The Tiger Forex Report 6-26-23

The Tiger Forex Report – Week of 6/26 – 6/30/2023

The DXY is fighting to hold critical support keeping the trend intact. Be careful of a new leg lower. If this occurs it would be a good indication of long-term USD weakness brewing.

Crude Oil traders continue to drift aimlessly. More of the same is expected.

30yr T-Bond Bears and Bulls are having trouble setting a directional tone. Wait for a valid signal. Expect some head fakes, and more sideways trading.

EURUSD Weekly Outlook:

The EURUSD planted a higher move high and a lower move low last week. Key off the upside breakout level. Trading under here keeps the Bears set for a follow through move lower. A test of the downside correction zone is likely, but that is all that should occur if the trend is going to firm up again. With the Fed on pause this scenario is starting to become very viable. Only a failure from the 1.0782 level confirms Bearish resolve for a move that targets new monthly lows down towards the 1.0550 level.

Trading above the upside breakout level confirms the Bulls intentions to capitalize on the Fed’s new pausing posture. This is a big seal folks. If the EURUSD can pull off a breakout, then the long-term trend Bull should ignite fresh buying momentum. 1.1275 is the first stop on a move that could see the 1.1400 level before the summer is through.

GBPUSD Weekly Outlook:

After blasting through resistance throughout the month of June the Bears finally pulled off a correction. Use caution selling into this market. After the recent runup it is not uncommon to have a slight pull back. The question is, will downside momentum hold in the wake of the FED pause? See how Monday starts. If the Bears can take out Friday’s low, then there is a good chance that the GBPUSD will fall back into the downside correction zone. This is all that is expected for the Bears. The trend over all is still a Bull.

Do not fight a fresh rally above the upside breakout level. Even though fundamentals economically area disaster in the UK the trend is likely to hold for a few months. The reality is the FED pause has the potential to fuel an extended leg higher for the GBPUSD that targets the 1.3065-13085 resistance band. Do not take the trend for granted. If the BOE does not follow the FED’s lead, then the GBPUSD Bulls could press through resistance for the next couple of months.

USDCHF Weekly Outlook:

Well, the USDCHF is one of the FX pairs that is not stirring the DXY. The overall trend is a Bear, and a fresh wave of selling is likely soon to help weaken the USD further. An early play for support is in the cards to start the week off. Be careful fading any fresh selling pressure. The downside breakout level is a key pivot holding the medium trend intact. A failure from here is a very negative signals that the long-term Bears are ready to slam new monthly lows back towards the 0.8727 – 0.8715 support band.

Under current market conditions the Swissie is not setup for a rally either fundamentally or technically. Only a rally above the upside breakout level confirms that the Bulls are back in control. A breach of this area should make the upside target level a viable objective. This is all that is likely to happen this week. With the FED on pause there is no justification to maintain any strong upside move.

USDJPY Weekly Outlook:

This is one currency that did not get the memo about USD weakness. USDJPY Bulls are defying most major FX pairs against the USD with extreme divergence. The trend is your friend, and this currency remains in a buy dip posture. 145.05 is the first target on a move that has the potential to hit 145.80 before there is a pause. The only thing in the short-term future that would change this outlook is if the BOJ starts to raise rates. And actual action needs to occur, and not just hawkish vernacular in their tone.

USDJPY Bears have a challenge on their hands. Any slide back to the critical monthly directional pivot level would be viewed as a profit taking slide. This pivot resides in the downside correction zone. This area should hold firm, and the Bears are not likely to get below here any time soon. However, if the BOJ actually does something, then the market has the potential to change the trend from Bullish to Bearish overall. Let us see what the week ahead brings us. With all of the Russian / Ukrainian news being released the currency markets may begin to swing violently. Trading under 138.40 targets the 129.70 – 129.55 support band. If the USD gets really crushed, then this outlook becomes very likely.

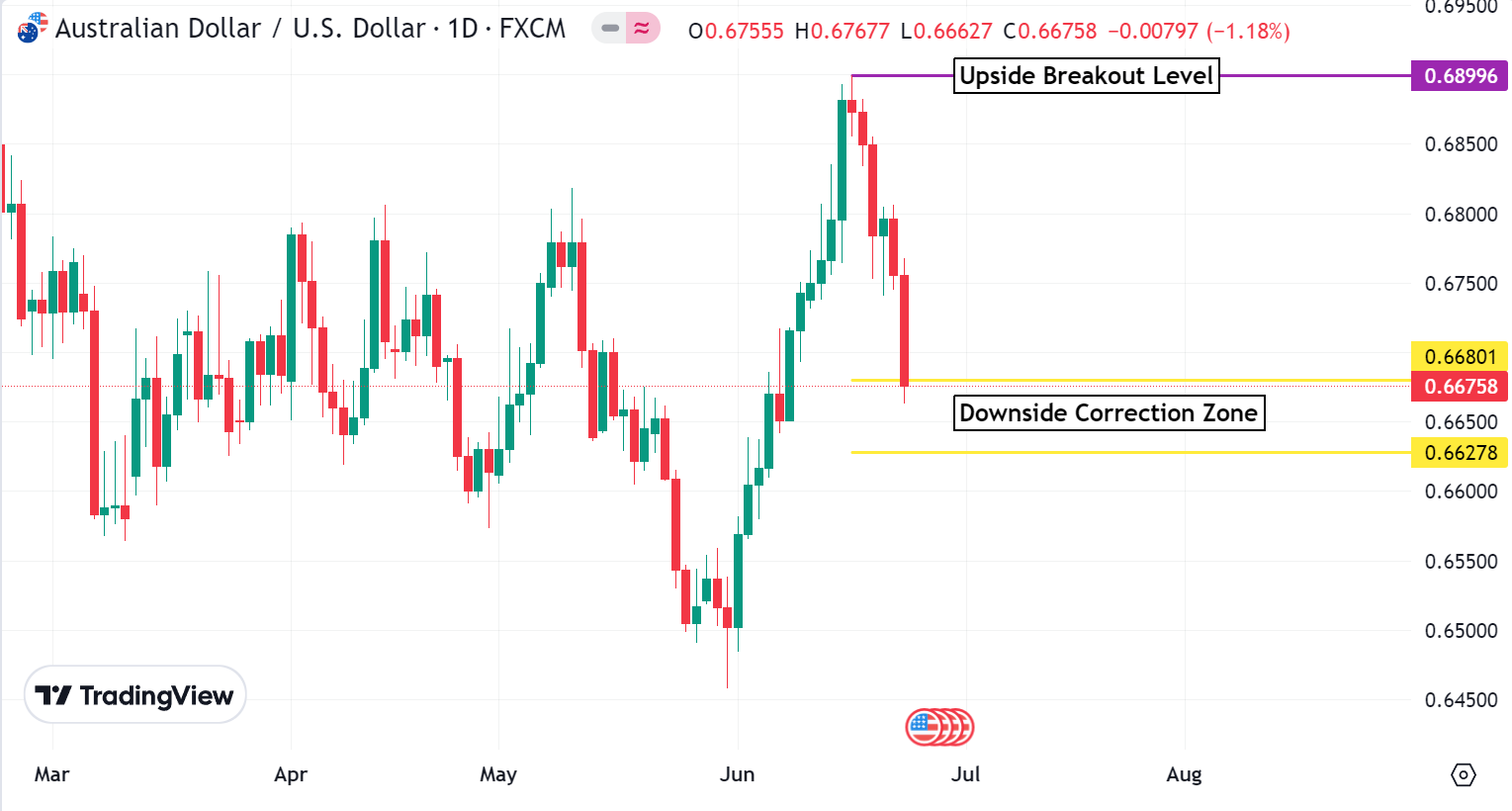

AUDUSD Weekly Outlook:

AUDUSD Bears took a hit last week and fell into the downside correction zone. This is a strong support area, and may put a halt to the selling pressure. Over all the trend is neutral for this market, and more of the same is the most likely outcome. Pick your points wisely and wait for a strong signal. If the market slips below the 0.6627 level, then the Bears could see this FX pair finally breakout of the neutral trend and slam new major lows down towards the 0.6390 level.

If the DXY is getting hit this week, then this currency should start to turn back to the upside. It will be a choppy trade back up towards the upside breakout level. Remember this currency has been in a big sideways way for months now. Only a breach of the upside breakout level confirms overall strength, and also a fresh Bullish trend. 0.7045 is the upside objective if it is just a spike. Sustained trading above 0.6899 is expected to build momentum for a rally that targets the 0.7225 level over the next few weeks.

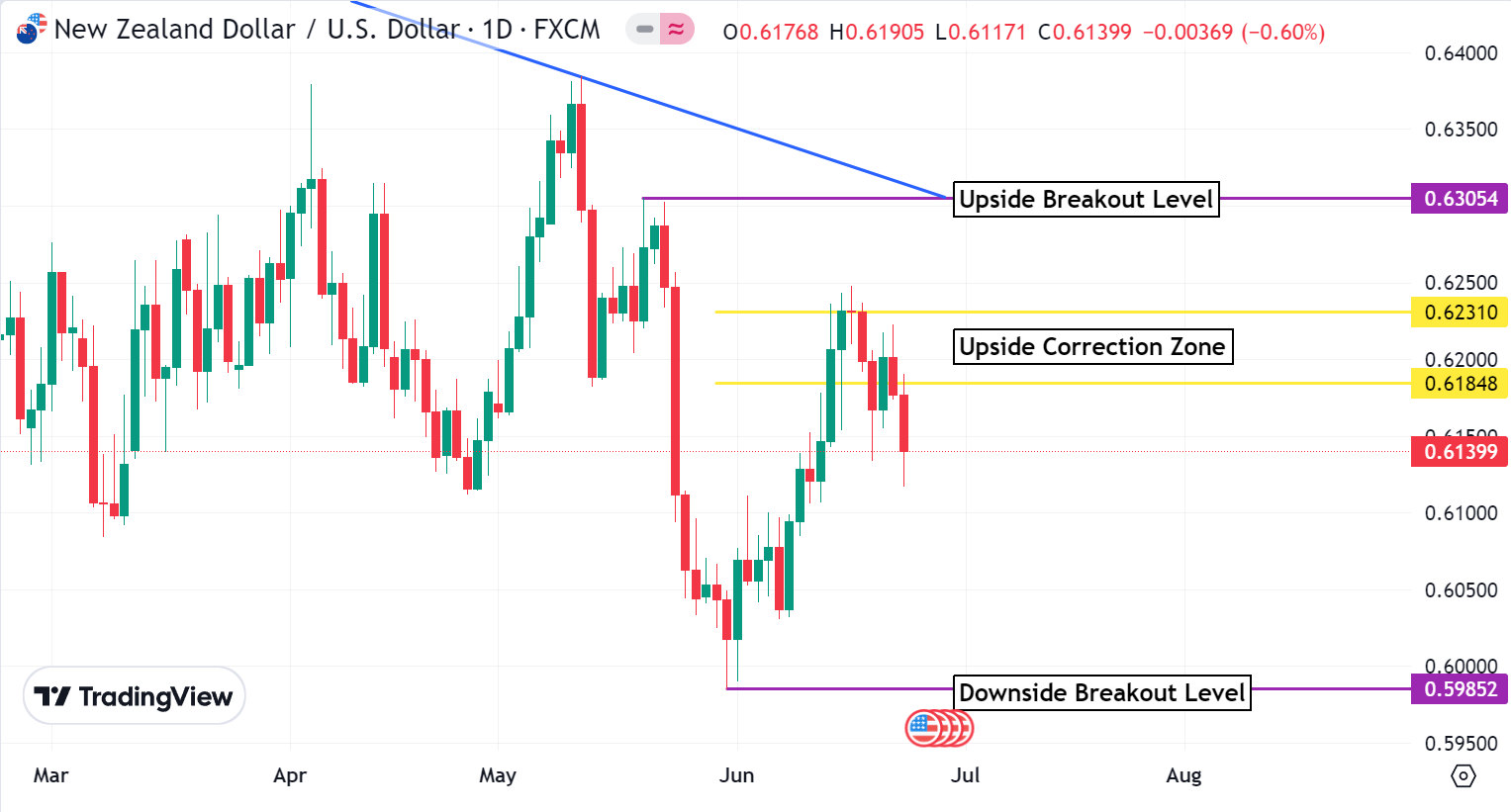

NZDUSD Weekly Outlook:

This week will be the real test for the NZDUSD. The market fell off the upside correction zone, and the Bears are expected to make another run at support this week. Trading below 0.6184 keeps the currency pointed lower looking to press new move lows towards the downside breakout level. The trend is Bearish, and even the FED pause is not likely to shore up this FX pair. 0.5873 is the long-term downside target.

If the Bulls can lift the market back into the upside correction zone it will be a fight as the Bulls try and turn this currency around. Do not fight a rally above the 0.6231 level. Trading above here is expected to touch off Stops and fresh Buying that targets the upside breakout level. This is the critical price level holding the trend intact. If the market gets above here it locks in the short-term Bull trend, and starts to tip the scales for a Neutral trend moving forward.

USDCAD Weekly Outlook:

The USDCAD Bears have proven their worth over the past few weeks. Can the downside target zone hold??? This is a tough question with the USD under pressure. Short-term this market is likely ready for a bounce back towards the long-term directional pivot level. This is a key area holding the Bearish trend together. If there is a rally above here it would be a good indication that the currency is setting up a range trade, and the lower part of the range has been set.

This market is ready for a bounce, but USD weakness could still keep the USDCAD in the gutter. Trading under 1.3113 is a bad sign that the Bears are ready to keep hitting new lows towards the 1.3075 – 1.3065 support band. 1.2744 is the extended sell off objective. If the market gets a close below 1.3065, then the Bears will be very tough to fade for the next couple of weeks.

Tigers! Don't miss our 4th of July Tiger Dollar Sale! From now until July 7th, you can receive up to a 40% bonus when you purchase Tiger Dollars! Tiger Dollars go towards all subscriptions and purchases. Click here to learn more!