The Tiger Forex Report 6-12-23

The Tiger Forex Report – Week of 6/12 – 6/16/2023

DXY watchers are set for some sideways trading in front of the Fed meeting. Multiple FX crosses are flirting with directional pivot levels, and that means it is a waiting game until the rate hike. Or not???

Crude Oil is likely to remain directionless through the Fed meeting. Watch the “Transports” in the stock market. If they trend higher than we may see a Bullish breakout.

30yr T-Bond traders are set for a boring trade until the Fed meeting is over. The pundits say there will be no rate hike. That seems like more media coercion because the economic numbers do not concur.

EURUSD Weekly Outlook:

Expect a tough trade this week until the Fed meeting is over. The Bulls are flirting with resistance, and another challenge of the upside breakout level is likely. If the EURUSD can get a close above the upside breakout level than the market has a chance at pressing new move highs up into the critical resistance band. This is all that should occur unless the Fed does not raise rates. Be careful of a potential head fake rally.

Trading between the breakout levels will be a headache for a few days. If you do not have a valid signal, it would be advisable to wait things out until after the Fed release. Only a failure from the downside breakout level confirms that Bearish momentum is building once again. Use caution fading new move lows. Downside projections have this FX pair targeting the 1.0375 level. If the Fed raises rates, then USD strength should return for a few weeks.

GBPUSD Weekly Outlook:

GBPUSD Bulls are showing little signs of letting up. The short-term trend is positive, and looks to remain so for a few days. As we await the Fed meeting it is likely that the market will continue to press resistance up towards the upside breakout level. Be careful with a print above the 1.2682 level. If the market gets above here it may be a head fake. Only a pause by the Fed would justify the short-term trend extending new move highs towards any extremes. 1.2820 is the long-term rally objective if the Fed reverses gears. Not likely though.

Of the major FX currency pairs, the GBPUSD is less likely to stumble that hard against the USD. If the Fed remains Hawkish it would impede the Bullish trend in place, but not necessarily change the overall trend. In the event of a slide below the downside breakout level the market should press support all the way into the downside target zone. Watch the Fed speak after the meeting. If the Hawkishness prevails, then the Bears may be able to extend a fresh wave lower.

USDCHF Weekly Outlook:

USDCHF Bears are treading water above the downside target zone. Another play for this area may be the call in front of the Fed meeting. It is likely to be a consolidation trade over the next few days. However, if the market can get below 0.8937 then the downside breakout level becomes a viable objective. This would most likely only occur if the Fed does not hike rates. We shall see.

If the Fed hikes rates this week, then a rally is very likely. It would be unwise to fight a move above the upside breakout level. 0.9201 is the first stop on a move that could reach 0.9431 within a few weeks. The consensus is pushing the USD Bear scenario so hard, and no more rate hike rhetoric as well. So far, every time they have pushed this it has worked out in our favor. Until the Fed states that they are pausing for a while, the economic numbers justify it, and we are in a recession we will maintain our outlook.

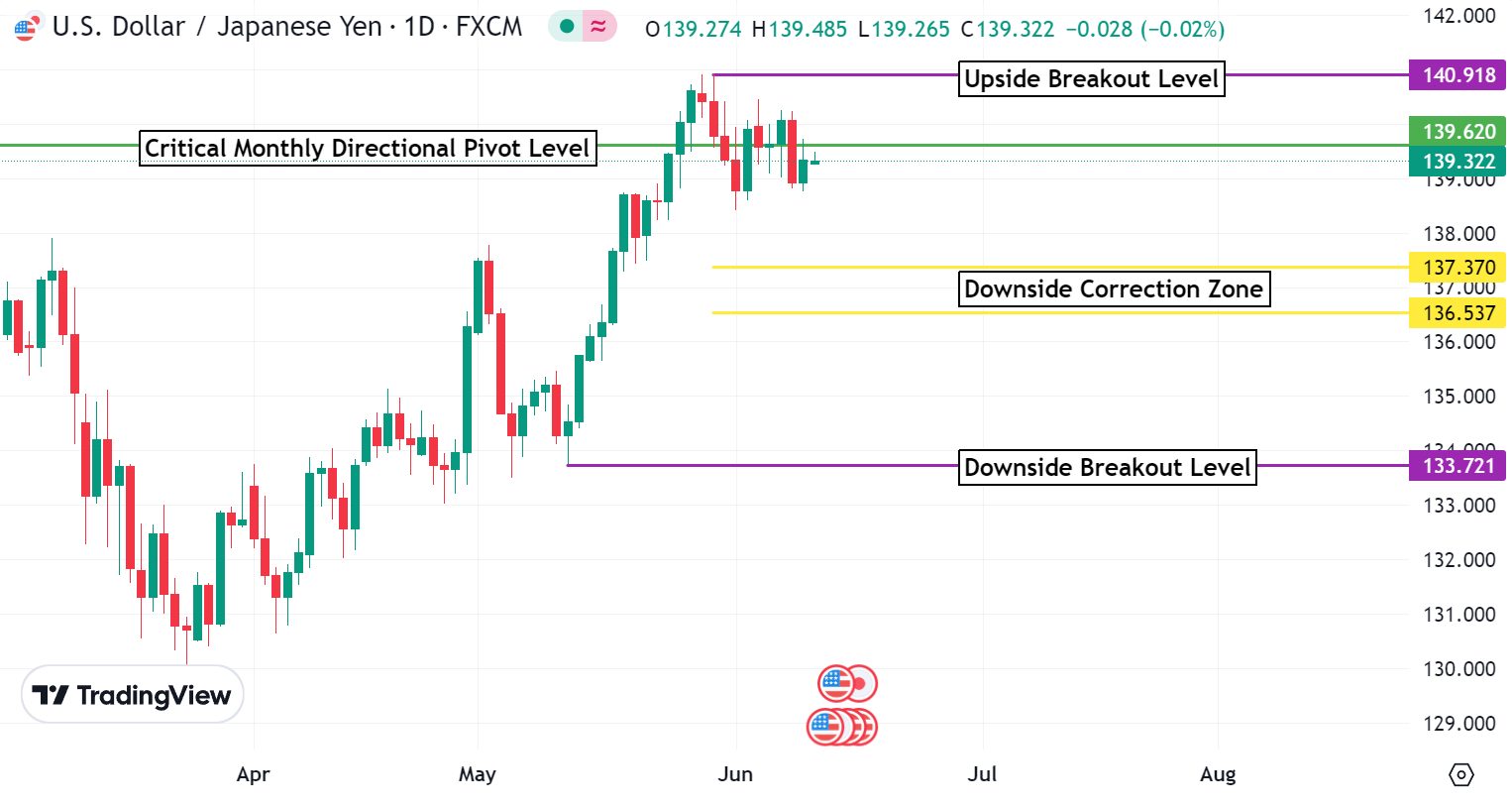

USDJPY Weekly Outlook:

USDJPY Bulls have control of the trend overall, but it may be a tight trade for a few days. Trading around the critical monthly directional pivot level is expected to be touch and go. If the market sustains a trade below 139.57, then the Bears have a chance at slipping back into the downside correction zone. This is all that is on the menu for a lower trading market. A close below 136.53 is needed to confirm any real Bearish hold on trend direction. The downside breakout level is the longer-term sell off target.

Until the Fed meeting is over it will be a boring go of it for the Bulls. However, a breach of the upside breakout level and the Bulls will be set for a stampede higher. 142.44 is the first stop on a move that has the potential to poke at the 143.15 level before there is a correction. If the Fed remains Hawkish it would reinforce this theory. Let us see what surprise the week will bring. It is unlikely that the buy break posture will be overturned though.

AUDUSD Weekly Outlook:

Aussie Bulls are on their own campaign, and do not care about USD strength at this moment in time. Be careful of a head fake to the upside this week. The long-term trend is still Bearish, and it is only the short-term trend that is a Bull. A challenge of the upside breakout level is required to confirm strength to press newer highs to the upside target level. Until the Fed stops raising rates it is not likely to get the AUDUSD above the 0.6892 level.

The Bears are stretched by the recent show of strength, but a recoil move is on the agenda. Watch Yields this week. If they start to strengthen, then it is very likely that the Bears will regain control of the market. AUDUSD traders could be eyeballing the downside breakout level in a heartbeat if the Fed hikes again. Especially if the posture remains Hawkish. Then we will be setting up for conditions to slam new multi month lows. 0.6275 is the long-term downside target.

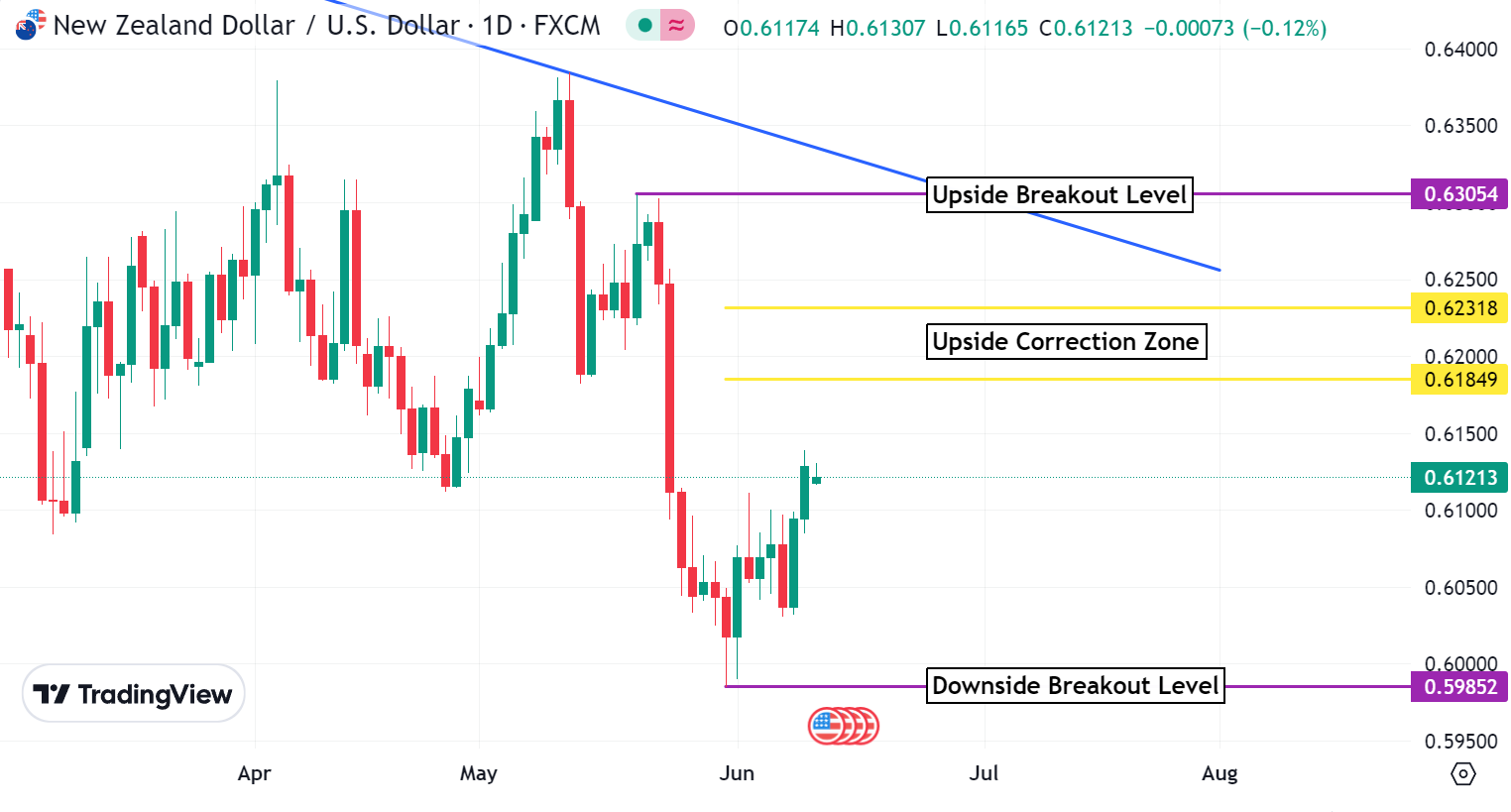

NZDUSD Weekly Outlook:

NZDUSD Bulls are pressing resistance, but it is a fight. Short-term momentum is positive, and a play for the upside correction zone is likely if the USD and Yields fall under pressure. 0.6231 is about all that is going to result from higher move highs. The Fed meeting should bring USD strength back, and it should stall any rally in this currency as well. The upside breakout level is the longer-term upside target if the USD falls apart this week.

Until the meeting is over it is not likely that the Bears will get a hold of this market. The NZDUSD is fundamentally a mess and the downside breakout level is a viable objective if the USD catches a bid. Also, if the Fed does raise rates, then newer multi month lows target the 0.5625 level. If the Fed disappoints the consensus, we may see this currency get all the way down to the 0.5400 – 0.5375 target band within a few weeks. Look out below.

USDCAD Weekly Outlook:

More sideways trading ahead for the USDCAD between the long-term directional pivot levels. The Fed meeting should set the tone for a nerve wrecking week ahead. Even though the short-term trend is a Bear, the market is in a big holding pattern. Key off the 1.3303 level. Trading above here keeps the Bulls trying to capitalize off the strong support, and a potential bounce back up towards the 1.3672 level. Only a breach of this level confirms a new wave higher that looks to extend trading back towards the upper boundary of the last six months trading range.

Trading under 1.3303 is a negative indication that the USD is starting to lose strength, and that the Fed may be ready for a pause. Like it or not these are the two biggest fundamental variables that could help the USDCAD Bears start a true trend to the downside. 1.2985 is the long-term sell off objective if these fundamentals truly shift. However, that goes against our forecast. Higher Yields and a stable to strong USD is still the forecast until the Fed confirms the Hawkishness is on pause. Do yourself a favor and wait for a strong signal, or wait until the dust settles after the Fed meeting.