The Tiger Forex Report 6-10-24

The Tiger Forex Report – Week of 6/10 – 6/14/2024

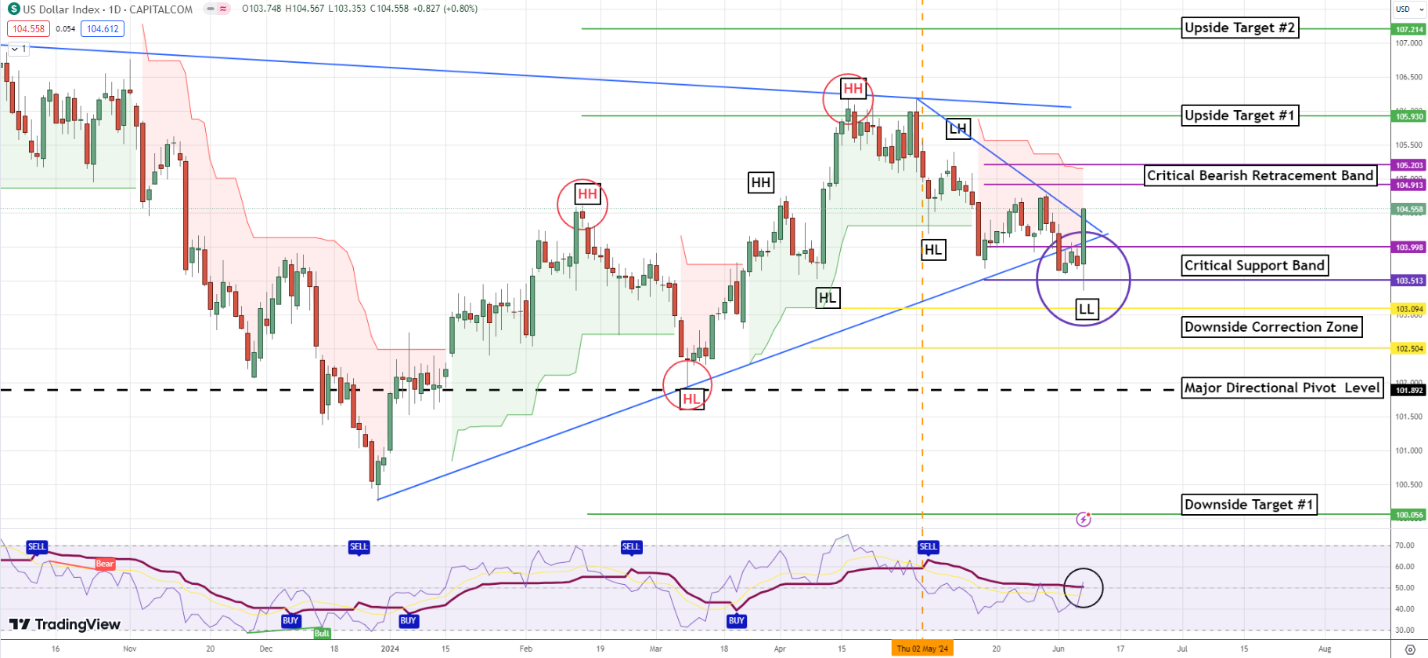

The DXY had a big boost to the end last week. Follow through Bullish action is the outlook. Forget the FED, but be ready for a potential sideways choppy trade.

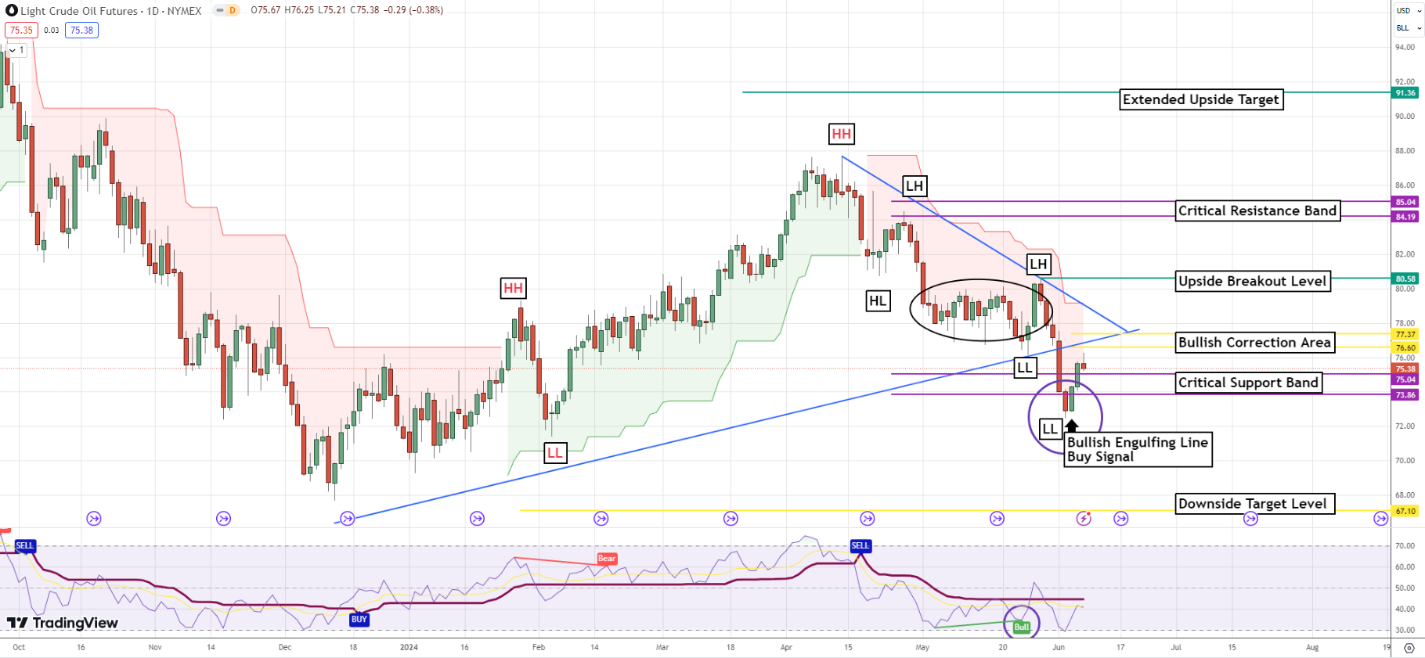

Crude Oil triggered a Buy signal, and a rally into the Bullish correction area is the call.

The 30yr T-Bond touched off a Bearish Engulfing Line Sell signal on Friday. A break into the Bearish correction zone is likely.

EURUSD Weekly Outlook:

Last week the EURUSD ended in the gutter, and this week the market should remain under pressure. Key off the breakout levels. The downside breakout level should be in play early this week. If the market gets under here the Bears should be able to press lows into the critical support band. This is all that is likely out of a Bearish slide. Under 1.0733 the downside target #1 will become the longer-term trend objective.

If the EURUSD does an about-face it will be a fight to cut through resistance. A rally above the upside breakout level is needed to confirm any strong shift in direction. It is very doubtful that this FX pair can get back to these levels this week. There is a reason the upside breakout level has the line through the label. If the Bulls get back above here this week there will be an update with a whole new outlook. Very doubtful there will be that much volatility this week. It would be a very big shock if it did.

GBPUSD Weekly Outlook:

The Bears have a hold of the GBPUSD, and a test of support is our call. The monthly directional pivot level is the target. Below here the short-term correction band should help the market find a floor on this leg lower. Only a failure from 1.2502 would confirm the Bear’s resolve to reach the downside correction band and help lock this market into the wide-range trade of the last few months.

Momentum is under the Bear’s control. A breach of last week’s highs would be needed to reverse the outlook. If this occurs the upside target #1 would be a viable objective. An update will be given in the case of a big Bullish reversal of fortune this week.

USDCHF Weekly Outlook:

The USDCHF touched off a Bullish Engulfing line buy signal. This sets the market up to challenge the 0.9010 level. If the market can breach this level, then the Bulls could press new move highs up to the critical resistance band. A move above here really would reverse gears for this currency pair, and be a good indication that the trend is a strong Bull. The upside target level would then be a viable longer-term objective.

Only a break under last week’s low would negate the buy signal. A failure here rips the rug out from the market and targets the monthly directional pivot level. If the market falls back into this area there will be an update.

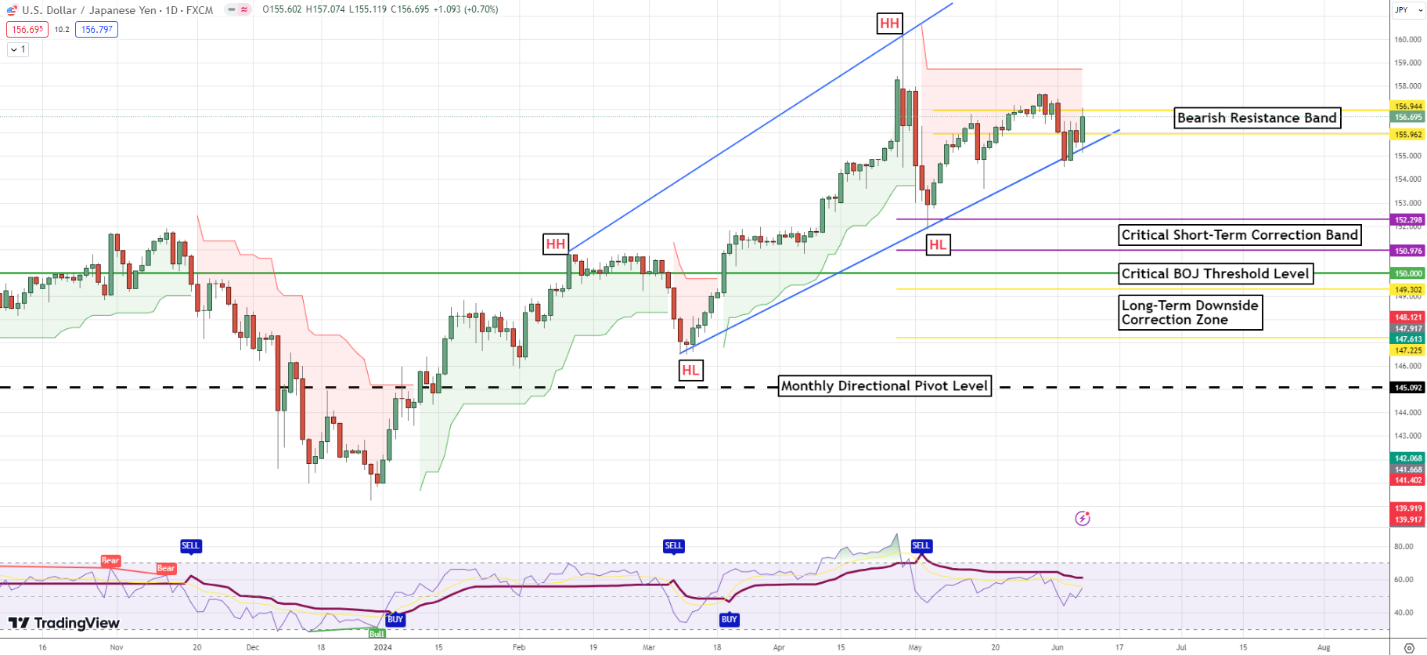

USDJPY Weekly Outlook:

Talk about a rough trade. The USDJPY is likely to limp around the Bearish resistance band. No follow-through is expected in this FX pair this week. Be careful. Sustained trading above 156.94 could get the Bulls in control again. New move highs target the 162.25 level. New monthly highs and high volatility could make trading this market very difficult.

If the USDJPY falls below last week’s low the Bears should touch off fresh selling pressure. The critical short-term correction band is the first stop on a move that could touch the critical BOJ threshold level. Watch yields. If they reverse and soften up, then this market could really start to slam support.

AUDUSD Weekly Outlook:

Slama-jama. The AUDUSD took one on the chin hard Friday. The Bears are in control, and a sell rally forecast is the outlook for early in the week. A test of the monthly directional pivot level is very likely. Below here the market should find a floor in the downside correction zone. Do not fight a failure below this area. A close below the downside correction zone would be a negative indication that this currency is reversing the trend.

Only a rally above last week's high would take us off the Bearish campaign. Trading back above here would confirm the Bull's resolve and put the upside target level in the crosshairs. The long-term upside target is the extended objective.

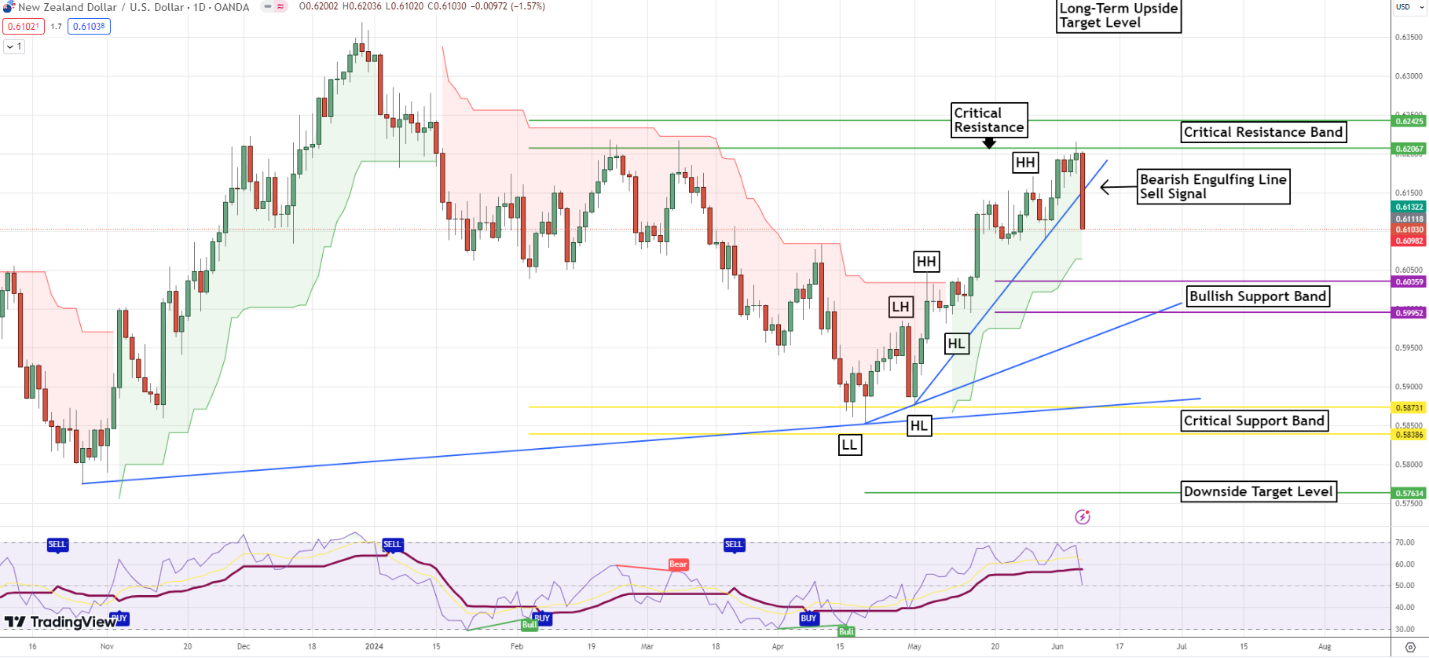

NZDUSD Weekly Outlook:

Extra! Extra! There was a large Bearish Engulfing Line sell signal in the NZDUSD last week. The Bullish support band is the objective. If the trend is to going to return to a Bull there will most likely be a bounce in this area. Watch Yields. There could be a big influence from this variable on the Bearish slide. If there is a close below 0.5995 the trend may not be in jeopardy, but it will most likely be on hold. Back to range trade conditions.

A rally above the high set on Thursday would negate the Sell signal, and set the Bulls up for a power rally that targets the long-term upside target level at 0.6410. Should this occur there will be an update. Right now there is no indication that the NZDUSD could reverse gears so strongly this week.

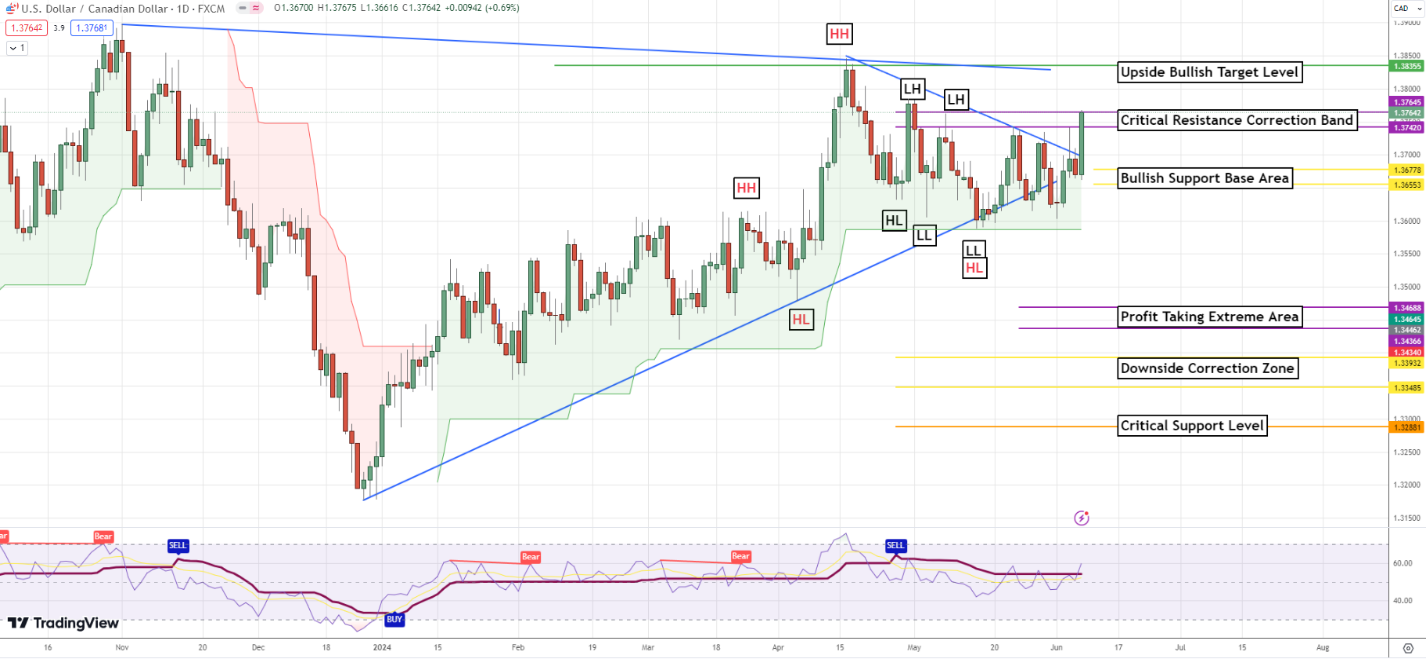

USDCAD Weekly Outlook:

USDCAD Bulls rallied into the critical resistance correction band. Use caution here. If the Bulls can sustain a trade above this area, fresh buying is likely to enter the market. This would put the upside-bullish target level in the high probability factor. Watch Yields. There was a Sell signal in the Bonds, and that could help juice the Bulls in this currency pair.

If the market starts to falter it may mean the USDCAD is ready for a profit-taking pullback. This would set the Bullish support base area as the most viable objective for trading if this scenario develops. The trend is a Bull, and there is not much to believe that the Bears could really touch off a big slide. A close below 1.3600 is needed to confirm any extended leg lower. Then the profit taking extreme area will be where the Bears are looking to drag this FX pair down to.