The Tiger Forex Report 5-28-24

The Tiger Forex Report – Week of 5/27 – 6/01/2024

The DXY is starting the week on edge. Expect more downward pressure this week.

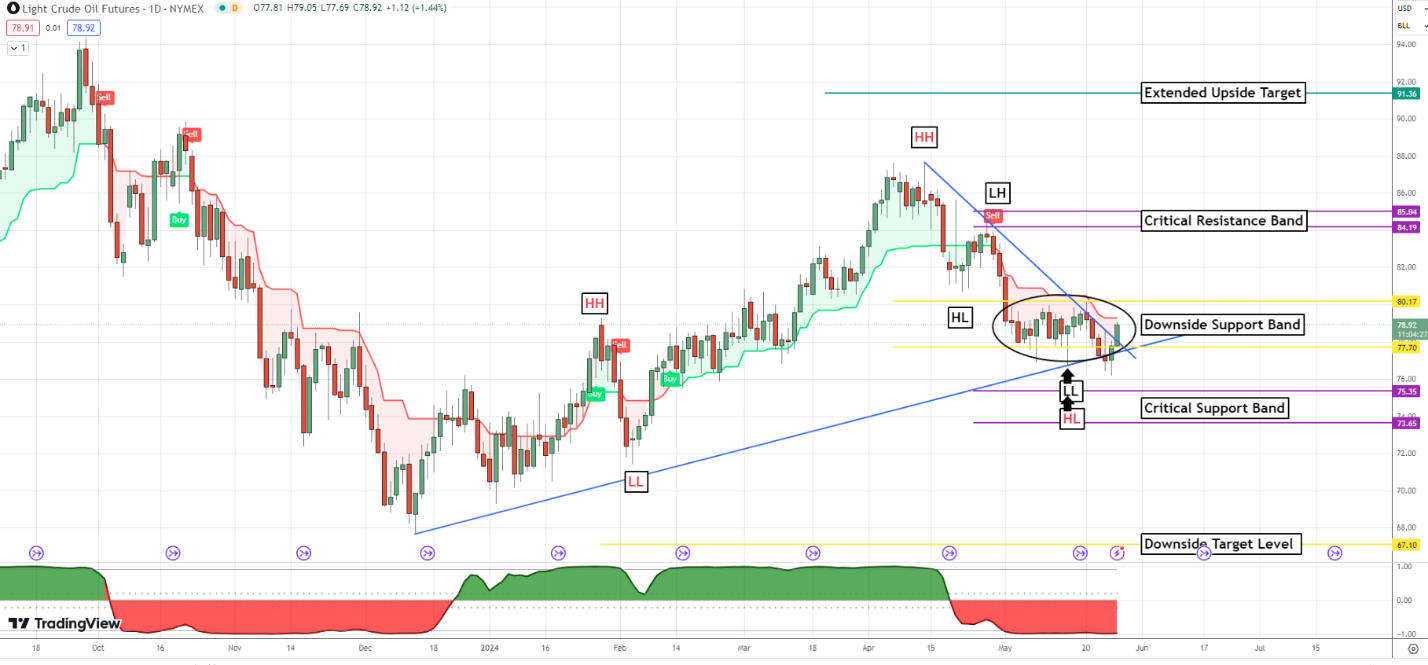

Crude Oil Bulls are getting a bounce, and more upside action is on the menu for early in the week.

30yr T-Bond traders are in limbo. More choppy sideways trading is likely.

EURUSD Weekly Outlook:

EURUSD Bulls are on the move. An early challenge of resistance is the call for the start of the week. New move highs are likely, and a strong trend surge is expected. The critical resistance band is the objective. With Yields flat, there is not much more potential for the upside. Unless Yields fall apart this week. Then fresh buying is expected to enter the market and help fuel higher highs.

Only a failure from the monthly directional pivot level reverses the outlook. Trading back under this level would be a negative indication that the Bears are going to make a play for the critical support band. This is all that is likely until there is a big rally in Yields. The EU is in shambles, and it would be wise to watch the economic numbers. Fundamentals are expected to drive the trade this summer.

GBPUSD Weekly Outlook:

The Bulls are in control of the GBPUSD and more upside action is expected. This currency is in a buy break posture and it should remain so this week. Bullish momentum has the potential to lift the market all the way to the upside target #1. That is all that is likely out of the Bulls. Overall the Pound is stuck in a wide range trade. It would be unwise to expect any long-term trend move.

If there is a pull back the upside correction zone should hold. Only a failure from 1.2628 would change this outlook. A failure here should have the GBPUSD pressing the monthly directional pivot level fast. Below here the downside correction band would become a very likely target. Yields are flat so watch the economic numbers for potential fresh selling pressure.

USDCHF Weekly Outlook:

Talk about a ho-hum trade. We have been warning about this, and more of the same is likely. Use the critical resistance level for directional bias. Below here the Bears are likely to drag the market back to the digestion area. That is all that is expected out of a lower trade. It is what it is. Keep your expectations rational for this FX pair. The critical support band is the extreme for any downside action.

A rally above 0.9149 would be a positive indication that the Bulls are ready to press resistance. But do not expect much. The upside target level is the objective for a fresh leg higher. Until there is a valid trend signal the USDCHF is most likely going to remain in a sloppy trade for the next few months. Be careful.

USDJPY Weekly Outlook:

After weeks of extreme volatility, the USDJPY has settled into a narrow trade. It will be a tight trade in the Bearish resistance band. The best advice is to wait for a break to buy when there is a valid signal. Below 155.96 the Bears will be flirting with a pullback to the critical short-term correction band. With Crude Oil on the rebound, the Bears will not have much of an edge on this market.

A close above 156.94 this week would be a good indication that the Bulls are ready to make another play for the highs. 161.20 is the long-term upside target. Watch Yields. If they firm back up it should help to shore up the Bulls resolve to make higher move highs. Be careful though. If the USDJPY stays in a tight trade this week it would be a negative indication that a flatline trade could develop. That would not bode well for Bulls or Bears.

AUDUSD Weekly Outlook:

The AUDUSD remains in a positive outlook for early this week. New move highs? This could happen since the DXY is on edge. Be careful not to fade the Bulls. If the market sparks new move highs on the Daily chart it would be a good sign that the Bulls are on a mission for the upside target level. This is very likely if Yields soften this week.

Only a failure from the Bullish correction zone would take us off the Bullish outlook. A failure from this area would be a good indication that the AUDUSD is ready to pull back to the monthly directional pivot level. It is expected that a lower trading market should hold this area. However, if the market dips under this area the downside correction zone should find a short-term floor for a lower trading market.

NZDUSD Weekly Outlook:

The NZDUSD bulls are on the move. Higher move highs target the critical resistance band. This is a big area. It is not out of the question for a spike high to occur in this area before the market pulls back to fall on support. Only a close above 0.6242 would confirm the Bullish resolve and extend the Bullish objective. A move like this would make the long-term upside target level a viable target over the next few weeks.

If the Bears reverse gears on the trend, it will be a tuff trade back to the Bullish Support band. The trend is your friend, and it is not expected that the NZDUSD will get below this area. However, if Yields catch a strong bid the NZDUSD Bears could come back with a vengeance. Let us wait and see if there is a valid sell signal first before we look to capitalize on any downside action.

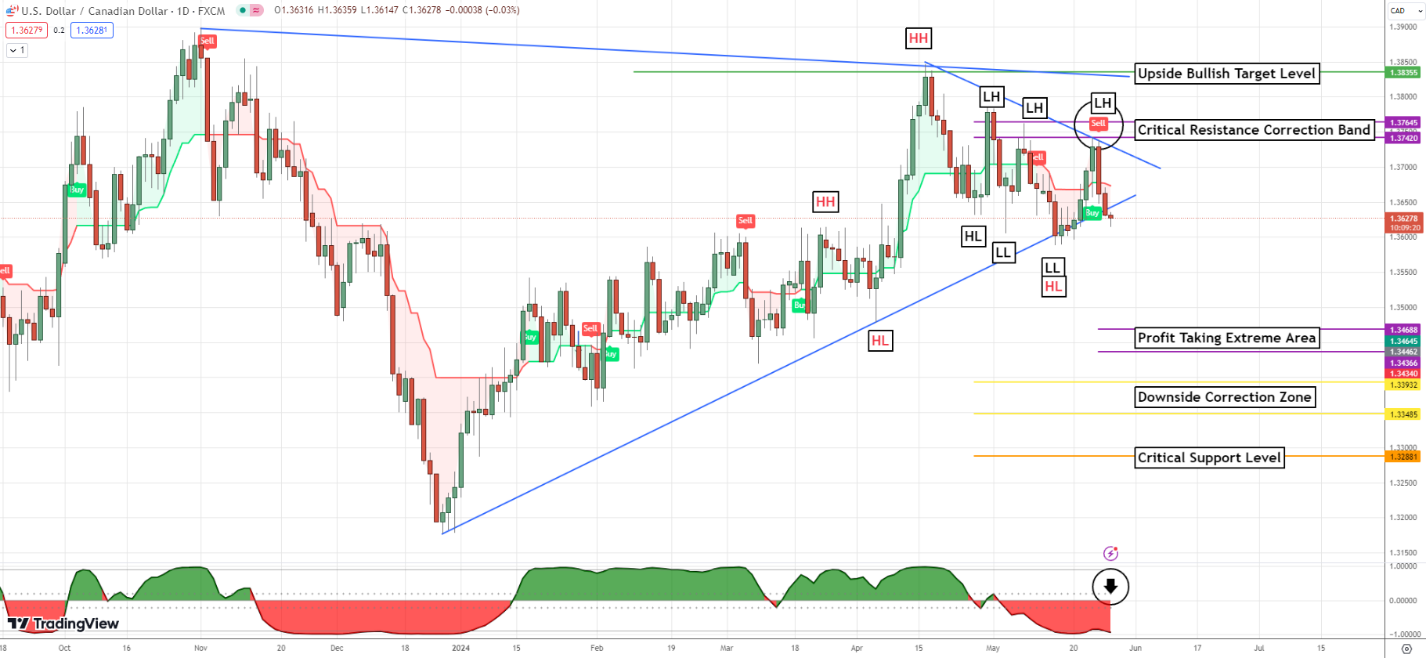

USDCAD Weekly Outlook:

Sell signals have the USDCAD Bears leaning on support, and the weak DXY is helping to give the Bears an edge. It would be foolish to fight this slide. If the market touches off new move lows the selling pressure is expected to build. Trading below 1.3600 would be a good indication that the selling pressure is likely to build. The profit-taking extreme area would then become a viable objective for the next couple of weeks.

Not much is likely to the upside this week, but if the market catches a bid the Bulls could get back up to the critical resistance correction band. Be careful if the USDCAD gets back to this area. Rallies are not expected to hold up. Only a close above 1.3764 would confirm the USDCAD Bulls resolve to make a run for the upside bullish target level.