The Tiger Forex Report 5-8-23

The Tiger Forex Report – Week of 5/8 – 5/12/2023

DXY Bears have a hold of the index, and an early test of support this week is likely.

Crude Oil Bears are on pause after slamming support hard last week. A short-term Bullish correction is very likely in the days to come.

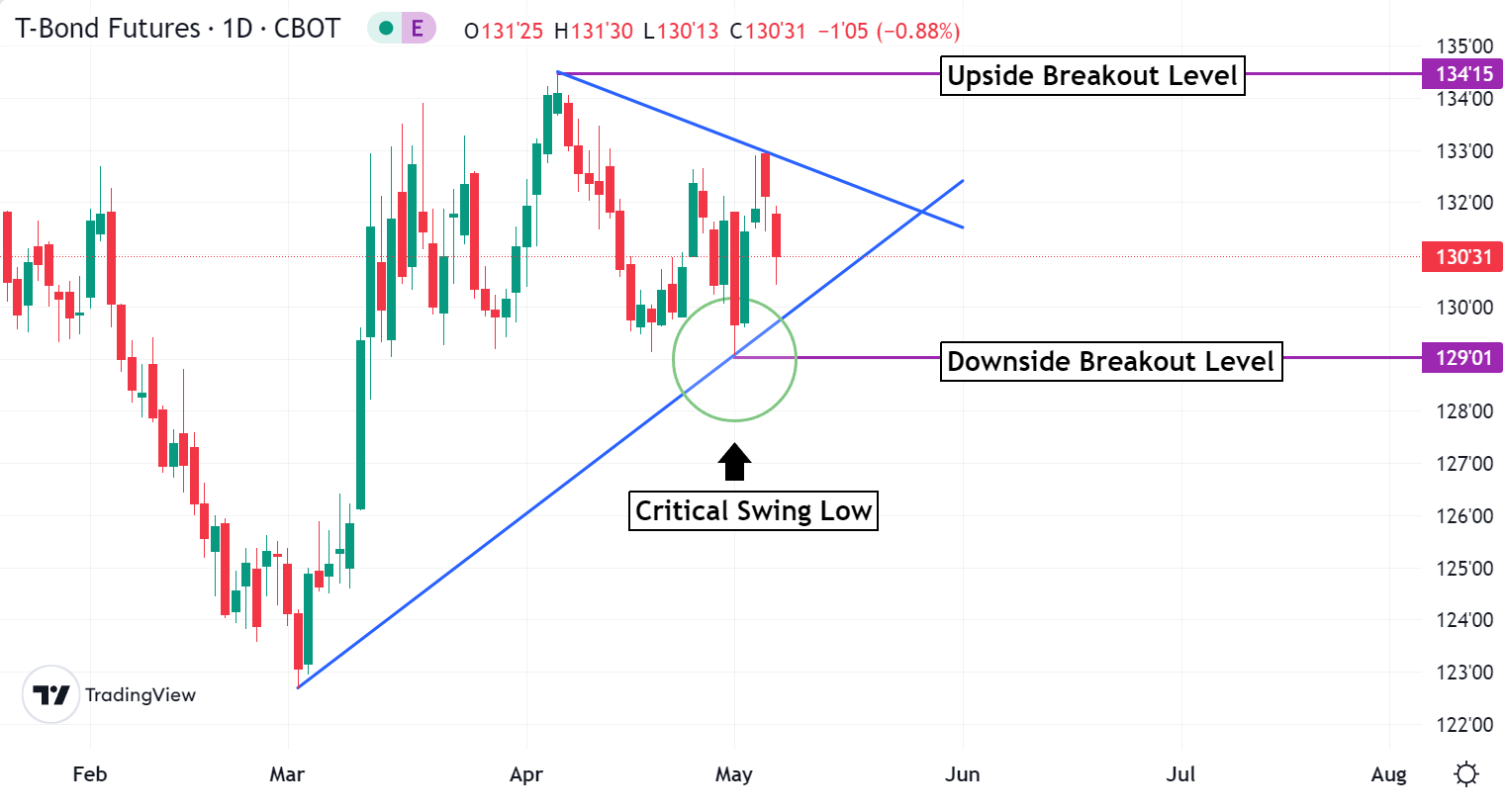

30yr T-Bond traders had a tough week last week with the Fed release. Expect a rise in Yields early in the week. If this occurs it should give a lift to the USD for a couple of days.

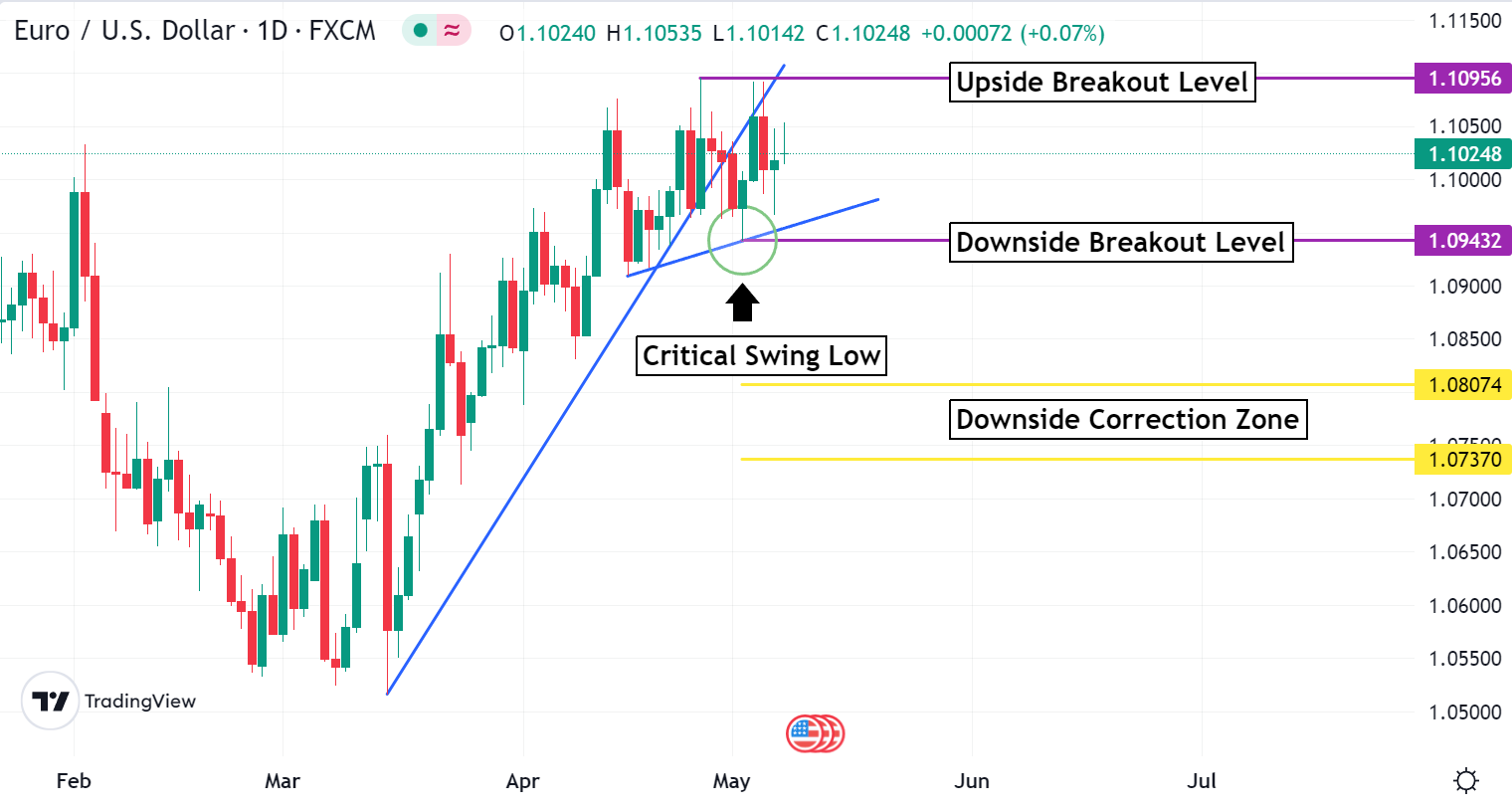

EURUSD Weekly Outlook:

This market is stuck in a tough range trade, and there may be a few more days of limbo early in the week. Trading between the breakout levels will be tough. A rally above the upside breakout level may be short-lived. Only a close above this level confirms strength for a fresh leg higher. Trading above here targets the 1.1175 – 1.1205 resistance band. 1.1350 is the extended upside objective.

A failure from the downside breakout level is expected to touch off fresh selling pressure in the EURUSD. If Yields are up this week, then the Bears have a good chance at making a run for the downside correction zone. This is all that is likely in the short-term because of potential ECB actions in the weeks to come. If this scenario unfolds, then it is likely that this currency pair is setting a very large range trade area.

GBPUSD Weekly Outlook:

British Pound traders are riding the Rally Train as the Bulls press newer move highs in the short-term trend. This is likely to continue this week. The BOE is set for another hike, and that is one of the major supporting factors for the upside trend. Look for an early rally up towards the 1.2740 level. This should put a short-term cap on the move, and a consolidation phase may develop. 1.2810 is the extended upside objective.

Only a failure from the downside breakout level confirms a short-term pause in the Bull trend. Trading below here should touch off fresh selling pressure that targets the downside correction zone. This is all that is on the agenda for a lower trading GBPUSD. If U.S. Yields rise this week, then it may help the Bears achieve this sell off. Watch the 30yr T-Bond for clues about direction this week.

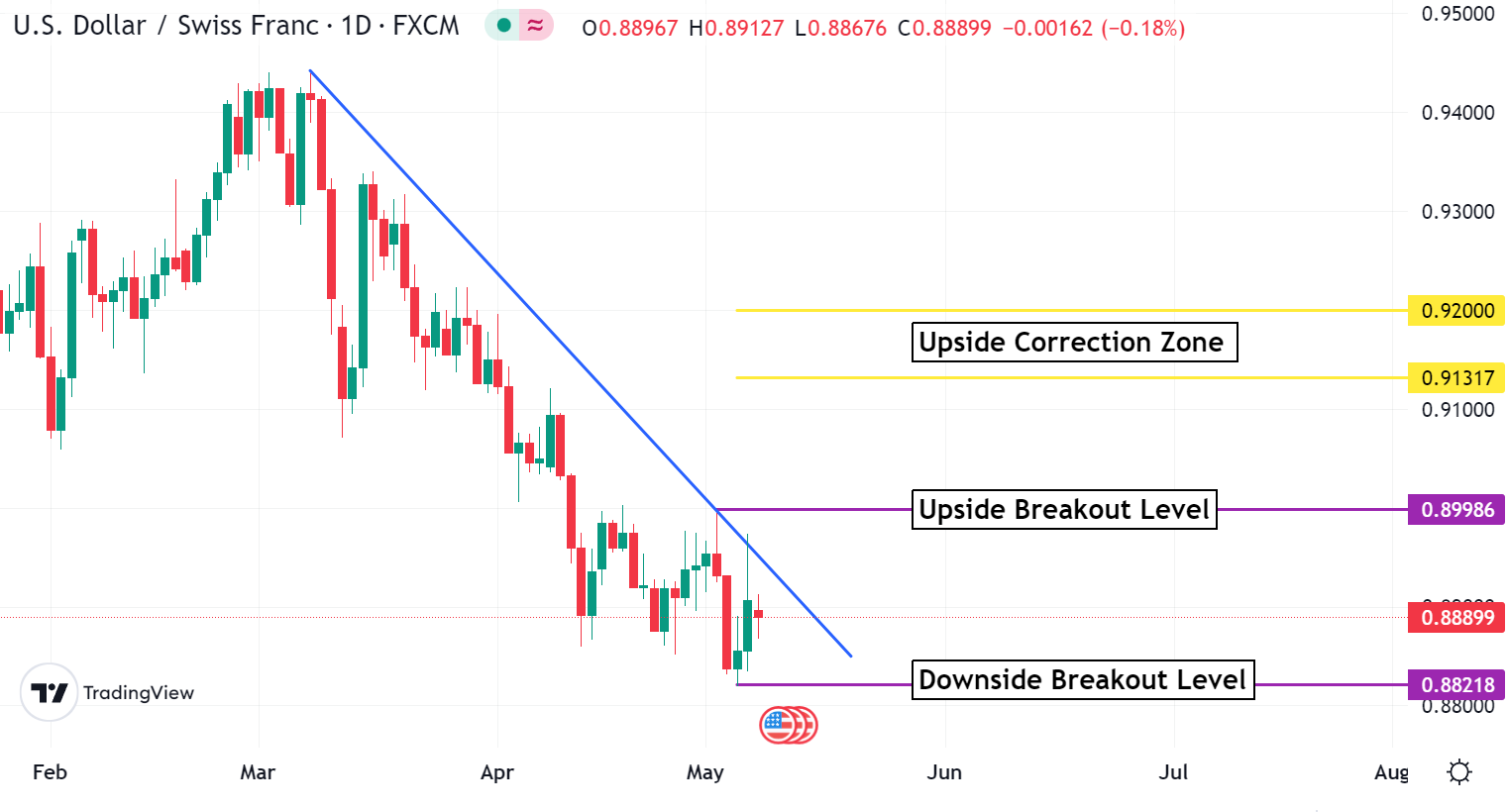

USDCHF Weekly Outlook:

The Bear trend is relentless in the USDCHF, and it will be hard for the Bulls to catch a sustained bid. If Yields have a sharp rise this week, then the Bulls may make a play for the upside breakout level. Only a rally above here shifts gears for a fresh leg up that targets the upside correction zone. This is all that is likely from a Bullish reversal. Remember the overall long-term trend for this currency is Bearish.

A failure from the downside breakout level this week is a negative sign that the Bears are set to press newer move lows down towards the 0.8750 level. If U.S. Yields pull back this week, then the Bears are likely to capitalize on squeezing the weak longs out of the market. 0.8590 is the extended downside objective.

USDJPY Weekly Outlook:

While the USD may be under pressure, there is divergence in the USDJPY. It will be a grind, but another run at higher levels is likely. Key off the downside breakout level. Trading above here keeps the Bulls poised for another surge higher towards the upside breakout level. This is a critical area. A breach of 137.91 and all bets are off as the market makes are run for new move highs up to the 139.50 – 139.82 resistance band.

A dip below the downside breakout level should touch off fresh selling, and a test of the downside target level. This is all that is likely from a sell off this week. Overall, the USD should remain strong against the Yen. Fundamental factors strongly support this. Only a sharp pull back in U.S. yields would reverse this outlook for a little while.

AUDUSD Weekly Outlook:

Aussie Bulls are trying to make a solid change in trend. An early challenge of resistance this week is the call. Fresh buying is likely to drive the AUDUSD up into the upside correction zone. There is a big shakeup at the BOA, and this may be fueling the bounce. Not much more is expected out of a rally unless the U.S. Yields pull back sharply. In that event, the Bullish upside objective will be extended up towards the 0.7250 level.

A pull back below the upside breakout level this week keeps the market in limbo all the way back to the downside breakout level. This is a critical area. A failure from here confirms the Double Bottom supporting the market is a failure. New move lows target the 0.6425 level. This is the first stop on a fresh leg South that could hit 0.6280 before there is a bounce. If U.S. Yields rise sharply this week the AUDUSD should get slapped down very hard.

NZDUSD Weekly Outlook:

The NZDUSD is pressing resistance hard, and a challenge of the upside target level is likely. Our once U.S. ally is now leaning towards the BRICs, and that is lending short-term support to this market. This is all that is likely for a rally this week. Overall fundamentals are still a disaster for this currency. 0.6600 is the extended upside target if this FX pair becomes a runaway Bull.

Trading back below the upside breakout level reverses gears for the market and puts this currency into a tough range trade. Only a failure from the downside breakout level confirms that the Bear trend is back in full force. 0.5990 is the first stop on a Break that could reach 0.5770 before there is a bounce. Watch Yields. If they rise sharply, then the downside sell off has a high potential of manifesting.

USDCAD Weekly Outlook:

The USD got hit hard last week against the CAD, and more support bashing is on the menu for this week. Expect a test of the downside breakout level. Trading below here is a fresh sell signal that targets the 1.3150 level. Be careful fading a break back to this area. Downside momentum could pile drive this currency down to the 1.2988 level before there was a bounce.

Above the downside breakout level, it will be a choppy trade all the way up to the upside breakout level. Only a breach of this level confirms strength in the USDCAD. Trading above 1.3670 targets a big leap through resistance all the way up towards the 1.4120 level. What could spark such a move??? A big sell off in the 30yr T-Bonds is the most likely culprit. Let us see how these markets shape up this week.