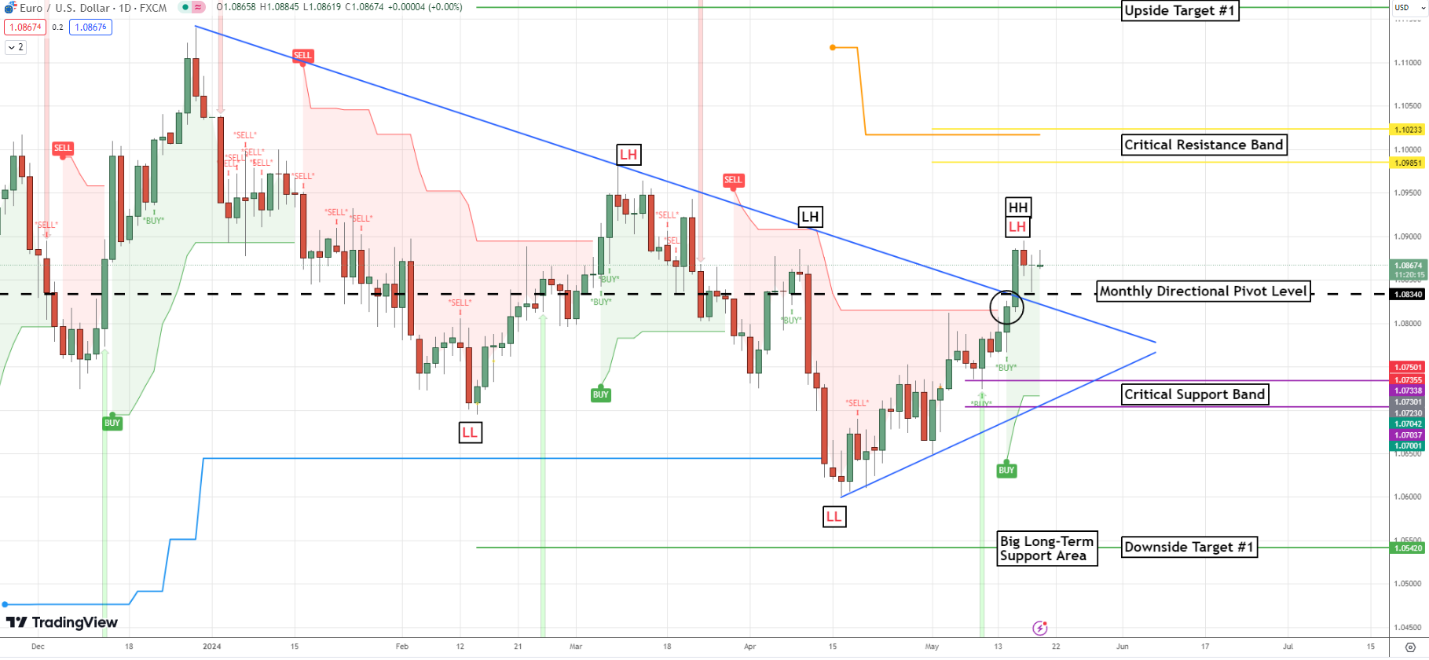

EURUSD Weekly Outlook:

The EURUSD set a short-term higher move high, but could it be the longer-term lower move high? Key off the monthly directional pivot level for the market’s bias. Trading above here keeps this currency in a Bullish posture that targets the critical resistance band. This is all that is expected out of a higher trading market unless there is a big softening in Yields.

A failure from 1.0834 would be a good sign that the Bears are back in control of things. Trading in this area should keep the EURUSD hard pressed as it regains in the negative trend. This puts the critical support band in their sights. That should be it for a lower trading market this week. A close below 1.0703 this week would be a very negative sign that a strong Bear trend may be emerging.

GBPUSD Weekly Outlook:

Can the GBPUSD Bulls keep the momentum going? Trading above 1.2692 puts the market back into the wide range trade zone. More chopping around. Only a rally above the upside target #1 would confirm that this currency is breaking out to the upside. 1.3010 is the extended bullish objective.

Below 1.2692 The Bears will be on a mission to drag the GBPUSD back below the monthly directional pivot level. Should this occur, all bets are off for the Bulls. Expect a volatile trade. A failure from this area would be a good indication that the Bears are going to drive the market towards the downside correction band.

USDCHF Weekly Outlook:

Big boring continues to be the call for the Swissie. It is a sideways trade. Wait for a valid signal. It may be tough to hear, but it would be unwise to force a trade. Here are two calls for you…

A breach of the critical resistance band extends the Bullish objective to the upside target level.

A failure from 0.8936 should help the Bears drive the market down to the critical short-term support band.

USDJPY Weekly Outlook:

The Bulls are set for another challenge of the Bearish resistance band. Use caution fighting a rally in this area. If the USDJPY can sustain a trade above the 156.94 level, there could be another balloon under water rally shooting this currency back up towards new monthly highs. 164.25 is the longer-term upside target.

Sustained trading below 155.96 will have the USDJPY in a grind of a Bear trade that targets the critical short-term correction band. Watch Yields and Crude Oil. If they remain soft there is a good chance that the Bears may get another fresh leg lower. The critical BOJ threshold level is the key objective if a Bearish trend really begins to manifest.

AUDUSD Weekly Outlook:

AUDUSD Bulls are riding a steep slope higher. A challenge of the Bullish trend confirmation level is on the menu. Do not fight a rally above here. Fresh buying is likely to fuel a move that has the potential to hit the long-term upside target. If Yields soften this week it would help to support this outlook.

If the Bears take the reins it will be a grind back into the Bullish correction zone. This is the base holding the short-term trend in place. Trading under here would be a good indication that the AUDUSD may fall back to the monthly directional pivot level. The downside correction zone should be the extreme for a lower trading market this week.

NZDUSD Weekly Outlook:

The Bulls broke out to the upside last week, and the question is can the Bulls continue to press on? Momentum is on the side of the Bulls and a challenge of the critical resistance band this week is not out of the question. There is significance to a move back into this area. Trading at these levels would be a good indication that the longer-term trend is becoming Bullish. If there is a close above 0.6242 then the long-term upside target level becomes a viable objective.

If the Bears get a grip on this market, it will be a sideways trade down to the Bullish support band. This should be all that a lower trading market produces. Only a failure from the 0.5963 level would reverse the forecast. The critical support band would then be the Bears' big target.

USDCAD Weekly Outlook:

The USDCAD looks like it wants to hold support. Trend analysis is Bearish in the short-term, but Bullish in the long-term. We like the Bulls this week. Key off the short-term correction band. Trading above 1.3623 should firm this currency up for a challenge of resistance. The critical resistance correction band is the big area to cross. If the market gets above 1.3764, then the long-term Bull should continue to seek higher move highs.

Below 1.3623 the Bears will be on a mission to spark a newer move low. Last week the USDCAD set a newer move low that could be a higher move low in the medium-term outlook. If the Bears set a new low this week it could get very rough to the downside. If the rug gets ripped out from underneath its feet fresh selling pressure is likely to send this market careening toward the downside correction band.